Home Depot Stock: Guidance Maintained Despite Disappointing Q[Quarter] Results

![Home Depot Stock: Guidance Maintained Despite Disappointing Q[Quarter] Results Home Depot Stock: Guidance Maintained Despite Disappointing Q[Quarter] Results](https://hirschfeld-kongress.de/image/home-depot-stock-guidance-maintained-despite-disappointing-q-quarter-results.jpeg)

Table of Contents

Disappointing Q2 Earnings Report Detailed

Home Depot's Q2 2024 earnings report revealed a mixed bag. While the company reported strong revenue, it failed to meet analysts' expectations, leading to a dip in the stock price. Let's break down the key figures:

-

Revenue: While the specific revenue figure needs to be inserted here (e.g., "$40 billion"), it still represented a [percentage]% increase compared to the same period last year. However, this fell short of the [Dollar Amount] billion that analysts had predicted.

-

Earnings Per Share (EPS): Home Depot reported an EPS of [Specific EPS number], which was significantly lower than the anticipated [anticipated EPS number] and the [previous year EPS number] from Q2 of the previous year.

-

Comparable Sales Growth: Comparable sales growth, a key indicator of performance, was reported at [percentage]%, indicating a slowdown in sales growth compared to previous quarters and the same period last year. This is likely due to several factors, including:

- Inflationary Pressures: Rising prices for building materials and home improvement supplies have impacted consumer spending.

- Shifting Consumer Spending Habits: Consumers may be re-allocating their budgets away from discretionary spending, including home improvements.

- Inventory Levels: While inventory levels were managed effectively, any overstocking or understocking in specific product categories could contribute to fluctuations in sales.

-

Operating Expenses and Margins: Home Depot's operating expenses showed a [percentage]% increase compared to the previous year. This, combined with the softer-than-expected revenue, resulted in a compression of operating margins.

Home Depot's Maintained Guidance: A Closer Look

Despite the underwhelming Q2 results, Home Depot surprisingly maintained its full-year guidance. This decision warrants a closer examination:

-

Full-Year Guidance: The company reaffirmed its outlook for [state the specific guidance provided, e.g., a specific percentage range of sales growth or EPS].

-

Reasons for Confidence: Home Depot's confidence in its maintained guidance might stem from several factors:

- Long-Term Market Trends: The company may be banking on a recovery in the housing market or sustained long-term demand for home improvement projects.

- Projected Sales Growth in Specific Areas: Perhaps certain product categories or geographic regions are anticipated to perform better in the remaining quarters, offsetting weaker areas.

- Cost-Cutting Measures: Internal efficiency improvements and cost-cutting measures could help them meet their financial targets.

-

Potential Risks and Uncertainties: However, several factors could threaten Home Depot's ability to meet its guidance:

- Further Economic Slowdown: A more pronounced economic downturn could further dampen consumer spending.

- Supply Chain Disruptions: Continued challenges in the global supply chain could impact product availability and costs.

- Increased Competition: Intense competition from other home improvement retailers may put pressure on margins and sales.

-

Implications for Investors: The maintained guidance, despite the weak Q2, could be interpreted positively by some investors, indicating management’s confidence in the company’s long-term strategy. However, others might remain cautious, awaiting further evidence of a turnaround.

Market Reaction and Analyst Opinions on Home Depot Stock

The market's reaction to Home Depot's Q2 earnings and maintained guidance was mixed. Immediately following the announcement, the HD stock price [describe the immediate reaction, e.g., "experienced a slight dip of X%," or "remained relatively stable"].

- Analyst Ratings: Following the report, various financial analysts provided their opinions, resulting in a diverse range of ratings. [Insert details about specific analyst upgrades, downgrades, or price target adjustments, citing sources if possible]. Some analysts maintained a "buy" rating, highlighting Home Depot's strong brand, market position, and long-term growth potential. Others adopted a more cautious stance, citing the economic uncertainties and the weaker-than-expected Q2 performance.

Conclusion

Home Depot's Q2 2024 earnings report revealed weaker-than-expected results, but the company's decision to maintain its full-year guidance is noteworthy. This creates a complex situation for investors. While the Q2 numbers were disappointing, the sustained outlook suggests a degree of confidence in long-term prospects. However, various risks and uncertainties remain. Understanding the implications of both the weaker Q2 and the maintained guidance is crucial for informed investment decisions.

Call to Action: Conduct thorough research, considering your personal risk tolerance and financial goals before making any investment decisions regarding Home Depot stock. Explore resources like financial news websites, analyst reports, and SEC filings to gain a comprehensive understanding of Home Depot’s performance and the broader home improvement sector. Stay informed about the evolving landscape of Home Depot stock and its impact on your portfolio.

