Hong Kong's US Dollar Peg: Intervention After A Two-Year Pause

Table of Contents

Understanding Hong Kong's Linked Exchange Rate System (LERS)

The cornerstone of Hong Kong's monetary policy is its Linked Exchange Rate System (LERS), which maintains a tight peg between the HKD and the USD. This system, managed by the HKMA, aims to keep the HKD exchange rate within a specified band against the USD. The HKMA acts as the anchor, buying and selling US dollars to maintain this stability.

-

The Mechanics: The LERS operates within a 7.75-7.85 HKD per USD band. When the HKD weakens towards the weak side of the band (7.85), the HKMA buys HKD and sells USD, injecting liquidity into the market and pushing the exchange rate back up. Conversely, if the HKD strengthens towards the strong side of the band (7.75), the HKMA sells HKD and buys USD, thus weakening the HKD.

-

The HKMA's Role: The HKMA's active management is vital to maintaining the peg. It holds substantial foreign currency reserves, primarily USD, to facilitate these interventions. This ensures the system's stability and confidence in the HKD.

-

Implications of Breaching the Band: Although highly unlikely given the HKMA's substantial reserves, breaching the band would signal a significant shift in the economic landscape, potentially triggering market volatility and impacting investor confidence. Historical interventions have been successful in maintaining the peg, showcasing the HKMA's effectiveness.

The Two-Year Pause and the Reasons Behind It

From [Start Date] to [End Date], the HKMA refrained from intervening in the foreign exchange market, marking a notable two-year pause. This period of inactivity reflects a period of relative market stability and low volatility in the HKD.

-

Factors Contributing to the Pause: Several factors likely contributed to the reduced need for intervention. These include relatively stable global economic conditions, limited capital outflows from Hong Kong, and a predictable US monetary policy during parts of that period.

-

Global Economic Conditions: The global economic climate during the pause, characterized by [mention specific economic conditions, e.g., low interest rates, stable growth], likely supported the stability of the HKD and reduced the need for intervention.

-

HKMA Statements and Policies: The HKMA’s public statements during this period indicated confidence in the LERS’s resilience and the effectiveness of its existing monetary policy framework.

The Trigger for Recent Intervention: Analyzing the Market Conditions

The recent intervention by the HKMA signals a shift in market dynamics. While the exact details may not be publicly available in full, it is likely a response to pressure on the HKD.

-

Exchange Rate Movements: The recent intervention likely followed discernible movements in the HKD exchange rate approaching the weak side of the band. [Insert specific data points if available].

-

Capital Flows and Interest Rate Differentials: Capital flows, driven by global economic uncertainties and interest rate differentials between the US and Hong Kong, may have put downward pressure on the HKD.

-

US Monetary Policy Impact: Changes in US monetary policy, such as interest rate hikes, can significantly impact the HKD through capital flows and investor sentiment.

Implications of the Intervention for Hong Kong's Economy and Investors

The HKMA's intervention carries significant implications for Hong Kong's economy and investors.

-

Short-Term Implications: The immediate effect is likely to be a stabilization of the HKD, bolstering confidence in the currency and potentially reducing volatility. However, the costs of the intervention (opportunity costs of holding reserves etc.) should be considered.

-

Long-Term Implications: The long-term effects depend on the persistence of the underlying economic forces that triggered the intervention. Continued external pressures could require further intervention.

-

Impact on Investors: Investors holding HKD assets are likely to experience increased stability, whereas investors expecting a weakening HKD might see reduced opportunities for gains.

Future Outlook for Hong Kong's US Dollar Peg

The sustainability of the Hong Kong dollar peg remains a key question in the face of global economic uncertainties and geopolitical risks.

-

Potential Threats: Potential threats to the peg include significant capital flight triggered by economic shocks or political instability. Geopolitical risks also pose a challenge to the peg’s longevity.

-

HKMA Response Strategies: The HKMA has demonstrated its commitment to maintaining the peg, suggesting it will continue to use its substantial reserves and policy tools to defend the HKD's stability.

-

Likely Scenarios: A few scenarios are possible: continued stability, periodic interventions to manage temporary pressures, or perhaps adjustments to the band. The actions and policies of both the US Federal Reserve and the Chinese central bank play a crucial role.

Conclusion: Hong Kong's US Dollar Peg – Navigating the Future

The recent intervention in Hong Kong's currency market marks a significant event, highlighting the importance of the US dollar peg and the HKMA's role in maintaining its stability. The reasons behind the intervention, largely linked to external economic forces and potential capital flow fluctuations, underline the interconnectedness of the Hong Kong and global economies. Understanding Hong Kong's Linked Exchange Rate System is vital for investors and businesses alike. The long-term outlook for the peg remains subject to various global factors; however, the HKMA's readiness to intervene suggests a continued commitment to maintaining this crucial aspect of Hong Kong's economic framework. Stay updated on the latest developments concerning Hong Kong's US dollar peg to make informed decisions about your investments and business strategies.

