High Stock Valuations And Investor Concerns: BofA's Analysis

Table of Contents

BofA's Key Findings on Current Market Valuation

BofA's recent analysis provides a detailed assessment of current market valuations, employing various key metrics. While the specific numbers may vary depending on the report's release date, the general conclusion often points towards a market that's operating at elevated valuation levels. Many major indices and sectors are trading at price-to-earnings ratios (P/E) significantly higher than their historical averages. Similarly, price-to-sales ratios (P/S) and other valuation multiples are often above long-term averages, suggesting a potential overvaluation in certain segments.

- Key metrics used by BofA: BofA’s analysis typically incorporates a range of valuation metrics, including P/E ratios, P/S ratios, price-to-book ratios (P/B), and dividend yield, alongside comparisons to historical averages and industry benchmarks.

- Specific sectors identified as overvalued or undervalued: BofA’s reports often highlight specific sectors showing signs of overvaluation (e.g., technology, certain consumer discretionary segments) and those appearing relatively undervalued (e.g., energy, certain financials, depending on market conditions). These assessments are fluid and change based on economic shifts.

- Comparison to historical valuation levels: A crucial aspect of BofA's analysis involves comparing current market capitalization and valuation multiples to historical data, providing context to the current situation and revealing potential risks or opportunities.

Investor Concerns Stemming from High Stock Valuations

The elevated valuations identified by BofA naturally trigger significant investor concerns. The fear of a market correction or even a bear market is palpable. High valuations leave less room for error; a negative economic shock could lead to a more substantial market downturn.

- Fear of a market crash or significant correction: Investors worry that current prices are unsustainable and a significant correction is inevitable, potentially eroding their portfolio value substantially.

- Concerns about future returns given current valuations: High valuations imply lower potential future returns compared to investments made at lower price points. This significantly impacts long-term investment strategies.

- Impact on different investment strategies: Value investors, who seek undervalued assets, find fewer attractive opportunities in a high-valuation market. Growth investors, on the other hand, may continue to find opportunities within specific sectors, but face increased risk. This necessitates a reevaluation of investment approaches.

BofA's Recommendations and Strategies for Investors

In the face of these challenges, BofA typically advocates for a cautious yet opportunistic approach. Their recommendations often emphasize the importance of prudent risk management and strategic diversification.

- Specific recommendations from BofA's report: BofA’s recommendations often include a careful review of existing portfolios, with a focus on sector diversification and a reduction in exposure to potentially overvalued assets.

- Suggested adjustments to investment portfolios: This may involve shifting assets from overvalued sectors to those considered relatively undervalued or increasing exposure to defensive sectors.

- Strategies for mitigating risk in a high-valuation market: These strategies commonly involve maintaining sufficient cash reserves, diversifying across asset classes (stocks, bonds, real estate, etc.), and potentially considering hedging strategies to protect against market downturns.

Alternative Perspectives and Further Considerations

While BofA's analysis provides valuable insights, it’s crucial to consider alternative perspectives. Other market analysts may hold differing views on the severity of the overvaluation or the likelihood of a market correction. Furthermore, unforeseen economic events or shifts in investor sentiment can significantly impact market valuations.

- Alternative viewpoints on market valuations: Some analysts may argue that technological advancements or other fundamental factors justify current high valuations, while others might point to specific economic indicators suggesting a less dire outlook.

- Potential factors not considered in BofA's analysis: Unforeseen geopolitical events, technological disruptions, or regulatory changes can significantly impact the market and may not always be fully incorporated into initial analyses.

- Long-term versus short-term market perspectives: It's crucial to differentiate between short-term market fluctuations and long-term growth trends. While high valuations might signal short-term risks, the long-term prospects of the market could still be positive.

Conclusion: Understanding High Stock Valuations and Making Informed Investment Decisions

BofA's analysis highlights significant concerns regarding high stock valuations and their potential impact on investor portfolios. The current market environment necessitates careful risk management, diversification, and a thorough understanding of the potential risks and opportunities. While BofA's recommendations offer valuable guidance, it's crucial to remember that every investor's situation is unique. Stay informed about high stock valuations and investor concerns by regularly reviewing market analysis from reputable sources like BofA and others. Make informed investment decisions based on thorough research and professional guidance. Remember to consult with a financial advisor before making any significant investment changes.

