HKMA's US Dollar Purchases: A Sign Of Pressure On The Hong Kong Dollar

Table of Contents

Understanding the Hong Kong Dollar's Peg Mechanism

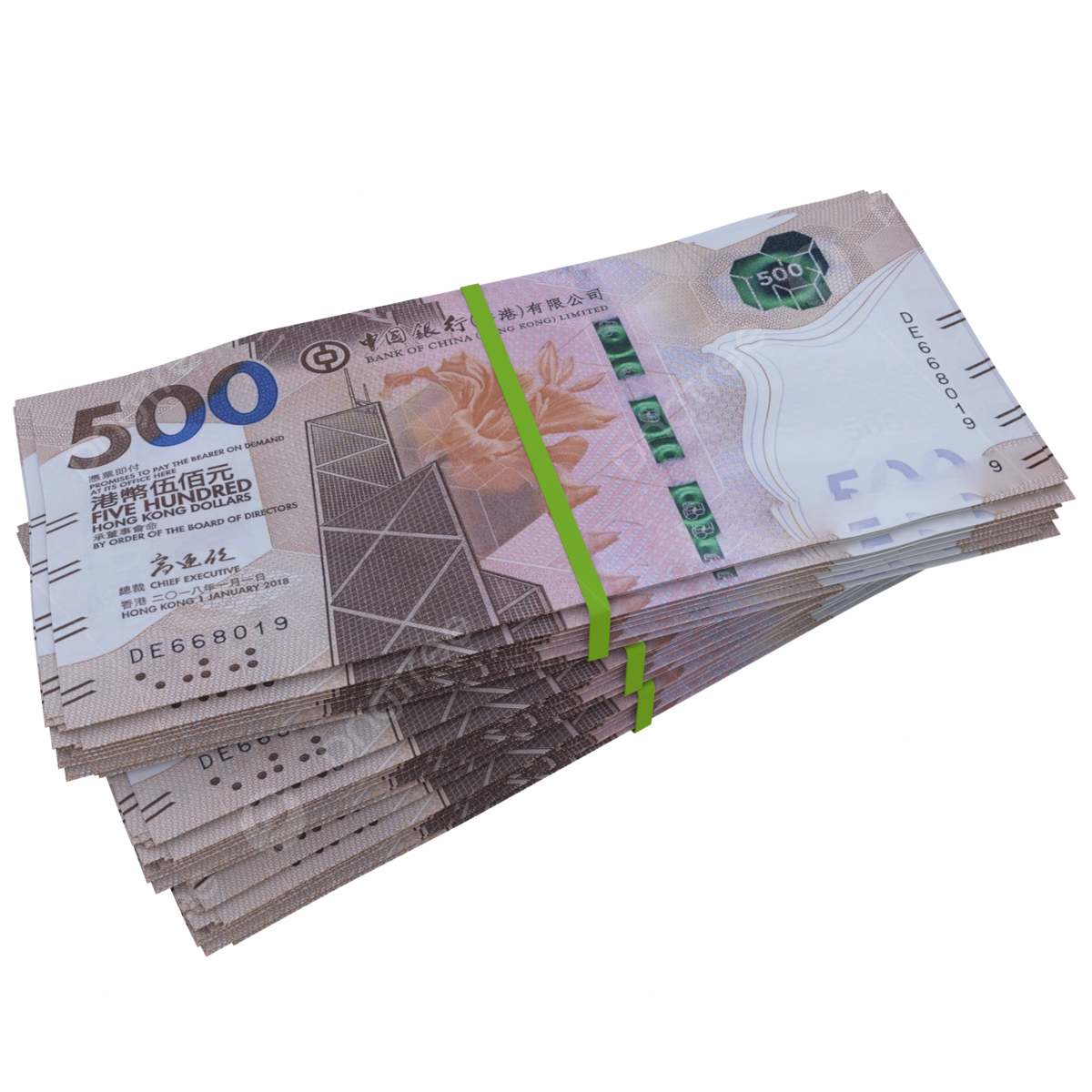

The Hong Kong dollar operates under a linked exchange rate system, a form of currency board arrangement. This system maintains a narrow band of 7.75 to 7.85 HKD per USD. The HKMA is responsible for ensuring the HKD remains within this trading band. To maintain the peg, the HKMA intervenes in the foreign exchange market, buying or selling US dollars to influence the HKD's exchange rate. This intervention is crucial for maintaining confidence in the currency and ensuring price stability. The success of the Hong Kong dollar peg hinges on the HKMA's ability to manage the supply of HKD and its reserves of USD. The mechanism functions as a safeguard against significant fluctuations, aiming for a stable and predictable exchange rate. Key elements of this system include:

- A high level of foreign exchange reserves: The HKMA holds substantial US dollar reserves to facilitate interventions.

- Strict monetary policy: The HKMA's monetary policy is closely tied to US interest rates to prevent large interest rate differentials.

- Transparency: The HKMA regularly publishes data on its interventions to maintain market transparency and credibility.

The US dollar's role is paramount; it serves as the anchor currency, providing stability and predictability to the Hong Kong dollar. The effectiveness of the Hong Kong dollar peg relies heavily on the stability of the USD itself and the continued strength of the US economy.

The HKMA's Recent US Dollar Purchases: A Detailed Look

In recent months, the HKMA has undertaken several notable interventions, purchasing significant amounts of US dollars. While precise figures are not always immediately released, news reports and HKMA statements indicate an increased frequency and scale of these purchases. (Note: Insert a chart or graph here visually representing the reported US dollar purchases by the HKMA over a specified period. Source the data from official HKMA releases or reputable financial news sources like the Financial Times or Bloomberg.) For example, on [Date], the HKMA reportedly bought [amount] USD to support the HKD. These interventions suggest an increase in pressure on the Hong Kong dollar, necessitating active management by the HKMA to maintain the currency's peg.

