High Stock Market Valuations: Understanding BofA's Reassuring View

Table of Contents

BofA's Key Arguments for a Positive Outlook on High Valuations

BofA's optimistic stance on high stock market valuations rests on several key pillars. They argue that the current elevated prices are not necessarily unsustainable, supported by several macroeconomic and microeconomic factors.

-

Low Interest Rates: The prolonged period of low interest rates significantly impacts stock valuations. Lower borrowing costs make it cheaper for companies to invest, fueling growth and boosting future earnings, which in turn supports higher stock prices. This low interest rate environment encourages investors to seek higher returns in the stock market rather than lower-yielding bonds.

-

Strong Corporate Earnings: Robust corporate earnings are a cornerstone of BofA's argument. Many companies have demonstrated impressive earnings growth, exceeding expectations and justifying, at least partially, the current high valuations. This earnings growth, driven by factors such as increased productivity and strong consumer demand, suggests a healthy underlying economy capable of sustaining current stock prices.

-

Technological Innovation: The ongoing technological revolution continues to reshape industries and drive significant long-term growth. BofA highlights the tech sector's potential for disruptive innovation, leading to significant increases in productivity and efficiency, ultimately translating into higher future earnings and justifying the premium placed on tech stocks, contributing to overall high stock market valuations.

-

Long-Term Growth Potential: BofA’s analysis projects continued long-term economic growth, underpinning their belief in the sustainability of high stock market valuations. This projection takes into account factors like global demographic shifts, emerging markets' expansion, and continued technological advancements. This long-term perspective suggests that current valuations, while high, are not necessarily indicative of an imminent market correction.

Understanding the Metrics Used by BofA in Their Analysis

BofA's analysis relies on a range of valuation metrics to assess the current market environment. Understanding these metrics is crucial to grasping their conclusions.

-

Price-to-Earnings Ratio (P/E): This classic metric compares a company's stock price to its earnings per share. A higher P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations.

-

Price-to-Sales Ratio (P/S): This ratio compares a company's stock price to its revenue per share. It is often used for companies with negative earnings or those in high-growth sectors where future earnings are uncertain.

-

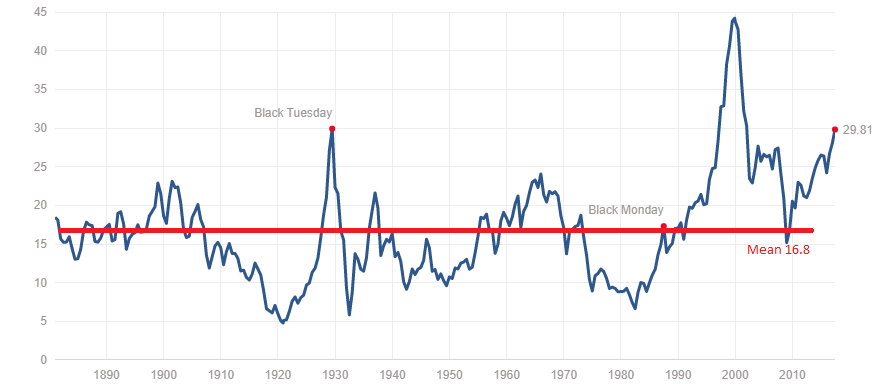

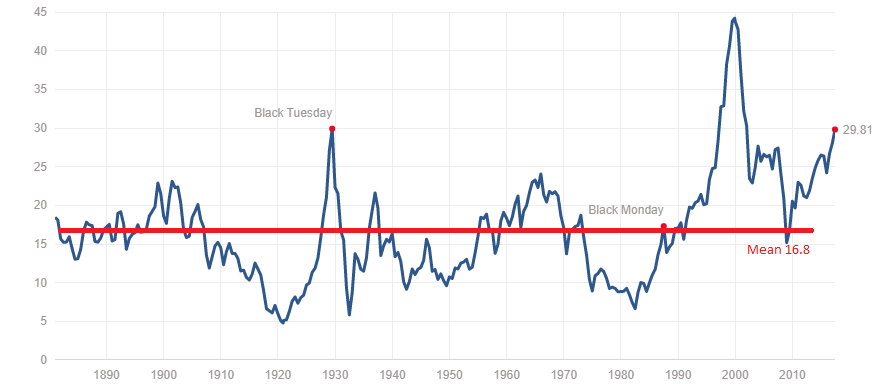

Cyclically Adjusted Price-to-Earnings Ratio (CAPE): Also known as the Shiller P/E ratio, this metric adjusts the traditional P/E ratio to account for cyclical variations in earnings, providing a longer-term perspective on valuation. BofA likely uses this metric to assess the long-term sustainability of high stock market valuations.

