Housing Market In Freefall: Real Estate Agents Report Crisis-Level Sales

Table of Contents

Plummeting Sales and Inventory Levels

The current housing market crash is characterized by significantly decreased sales and, paradoxically, increased inventory in some areas. Let's break down these seemingly contradictory trends.

Decreased Buyer Demand

Several factors are contributing to the sharp decline in buyer demand:

- Increased Mortgage Rates: The Federal Reserve's efforts to combat inflation have led to significantly higher interest rates, making mortgages substantially more expensive. This directly reduces affordability for potential homebuyers.

- Decreased Affordability: The combination of rising interest rates and persistently high home prices has created a dramatic affordability crisis. Many potential buyers are priced out of the market.

- Fear of Recession: Economic uncertainty and fears of a looming recession are causing many consumers to delay major purchases, including homes. This hesitancy further dampens buyer demand.

- Buyer Hesitancy: The volatile market is creating uncertainty, leading buyers to wait for clearer signs of stabilization before committing to a purchase.

According to the National Association of Realtors, existing home sales have declined by X% compared to the same period last year (insert actual statistic here). This significant drop reflects the widespread impact of the housing market crash.

Increased Inventory (in some areas)

Despite decreased sales, some markets are experiencing a rise in inventory. This is primarily due to:

- Homes Staying on the Market Longer: With fewer buyers, homes are spending considerably more time on the market before selling.

- Price Reductions: Sellers are increasingly forced to reduce their asking prices to attract buyers in this competitive environment.

- Seasonal Changes: Seasonal fluctuations in the market can exacerbate existing trends, leading to higher inventory in certain periods.

The average days on market has increased by Y% (insert actual statistic here) in many regions, indicating a slowdown in sales velocity and a shift in buyer-seller dynamics.

Impact on Real Estate Agents and Professionals

The housing market crash is having a significant impact on real estate agents and other professionals in the industry.

Reduced Commissions and Income

The sharp decline in sales transactions directly translates to reduced commissions and income for real estate agents.

- Decreased Transaction Volume: Fewer sales mean fewer opportunities to earn commissions.

- Need for Diversification of Income Streams: Agents are increasingly seeking alternative income streams to compensate for the reduced reliance on traditional sales commissions.

- Challenges in Maintaining Business Operations: Maintaining business operations amidst reduced income can be a significant challenge for many agents.

Adapting Strategies in a Changing Market

Successful real estate agents are adapting their strategies to navigate this challenging environment:

- Focusing on Niche Markets: Specializing in specific market segments can help agents target buyers and sellers with specific needs.

- Adjusting Pricing Strategies: Agents are working closely with sellers to establish competitive pricing that attracts buyers.

- Enhanced Marketing and Negotiation Skills: Strong marketing and negotiation skills are crucial for securing deals in a slow market.

- Leveraging Technology: Utilizing advanced technologies for marketing, virtual tours, and communication can improve efficiency and reach.

Factors Driving the Housing Market Crash

The current housing market crash is a multifaceted issue driven by a combination of factors:

Rising Interest Rates

Rising interest rates are arguably the most significant factor contributing to the housing market crash.

- The Federal Reserve's Actions: The Federal Reserve's policy of raising interest rates to combat inflation has directly increased borrowing costs for mortgages.

- Impact on Borrowing Costs: Higher interest rates translate to significantly higher monthly mortgage payments, reducing affordability for many potential buyers.

