High-Yield Dividend Investing: A Simple Strategy For Maximum Returns

Table of Contents

Understanding High-Yield Dividend Stocks

High-yield dividend investing focuses on acquiring dividend stocks that offer a higher-than-average dividend yield compared to the overall market. These stocks aim to provide a steady stream of passive income while potentially appreciating in value. However, understanding the nuances is crucial for success.

Identifying Reliable High-Yield Dividend Stocks

Choosing the right dividend stocks is paramount. Several factors need careful consideration before investing:

- Dividend Payout Ratio: This ratio shows the percentage of earnings a company pays out as dividends. A sustainable payout ratio is typically below 70%, indicating the company retains enough earnings for growth and future dividend payments.

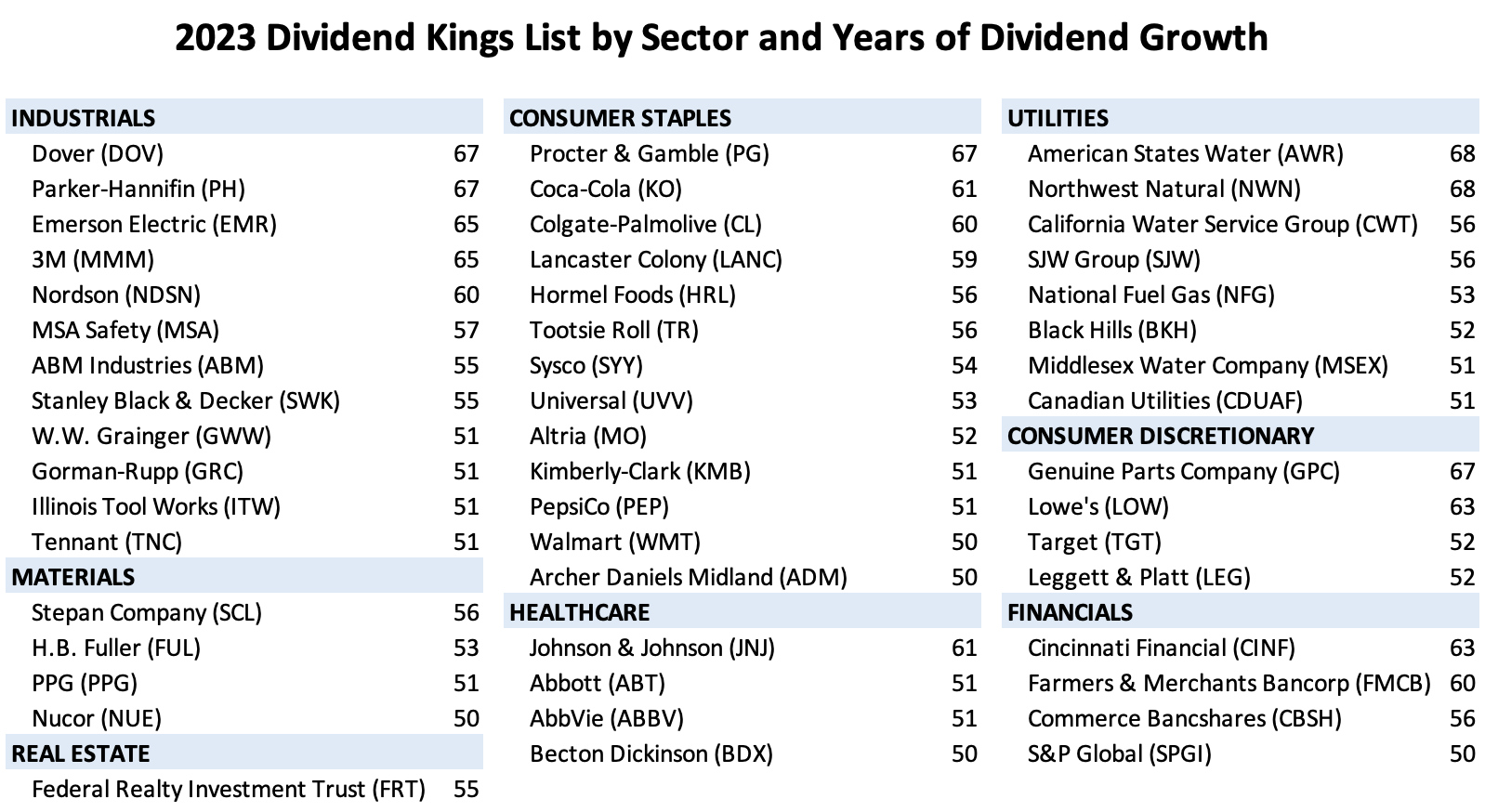

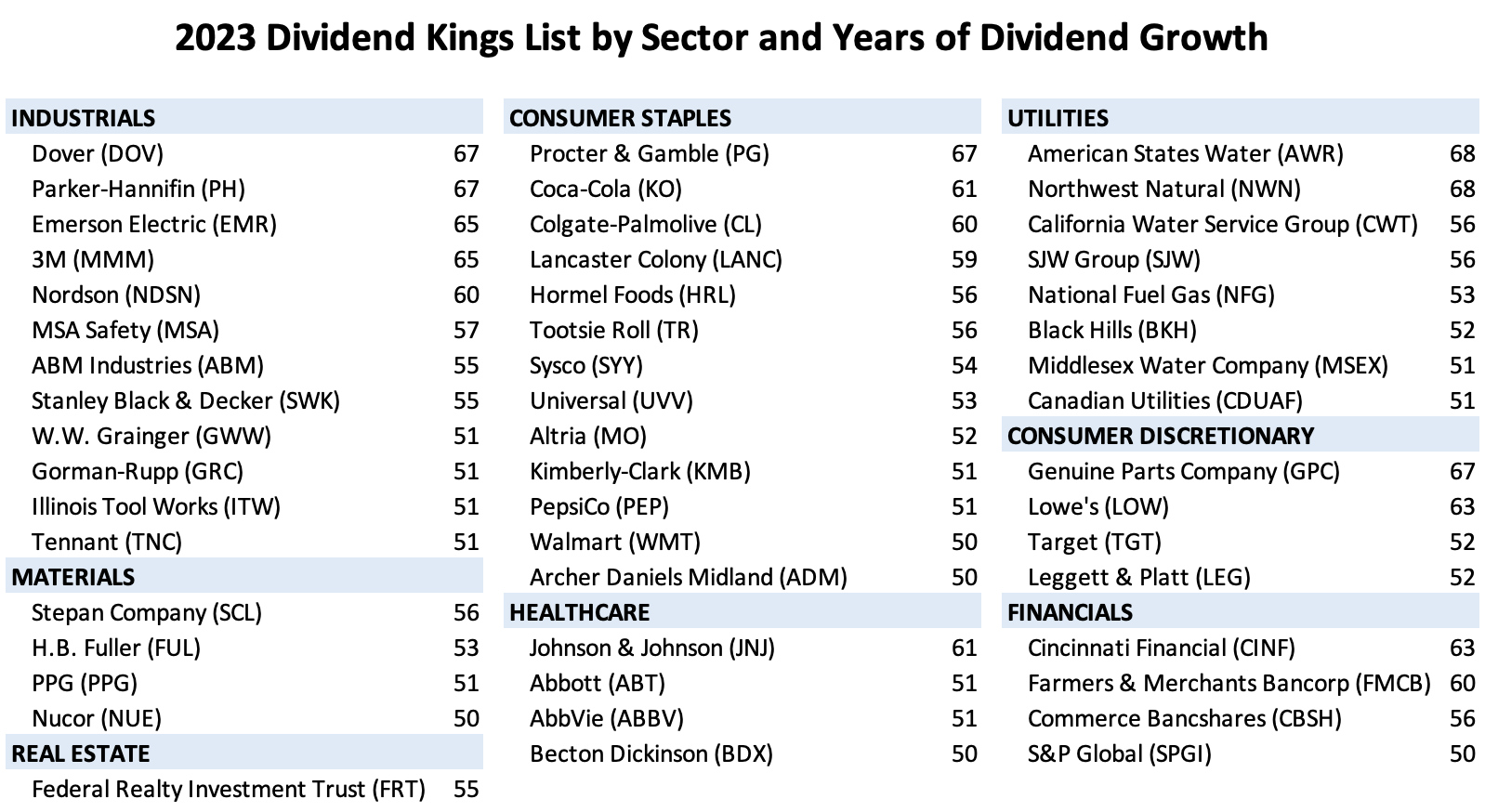

- Dividend Growth History: Look for companies with a consistent record of increasing dividends over time. This demonstrates financial strength and a commitment to shareholder returns.

- Company Stability and Financial Health: Analyze the company's financial statements, including its debt-to-equity ratio, to assess its financial stability and ability to withstand economic downturns. A lower debt-to-equity ratio generally indicates better financial health.

- Industry Trends: Research the industry in which the company operates to understand its long-term growth prospects and potential risks.

Resources for Researching Dividend Stocks: Numerous resources are available to help you research dividend stocks, including:

- Financial websites such as Yahoo Finance, Google Finance, and Bloomberg.

- Dedicated stock screeners that allow you to filter stocks based on various criteria, including dividend yield, payout ratio, and growth rate.

