High-Yield Dividend Investing: A Simple, Effective Strategy

Table of Contents

Understanding High-Yield Dividend Investing

What are Dividends?

Dividends represent a portion of a company's profits distributed to its shareholders. They are a crucial element of high-yield dividend investing, offering a return on investment beyond potential capital appreciation. Understanding dividends is key to successful investing in this strategy.

- Types of Dividends: Companies typically issue cash dividends, directly deposited into your account. Some may also offer stock dividends, increasing your ownership stake in the company.

- Dividend Yield Calculation: The dividend yield is calculated by dividing the annual dividend per share by the current stock price. A higher yield generally indicates a higher payout relative to the stock's price. For example, a stock trading at $50 with a $2 annual dividend has a 4% dividend yield ($2/$50 = 0.04).

- Significance of Dividend Yield: While a high yield can be attractive, it's crucial to consider the underlying company's financial health. A high yield might signal financial distress in some cases. Always research the company thoroughly.

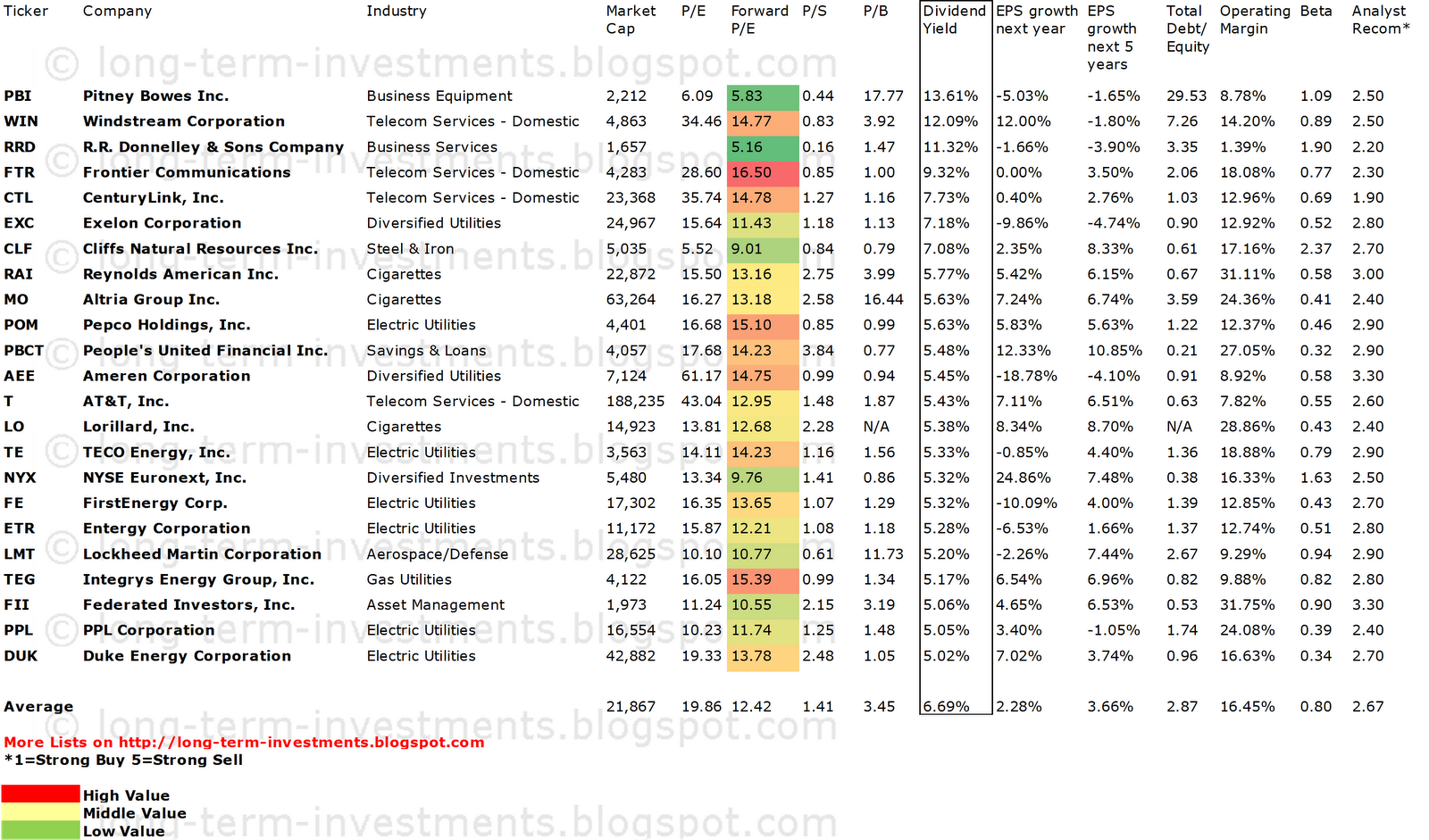

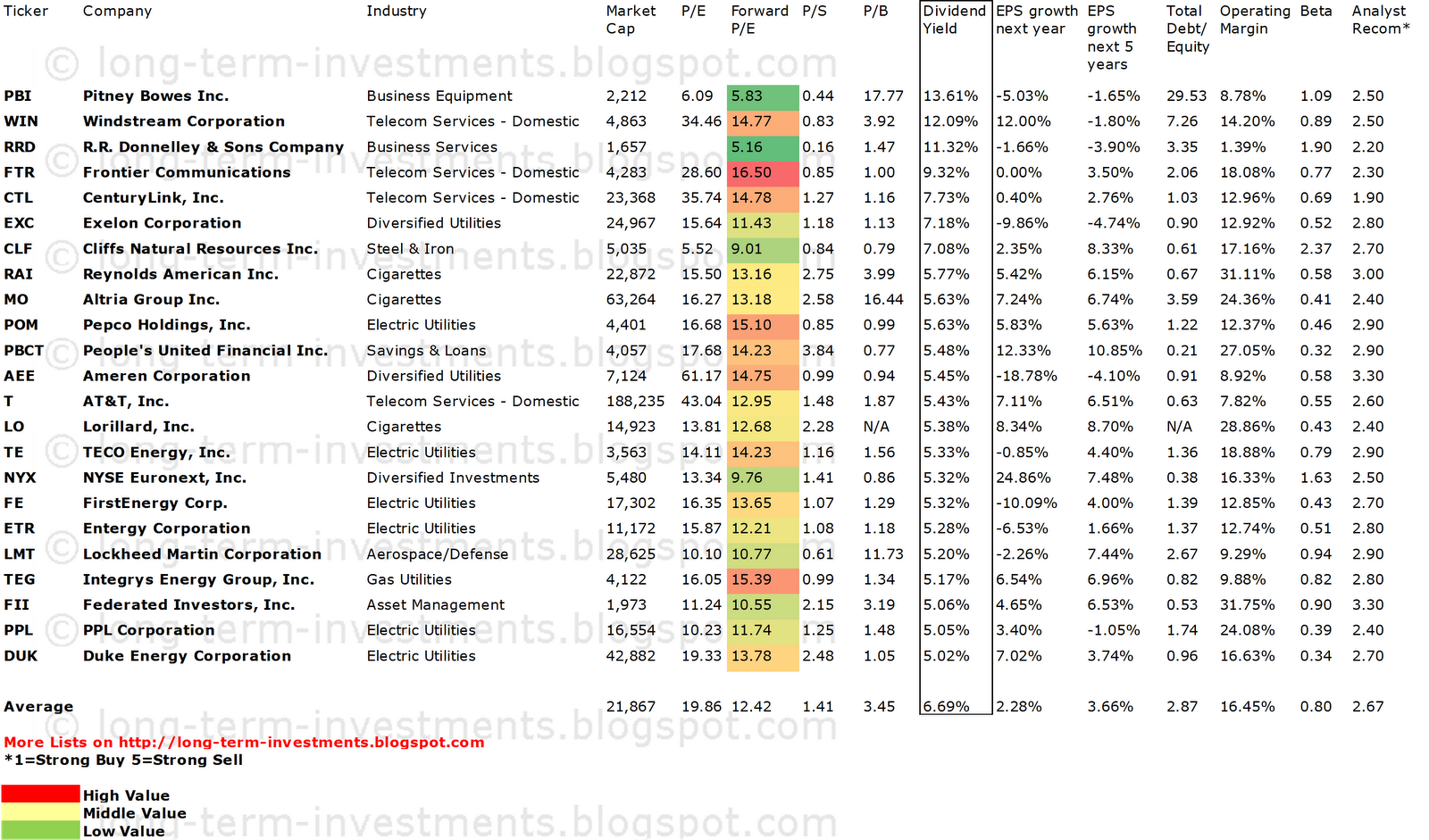

- Examples: Many established companies in sectors like utilities, real estate investment trusts (REITs), and consumer staples offer high dividend yields. Research specific companies within these sectors to identify potential investment opportunities.

Benefits of High-Yield Dividend Investing

High-yield dividend investing offers several compelling advantages:

- Passive Income Generation: Dividends provide a regular stream of passive income, supplementing your overall financial plan.

- Potential for Capital Appreciation: While dividend income is a key focus, the underlying stock price can also appreciate, further enhancing your returns. This aspect of growth is important to remember when evaluating high-yield dividend stocks.

- Hedging Against Inflation: Dividend payments often increase over time, helping to offset the erosive effects of inflation on your investment's purchasing power.

- Building Long-Term Wealth: Consistent dividend income, when reinvested, fuels compounding growth, leading to significant wealth accumulation over the long term. This is a core principle of successful high-yield dividend investing.

- Reduced Reliance on Market Volatility: While stock prices fluctuate, the consistent income stream from dividends can provide stability during market downturns. This helps to reduce the emotional stress often associated with market volatility.

Risks of High-Yield Dividend Investing

Despite the benefits, it's essential to acknowledge the potential risks associated with high-yield dividend investing:

- Dividend Cuts or Suspensions: Companies may reduce or eliminate dividend payments due to financial difficulties or strategic shifts.

- Company Financial Instability: Investing in financially unstable companies with high yields can lead to significant losses, even if they maintain their dividend payouts.

