Honeywell-Johnson Matthey Deal: $2.4 Billion Catalyst Business Acquisition

Table of Contents

Deal Details and Significance

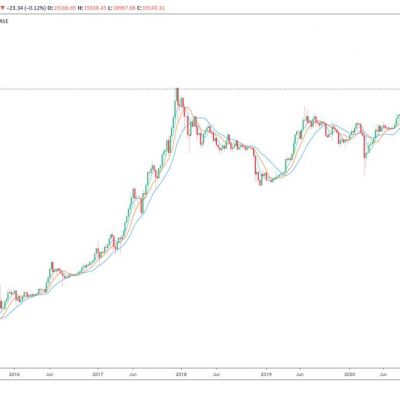

Financial Aspects of the Acquisition

The $2.4 billion price tag represents a substantial investment for Honeywell, signifying the company's belief in the long-term value of Johnson Matthey's catalyst technologies. Understanding the financial impact requires examining the deal structure, including the acquisition cost breakdown, payment methods, and projected return on investment (ROI).

- Acquisition Cost Breakdown: While the exact breakdown isn't publicly available, the $2.4 billion encompasses the value of Johnson Matthey's established catalyst technologies, intellectual property, and existing operations.

- Deal Completion Timeline: The acquisition is expected to close in the latter half of 2024, subject to regulatory approvals and customary closing conditions.

- Honeywell's Financing Strategy: Honeywell likely used a combination of cash reserves and debt financing to fund this substantial acquisition. The precise allocation remains undisclosed.

- Potential Financial Benefits for Honeywell: Analysts project significant ROI for Honeywell through increased market share, operational synergies, and the potential for new product development based on Johnson Matthey's advanced catalyst technologies. This acquisition is expected to boost Honeywell's financial performance in the long term.

Strategic Rationale Behind the Honeywell-Johnson Matthey Deal

Honeywell's acquisition of Johnson Matthey's catalyst business is far more than a simple financial transaction; it's a strategic maneuver designed to bolster its position in several key markets.

- Honeywell's Ambitions in the Catalyst Market: This acquisition significantly expands Honeywell's presence in the high-growth catalyst market, providing access to a wider range of technologies and applications.

- Expansion into New Geographical Markets: Johnson Matthey's global footprint opens new avenues for Honeywell to reach customers in various regions.

- Access to Cutting-Edge Catalyst Technologies: Johnson Matthey boasts a portfolio of advanced catalyst technologies vital for emission control and various chemical processes. This acquisition provides Honeywell with access to these leading-edge innovations.

- Strengthening Honeywell's Position in the Automotive Industry: The automotive industry is a significant consumer of catalyst technologies. By acquiring Johnson Matthey's expertise, Honeywell strengthens its position as a key player in this sector, particularly in the area of clean technology and emissions control.

Impact on the Automotive and Chemical Industries

Implications for the Automotive Industry

The Honeywell-Johnson Matthey deal reverberates throughout the automotive industry, particularly in emissions control.

- Impact on the Availability and Pricing of Automotive Catalysts: The acquisition could influence the supply chain dynamics, potentially impacting the availability and pricing of automotive catalysts.

- Potential for Advancements in Emissions Reduction Technologies: Access to Johnson Matthey's technology platform will enable Honeywell to accelerate innovation in emissions reduction technologies, contributing to cleaner vehicles.

- Changes in the Automotive Industry's Supplier Landscape: The consolidation of these two major players reshapes the supplier landscape, potentially leading to more strategic partnerships and alliances.

Implications for the Chemical Industry

The ripple effects extend beyond the automotive sector, significantly influencing the broader chemical industry.

- Impact on the Supply and Demand of Catalysts in Various Chemical Processes: The acquisition changes the dynamics of catalyst supply and demand, potentially impacting pricing and availability across various chemical processes.

- Potential Shifts in the Competitive Dynamics within the Chemical Industry: The combined entity creates a powerful competitor in the chemical catalyst market, potentially reshaping competitive landscapes.

- Opportunities for Innovation and Technological Advancements: The merger of Honeywell’s resources and Johnson Matthey's technological expertise opens doors for groundbreaking innovations in chemical manufacturing and catalyst technology.

