Housing Market In Freefall: Sales Reach Crisis Point

Table of Contents

Record-Low Housing Inventory Fuels the Freefall

The current housing market freefall is significantly fueled by a historically low housing inventory. This shortage of available homes is creating a perfect storm, impacting affordability and intensifying competition (before the recent downturn). The limited supply is a key driver of the crisis, pushing prices to unsustainable heights before the recent correction. Several factors contribute to this alarming low inventory:

-

Declining new construction starts: The number of new homes being built hasn't kept pace with population growth and demand, exacerbating the existing housing shortage. Building permits have also slowed down, further constricting supply. This directly relates to the low housing inventory and the overall housing market crash.

-

Increased demand exceeding supply: Strong demand, driven by factors like population growth and migration, has consistently outpaced the limited supply of homes available for sale. This imbalance creates a highly competitive market where buyers often face bidding wars and inflated prices (prior to the current downturn).

-

Impact on bidding wars and inflated prices: Before the current market correction, the low housing inventory resulted in fierce competition amongst buyers, leading to bidding wars that significantly drove up prices beyond what many could afford. This unsustainable market growth contributed to the current crisis.

-

Shifting demographics and migration patterns: Changes in population distribution, with people moving to certain regions more than others, have further strained housing supply in already popular areas, intensifying the housing shortage and contributing to the housing market decline. These shifts place additional pressure on the limited supply. This limited supply directly contributes to the ongoing housing market crash.

Rising Interest Rates Cripple Buyer Demand

The significant increase in interest rates has dealt a severe blow to buyer demand, acting as a major catalyst in the housing market freefall. Higher rates dramatically increase monthly mortgage payments, reducing the purchasing power of potential homebuyers.

-

Impact on monthly mortgage payments: Even a small increase in interest rates can translate into a substantial jump in monthly mortgage payments, making homeownership unaffordable for many. This affordability crunch is a primary reason for the housing market decline.

-

Reduced purchasing power for buyers: Higher interest rates effectively reduce the amount buyers can borrow, shrinking the pool of potential homes they can afford. This reduced purchasing power directly translates into fewer sales and contributes to the housing market crash.

-

Shift in buyer expectations and budget constraints: Rising interest rates force buyers to re-evaluate their expectations and significantly constrain their budgets. This leads to a decline in buyer activity and puts downward pressure on prices, contributing to the current housing market freefall.

-

Increased competition from investors: While some investors may pull back, others see opportunities in a declining market, potentially increasing competition for available properties. The impact of investor activity can be complex and depends on many factors, including the level of investor confidence in the real estate market. This also affects the ongoing housing market crash.

Economic Uncertainty Exacerbates the Crisis

The current economic climate, characterized by inflation, recession fears, and job market instability, is significantly worsening the housing market freefall. Economic uncertainty creates a ripple effect throughout the market.

-

Impact of inflation on material costs: Inflation drives up the cost of building materials, making new construction more expensive and contributing to the low housing inventory. This further restricts supply and exacerbates the housing market decline.

-

Consumer confidence and spending habits: Concerns about a potential recession and job security are impacting consumer confidence and spending habits. This cautious approach extends to the housing market, leading to decreased demand. A negative outlook on economic factors directly contributes to the housing market crash.

-

Potential for further price drops due to economic slowdown: An economic slowdown could lead to further price drops as buyers become more hesitant and sellers are forced to adjust their expectations. This contributes to the housing market freefall, and the uncertainty is further fueled by fear of an imminent economic recession.

