House Passes Tax Bill: Impact On Stock Market, Bonds, And Bitcoin

Table of Contents

Impact on the Stock Market

The House Tax Bill's impact on the stock market is multifaceted, with varying effects across different sectors. Understanding these potential shifts is crucial for investors looking to adjust their strategies.

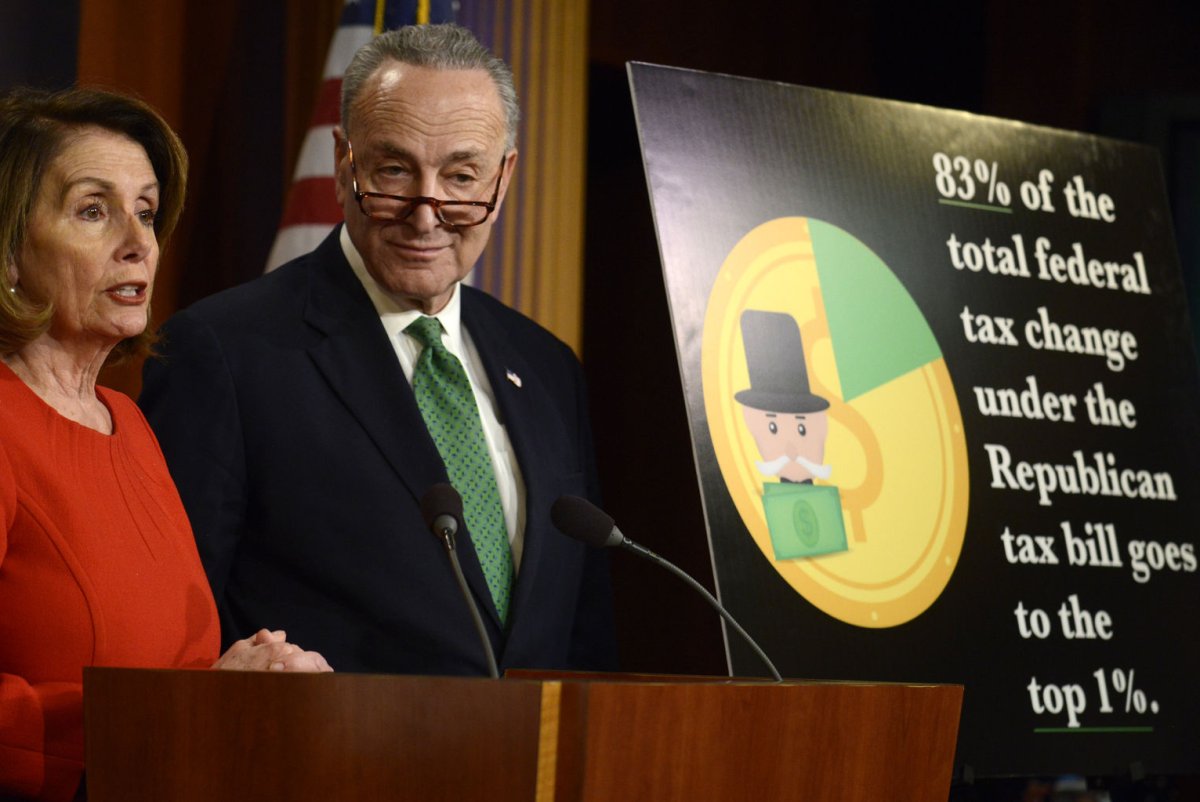

Potential Winners and Losers

Changes in corporate tax rates, capital gains taxes, and other provisions within the bill are expected to create a ripple effect across various industries.

- Technology: Companies with high R&D spending might see benefits from adjusted tax deductions, potentially boosting stock prices. Conversely, increased scrutiny on intangible assets could negatively impact some tech giants.

- Energy: The bill's impact on energy companies depends heavily on the specifics of its provisions related to fossil fuels and renewable energy incentives. Tax credits for renewable energy could boost related stocks, while changes to deductions for oil and gas exploration might hurt others.

- Healthcare: Pharmaceutical companies and healthcare providers could face both positive and negative changes, depending on the adjustments to tax credits and regulations within the healthcare sector. The precise impact remains uncertain until further details are clarified.

These are just a few examples, and the actual impact on each sector will depend on a complex interplay of factors including the final bill's details, market sentiment, and global economic conditions. Analysts predict increased volatility in the short term as investors reassess company valuations in light of the new tax landscape.

Increased Volatility and Uncertainty

The new tax law is likely to contribute to market fluctuations and uncertainty in the short term. Investor reactions will vary, potentially leading to market corrections as investors digest the implications of the changes.

- Investor Sentiment: Uncertainty surrounding the long-term economic effects of the bill could create a climate of risk aversion, leading to decreased investment and stock market volatility.

- Market Corrections: Short-term market corrections are possible as investors adjust their portfolios based on the new tax landscape.

