House Passes Trump Tax Bill: Last-Minute Changes Explained

Table of Contents

The House recently passed the Trump Tax Bill, but not without a flurry of last-minute changes. This revised legislation significantly alters the original proposal, impacting individuals and businesses alike. This article dissects these critical amendments, explaining their implications and providing clarity on what this means for taxpayers. We'll explore everything from individual tax brackets and the standard deduction to corporate tax rates and crucial business deductions. Understanding these changes is vital for navigating the complexities of the new tax landscape.

Key Changes to Individual Income Tax Rates

The Trump Tax Bill's passage involved significant adjustments to individual income tax rates. These alterations affect taxpayers across various income levels, impacting their overall tax liability.

Bracket Adjustments

The individual tax brackets underwent modifications, resulting in percentage changes that influence how much tax individuals owe. These changes, while seemingly small in some brackets, can have a substantial cumulative effect depending on income.

- Bracket 1 (10%): The lower bound of this bracket was slightly increased, benefiting low-income earners.

- Bracket 2 (12%): This bracket saw a minor expansion, affecting a larger segment of middle-income taxpayers.

- Bracket 3 (22%): Minimal changes were observed in this bracket.

- Bracket 4 (24%): This bracket experienced a slight upward adjustment, impacting a relatively small percentage of higher earners.

- Bracket 5 (32%): A minor reduction in the upper limit of this bracket occurred.

- Bracket 6 (35%): Minimal changes were observed.

- Bracket 7 (37%): This top bracket saw no significant alteration.

These adjustments, while seemingly subtle, can significantly impact taxpayers' overall tax liability depending on their specific income and deductions. For example, a family earning just above a bracket threshold might see a noticeable difference in their tax bill.

Impact on Standard Deduction and Exemptions

The Trump Tax Bill also modified the standard deduction and exemptions. The standard deduction increased significantly, potentially benefiting a larger number of taxpayers by lowering their taxable income. However, the elimination of personal and dependent exemptions offset some of this benefit.

- Pre-Amendment Standard Deduction: $12,200 (single filer), $24,400 (married filing jointly).

- Post-Amendment Standard Deduction: $12,950 (single filer), $25,900 (married filing jointly). (Illustrative example - actual figures may vary depending on the specific version of the bill.)

The net effect on individual taxpayers varied greatly depending on their income, filing status, and whether they previously claimed exemptions. It’s crucial to compare your pre and post-amendment tax liability to assess the impact.

Corporate Tax Rate Modifications

The revised Trump Tax Bill also included important modifications to corporate tax rates.

Changes to Corporate Tax Rates

One of the most significant changes was the adjustment to the corporate tax rate. The final percentage, after amendments, resulted in a [insert final percentage here]% rate. This reduction from the previous rate was intended to stimulate business investment and economic growth.

- Pre-Amendment Corporate Tax Rate: [Insert previous rate]

- Post-Amendment Corporate Tax Rate: [Insert final rate]

The lower corporate tax rate has significant implications for corporate profitability and investment strategies. Companies may choose to reinvest profits, leading to job creation and economic expansion. However, concerns remain regarding its potential impact on the national debt.

Impact on Business Deductions

Amendments to the bill also modified several business deductions. This could significantly affect a business's overall tax liability and profitability.

- Example 1: Changes to depreciation schedules.

- Example 2: Modifications to the deduction for interest expense.

- Example 3: Alterations to the research and development tax credit.

These changes require careful consideration by businesses during tax planning and financial forecasting. It’s critical to understand the implications of these alterations for investment decisions and long-term financial health.

Last-Minute Amendments and Their Rationale

The final version of the Trump Tax Bill incorporated several last-minute amendments, each with its own rationale and potential consequences.

Specific Amendments

Here are a few examples of significant last-minute amendments:

- Amendment 1: [Description of Amendment 1, its purpose, and potential controversy]. [Include quote from a relevant congressman, if available].

- Amendment 2: [Description of Amendment 2, its purpose, and potential controversy]. [Include quote from a relevant congressman, if available].