- Market Downturns: Market downturns can negatively impact stock prices, even for companies with strong dividend histories.

- Tax Implications: Dividend income is typically subject to taxation, impacting your overall return. Carefully consider the tax implications before making investment decisions.

Identifying Strong Dividend Stocks

Analyzing Financial Statements

Thorough financial statement analysis is critical for identifying robust high-yield dividend stocks:

- Dividend Payout Ratio: This ratio shows the percentage of earnings paid out as dividends. A sustainable payout ratio (typically below 70%) indicates a company's ability to maintain its dividend payments.

- Debt-to-Equity Ratio: A high debt-to-equity ratio suggests a company is heavily reliant on debt, potentially increasing the risk of dividend cuts.

- Free Cash Flow: Free cash flow represents the cash a company generates after covering its operating expenses and capital expenditures. Strong free cash flow is crucial for supporting dividend payments.

- Earnings Per Share (EPS): Consistent and growing EPS demonstrates a company's profitability and capacity for future dividend increases.

Evaluating Company History and Stability

Assessing a company's history is vital for high-yield dividend investing:

- Consistent Dividend Payments: A long history of consistent dividend payments indicates a commitment to returning value to shareholders.

- Strong Track Record of Earnings Growth: Companies with consistent earnings growth are more likely to sustain and increase their dividend payouts.

- Market Position and Competitive Advantage: Companies with a strong market position and competitive advantage are generally better positioned to weather economic downturns and maintain their dividend payments.

- Management Team Expertise and Reputation: A skilled and experienced management team is essential for long-term success and reliable dividend payments.

Diversification Strategies

Diversification is key to mitigating risk in high-yield dividend investing:

- Spreading Investments Across Different Sectors: Diversifying across various sectors reduces the impact of sector-specific downturns on your portfolio.

- Geographic Diversification: Investing in companies from different geographic regions can help further reduce overall portfolio risk.

- Utilizing ETFs and Mutual Funds: Exchange-traded funds (ETFs) and mutual funds offer diversified exposure to a basket of high-yield dividend stocks, simplifying portfolio construction.

Building and Managing Your High-Yield Dividend Portfolio

Creating a Diversified Portfolio

Constructing a well-diversified portfolio is fundamental to successful high-yield dividend investing:

- Selecting a Mix of High-Yield Stocks from Different Sectors: Choose companies across different sectors to mitigate risk and capitalize on diverse growth opportunities.

- Balancing Risk and Return: Carefully balance your portfolio between high-yield, potentially higher-risk stocks and more established, lower-yield companies.

- Considering Investment Timelines: Determine your investment horizon to align your portfolio strategy with your long-term financial goals.

- Regularly Reviewing and Rebalancing the Portfolio: Regularly review your portfolio's performance and rebalance it to maintain your desired asset allocation.

Reinvestment Strategies

Reinvesting dividends is a powerful tool for compounding growth:

- Reinvesting Dividends for Compounding Growth: Reinvesting dividends allows you to buy more shares, accelerating your wealth accumulation.

- Utilizing Dividend Reinvestment Plans (DRIPs): Many companies offer DRIPs, automatically reinvesting your dividends to buy additional shares at a discounted price.

- Exploring the Tax Implications of Reinvestment: Understand the tax implications of reinvesting dividends to optimize your tax efficiency.

Monitoring Your Portfolio’s Performance

Continuous monitoring is vital:

- Tracking Dividend Income: Regularly track your dividend income to monitor the performance of your portfolio.

- Evaluating Capital Appreciation: Evaluate the capital appreciation of your investments to assess the overall return on your portfolio.

- Adjusting the Portfolio Based on Market Conditions: Adjust your portfolio based on market changes and economic conditions to optimize returns and mitigate risks.

Conclusion

High-yield dividend investing offers a powerful, yet simple approach to wealth building. By carefully selecting strong dividend-paying stocks, diversifying your portfolio, and employing sound risk management strategies, you can generate a consistent stream of passive income and build lasting wealth. This strategy, while offering potential for significant returns, requires careful research, planning, and ongoing monitoring.

Ready to start building your own high-yield dividend portfolio? Begin your journey today by researching high-yield dividend stocks and developing a well-diversified investment plan. Learn more about the benefits of high-yield dividend investing and take control of your financial future.

Featured Posts

-

West Bengal Madhyamik Result 2025 Official Merit List And Analysis

May 10, 2025

West Bengal Madhyamik Result 2025 Official Merit List And Analysis

May 10, 2025 -

Young Thugs Back Outside Everything We Know About The Upcoming Album

May 10, 2025

Young Thugs Back Outside Everything We Know About The Upcoming Album

May 10, 2025 -

French Minister Urges More Robust Eu Action Against Us Tariffs

May 10, 2025

French Minister Urges More Robust Eu Action Against Us Tariffs

May 10, 2025 -

Sunken Superyacht Recovery Diver Killed In Initial Salvage Attempts

May 10, 2025

Sunken Superyacht Recovery Diver Killed In Initial Salvage Attempts

May 10, 2025 -

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Buyout

May 10, 2025

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Buyout

May 10, 2025