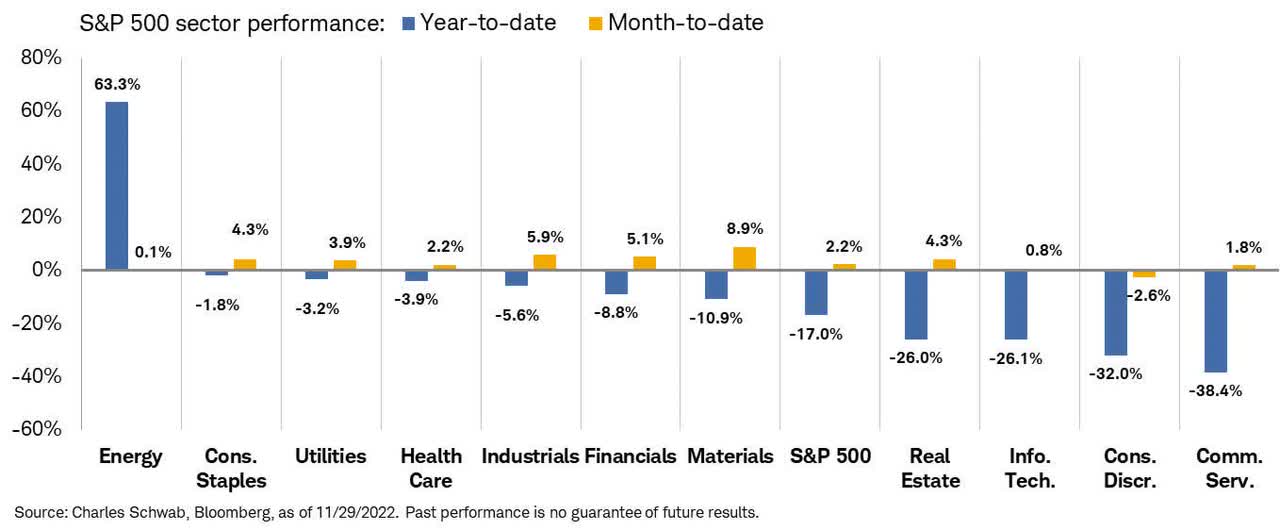

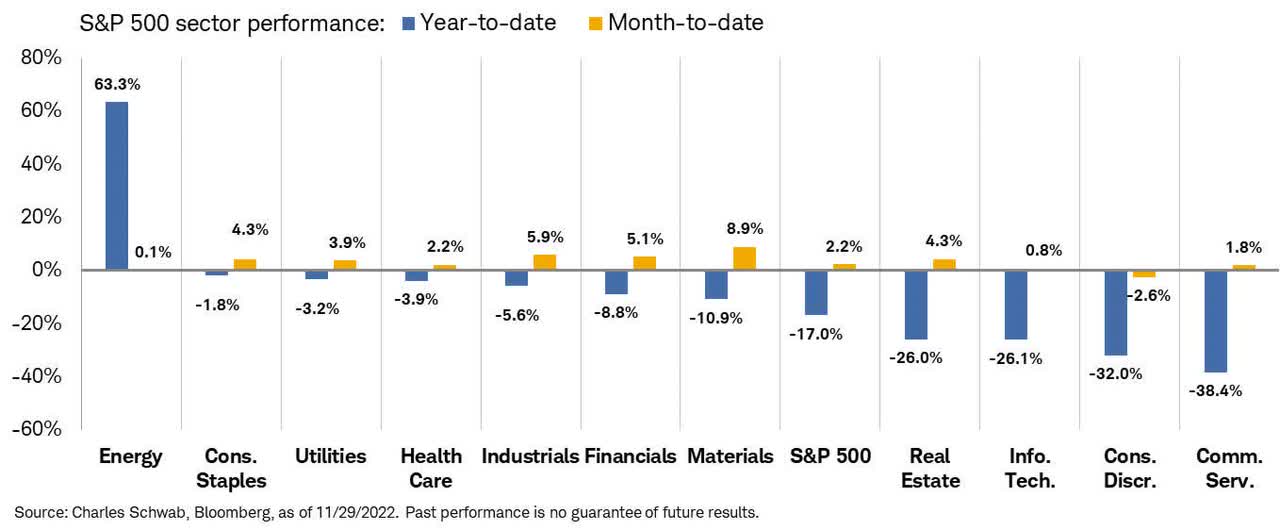

- Relationship Between Interest Rates and Home Prices: There's a strong inverse correlation between interest rates and home prices; higher rates generally lead to lower prices. (Include a graph illustrating this correlation here)

Inflation and Economic Uncertainty

Inflation and economic uncertainty are further eroding consumer confidence and impacting purchasing power.

- Impact on Disposable Income: Inflation reduces disposable income, leaving less money for significant purchases like homes.

- Consumer Sentiment Surveys: Consumer sentiment surveys reflect decreasing confidence in the economy, impacting purchasing decisions.

- Predictions from Economic Analysts: Many economic analysts predict continued economic uncertainty, which will likely impact the housing market for some time.

Geopolitical Instability

Global events, including war and political instability, also contribute to market uncertainty.

- Uncertainty and its Effect on Investment: Geopolitical instability creates uncertainty, making investors hesitant to commit to real estate investments.

- Supply Chain Disruptions Impacting Construction: Global events can disrupt supply chains, impacting the availability of building materials and increasing construction costs.

- Investor Sentiment: Negative global events often lead to decreased investor sentiment in the real estate market.

Predictions and Outlook for the Future

Predicting the future of the housing market is inherently complex, but we can offer some insights based on current trends.

Short-Term vs. Long-Term Forecasts

There are varying opinions on the short-term and long-term outlook:

- Expert Opinions on Market Recovery Timelines: Some experts predict a relatively quick market recovery, while others anticipate a more prolonged period of adjustment.

- Potential for Further Price Drops: Further price corrections are possible, depending on the trajectory of interest rates and economic conditions.

- Factors That Could Influence Future Market Trends: Factors like inflation control, interest rate adjustments, and overall economic stability will significantly impact future market trends.

Advice for Homebuyers and Sellers

Navigating this turbulent market requires careful planning:

- Strategies for Buyers: Buyers should focus on securing pre-approval for mortgages, negotiating prices aggressively, and being prepared for a potentially longer search process.

- Strategies for Sellers: Sellers should carefully price their properties competitively, ensure their homes are in excellent condition, and work closely with experienced real estate agents.

Conclusion

The housing market crash is a complex issue driven by a confluence of economic and geopolitical factors. Real estate agents are facing unprecedented challenges as sales plummet, but adaptation and strategic adjustments are crucial for survival in this rapidly evolving market. Understanding the causes and potential trajectory of this housing market crash is essential for both professionals and consumers. Stay informed on the latest developments in the housing market and seek expert advice to make informed decisions regarding your real estate investments. Navigating the current challenges in the housing market crash requires careful planning and a realistic assessment of market conditions. Don't hesitate to consult with a real estate professional to develop a personalized strategy for navigating this challenging market.

Featured Posts

-

Metallica To Play Two Nights At Dublins Aviva Stadium In 2026

May 30, 2025

Metallica To Play Two Nights At Dublins Aviva Stadium In 2026

May 30, 2025 -

The Sustainability Of Manila Bays Vibrant Ecosystem

May 30, 2025

The Sustainability Of Manila Bays Vibrant Ecosystem

May 30, 2025 -

The Ultimate Guide To Air Jordan Sneakers Releasing May 2025

May 30, 2025

The Ultimate Guide To Air Jordan Sneakers Releasing May 2025

May 30, 2025 -

Deutsche Bank Analyse De Son Evolution Et De Ses Crises

May 30, 2025

Deutsche Bank Analyse De Son Evolution Et De Ses Crises

May 30, 2025 -

Wiederkehr Und Widerstand Juedische Sporttradition In Augsburg

May 30, 2025

Wiederkehr Und Widerstand Juedische Sporttradition In Augsburg

May 30, 2025