- Amendment 3: [Description of Amendment 3, its purpose, and potential controversy]. [Include quote from a relevant congressman, if available].

These last-minute adjustments often reflected compromises and negotiations among different factions within the legislature. Understanding the reasoning behind these amendments is essential to comprehending the bill's overall impact.

Potential Long-Term Effects of the Trump Tax Bill

The Trump Tax Bill's long-term effects are complex and subject to various interpretations. Forecasting these impacts requires considering both economic and social implications.

Economic Impact

Economists hold diverse views on the bill's predicted economic effects. Some anticipate increased economic growth due to the lower corporate tax rate and potential investment stimulation. Others express concern over increased national debt and potential inflationary pressures.

- Potential Positive Impacts: Job creation, increased investment, economic growth.

- Potential Negative Impacts: Increased national debt, inflation, widening income inequality.

Reputable economic forecasts and expert opinions should be consulted for a comprehensive understanding of potential outcomes.

Social Impact

The social consequences of the tax bill's changes are also multifaceted. The impacts on different income groups and demographic populations need careful consideration.

- Impact on Low-Income Households: The increased standard deduction may offer some relief, but the elimination of exemptions could offset this benefit for some.

- Impact on High-Income Households: They may benefit significantly from the lower tax rates.

- Impact on Businesses: Smaller businesses may experience more significant benefits than larger corporations.

A thorough analysis of these social consequences is necessary for a complete assessment of the bill's long-term impact.

Conclusion

The House's passage of the Trump Tax Bill marked a significant legislative event, incorporating several last-minute amendments that altered individual and corporate tax rates, deductions, and other key provisions. These changes have the potential to significantly impact both the economy and society in the long term, with both positive and negative consequences. Understanding the intricacies of these alterations is crucial for individuals and businesses to adapt their financial strategies accordingly.

Call to Action: Stay informed about the Trump Tax Bill and its effects. Further research is recommended to fully understand how these changes will impact your specific tax situation. For detailed information and personalized tax advice, consult a qualified tax professional. Learn more about the amended Trump Tax Bill and plan accordingly.