![Home Depot Stock: Guidance Maintained Despite Disappointing Q[Quarter] Results Home Depot Stock: Guidance Maintained Despite Disappointing Q[Quarter] Results](https://hirschfeld-kongress.de/image/home-depot-stock-guidance-maintained-despite-disappointing-q-quarter-results.jpeg)

Featured Posts

-

The Thames Water Executive Bonus Scandal A Detailed Examination

May 22, 2025

The Thames Water Executive Bonus Scandal A Detailed Examination

May 22, 2025 -

Impact Of Late Snowfall And Storms On The Southern French Alps

May 22, 2025

Impact Of Late Snowfall And Storms On The Southern French Alps

May 22, 2025 -

National Treasure Trafficking Bbc Antiques Roadshow Couple Sentenced

May 22, 2025

National Treasure Trafficking Bbc Antiques Roadshow Couple Sentenced

May 22, 2025 -

Tory Wifes Jail Sentence Stands Following Southport Migrant Comments

May 22, 2025

Tory Wifes Jail Sentence Stands Following Southport Migrant Comments

May 22, 2025 -

Chat Gpt And Open Ai Facing Ftc Investigation A Deep Dive Into The Issues

May 22, 2025

Chat Gpt And Open Ai Facing Ftc Investigation A Deep Dive Into The Issues

May 22, 2025

Latest Posts

-

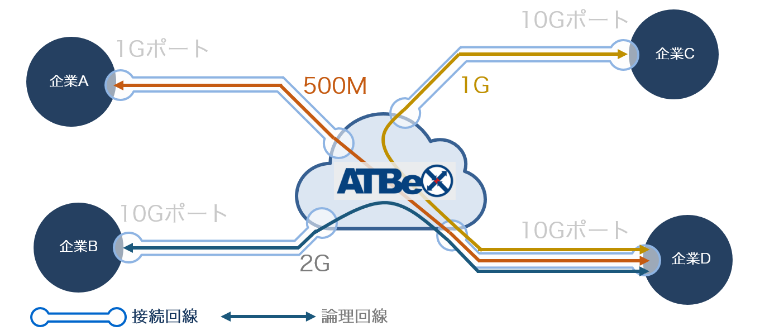

At Be X Ntt Multi Interconnect Ascii Jp

May 22, 2025

At Be X Ntt Multi Interconnect Ascii Jp

May 22, 2025 -

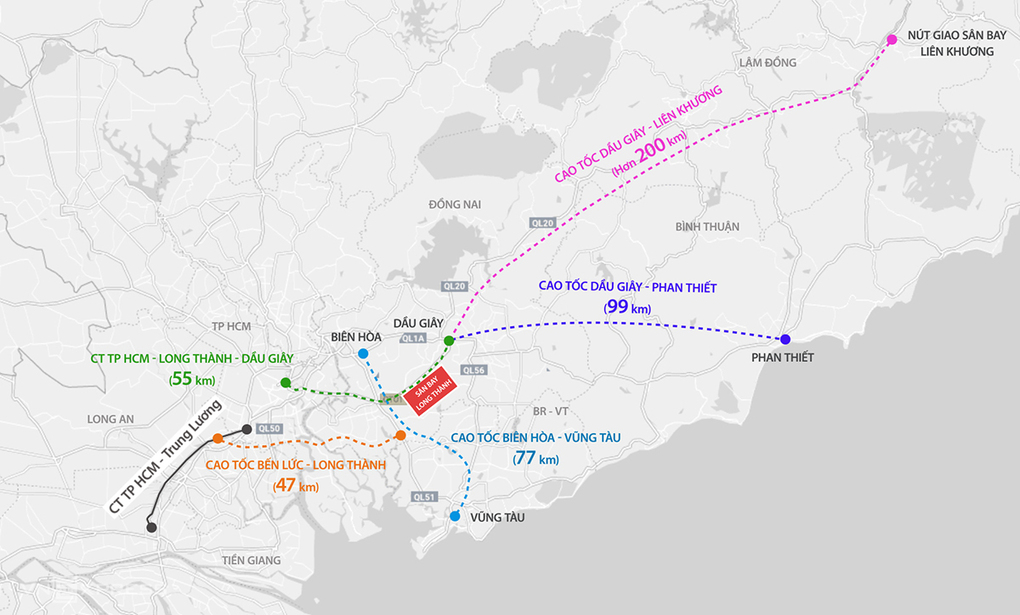

Thong Tin Moi Nhat Cao Toc Noi Dong Nai Va Vung Tau Sap Thong Xe

May 22, 2025

Thong Tin Moi Nhat Cao Toc Noi Dong Nai Va Vung Tau Sap Thong Xe

May 22, 2025 -

Ascii Jp Ntt Multi Interconnect At Be X

May 22, 2025

Ascii Jp Ntt Multi Interconnect At Be X

May 22, 2025 -

Cao Toc Dong Nai Vung Tau Du Kien Thong Xe Thang 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Du Kien Thong Xe Thang 9

May 22, 2025 -

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025