Hot New SPAC Stock: A Competitive Analysis Against MicroStrategy

Table of Contents

Understanding the Hot New SPAC Stock (NewCo SPAC)

Business Model and Target Market

NewCo SPAC is targeting an acquisition within the [Specify Industry, e.g., renewable energy sector]. Its business model centers on [Describe the core business model, e.g., developing and deploying innovative solar panel technology]. This positions NewCo SPAC to capitalize on the burgeoning demand for [Specify market need, e.g., sustainable energy solutions].

- Key features: [List key features, e.g., patented technology, strong IP portfolio, experienced management team]

- Competitive advantages: [List competitive advantages, e.g., cost-effective production, superior energy efficiency, strategic partnerships]

- Market size and growth potential: The global [Specify market, e.g., renewable energy] market is projected to reach [Insert market size projection with source] by [Insert year], presenting significant growth prospects for NewCo SPAC.

- Financial projections (if available): [Insert relevant financial projections, e.g., revenue forecasts, profitability targets, etc. Always cite sources.]

Management Team and Track Record

NewCo SPAC boasts a seasoned management team with a proven track record in [Specify relevant industry experience, e.g., technology, finance, renewable energy].

- Key individuals: [List key individuals and their relevant experience, e.g., CEO with 20 years in the renewable energy sector, CFO with expertise in high-growth companies]

- Past successes and failures: [Briefly describe past successes and any relevant failures, highlighting lessons learned and demonstrating competence.]

- Relevant experience in the target industry: The team's combined experience provides them with a deep understanding of the [Specify industry, e.g., renewable energy sector] landscape and the challenges inherent in scaling a successful business.

Financial Performance and Valuation

While pre-acquisition, NewCo SPAC's financial performance is primarily reflected in its trust account. Post-acquisition, the valuation will depend heavily on the target company's performance. Key metrics to watch include:

- Key financial ratios: [Mention key ratios such as P/E ratio (post-acquisition), Debt/Equity ratio, etc. These will be available after the acquisition is complete.]

- Valuation multiples: [Discuss expected valuation multiples based on comparable companies in the industry.]

- Comparison to industry peers: [Compare valuation and financial performance to similar companies within the same sector.]

- Potential risks and uncertainties: Investing in SPACs always involves risk, including the risk of the acquisition failing to materialize or the target company underperforming.

MicroStrategy: A Benchmark for Bitcoin-Focused Investments

MicroStrategy's Bitcoin Strategy

MicroStrategy's investment strategy is heavily focused on Bitcoin, making it a relevant benchmark for investors considering exposure to cryptocurrency.

- Size of Bitcoin holdings: MicroStrategy has amassed a substantial Bitcoin holding, making it one of the largest corporate holders globally. [Insert current Bitcoin holdings with source.]

- Investment timeline: MicroStrategy has been steadily accumulating Bitcoin over several years. [Briefly outline the timeline of their Bitcoin investments.]

- Reasons for the strategy: MicroStrategy's rationale centers on Bitcoin as a long-term store of value and a hedge against inflation. [Explain MicroStrategy's reasoning behind their investment in Bitcoin.]

- Potential risks and rewards: Investing in Bitcoin carries considerable risk due to its volatility, but the potential for significant returns is also high.

MicroStrategy's Financial Performance

MicroStrategy's financial performance has been impacted by the volatility of Bitcoin.

- Impact of Bitcoin on the company's financials: Bitcoin's price fluctuations directly affect MicroStrategy's balance sheet and reported earnings. [Explain the correlation between Bitcoin's price and MicroStrategy's financial statements.]

- Profitability: MicroStrategy's profitability is intertwined with the performance of its Bitcoin holdings. [Analyze the impact on profitability.]

- Revenue streams: While MicroStrategy’s core business remains its software solutions, the Bitcoin holdings represent a significant portion of its assets. [Discuss the contribution of Bitcoin to overall revenue.]

- MicroStrategy stock performance: The performance of MicroStrategy's stock is closely linked to the price of Bitcoin. [Analyze the correlation between MicroStrategy stock price and the Bitcoin price.]

