House Republicans Detail Trump's Proposed Tax Cuts

Table of Contents

Key Features of Trump's Proposed Tax Cuts

The overarching goal of the Trump tax cuts proposal was to stimulate economic growth by reducing the tax burden on both businesses and individuals. This ambitious tax reform aimed to create a more competitive business environment and boost consumer spending. Specific features included:

-

Corporate Tax Rate Reduction: The proposal called for a significant reduction in the corporate tax rate, from 35% to a proposed 21%. This substantial decrease aimed to incentivize businesses to invest more, expand operations, and create jobs.

-

Individual Income Tax Bracket Changes: The plan significantly altered individual income tax brackets. While specific changes varied depending on income levels, it generally involved reducing the number of brackets and lowering rates across the board. This resulted in lower tax liabilities for many individuals.

-

Modifications to Deductions and Credits: The proposed tax cuts included modifications to various deductions and credits. The standard deduction was increased, benefiting many taxpayers. Changes to the child tax credit were also proposed, aiming to provide more support to families.

-

Impact on Capital Gains Taxes: The plan's effect on capital gains taxes was a point of contention. While some aspects were altered, the exact changes and their implications were subject to debate.

-

Potential Elimination or Modification of Specific Taxes: The proposal also included the potential elimination or modification of certain taxes, further contributing to the overall reduction in the tax burden. This aspect faced significant opposition and alterations during the legislative process.

House Republicans' Role in Detailing the Plan

House Republicans played a pivotal role in shaping and presenting the Trump tax cuts proposal. Key figures, including the House Speaker and chairs of relevant committees like the House Ways and Means Committee, spearheaded the legislative effort. This involved numerous meetings, negotiations, and compromises to arrive at a final bill. The legislative process included:

-

Specific Committees Involved: The House Ways and Means Committee was central, along with other relevant committees, in drafting and reviewing the legislation.

-

Public Hearings and Debates: Numerous public hearings and debates were held to discuss the proposal and gather input from various stakeholders.

-

Amendments and Changes: The House made several amendments and changes to the original proposal during the legislative process, reflecting compromises and negotiations between different factions within the Republican party. The final bill differed in several aspects from the initial plan.

Projected Economic Impacts of the Proposed Tax Cuts

House Republicans and independent analysts offered varying projections regarding the economic consequences of the Trump tax cuts. The projected positive impacts included:

-

GDP Growth Projections: Proponents argued that the tax cuts would stimulate significant GDP growth by boosting investment and consumer spending.

-

Job Creation Estimates: The plan was projected to lead to job creation through increased business investment and economic activity.

However, criticisms and counterarguments also emerged:

-

Potential Impact on the National Debt: Critics argued that the tax cuts would significantly increase the national debt due to the reduction in government revenue.

-

Potential Impact on Income Inequality: Concerns were raised that the tax cuts could exacerbate income inequality, disproportionately benefiting high-income earners. This was a major point of contention in the public and political debates.

Public Reaction and Political Implications

Public reaction to the Trump tax cuts proposal was sharply divided. While some sectors, particularly businesses and high-income earners, voiced support, others, including labor unions and low-to-middle-income individuals, expressed strong opposition.

-

Public Opinion Polls: Public opinion polls revealed a significant divide in support, highlighting the political polarization surrounding the issue.

-

Reactions from Key Interest Groups: Business groups largely supported the tax cuts, while labor unions expressed concern about its potential negative impact on workers and the economy.

-

Political Fallout and Impact on Future Elections: The tax cuts became a central issue in subsequent elections, with Democrats consistently criticizing the plan and Republicans defending it as a necessary measure to boost economic growth. This highlights the significant political implications of the tax cut proposal.

Conclusion: Understanding Trump's Proposed Tax Cuts

The Trump tax cuts proposal, meticulously detailed by House Republicans, involved significant changes to the US tax code, aiming to stimulate economic growth through tax reductions for businesses and individuals. While proponents highlighted potential benefits like increased GDP growth and job creation, critics raised concerns about the national debt and income inequality. Understanding the complexities of this "Republican tax plan" requires analyzing its various components, including corporate tax rate reductions, changes to individual income tax brackets, and modifications to deductions and credits. The intense public and political debates surrounding this "tax cuts proposal" further underscore its profound influence on the US economy and political landscape. Stay updated on the developments surrounding Trump's proposed tax cuts and the ongoing debate on tax reform by following reputable news sources and engaging in informed discussions.