Future Outlook and Potential Challenges

Honeywell's Integration Strategy

Successful integration of Johnson Matthey's catalyst business into Honeywell's operations is crucial. This involves meticulous planning and execution to leverage synergies and minimize disruptions.

- Key Steps Involved in the Integration Process: The process will likely involve a phased approach, including thorough due diligence, talent retention strategies, and the gradual consolidation of operations.

- Potential Synergies and Cost Savings: Integrating operations should produce cost efficiencies and operational synergies, enhancing profitability.

- Challenges Related to Merging Different Corporate Cultures: Merging two distinct corporate cultures requires careful management to minimize friction and retain valuable talent.

- Potential Risks Associated with the Integration: The integration process carries inherent risks, including potential delays, unforeseen complications, and integration challenges.

Long-Term Growth Prospects

The Honeywell-Johnson Matthey deal positions Honeywell for significant long-term growth, particularly in the sustainable development sector.

- Honeywell's Projected Growth in the Catalyst Market: Analysts predict substantial growth for Honeywell in the catalyst market, driven by increased demand for emission control technologies and advancements in chemical manufacturing.

- The Impact of This Acquisition on Honeywell's Overall Financial Performance: The acquisition is expected to positively impact Honeywell's financial performance, generating increased revenue and profitability.

- Long-Term Sustainability of the Catalyst Business: The focus on emission control and sustainable technologies positions the combined entity for long-term sustainability and growth in a market increasingly driven by environmental concerns.

Conclusion

The Honeywell-Johnson Matthey deal, a $2.4 billion catalyst for growth, represents a significant strategic acquisition with far-reaching implications for the automotive and chemical industries. This transaction positions Honeywell for significant expansion in the catalyst market, bringing together complementary technologies and expertise. While integration challenges exist, the long-term growth prospects are compelling. Understanding the details of this landmark $2.4 billion catalyst deal is crucial for anyone following the automotive, chemical, and clean technology sectors. To stay informed about the impact of the Honeywell-Johnson Matthey acquisition and the future of catalyst technology, continue to follow industry news and analysis.

