High Stock Market Valuations: Why BofA Says Investors Shouldn't Panic

Table of Contents

BofA's Rationale: Understanding the Nuances of Valuation

BofA's assessment of market valuations isn't based on simplistic metrics alone. Their analysis incorporates a range of factors and methodologies, going beyond the headline numbers to provide a more nuanced understanding. They likely utilize key metrics such as the price-to-earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE), and other valuation models to paint a comprehensive picture.

Key arguments supporting BofA's relatively calm outlook include:

-

Low interest rates justify higher valuations: Historically low interest rates reduce the opportunity cost of investing in stocks, allowing for higher valuations to persist. Lower borrowing costs also benefit businesses, supporting earnings growth.

-

Strong corporate earnings growth can support current prices: Robust corporate earnings growth can offset concerns about high valuations. Companies demonstrating strong profitability and consistent revenue increases can justify higher price-to-earnings multiples. BofA's research likely incorporates detailed earnings forecasts to support this claim.

-

Long-term economic growth projections mitigate valuation concerns: BofA's analysis probably includes long-term economic growth projections, which suggests that even with currently high valuations, future growth can support higher stock prices over the long term.

-

Comparison to historical valuations to contextualize current levels: By comparing current valuations to historical averages and considering periods of similar economic conditions, BofA aims to provide perspective and prevent unwarranted panic. This historical context helps determine whether current valuations are exceptionally high or simply reflect the current economic climate.

Data points and statistics from BofA's reports, including specific P/E ratios and growth projections, would further strengthen these claims. However, without direct access to their internal reports, this article can only discuss the general rationale.

Factors Beyond Traditional Valuation Metrics

Traditional valuation metrics, while important, don't capture the full picture. Several factors often overlooked by simple P/E ratios can significantly influence market valuations and investor behavior:

-

Technological innovation driving future growth: Breakthrough innovations and technological advancements can significantly alter future earnings potential, justifying higher current valuations. The potential for disruptive technologies to reshape industries should be considered.

-

The impact of quantitative easing (QE) and monetary policy: Central banks' monetary policies, such as QE, inject liquidity into the market, influencing asset prices and potentially supporting higher valuations. The influence of these policies on market sentiment is considerable.

-

Geopolitical factors and their influence on market sentiment: Global events, political uncertainty, and geopolitical risks can profoundly impact investor sentiment and market valuations, introducing both opportunities and threats.

How these factors influence investor decisions is crucial:

-

Technological disruption leading to higher future earnings potential: Investors are willing to pay a premium for companies poised to benefit from technological disruption.

-

Impact of low interest rates on investment returns: Low interest rates make stocks a more attractive investment relative to bonds, driving up demand and valuations.

-

Uncertainty surrounding geopolitical events creating both opportunities and risks: Geopolitical events can create uncertainty, leading to market volatility but also presenting opportunities for shrewd investors.

Strategies for Navigating High Stock Market Valuations

While high stock market valuations may cause apprehension, there are strategies to mitigate risk and participate in potential market growth:

-

Diversification across asset classes to mitigate risk: Diversification across various asset classes, such as stocks, bonds, and real estate, is essential to reduce portfolio volatility.

-

Focus on quality companies with strong fundamentals: Investing in companies with robust balance sheets, consistent earnings growth, and strong competitive advantages can help navigate market downturns.

-

Long-term investment horizon to weather market fluctuations: A long-term investment approach allows you to weather short-term market fluctuations and benefit from compounding returns.

-

Regular portfolio rebalancing to maintain target asset allocation: Regular rebalancing helps maintain your desired asset allocation and adjusts your portfolio to changing market conditions.

Practical steps for investors include:

-

Review and adjust portfolio allocation: Evaluate your current asset allocation and make adjustments to align with your risk tolerance and long-term goals.

-

Consider dollar-cost averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations.

-

Consult with a financial advisor for personalized guidance: A financial advisor can provide tailored advice based on your individual circumstances and financial goals.

Addressing Investor Concerns: The Risk of a Market Correction

A market correction—a temporary but sharp decline in market prices—is always a possibility. While BofA might downplay immediate panic, acknowledging this risk is crucial. However, a correction doesn't necessarily signal a catastrophic market crash. Historically, corrections have been followed by periods of market recovery.

Strategies to mitigate the risk of losses during a correction include maintaining diversification, focusing on high-quality companies, and sticking to a long-term investment strategy. The benefits of a long-term approach become particularly apparent during periods of market volatility, as temporary setbacks are less impactful on overall investment performance.

