HMRC Tax Letters: A Guide For UK Households

Table of Contents

Common Types of HMRC Tax Letters and Their Meanings

Let's delve into the different types of HMRC tax letters you might encounter and what they signify.

Tax Assessment Letters

A tax assessment letter from HMRC outlines your tax liability for a specific tax year. This crucial document details:

- The tax year covered (e.g., 2022-2023).

- The total tax you owe (income tax, Capital Gains Tax etc).

- The payment deadlines.

It's absolutely vital to check the accuracy of your HMRC tax assessment. Discrepancies can arise from various sources, including:

- Errors in your self-assessment tax return.

- Incorrect income reported.

- Changes in your circumstances not communicated to HMRC.

If you spot an error, contact HMRC immediately using the details provided on the letter. Gather supporting documentation like payslips, P60s, and bank statements to support your claim. Keywords: HMRC tax assessment, self-assessment tax, income tax, tax calculation, Capital Gains Tax.

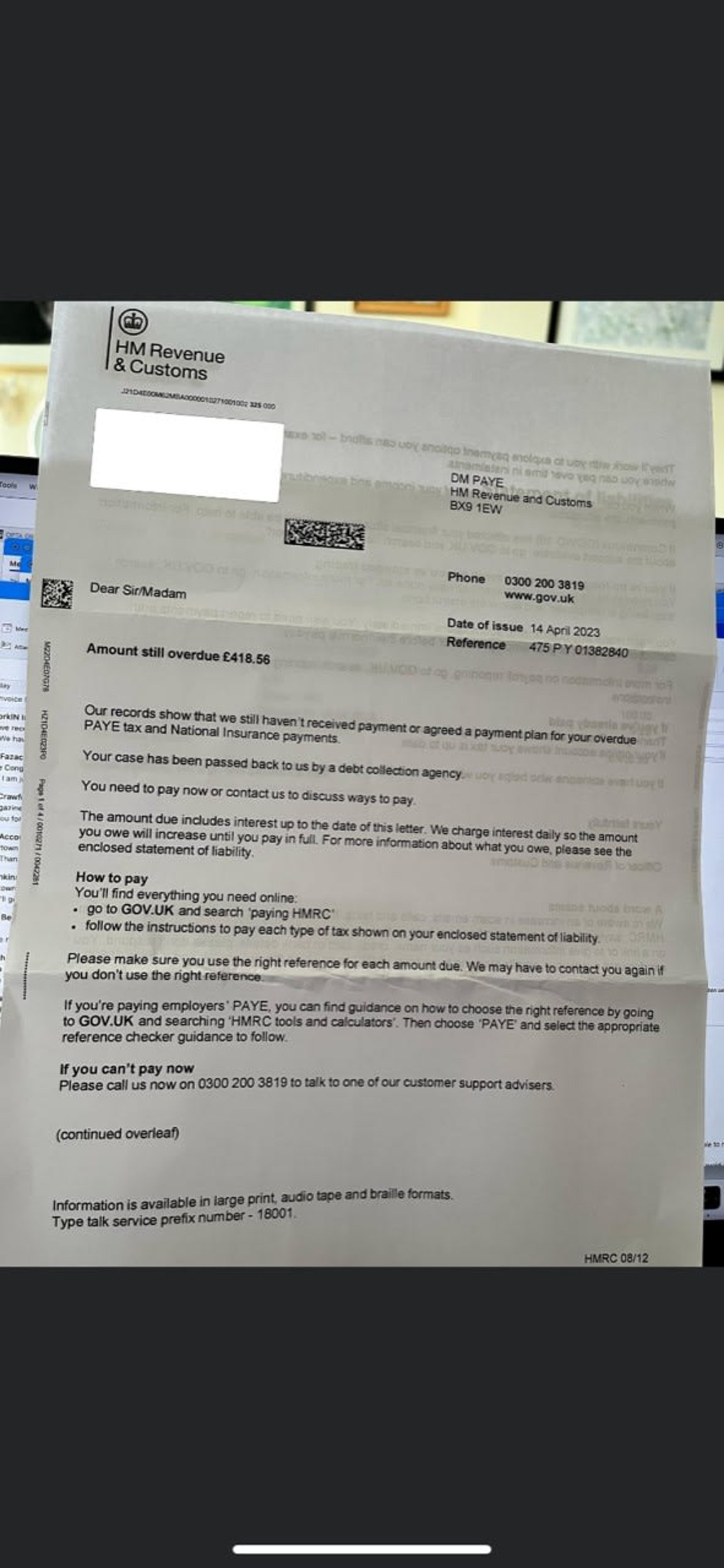

Payment Reminder Letters

An HMRC payment reminder letter indicates that a tax payment is overdue. These letters serve as a warning, giving you a final chance to settle your outstanding tax bill before penalties are applied. Ignoring these reminders can have serious consequences, leading to:

- Late payment penalties, which can significantly increase your overall tax bill.