Featured Posts

-

Edinburgh To Host The 2027 Tour De France Grand Depart

May 23, 2025

Edinburgh To Host The 2027 Tour De France Grand Depart

May 23, 2025 -

First Test Win For Zimbabwe Muzarabanis Bowling Dominates Bangladesh

May 23, 2025

First Test Win For Zimbabwe Muzarabanis Bowling Dominates Bangladesh

May 23, 2025 -

Discovering The Roots Of The Whos Iconic Name

May 23, 2025

Discovering The Roots Of The Whos Iconic Name

May 23, 2025 -

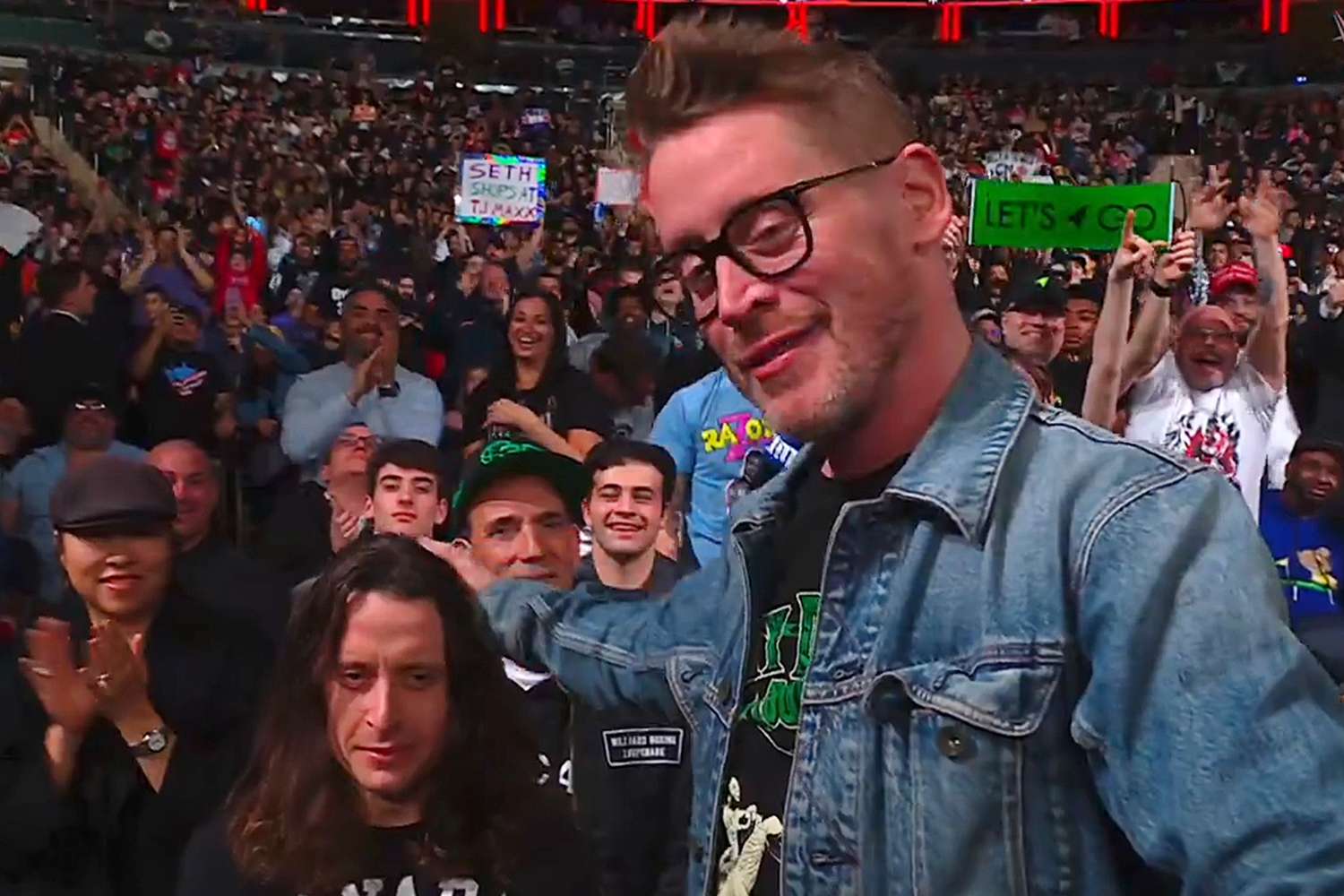

Macaulay Culkins Wwe Raw Appearance With Brother Rory Sparks Fan Frenzy

May 23, 2025

Macaulay Culkins Wwe Raw Appearance With Brother Rory Sparks Fan Frenzy

May 23, 2025 -

Employee Quits Pub Landlord Unleashes Angry Explicit Rant

May 23, 2025

Employee Quits Pub Landlord Unleashes Angry Explicit Rant

May 23, 2025

Latest Posts

-

Kieran Culkin To Play Caesar Flickerman In Sunrise On The Reaping

May 23, 2025

Kieran Culkin To Play Caesar Flickerman In Sunrise On The Reaping

May 23, 2025 -

Succession Sky Atlantic Hd A Comprehensive Guide

May 23, 2025

Succession Sky Atlantic Hd A Comprehensive Guide

May 23, 2025 -

Sunrise On The Reaping Kieran Culkin Cast As Caesar Flickerman

May 23, 2025

Sunrise On The Reaping Kieran Culkin Cast As Caesar Flickerman

May 23, 2025 -

Fact Check Separating Fact From Fiction Suraj Venjaramoodu And The Oscar Speech

May 23, 2025

Fact Check Separating Fact From Fiction Suraj Venjaramoodu And The Oscar Speech

May 23, 2025 -

Malayalam Movie News Debunking The Suraj Venjaramoodu Kieran Culkin Oscar Speech Rumor

May 23, 2025

Malayalam Movie News Debunking The Suraj Venjaramoodu Kieran Culkin Oscar Speech Rumor

May 23, 2025