High Stock Market Valuations and Your Investment Strategy

BofA's argument against immediate panic centers on the nuances of valuation, the influence of factors beyond traditional metrics, and the importance of long-term planning. By considering these elements—low interest rates, strong earnings growth, long-term economic projections, and technological innovation—investors can gain a more balanced perspective. Effective strategies for navigating high stock market valuations include diversification, focusing on quality companies, adopting a long-term horizon, and regular portfolio rebalancing. Don't let high stock market valuations deter you from long-term investing. Understand the nuances, diversify your portfolio, and create a strategy that aligns with your financial goals. Learn more about managing your investments in the face of high stock market valuations today! Consult with a financial professional to develop a personalized investment plan that aligns with your risk tolerance and long-term objectives.

Featured Posts

-

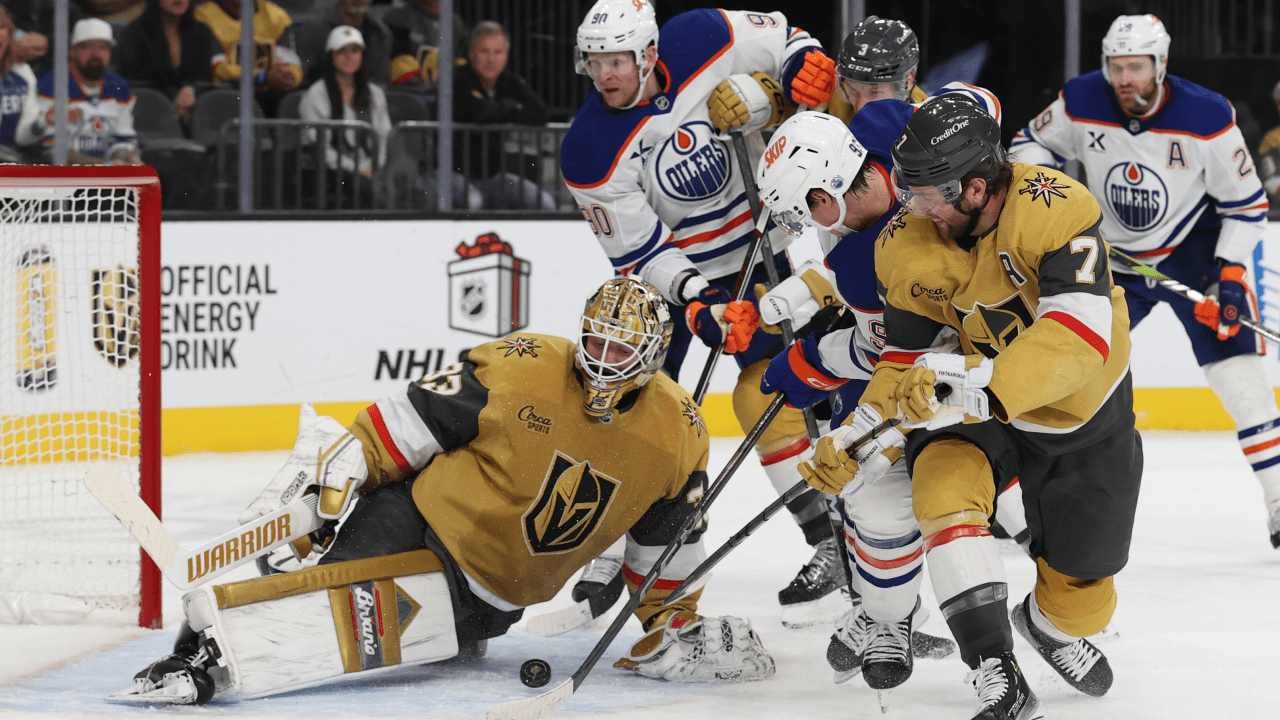

Hills Shutout Performance Propels Golden Knights To 4 0 Win Over Blue Jackets

May 10, 2025

Hills Shutout Performance Propels Golden Knights To 4 0 Win Over Blue Jackets

May 10, 2025 -

Jessica Tarlov Condemns Jeanine Pirros Stance On Canada Trade Dispute

May 10, 2025

Jessica Tarlov Condemns Jeanine Pirros Stance On Canada Trade Dispute

May 10, 2025 -

Will Nigel Farages Reform Party Succeed Beyond The Complaints

May 10, 2025

Will Nigel Farages Reform Party Succeed Beyond The Complaints

May 10, 2025 -

Zolotye Rytsari Vegasa Vyigryvayut U Minnesoty V Dopolnitelnoe Vremya Pley Off

May 10, 2025

Zolotye Rytsari Vegasa Vyigryvayut U Minnesoty V Dopolnitelnoe Vremya Pley Off

May 10, 2025 -

Minister Announces Accelerated Timeline For 14 Edmonton School Projects

May 10, 2025

Minister Announces Accelerated Timeline For 14 Edmonton School Projects

May 10, 2025