BofA likely compares these metrics to their historical averages to determine whether current valuations are exceptionally high or fall within a reasonable range, considering the current economic landscape and interest rate environment.

Potential Risks and Counterarguments to BofA's View

While BofA presents a positive outlook, it's crucial to acknowledge potential risks and counterarguments. High stock market valuations are not without their inherent dangers.

-

Market Corrections: The possibility of a significant market correction remains a real concern. High valuations leave less room for error, meaning that any negative news or economic slowdown could trigger a sharp decline in prices.

-

Inflationary Pressures: Rising inflation could erode corporate profits and negatively impact stock valuations. If inflation outpaces earnings growth, the current high P/E ratios might become unsustainable.

-

Geopolitical Risks: Geopolitical instability, such as international conflicts or trade wars, can significantly impact market sentiment and trigger sell-offs, potentially leading to a market correction despite underlying economic strength.

-

Overvaluation Concerns: Many investors remain unconvinced about the long-term sustainability of current valuations, arguing that certain sectors are significantly overvalued relative to their fundamental value. These concerns highlight the inherent risks associated with high stock market valuations.

BofA's Recommendations and Investment Strategies

Based on their analysis, BofA likely recommends a balanced approach to investing. While acknowledging the potential risks, they might still advocate for maintaining exposure to the stock market, albeit with a focus on risk management. This might involve:

-

Sector Allocation: Focusing on sectors they believe are less vulnerable to market corrections or inflationary pressures.

-

Long-Term Investment Strategy: Emphasizing the importance of a long-term investment horizon to weather short-term market volatility.

-

Diversification: Maintaining a well-diversified portfolio across various asset classes to mitigate risk.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's surprisingly positive outlook on high stock market valuations offers a valuable perspective, highlighting the influence of low interest rates, strong corporate earnings, technological innovation, and projected long-term growth. However, it’s crucial to acknowledge the inherent risks, including the potential for market corrections, inflationary pressures, and geopolitical uncertainties. Understanding valuation metrics like the P/E ratio, P/S ratio, and CAPE ratio is crucial for navigating this complex environment. Thorough due diligence and a balanced approach, considering both the opportunities and challenges presented by high stock market valuations, are essential for developing a successful investment strategy. We encourage you to further research BofA’s report and to carefully consider managing high stock market valuations in your own portfolio. Understanding high stock market valuations is key to navigating the current market successfully.

Featured Posts

-

Miera Sarunas Ukraina Trampa Loma Un Putina Prasibas

May 27, 2025

Miera Sarunas Ukraina Trampa Loma Un Putina Prasibas

May 27, 2025 -

Tayemna Zustrich U Peterburzi Novi Fakti Pro Peregovori Predstavnikiv Trampa Ta Putina

May 27, 2025

Tayemna Zustrich U Peterburzi Novi Fakti Pro Peregovori Predstavnikiv Trampa Ta Putina

May 27, 2025 -

How To Watch March Madness 2025 Without A Cable Subscription

May 27, 2025

How To Watch March Madness 2025 Without A Cable Subscription

May 27, 2025 -

Watch Ghost Season 4 Finale Online Free The Ultimate Guide

May 27, 2025

Watch Ghost Season 4 Finale Online Free The Ultimate Guide

May 27, 2025 -

How To Watch Ghost Season 4 Finale Free Streaming Options

May 27, 2025

How To Watch Ghost Season 4 Finale Free Streaming Options

May 27, 2025

Latest Posts

-

Enciso Phillips And Woolfenden New Signings Boost Ipswich Town

May 28, 2025

Enciso Phillips And Woolfenden New Signings Boost Ipswich Town

May 28, 2025 -

Ipswich Town Beat Bournemouth Thanks To Nathan Broadheads Strike

May 28, 2025

Ipswich Town Beat Bournemouth Thanks To Nathan Broadheads Strike

May 28, 2025 -

Afc Bournemouth Vs Ipswich Town Predicted Lineup And Injury Concerns

May 28, 2025

Afc Bournemouth Vs Ipswich Town Predicted Lineup And Injury Concerns

May 28, 2025 -

Mc Kenna Injury Update Philogene Blow For Ipswich Town

May 28, 2025

Mc Kenna Injury Update Philogene Blow For Ipswich Town

May 28, 2025 -

Ipswich Towns Bournemouth Trip Latest Injury Report

May 28, 2025

Ipswich Towns Bournemouth Trip Latest Injury Report

May 28, 2025