- Speculation: Speculation and market sentiment will play a significant role in shaping the immediate aftermath of the bill's passage, potentially exaggerating short-term price swings.

Impact on the Bond Market

The House Tax Bill's influence on the bond market is primarily driven by its potential effects on interest rates and investor behavior.

Interest Rate Changes and Bond Yields

The tax bill's impact on interest rates is complex and depends on several factors, including how changes in corporate tax rates affect borrowing costs.

- Corporate Borrowing: Lower corporate tax rates might stimulate business investment, potentially increasing demand for loans and driving up interest rates. This, in turn, could lead to lower bond prices.

- Government Borrowing: Increased government borrowing to finance potential budget deficits could also impact interest rates, affecting the overall bond market. This effect could be amplified by the increased demand for government bonds.

- Different Bond Types: The impact varies across different bond types. Government bonds might see increased or decreased demand depending on prevailing economic conditions, while corporate bonds will reflect the effect of changes in corporate tax rates and borrowing costs.

Investor Behavior and Demand for Bonds

Tax changes can significantly alter investor demand for bonds.

- Capital Flight: Investors might shift funds from other asset classes, like stocks, into bonds if they perceive bonds as a safer investment due to increased market uncertainty. This increased demand would likely push bond prices up and yields down.

- Risk Aversion: An increase in risk aversion due to economic uncertainty could boost the demand for bonds, viewed as a safe haven asset.

- Bond Yields: The overall effect on bond yields will depend on the balance between these opposing forces. Increased demand will likely drive down yields, while increased government borrowing might drive them up.

Impact on Bitcoin and Cryptocurrencies

The House Tax Bill introduces significant uncertainty for the cryptocurrency market, particularly regarding Bitcoin's price and future trajectory.

Regulatory Uncertainty and Bitcoin Price

The bill's lack of clarity on the regulatory framework for cryptocurrencies could significantly impact Bitcoin's price.

- Regulatory Ambiguity: Ambiguity surrounding tax implications and regulations could trigger investor uncertainty, leading to potential price volatility.

- Tax Compliance Costs: The cost of complying with new cryptocurrency tax regulations might discourage some investors and reduce overall market activity.

- Trading Volume: The bill's impact on Bitcoin trading volume remains uncertain, with the potential for both increased volume from speculators and decreased volume due to regulatory concerns.

Taxation of Cryptocurrency Gains and Losses

The bill introduces specific tax implications for investors holding or trading Bitcoin.

- Capital Gains Taxes: Profits from Bitcoin trading are subject to capital gains taxes, the rates of which are determined by the length of time the asset is held.

- Reporting Challenges: Reporting cryptocurrency transactions for tax purposes poses significant challenges due to the complexity and decentralized nature of the cryptocurrency market.

- Investment Attractiveness: The bill's tax provisions could affect Bitcoin's attractiveness as an investment asset, impacting future adoption and market capitalization.

Conclusion

The House-passed tax bill is poised to significantly influence the stock market, bond market, and the cryptocurrency market, including Bitcoin. While some sectors might benefit from reduced corporate tax rates, the bill's uncertainty concerning long-term effects could lead to increased market volatility across asset classes. The impact on Bitcoin will depend heavily on the clarity and implementation of cryptocurrency-specific tax regulations. The overall impact will depend on the interplay of factors like investor sentiment, government policy, and global economic conditions.

Call to Action: Stay informed about the final passage and implementation of the House Tax Bill and its potential impact on your portfolio. Thoroughly research the effects of the House Tax Bill on your specific investments in stocks, bonds, and Bitcoin to make informed decisions about your financial future. Understanding the complexities of this legislation is crucial for effectively managing your investments in this changing tax environment.

Featured Posts

-

Discover The Top 10 Us Beaches For 2025 According To Dr Beach

May 24, 2025

Discover The Top 10 Us Beaches For 2025 According To Dr Beach

May 24, 2025 -

Understanding Microsofts Palestine Email Block A Recent Controversy

May 24, 2025

Understanding Microsofts Palestine Email Block A Recent Controversy

May 24, 2025 -

Zapreschenniy Garazh Istoriya Protivostoyaniya Ryazanova I Tsenzury Pri Brezhneve

May 24, 2025

Zapreschenniy Garazh Istoriya Protivostoyaniya Ryazanova I Tsenzury Pri Brezhneve