- Further debt collection action from HMRC.

Make timely tax payments a priority. Set up direct debits or use the online HMRC payment portal to avoid late payment issues. Keywords: HMRC payment reminder, tax payment deadline, late tax payment penalty.

Penalty Letters

Receiving an HMRC penalty letter means you've incurred a penalty for failing to meet your tax obligations. Penalties can be levied for:

- Late filing of your self-assessment tax return.

- Late payment of your tax bill.

- Submitting an inaccurate tax return.

Penalties are calculated based on the severity and duration of the breach. While penalties can be significant, you may be able to appeal if you believe the penalty was unfairly applied. Always review the letter carefully and consider seeking professional tax advice if needed. Keywords: HMRC penalty letter, tax penalties UK, appealing HMRC penalties.

Other HMRC Correspondence

Besides the above, you may receive other HMRC correspondence, such as:

- HMRC enquiry letters: These request further information regarding your tax return. Respond promptly and completely to avoid delays.

- Letters requesting further information for a tax investigation. Cooperate fully and seek professional advice if needed.

Keywords: HMRC enquiry letter, HMRC correspondence, tax investigation.

Responding to HMRC Tax Letters: A Step-by-Step Guide

Effective communication is key when dealing with HMRC tax letters.

Understanding the Letter's Content

Carefully read the entire letter, paying close attention to:

- The reference numbers.

- The specific details of your tax liability.

- All deadlines and required actions.

Checking for Errors

Verify the accuracy of the information provided against your own records. This might involve:

- Checking your payslips, P60s, and bank statements.

- Reviewing previous tax returns.

- Consulting with a tax professional if needed.

Contacting HMRC

HMRC offers several ways to contact them:

- Their online portal.

- Phone.

- Post.

Contact them if you have any queries, disputes, or need to appeal a penalty.

Making Payments

HMRC provides various payment methods:

- Online payment portal.

- Bank transfer.

- Cheque (less preferred).

Avoiding HMRC Tax Letter Problems: Proactive Tax Planning

Proactive tax planning is the best way to prevent issues with HMRC.

Keeping Accurate Records

Maintain organized financial records throughout the year. Consider using:

- Accounting software.

- Hiring an accountant.

Filing Tax Returns on Time

Meet all self-assessment deadlines to avoid late filing penalties. Set reminders well in advance.

Understanding Your Tax Obligations

If unsure about your tax obligations, seek professional advice from a tax advisor. Utilize HMRC's online resources for guidance.

Conclusion: Taking Control of Your HMRC Correspondence

Understanding and responding effectively to HMRC tax letters is essential for every UK household. By following the steps outlined above and practicing proactive tax planning, you can avoid unnecessary stress and penalties. Don't ignore your HMRC tax letters; take control of your HMRC tax affairs today. Learn more about HMRC tax letters and ensure you're fully compliant with your tax obligations.

Featured Posts

-

Second Typhon Battery Us Army Bolsters Pacific Defense

May 20, 2025

Second Typhon Battery Us Army Bolsters Pacific Defense

May 20, 2025 -

Agatha Christie L Integrale De Ses Aventures Et Mysteres

May 20, 2025

Agatha Christie L Integrale De Ses Aventures Et Mysteres

May 20, 2025 -

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025 -

Learn To Write Like Agatha Christie Bbcs New Ai Writing Course

May 20, 2025

Learn To Write Like Agatha Christie Bbcs New Ai Writing Course

May 20, 2025 -

Nyt Mini Crossword Answers March 8

May 20, 2025

Nyt Mini Crossword Answers March 8

May 20, 2025

Latest Posts

-

Gaite Lyrique Evacuation Des Salaries Et Demande De Securite A La Mairie De Paris

May 20, 2025

Gaite Lyrique Evacuation Des Salaries Et Demande De Securite A La Mairie De Paris

May 20, 2025 -

Nigerias Moral Landscape Exploring Pragmatism Through The Lens Of The Kite Runner

May 20, 2025

Nigerias Moral Landscape Exploring Pragmatism Through The Lens Of The Kite Runner

May 20, 2025 -

Atkinsrealis Droit Expertise Juridique Et Conseils D Affaires

May 20, 2025

Atkinsrealis Droit Expertise Juridique Et Conseils D Affaires

May 20, 2025 -

The Decamerons Lou Gala A Deep Dive Into Her Character And Performance

May 20, 2025

The Decamerons Lou Gala A Deep Dive Into Her Character And Performance

May 20, 2025 -

Nigeria Navigating Pragmatism And The Kite Runner Dilemma

May 20, 2025

Nigeria Navigating Pragmatism And The Kite Runner Dilemma

May 20, 2025