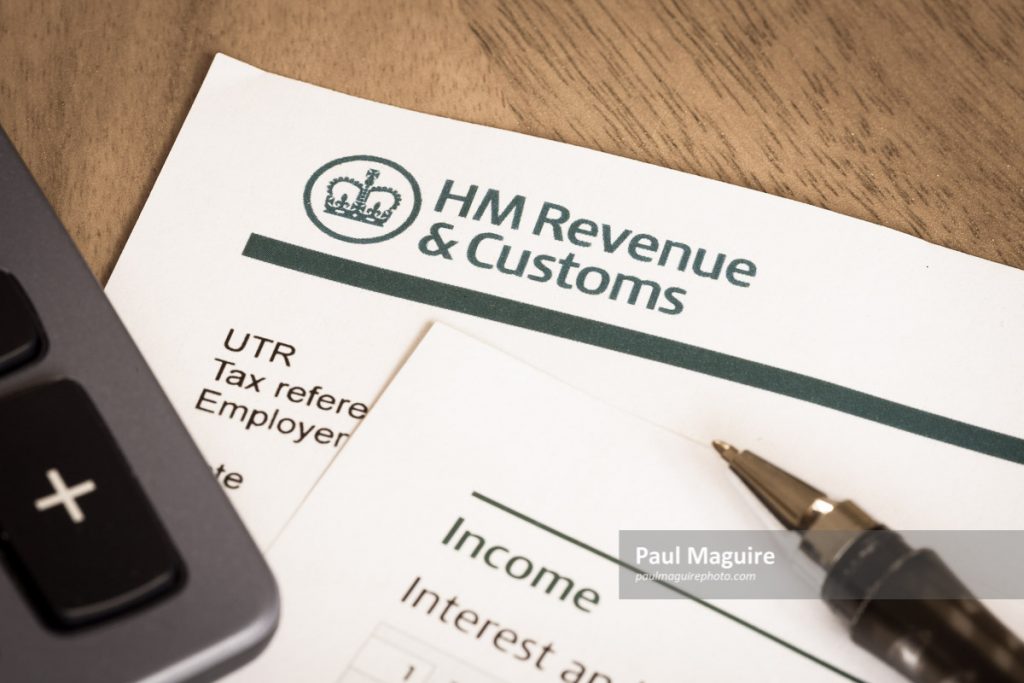

HMRC's New Tax Code: Implications For Your Savings And Income

Table of Contents

Understanding the Changes in the New HMRC Tax Code

HMRC periodically updates its tax code to reflect economic changes and government policy. The latest revision introduces several key modifications that affect taxpayers across the income spectrum. These changes aim to streamline certain aspects of the tax system while also adjusting tax burdens. Let’s explore the core alterations:

-

Changes to tax bands and thresholds: The new tax code may adjust the income thresholds defining different tax bands (basic rate, higher rate, additional rate). This means your income could fall into a different tax bracket, potentially altering your overall tax liability. Understanding these new thresholds is key to accurately calculating your tax owed. Check the official HMRC website for the most up-to-date information on tax bands and thresholds for the current tax year.

-

New allowances or deductions: The government may introduce new allowances or deductions, potentially reducing your taxable income. These could be targeted at specific groups or circumstances, such as those with childcare expenses or those contributing to a pension. Keeping abreast of these changes can lead to significant tax savings.

-

Simplifications or complexities introduced: While some changes aim for simplification, others might add layers of complexity. For example, changes to the rules governing capital gains tax or the treatment of rental income might require more careful attention.

-

Impact on different income levels (high, medium, low): The impact of the new HMRC tax code varies depending on your income level. Higher earners might face alterations in their higher-rate tax band, while lower earners may see adjustments to their personal allowance. It's essential to understand how these changes specifically affect your financial situation. Tax code changes 2024 (or the relevant year) will be crucial in understanding your personal implications.

Impact on Your Savings

The new HMRC tax code also impacts how your savings are taxed. Understanding these implications is vital for maximizing the returns on your investments.

-

ISAs (Individual Savings Accounts): While the ISA allowance itself might not change drastically year-on-year, the overall tax landscape could affect the attractiveness of ISAs compared to other investment options. Understanding any changes to tax-free allowances within ISAs is crucial for maintaining tax efficiency.

-

Pension contributions: Changes to tax relief on pension contributions could significantly affect your retirement planning. The amount of tax relief you receive might be adjusted, influencing your net contribution and your overall pension savings. Always review your pension strategy in light of the new tax code.