Featured Posts

-

Seven Killed In Yellowstone National Park Area Truck And Van Collision

May 05, 2025

Seven Killed In Yellowstone National Park Area Truck And Van Collision

May 05, 2025 -

Mark Carneys White House Meeting With Trump What To Expect

May 05, 2025

Mark Carneys White House Meeting With Trump What To Expect

May 05, 2025 -

Impact Of Us Tariffs On Sheins London Ipo Plans

May 05, 2025

Impact Of Us Tariffs On Sheins London Ipo Plans

May 05, 2025 -

Spotify I Phone App Enhanced Payment System Explained

May 05, 2025

Spotify I Phone App Enhanced Payment System Explained

May 05, 2025 -

Review Of Honjo Modern Japanese Cuisine In Hong Kongs Sheung Wan

May 05, 2025

Review Of Honjo Modern Japanese Cuisine In Hong Kongs Sheung Wan

May 05, 2025

Latest Posts

-

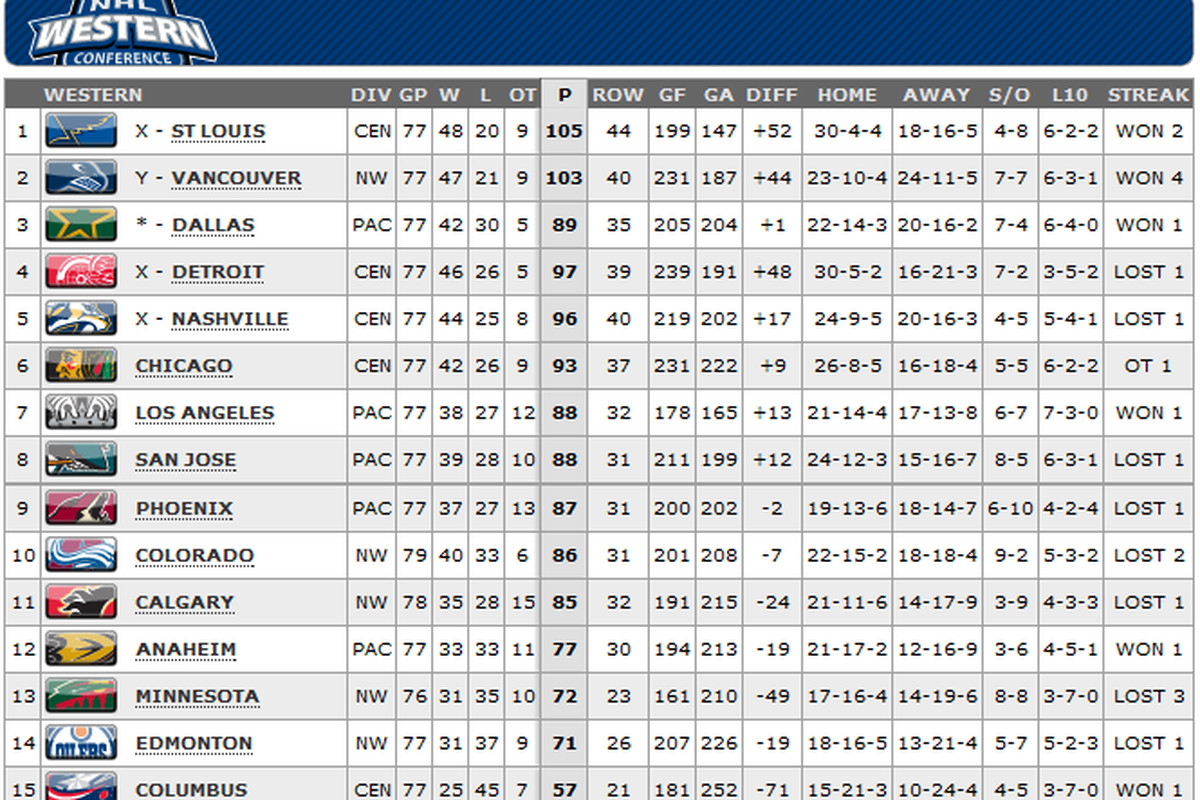

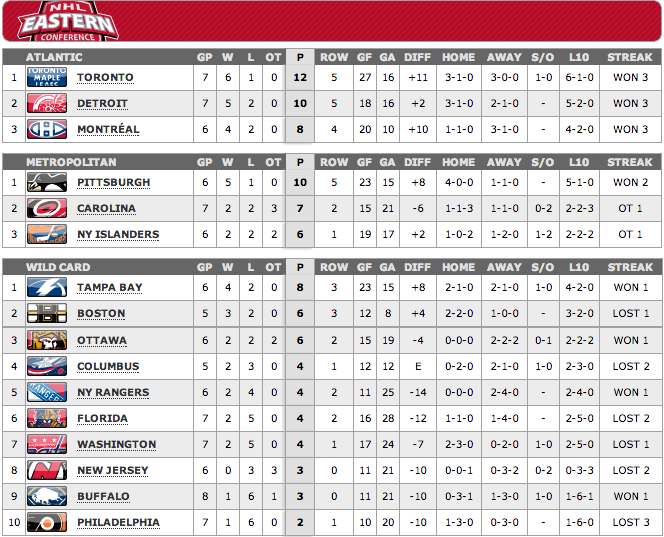

Nhl Standings The Western Conference Wild Card Contenders

May 05, 2025

Nhl Standings The Western Conference Wild Card Contenders

May 05, 2025 -

10 Year Mortgages In Canada Reasons For Limited Interest

May 05, 2025

10 Year Mortgages In Canada Reasons For Limited Interest

May 05, 2025 -

Carney Trump Meeting Will Cusma Survive

May 05, 2025

Carney Trump Meeting Will Cusma Survive

May 05, 2025 -

Understanding The Shift Shopifys Lifetime Program And Developer Earnings

May 05, 2025

Understanding The Shift Shopifys Lifetime Program And Developer Earnings

May 05, 2025 -

Western Conference Wild Card Battle Nhl Playoff Standings Analysis

May 05, 2025

Western Conference Wild Card Battle Nhl Playoff Standings Analysis

May 05, 2025