-

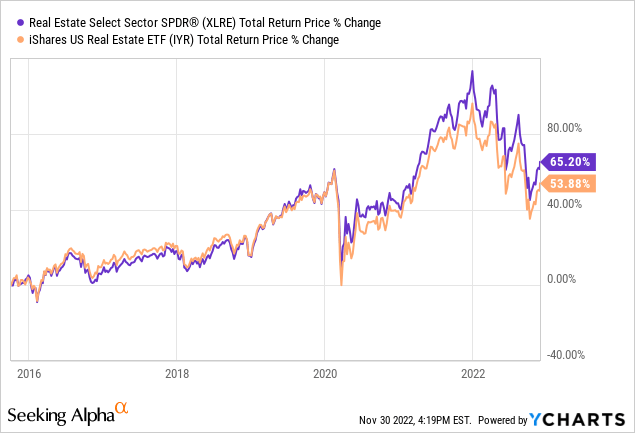

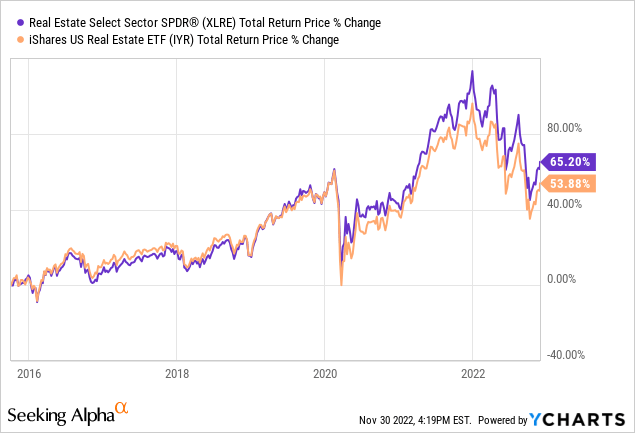

Impact on investor confidence in the real estate market: Economic uncertainty can erode investor confidence, potentially leading to decreased investment in the real estate market. This lack of investment further contributes to the housing market freefall and market instability.

The Impact on Different Market Segments

The housing market freefall is impacting different market segments in varying ways:

-

Challenges faced by first-time homebuyers: First-time homebuyers are particularly vulnerable, facing higher interest rates, limited affordability, and fierce competition. They often bear the brunt of the housing market decline.

-

Changes in luxury home sales: While the luxury market may be less sensitive to interest rate hikes, it's not immune to economic uncertainty. Sales in this segment are also likely to slow down. This decrease in sales also contributes to the housing market crash.

-

Impact on rental market demand: As homeownership becomes less accessible, demand for rental properties could increase, leading to potential rent increases and further market complexities. This shifting of demand is another consequence of the housing market freefall.

What the Future Holds for the Housing Market Freefall

Predicting the future of the housing market freefall is challenging, but several scenarios are possible:

-

Potential for further price corrections: Depending on economic conditions, further price corrections are possible, particularly in overheated markets. The market instability contributes to this potential correction.

-

Possible shifts in buyer and seller behavior: Buyers may become more cautious and selective, while sellers might need to adjust their pricing strategies to attract buyers in this challenging market. This shift in behavior contributes to the housing market crash.

-

The role of government intervention: Government policies could play a role in mitigating the downturn, but the extent and impact of any intervention remain uncertain. Government intervention could impact the housing market freefall.

-

Opportunities for strategic buyers in a downturn: A housing market freefall can create opportunities for strategic buyers who can identify undervalued properties and negotiate favorable terms. Strategic buyers can benefit from the housing market decline.

Conclusion:

The housing market freefall is a complex issue stemming from a confluence of factors including record-low inventory, rising interest rates, and broader economic uncertainty. While the short-term outlook remains challenging, understanding these dynamics is crucial for navigating this turbulent period. Stay informed about shifts in the housing market freefall and adapt your strategies accordingly. Whether you're a buyer, seller, or investor, understanding this current crisis is paramount to making informed decisions in the evolving real estate landscape. For continued updates and analysis on the housing market freefall, subscribe to our newsletter!

Featured Posts

-

Haciosmanoglu Nun Macaristan Ziyareti Detaylar Ve Sonuclar

May 31, 2025

Haciosmanoglu Nun Macaristan Ziyareti Detaylar Ve Sonuclar

May 31, 2025 -

New Covid 19 Variant A Global Health Concern

May 31, 2025

New Covid 19 Variant A Global Health Concern

May 31, 2025 -

Boxing Results Munguia Dominates Surace In Rematch

May 31, 2025

Boxing Results Munguia Dominates Surace In Rematch

May 31, 2025 -

U S Gdp Falls 0 2 Impact Of Reduced Spending And Tariffs

May 31, 2025

U S Gdp Falls 0 2 Impact Of Reduced Spending And Tariffs

May 31, 2025 -

Como Preparar Una Deliciosa Brascada Guia Paso A Paso

May 31, 2025

Como Preparar Una Deliciosa Brascada Guia Paso A Paso

May 31, 2025