-

Savings accounts: The tax implications for interest earned on savings accounts could alter depending on the interest rate and your overall income. Be aware of how the new tax code might affect the after-tax returns on your savings. Remember to factor in savings interest tax when planning your savings strategy.

Impact on Your Income

The effects of the new tax code extend to different income streams, including employment, self-employment, and investments.

-

Employment income: Changes to PAYE (Pay As You Earn) are directly influenced by the updated tax bands and thresholds. Your employer will adjust your tax deductions accordingly, impacting your take-home pay. Ensure you understand how your PAYE is affected to avoid any unpleasant surprises.

-

Self-employment income: If you're self-employed, the new tax code will affect your self-assessment tax return. Changes to tax rates and allowances for self-employed individuals require careful consideration when completing your return.

-

Investment income: The tax implications for dividends and capital gains could change. The new tax code may adjust the tax rates or allowances applicable to these income types, requiring you to reassess your investment strategy. Ensure you factor in dividend tax and capital gains tax correctly in your calculations.

Planning and Preparation for the New HMRC Tax Code

Adapting to the new tax code requires proactive planning and preparation. Here are some crucial steps you can take:

-

Reviewing personal finances and tax liabilities: Carefully review your income, expenses, and tax liabilities to fully grasp the implications of the new code. Use tax calculators or seek professional assistance to assess the impact on your financial situation.

-

Seeking professional tax advice if necessary: If you're unsure about any aspect of the new tax code or its impact on your personal circumstances, seeking advice from a qualified tax advisor is highly recommended. They can help you optimize your tax planning and ensure you comply with all tax regulations.

-

Adjusting savings and investment strategies: Based on the changes outlined above, you may need to adjust your savings and investment strategies to maintain tax efficiency. This could involve altering your ISA contributions, pension payments, or investment portfolio.

-

Understanding potential tax implications of future financial decisions: Make informed decisions about future financial planning, considering the tax implications of the new code. This could include major purchases, significant investments, or any other financial move that has tax ramifications.

Navigating HMRC's New Tax Code for Optimal Financial Outcomes

The new HMRC tax code presents both challenges and opportunities. Understanding the changes to tax bands, allowances, and their impact on savings and income is paramount. By proactively reviewing your finances, seeking professional guidance when needed, and adapting your strategies accordingly, you can navigate this new tax landscape effectively. Take control of your finances by understanding HMRC's new tax code and plan accordingly. Learn more about the new HMRC tax code today! Consult a tax professional to optimize your tax planning under the new HMRC tax code.

Featured Posts

-

Hmrc Tax Return Changes Whos Affected And What You Need To Know

May 20, 2025

Hmrc Tax Return Changes Whos Affected And What You Need To Know

May 20, 2025 -

Agatha Christies Poirot Adaptations And Influences

May 20, 2025

Agatha Christies Poirot Adaptations And Influences

May 20, 2025 -

Le Bo Cafe De Biarritz Une Nouvelle Page S Ecrit Avec Des Gerants Experimentes

May 20, 2025

Le Bo Cafe De Biarritz Une Nouvelle Page S Ecrit Avec Des Gerants Experimentes

May 20, 2025 -

Newly Discovered Letters Illuminate Agatha Christies Literary Feuds

May 20, 2025

Newly Discovered Letters Illuminate Agatha Christies Literary Feuds

May 20, 2025 -

Nyt Mini Crossword Answer Key March 15

May 20, 2025

Nyt Mini Crossword Answer Key March 15

May 20, 2025

Latest Posts

-

Croissance Du Trafic Au Port Autonome D Abidjan 2021 2022

May 20, 2025

Croissance Du Trafic Au Port Autonome D Abidjan 2021 2022

May 20, 2025 -

Cote D Ivoire Le Port D Abidjan Et Ses Performances 2022

May 20, 2025

Cote D Ivoire Le Port D Abidjan Et Ses Performances 2022

May 20, 2025 -

Cote D Ivoire Impact Economique De L Arrivee Du Diletta Au Port D Abidjan

May 20, 2025

Cote D Ivoire Impact Economique De L Arrivee Du Diletta Au Port D Abidjan

May 20, 2025 -

Amenagement Urbain En Cote D Ivoire Les Plans De Detail Et Le Role Des Maires

May 20, 2025

Amenagement Urbain En Cote D Ivoire Les Plans De Detail Et Le Role Des Maires

May 20, 2025 -

Paa Analyse Du Trafic Maritime En Cote D Ivoire 2022

May 20, 2025

Paa Analyse Du Trafic Maritime En Cote D Ivoire 2022

May 20, 2025