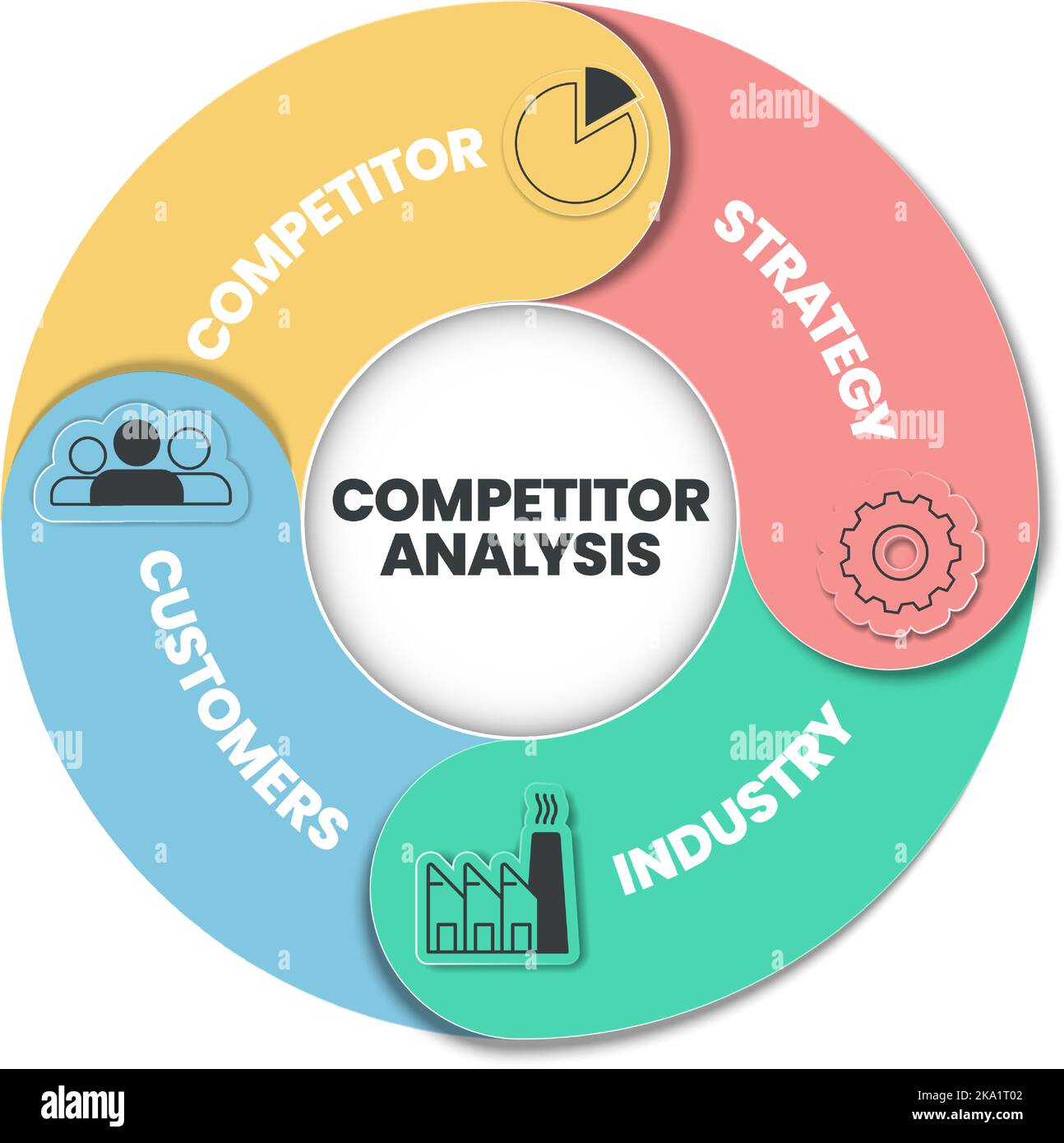

Comparative Analysis: NewCo SPAC vs. MicroStrategy

Investment Risks and Rewards

Investing in NewCo SPAC and MicroStrategy presents different risk profiles.

- Risk factors specific to each investment: NewCo SPAC carries the risks associated with pre-acquisition SPACs, while MicroStrategy's risk is mainly tied to Bitcoin's price volatility.

- Potential return on investment: Both investments offer high potential returns, but the nature of those returns differs significantly.

- Volatility comparisons: NewCo SPAC's volatility is likely to decrease post-acquisition but will still be influenced by the target company's performance, while MicroStrategy's volatility is directly correlated to Bitcoin.

Long-Term Growth Potential

The long-term growth prospects of NewCo SPAC and MicroStrategy are distinct.

- Future outlook for the SPAC's target industry: The [Specify industry, e.g., renewable energy sector] is expected to experience significant growth in the coming years.

- Long-term Bitcoin price predictions: Predicting the long-term price of Bitcoin is notoriously difficult, but various analysts offer different projections.

- Potential for diversification and synergy: NewCo SPAC, upon acquisition, may offer diversification benefits, depending on the target company, whereas MicroStrategy is heavily weighted towards Bitcoin.

Conclusion: Choosing Between a Hot New SPAC Stock and MicroStrategy

This comparative analysis highlights the distinct characteristics of investing in NewCo SPAC and MicroStrategy. NewCo SPAC offers exposure to a potentially high-growth industry, but carries the risks associated with pre-acquisition SPACs and the uncertainty of the target company’s performance. MicroStrategy provides direct exposure to Bitcoin, offering substantial potential returns but also considerable volatility. Both investments demand thorough due diligence.

Remember, this is not financial advice. The information provided is for educational purposes only. Before making any investment decisions regarding NewCo SPAC or MicroStrategy, conduct your own comprehensive research and consider consulting with a qualified financial advisor. Remember to carefully evaluate the risks and rewards involved in SPAC investing and always make informed investment choices. Consider engaging in further research on competitive SPAC analysis and evaluating SPAC stocks before making any decisions related to SPAC investing.

Featured Posts

-

Arctic Comic Con 2025 A Photo Review Characters Connections And The Ectomobile

May 09, 2025

Arctic Comic Con 2025 A Photo Review Characters Connections And The Ectomobile

May 09, 2025 -

Young Thugs Back Outside What We Know About The Upcoming Album

May 09, 2025

Young Thugs Back Outside What We Know About The Upcoming Album

May 09, 2025 -

India And Us To Discuss New Bilateral Trade Agreement

May 09, 2025

India And Us To Discuss New Bilateral Trade Agreement

May 09, 2025 -

Posthaste High Down Payments And The Canadian Dream Of Homeownership

May 09, 2025

Posthaste High Down Payments And The Canadian Dream Of Homeownership

May 09, 2025 -

Mujer Polaca Detenida En Reino Unido Sospechosa De Ser Maddie Mc Cann

May 09, 2025

Mujer Polaca Detenida En Reino Unido Sospechosa De Ser Maddie Mc Cann

May 09, 2025