HKD/USD Exchange Rate: Intervention Triggers Record Interest Rate Drop

Table of Contents

Understanding the HKD/USD Peg and its Mechanics

Hong Kong's currency, the Hong Kong dollar (HKD), operates under a linked exchange rate system, maintaining a narrow band against the US dollar (USD). This currency peg, a cornerstone of Hong Kong's monetary policy, is managed by the HKMA. The system aims to provide stability and predictability for businesses and investors, fostering confidence in the Hong Kong financial system. This linked exchange rate system is crucial for Hong Kong's economy, minimizing exchange rate volatility and supporting its role as an international financial center.

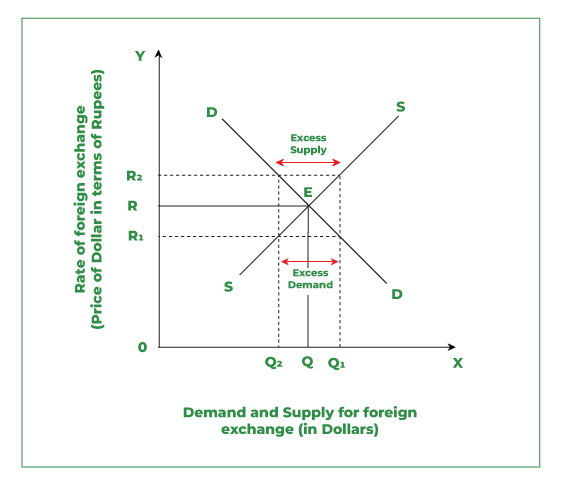

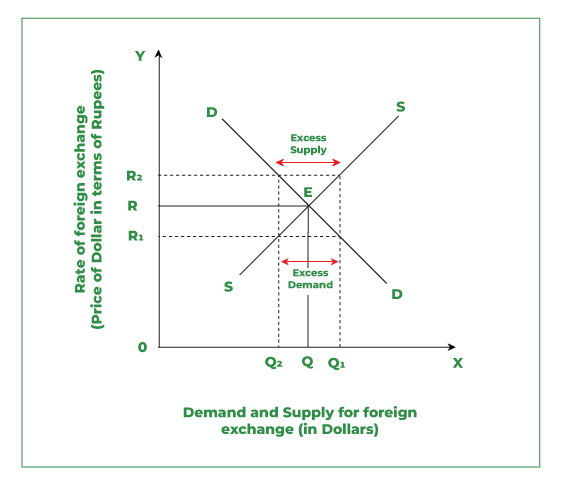

- Narrow Band: The HKD/USD exchange rate is typically maintained within a narrow band of 7.75 to 7.85 HKD per 1 USD. Any deviation outside this range triggers automatic intervention by the HKMA.

- HKMA Intervention: The HKMA uses its vast foreign exchange reserves to buy or sell HKD to maintain the peg. When the HKD weakens towards the upper band of 7.85, the HKMA buys HKD, injecting liquidity into the market and supporting its value. Conversely, when it strengthens towards 7.75, the HKMA sells HKD.

- Monetary Policy Implications: The currency peg significantly limits Hong Kong's ability to independently control its monetary policy. Interest rates in Hong Kong tend to closely follow those in the United States. This linkage helps maintain the HKD/USD peg but can limit the flexibility to respond to local economic conditions.

The Triggers Behind the Recent Rate Drop

The recent dramatic drop in interest rates was a direct response to significant pressure on the HKD/USD peg. Several factors contributed to this pressure:

- US Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes in the US made US dollar-denominated assets more attractive, leading to capital outflow from Hong Kong. Investors sought higher returns in the US, putting downward pressure on the HKD.

- Currency Speculation and Market Sentiment: Speculative attacks on the HKD, driven by negative market sentiment and uncertainty about the Hong Kong economy, exacerbated the pressure on the peg. These speculative pressures often amplify the impact of underlying economic factors.

- HKMA's Response: To defend the peg and prevent a significant devaluation of the HKD, the HKMA intervened heavily in the foreign exchange market, buying HKD to support its value. This intervention, however, required a substantial injection of liquidity, necessitating a record interest rate cut to manage the increased money supply and prevent inflationary pressures. The cost of maintaining the peg through intervention was significant, further highlighting the challenge of managing a linked exchange rate in a volatile global environment.

Consequences of the Record Interest Rate Drop

The drastic reduction in interest rates has several short-term and long-term consequences for the Hong Kong economy:

- Impact on Borrowing Costs: Lower interest rates reduce borrowing costs for businesses and consumers, potentially stimulating economic activity through increased investment and consumption. However, this could also lead to increased debt levels.

- Economic Growth and Inflation: While lower interest rates can boost economic growth in the short term, they could also fuel inflation if the increased money supply outpaces economic output. The HKMA will need to carefully monitor inflation indicators to manage potential risks.

- Investment Decisions: The lower interest rates may attract some foreign investment, but the uncertainty surrounding the HKD/USD exchange rate and the broader global economic outlook could dampen investment enthusiasm. The decreased returns on HKD-denominated assets could lead some investors to seek opportunities elsewhere.

Impact on Businesses and Investors

The recent volatility in the HKD/USD exchange rate presents significant challenges and opportunities for businesses and investors:

- Foreign Exchange Risk Management: Businesses engaged in international trade need to employ robust hedging strategies to mitigate the risks associated with fluctuating exchange rates. This might involve forward contracts, options, or other derivatives.

- Investment Opportunities: While the situation presents risks, it also creates opportunities for shrewd investors. Those with a longer-term perspective and risk tolerance may find attractive investment prospects in the Hong Kong market.

- Financial Planning: Individuals and businesses should carefully reassess their financial plans, considering the potential impact of the fluctuating HKD/USD exchange rate on their assets, liabilities, and investment strategies. Diversification and professional financial advice are highly recommended.

Conclusion

The recent volatility in the HKD/USD exchange rate, triggered by a confluence of factors including US interest rate hikes and market speculation, led to a record interest rate cut by the HKMA in its effort to maintain the currency peg. This unprecedented move has significant implications for Hong Kong's economy, impacting borrowing costs, economic growth, inflation, and investment decisions. Businesses and investors need to adapt their strategies to navigate the complexities of this dynamic currency pair.

Call to Action: Stay informed about the evolving HKD/USD exchange rate and its impact on your financial decisions. Regularly monitor market updates and consider consulting with financial professionals to navigate the complexities of this dynamic currency pair. Understanding the intricacies of the HKD/USD exchange rate is crucial for making sound financial decisions in Hong Kong's ever-changing economic landscape.

Featured Posts

-

Luis Enrique Ben Pastrim Te Psg 5 Yje Largohen

May 08, 2025

Luis Enrique Ben Pastrim Te Psg 5 Yje Largohen

May 08, 2025 -

Will Ubers Robotaxi Program Deliver On Its Stock Market Promise

May 08, 2025

Will Ubers Robotaxi Program Deliver On Its Stock Market Promise

May 08, 2025 -

Arsenal Ps Zh Istoriya Protivostoyaniy V Evrokubkakh

May 08, 2025

Arsenal Ps Zh Istoriya Protivostoyaniy V Evrokubkakh

May 08, 2025 -

Dwp Announces Six Month Universal Credit Rule Change

May 08, 2025

Dwp Announces Six Month Universal Credit Rule Change

May 08, 2025 -

Ride With Your Pet Uber Pet Launches In Delhi And Mumbai

May 08, 2025

Ride With Your Pet Uber Pet Launches In Delhi And Mumbai

May 08, 2025