Risks Associated with High-Yield Dividend Investing

While high-yield dividend investing offers the potential for significant returns, it's crucial to acknowledge the associated risks:

- Dividend Cuts: Companies may reduce or eliminate dividends if they face financial difficulties.

- Company Bankruptcy: Investing in financially unstable companies carries the risk of complete loss of capital.

- Market Volatility: Like all investments, dividend stocks are subject to market fluctuations, potentially impacting both their price and dividend payments.

Mitigating Risk: Several strategies can help mitigate these risks:

- Diversification: Spread your investments across multiple companies and sectors to reduce the impact of any single stock's underperformance.

- Thorough Research: Conduct in-depth research on each company before investing.

- Long-Term Investment Horizon: High-yield dividend investing is a long-term strategy. A longer time horizon allows you to ride out short-term market fluctuations.

Building a High-Yield Dividend Portfolio

Building a strong high-yield dividend portfolio involves a strategic approach to diversification, investment timing, and dividend reinvestment.

Diversification Strategies

Diversification is crucial to minimizing risk. Spread your investments across various sectors (e.g., technology, healthcare, consumer staples) and company sizes (large-cap, mid-cap, small-cap) to reduce the impact of any single sector or company's underperformance.

- Examples of Diversified Portfolios: A well-diversified portfolio might include companies from different geographic regions and industries to reduce exposure to specific economic or political risks.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the stock price. This strategy mitigates the risk of investing a lump sum at a market peak.

- How DCA Works: By investing consistently, you buy more shares when prices are low and fewer shares when prices are high, averaging out your cost per share. This is a powerful tool for income investing and reduces the emotional impact of market fluctuations.

Reinvesting Dividends

Reinvesting your dividends is key to accelerating your returns through the power of compounding. By reinvesting your dividends to buy more shares, you amplify your returns over time.

- Compounding Growth Example: A small initial investment with consistent dividend reinvestment can grow exponentially over several years, leading to substantial wealth accumulation.

Monitoring and Managing Your High-Yield Dividend Portfolio

Ongoing monitoring and management are essential for maximizing returns and mitigating risks.

Regular Portfolio Reviews

Regularly review your portfolio's performance and the performance of individual stocks. This allows you to identify any underperforming assets and make informed adjustments.

- Frequency of Review: Aim for quarterly or annual reviews, depending on your investment goals and risk tolerance.

- Indicators to Monitor: Key indicators include dividend yield, stock price changes, company news, and any changes in the company's financial health.

Tax Implications of Dividend Income

Dividend income is generally taxable. Understanding the tax implications is crucial for optimizing your returns. Tax-advantaged accounts such as retirement accounts can help minimize your tax burden.

- Tax-Advantaged Accounts: Consider using tax-advantaged accounts like 401(k)s or IRAs to reduce your tax liability on dividend income.

Adjusting Your Strategy

Market conditions and your personal financial goals may necessitate adjustments to your high-yield dividend investing strategy. Be prepared to adapt your strategy as needed.

- Examples of Adjustments: This might involve rebalancing your portfolio to maintain your desired asset allocation, selling underperforming stocks, or adding new stocks to capitalize on opportunities.

Maximize Your Returns with High-Yield Dividend Investing

This article has highlighted the importance of identifying reliable high-yield dividend stocks, building a well-diversified portfolio, reinvesting dividends to harness the power of compounding, and regularly monitoring your portfolio's performance. By implementing these strategies, you can significantly increase your chances of generating passive income and building long-term wealth through high-yield dividend investing. Remember that while high-yield dividend investing offers compelling potential, thorough research and a long-term perspective are crucial. Start building your high-yield dividend portfolio today! Begin your research by exploring reliable dividend stocks and implement a simple strategy for maximum returns.

Featured Posts

-

Newark Airport Faces Renewed Tech Problems Faa Reports

May 11, 2025

Newark Airport Faces Renewed Tech Problems Faa Reports

May 11, 2025 -

Cavaliers Vs Knicks Betting Preview February 21st Odds And Predictions

May 11, 2025

Cavaliers Vs Knicks Betting Preview February 21st Odds And Predictions

May 11, 2025 -

David Gentiles 7 Year Sentence Gpb Capital Fraud Conviction

May 11, 2025

David Gentiles 7 Year Sentence Gpb Capital Fraud Conviction

May 11, 2025 -

Manon Fiorots Shot At Valentina Shevchenko Ufc 315 Breakdown

May 11, 2025

Manon Fiorots Shot At Valentina Shevchenko Ufc 315 Breakdown

May 11, 2025 -

Quien Sera El Proximo Papa Explorando Las Posibilidades

May 11, 2025

Quien Sera El Proximo Papa Explorando Las Posibilidades

May 11, 2025