May 24, 2025 -

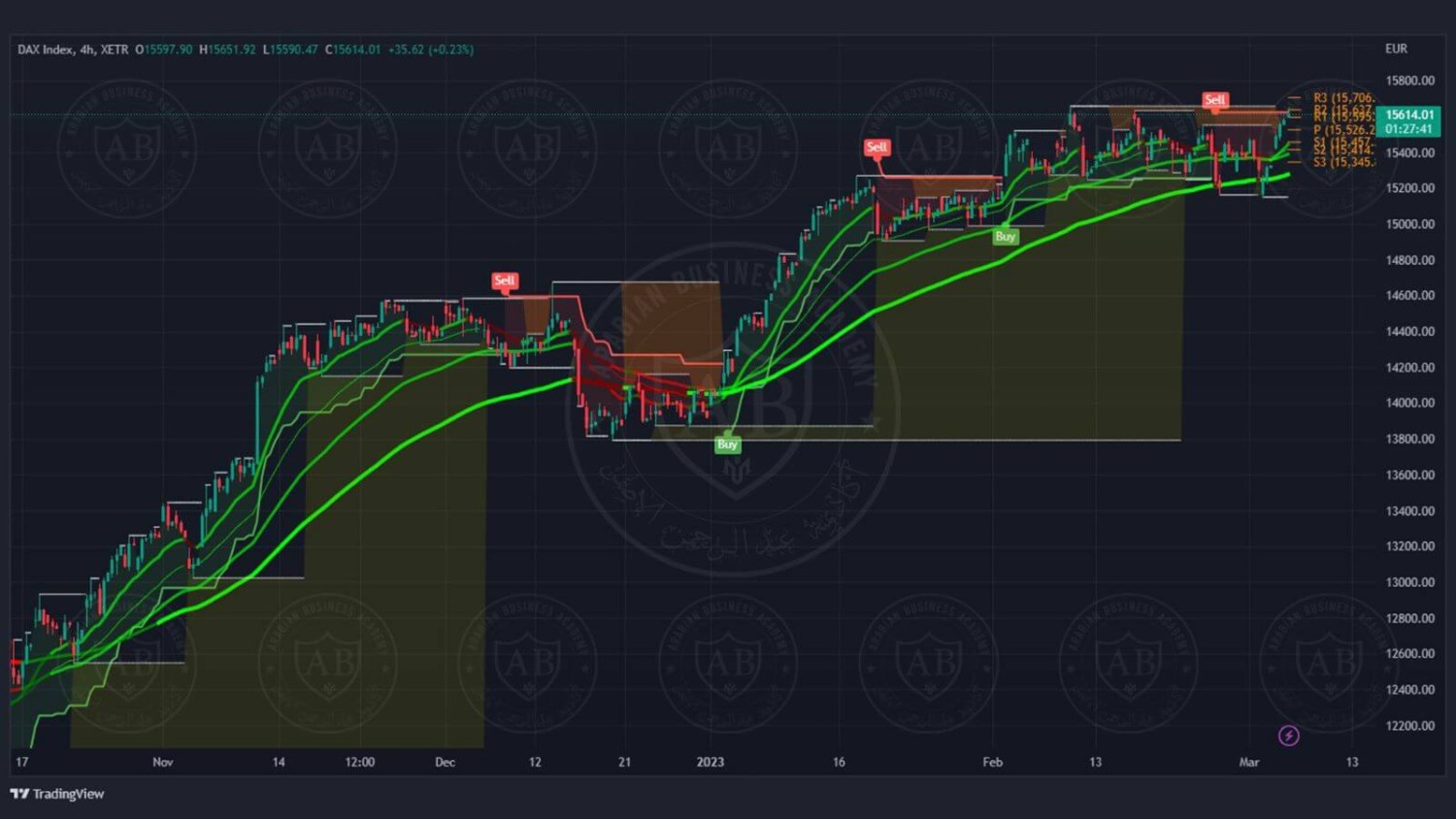

Adae Daks Alalmany Thlyl Lawl Mwshr Awrwby Ytjawz Mstwa Mars

May 24, 2025

Adae Daks Alalmany Thlyl Lawl Mwshr Awrwby Ytjawz Mstwa Mars

May 24, 2025 -

Lewis Hamiltons Comments Draw Sharp Criticism From Ferrari

May 24, 2025

Lewis Hamiltons Comments Draw Sharp Criticism From Ferrari

May 24, 2025

Latest Posts

-

Historic Commencement Famous Amphibian Delivers Address At University Of Maryland

May 24, 2025

Historic Commencement Famous Amphibian Delivers Address At University Of Maryland

May 24, 2025 -

2025 Umd Graduation The Unexpected Kermit The Frog Announcement

May 24, 2025

2025 Umd Graduation The Unexpected Kermit The Frog Announcement

May 24, 2025 -

The Muppet Maestro Kermit At The University Of Maryland Commencement

May 24, 2025

The Muppet Maestro Kermit At The University Of Maryland Commencement

May 24, 2025 -

World Famous Amphibian To Deliver Commencement Speech At University Of Maryland

May 24, 2025

World Famous Amphibian To Deliver Commencement Speech At University Of Maryland

May 24, 2025 -

Umd Commencement 2025 Kermit The Frogs Inspiring Address

May 24, 2025

Umd Commencement 2025 Kermit The Frogs Inspiring Address

May 24, 2025