Featured Posts

-

Fortnite Returns To Us I Phones

May 22, 2025

Fortnite Returns To Us I Phones

May 22, 2025 -

Vanja Mijatovic Razvod I Borba Protiv Negativnih Komentara

May 22, 2025

Vanja Mijatovic Razvod I Borba Protiv Negativnih Komentara

May 22, 2025 -

Voedselexport Naar Vs In De Problemen Abn Amro Analyseert Impact Heffingen

May 22, 2025

Voedselexport Naar Vs In De Problemen Abn Amro Analyseert Impact Heffingen

May 22, 2025 -

Rockies Vs Tigers 8 6 Upset Shows Potential

May 22, 2025

Rockies Vs Tigers 8 6 Upset Shows Potential

May 22, 2025 -

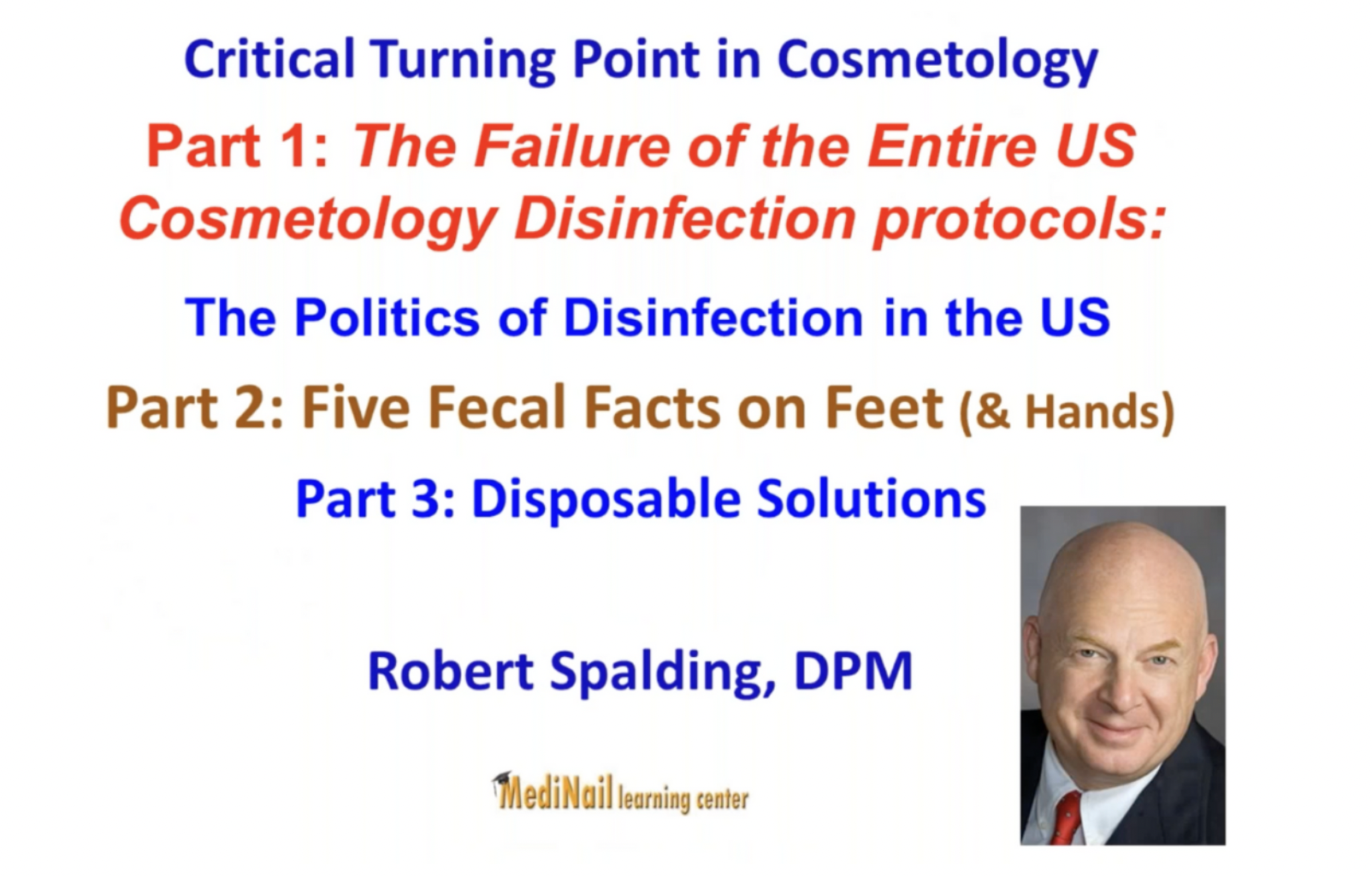

Prostate Cancer Screening The Case Of President Bidens 2014 Checkup

May 22, 2025

Prostate Cancer Screening The Case Of President Bidens 2014 Checkup

May 22, 2025

Latest Posts

-

Charting A New Course The Future Of Otter Conservation In Wyoming

May 22, 2025

Charting A New Course The Future Of Otter Conservation In Wyoming

May 22, 2025 -

Protecting Wyomings Otters A Critical Turning Point In Conservation

May 22, 2025

Protecting Wyomings Otters A Critical Turning Point In Conservation

May 22, 2025 -

Otter Management In Wyoming Challenges Changes And A Path Forward

May 22, 2025

Otter Management In Wyoming Challenges Changes And A Path Forward

May 22, 2025 -

Wyoming Otter Conservation A Pivotal Moment For Population Management

May 22, 2025

Wyoming Otter Conservation A Pivotal Moment For Population Management

May 22, 2025 -

Gray Wolf Mortality Second Colorado Wolf Dies In Wyoming

May 22, 2025

Gray Wolf Mortality Second Colorado Wolf Dies In Wyoming

May 22, 2025