Featured Posts

-

Ebd Alqadr Fy Mbarat Qtr W Alkhwr Alfwz Llkhwr

May 23, 2025

Ebd Alqadr Fy Mbarat Qtr W Alkhwr Alfwz Llkhwr

May 23, 2025 -

Best Memorial Day Appliance Sales 2025 Forbes Verified

May 23, 2025

Best Memorial Day Appliance Sales 2025 Forbes Verified

May 23, 2025 -

The 10 Best Cult Horror Movies You Ve Probably Never Heard Of

May 23, 2025

The 10 Best Cult Horror Movies You Ve Probably Never Heard Of

May 23, 2025 -

Uec Tutumlu Burc Para Yoenetiminde Ustalar

May 23, 2025

Uec Tutumlu Burc Para Yoenetiminde Ustalar

May 23, 2025 -

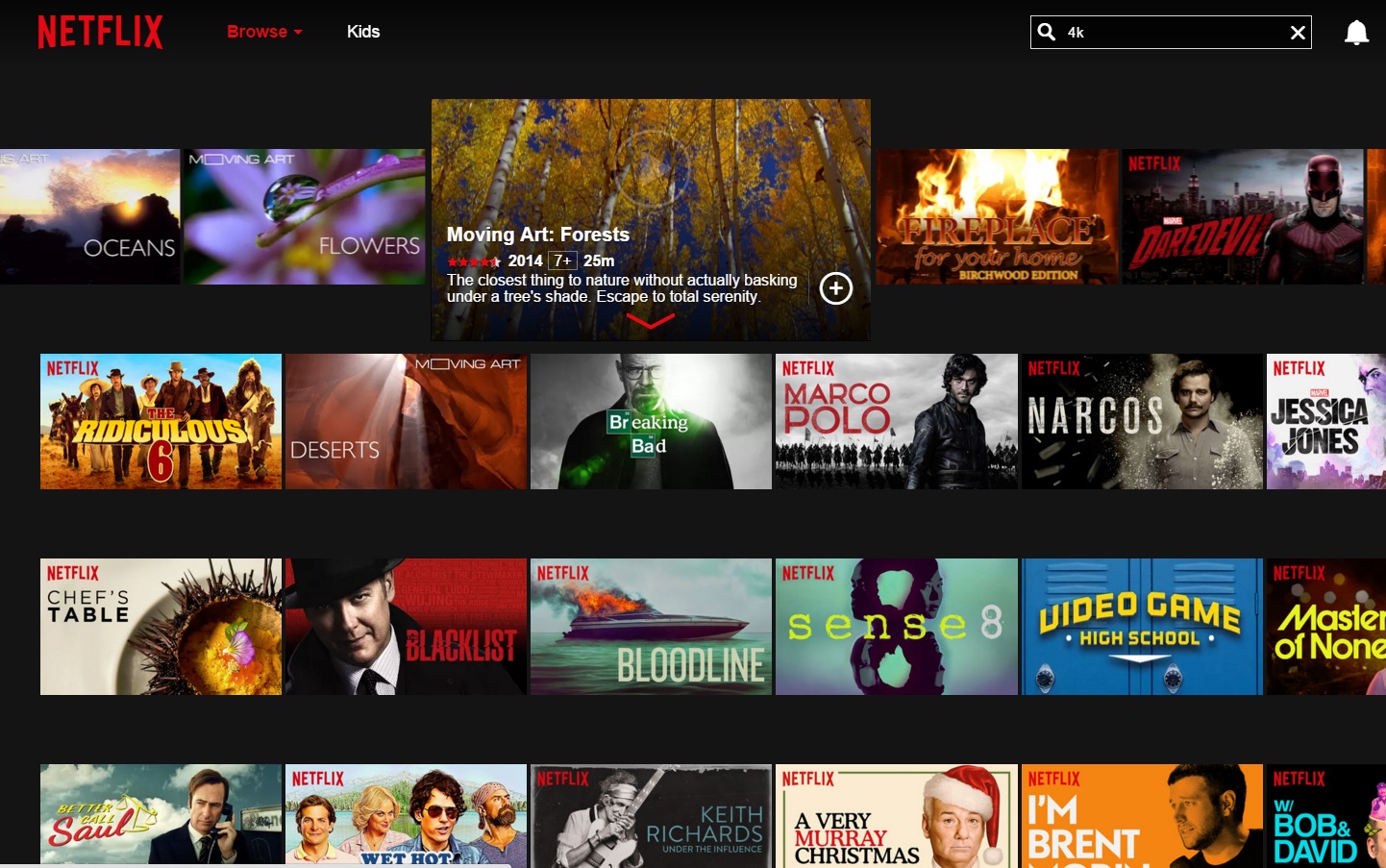

Netflix Lanseaza Un Serial Cu O Distributie Impresionanta De Actori

May 23, 2025

Netflix Lanseaza Un Serial Cu O Distributie Impresionanta De Actori

May 23, 2025

Latest Posts

-

Waldbrand In Essen Heisingen 07 04 2025 Feuerwehr Im Einsatz

May 23, 2025

Waldbrand In Essen Heisingen 07 04 2025 Feuerwehr Im Einsatz

May 23, 2025 -

Aetqalat Fy Almanya Ela Khlfyt Aemal Shghb Mn Mshjeyn

May 23, 2025

Aetqalat Fy Almanya Ela Khlfyt Aemal Shghb Mn Mshjeyn

May 23, 2025 -

Essen Ereignisse Rund Um Das Uniklinikum Beruehrend Und Bewegend

May 23, 2025

Essen Ereignisse Rund Um Das Uniklinikum Beruehrend Und Bewegend

May 23, 2025 -

Polizeimeldungen Essen Heisingen 07 04 2025 Grossbrand Im Wald

May 23, 2025

Polizeimeldungen Essen Heisingen 07 04 2025 Grossbrand Im Wald

May 23, 2025 -

Skandal An Nrw Unis Haftstrafen Fuer Manipulierte Noten

May 23, 2025

Skandal An Nrw Unis Haftstrafen Fuer Manipulierte Noten

May 23, 2025