Featured Posts

-

0 3

May 15, 2025

0 3

May 15, 2025 -

Menendez Brothers Resentencing Judges Ruling Explained

May 15, 2025

Menendez Brothers Resentencing Judges Ruling Explained

May 15, 2025 -

Transparantie En Verantwoording De Npos Aanpak Van Grensoverschrijdend Gedrag

May 15, 2025

Transparantie En Verantwoording De Npos Aanpak Van Grensoverschrijdend Gedrag

May 15, 2025 -

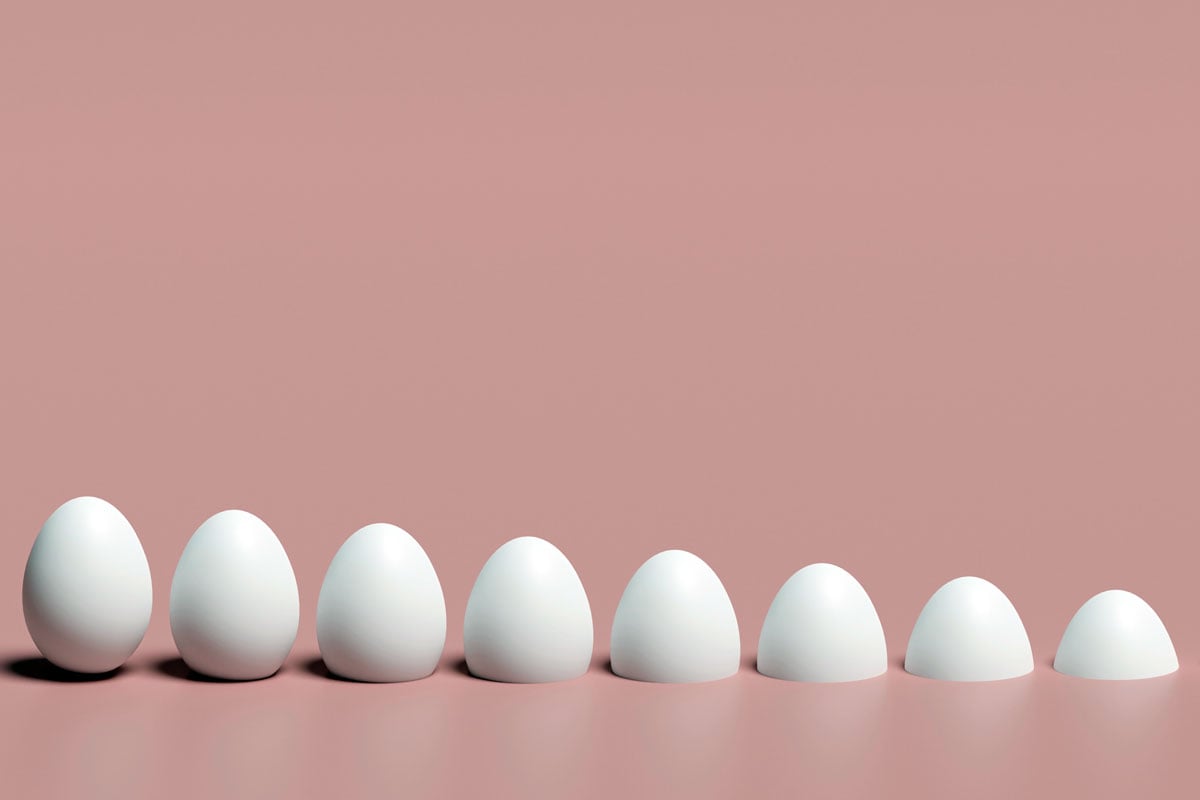

The Surprising Accuracy Of Trumps Egg Price Remarks

May 15, 2025

The Surprising Accuracy Of Trumps Egg Price Remarks

May 15, 2025 -

Sycuan Casino Resort Presents Padres Opening Series Details Revealed

May 15, 2025

Sycuan Casino Resort Presents Padres Opening Series Details Revealed

May 15, 2025

Latest Posts

-

San Jose Earthquakes Match Preview Key Insights From Quakes Epicenter

May 15, 2025

San Jose Earthquakes Match Preview Key Insights From Quakes Epicenter

May 15, 2025 -

San Jose Earthquakes Preview Quakes Epicenter Breakdown

May 15, 2025

San Jose Earthquakes Preview Quakes Epicenter Breakdown

May 15, 2025 -

New York City Vs Toronto In Depth Player Performance Analysis

May 15, 2025

New York City Vs Toronto In Depth Player Performance Analysis

May 15, 2025 -

Comparing Player Ratings New York City Fc Vs Toronto Fc

May 15, 2025

Comparing Player Ratings New York City Fc Vs Toronto Fc

May 15, 2025 -

San Jose Earthquakes Mls Season Starts Against Real Salt Lake

May 15, 2025

San Jose Earthquakes Mls Season Starts Against Real Salt Lake

May 15, 2025