Analyzing the Pressure on the Hong Kong Dollar

Several factors can contribute to pressure on the Hong Kong dollar, necessitating HKMA intervention:

- Capital Outflows: Significant capital outflows from Hong Kong, driven by factors like economic uncertainty or shifting investment strategies, can weaken the HKD.

- Speculative Attacks: Speculators might bet against the HKD, attempting to profit from a devaluation. This can trigger large-scale selling pressure.

- Interest Rate Differentials: If US interest rates rise significantly above Hong Kong's rates, it can encourage capital flight to the US, putting downward pressure on the HKD.

- Geopolitical Factors: Geopolitical events affecting Hong Kong or the broader global economy can also create uncertainty and lead to capital outflows.

These factors create imbalances in the foreign exchange market, requiring the HKMA to intervene by buying US dollars to increase demand for the HKD and maintain the peg within the allowed band. The frequency and scale of these interventions directly reflect the level of pressure on the Hong Kong dollar.

Implications of HKMA's Actions for Investors and Businesses

The HKMA's interventions have significant implications for investors and businesses operating in Hong Kong:

- Exchange Rate Volatility: While the HKMA aims to minimize volatility, interventions themselves can create short-term fluctuations in the exchange rate.

- Investment Decisions: The actions of the HKMA influence investment decisions, impacting asset allocation strategies and foreign direct investment flows.

- Business Operations: Businesses engaged in international trade are directly affected by exchange rate movements, impacting profitability and competitiveness.

- International Trade: The stability of the HKD is vital for Hong Kong's role as a major trading hub, impacting the cost of imports and exports.

Businesses should closely monitor HKMA actions and their potential impact on their operations. Hedging strategies might be necessary to mitigate exchange rate risks, and careful financial planning is crucial to navigate the uncertainties introduced by potential HKD fluctuations.

Alternative Scenarios and Future Outlook

Several potential scenarios could unfold in the future:

- Continued Pressure: The pressure on the HKD could persist, leading to more frequent and larger-scale HKMA interventions.

- Peg Adjustment: While unlikely, a reassessment of the existing peg or a potential adjustment to the band remains a possibility under extreme circumstances.

- Increased Intervention: The HKMA might increase its interventions, potentially depleting its US dollar reserves over time if the pressure continues unabated.

The long-term consequences depend on a multitude of factors, including global economic conditions, geopolitical stability, and the ongoing effectiveness of the HKMA's strategies. A thorough understanding of these possible scenarios is vital for informed decision-making.

Conclusion: The Significance of Monitoring HKMA's US Dollar Purchases

The HKMA's US dollar purchases are a crucial indicator of pressure on the Hong Kong dollar and reflect the challenges in maintaining the currency's peg. Monitoring these interventions is essential for investors and businesses to understand the current state of the Hong Kong economy and to make informed decisions. Staying informed about HKMA actions and their implications for the Hong Kong dollar is paramount for navigating the complexities of this dynamic market. Stay updated on the latest developments concerning HKMA's US dollar purchases and their impact on the Hong Kong dollar by subscribing to our newsletter/following our social media channels.

Featured Posts

-

Ice Evasion Migrant Remains In Tree For Eight Hours To Avoid Detention

May 04, 2025

Ice Evasion Migrant Remains In Tree For Eight Hours To Avoid Detention

May 04, 2025 -

Dope Girls Review Cocaine Electronica And Glamour In The Trenches

May 04, 2025

Dope Girls Review Cocaine Electronica And Glamour In The Trenches

May 04, 2025 -

Netherlands Weighs Reintroducing Ow Subsidies To Boost Bidding

May 04, 2025

Netherlands Weighs Reintroducing Ow Subsidies To Boost Bidding

May 04, 2025 -

Seven Fatalities Reported Near Yellowstone After Vehicle Collision

May 04, 2025

Seven Fatalities Reported Near Yellowstone After Vehicle Collision

May 04, 2025 -

Anchor Brewing Company To Shutter After 127 Years A Legacy Ends

May 04, 2025

Anchor Brewing Company To Shutter After 127 Years A Legacy Ends

May 04, 2025

Latest Posts

-

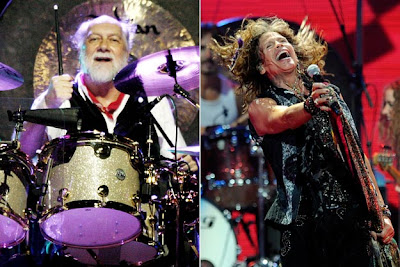

The Enduring Influence Of Fleetwood Mac A Supergroups Impact

May 04, 2025

The Enduring Influence Of Fleetwood Mac A Supergroups Impact

May 04, 2025 -

Examining Fleetwood Macs Claim To Supergroup Fame

May 04, 2025

Examining Fleetwood Macs Claim To Supergroup Fame

May 04, 2025 -

Fleetwood Mac Supergroup Pioneers Or Just A Highly Successful Band

May 04, 2025

Fleetwood Mac Supergroup Pioneers Or Just A Highly Successful Band

May 04, 2025 -

The Case For Fleetwood Mac As The Worlds First Supergroup

May 04, 2025

The Case For Fleetwood Mac As The Worlds First Supergroup

May 04, 2025 -

Were Fleetwood Mac The Original Supergroup A Critical Look

May 04, 2025

Were Fleetwood Mac The Original Supergroup A Critical Look

May 04, 2025