How AIMSCAP Conquered The World Trading Tournament (WTT) (If Applicable)

Table of Contents

AIMSCAP's Winning Trading Strategy

AIMSCAP's dominance in the WTT can be largely attributed to their sophisticated and multifaceted trading strategy. Two key pillars supported this achievement: advanced algorithmic trading and diversified portfolio management.

Advanced Algorithmic Trading

AIMSCAP leveraged sophisticated algorithms to analyze vast quantities of market data and predict trends with remarkable accuracy. Their system incorporated several key features:

- Real-time data analysis: AIMSCAP's algorithms processed real-time market data from multiple sources, including major exchanges and alternative data providers, ensuring they had the most up-to-date information available. This allowed for rapid response to market shifts and opportunities.

- Predictive modeling: Advanced machine learning techniques were used to build predictive models capable of forecasting price movements with a high degree of accuracy. This predictive capability was crucial for identifying profitable trading opportunities.

- Risk management algorithms: Sophisticated risk management algorithms were integrated into the trading system to minimize potential losses. These algorithms dynamically adjusted position sizes and trading strategies based on real-time market conditions and risk assessments.

- Backtesting procedures: Before deploying any new algorithm or strategy, AIMSCAP conducted rigorous backtesting using historical market data. This ensured that their trading systems were robust and reliable before live deployment. This rigorous approach to AIMSCAP algorithmic trading in the WTT was a critical success factor.

Keywords: AIMSCAP algorithmic trading WTT, AI in trading, high-frequency trading, algorithmic trading strategies.

Diversified Portfolio Management

AIMSCAP's success wasn't solely reliant on a single strategy or market. Their diversified portfolio management played a vital role in mitigating risk and maximizing returns.

- Asset diversification: AIMSCAP strategically allocated assets across a diverse range of markets and instruments, including equities, bonds, forex, and commodities. This reduced their exposure to any single market's volatility.

- Market hedging techniques: AIMSCAP employed various hedging techniques to protect their portfolio from unexpected market downturns. This included using options and futures contracts to offset potential losses.

- Dynamic portfolio rebalancing: AIMSCAP continuously monitored and rebalanced their portfolio to maintain the desired asset allocation. This ensured that they remained optimally positioned to capitalize on market opportunities.

Keywords: AIMSCAP portfolio management, risk diversification, WTT portfolio strategies, diversified investment strategies.

The Team Behind the Success

The AIMSCAP team's expertise and collaborative spirit were as crucial to their victory as their sophisticated trading strategies.

Expertise and Experience

The AIMSCAP team comprised highly experienced professionals with proven track records in finance and trading.

- Team member backgrounds: The team included quantitative analysts, financial engineers, experienced traders, and data scientists. Each member brought a unique skillset to the table.

- Years of experience: Many members possessed over a decade of experience in the financial markets, providing invaluable knowledge and insight.

- Relevant certifications: Several team members held prestigious certifications, including CFA (Chartered Financial Analyst) and CAIA (Chartered Alternative Investment Analyst) designations, demonstrating their high level of professional competence.

Keywords: AIMSCAP team, expert traders, WTT winning team, financial expertise.

Collaborative Teamwork and Communication

Effective communication and collaboration were essential to AIMSCAP's success. Their team operated as a well-oiled machine.

- Internal communication systems: AIMSCAP utilized advanced communication tools to ensure seamless information sharing and real-time collaboration among team members.

- Collaborative decision-making processes: Decisions were made through a collaborative process, leveraging the expertise and perspectives of all team members.

Keywords: AIMSCAP teamwork, communication strategies, WTT collaboration, team dynamics.

Technological Advantage

AIMSCAP's technological infrastructure provided a significant competitive advantage in the WTT.

Cutting-Edge Trading Technology

AIMSCAP invested heavily in cutting-edge trading technology to execute trades efficiently and effectively.

- High-speed trading platforms: They utilized high-speed, low-latency trading platforms to execute trades at optimal prices.

- Data analytics tools: Sophisticated data analytics tools were used to identify trends, patterns, and anomalies in vast datasets.

- Advanced charting software: Advanced charting software allowed the team to visualize market data effectively and make informed decisions.

Keywords: AIMSCAP technology, trading platforms, WTT tech advantage, trading technology.

Data Security and Infrastructure

Protecting sensitive data and maintaining reliable infrastructure were paramount for AIMSCAP.

- Data encryption: Robust data encryption protocols ensured the confidentiality and integrity of all sensitive data.

- Cybersecurity protocols: Comprehensive cybersecurity measures were in place to prevent unauthorized access and data breaches.

- System redundancy: Redundant systems and fail-safes minimized the risk of downtime and ensured the continuous operation of their trading infrastructure.

Keywords: AIMSCAP security, data protection, WTT infrastructure, cybersecurity.

Conclusion

AIMSCAP's victory at the World Trading Tournament (WTT) serves as a compelling case study in strategic trading, technological innovation, and teamwork. Their success highlights the crucial role of advanced algorithmic trading, diversified portfolio management, and a highly skilled and collaborative team. By learning from AIMSCAP’s approach, aspiring traders can improve their own strategies and potentially achieve similar success. To learn more about AIMSCAP's strategies and how they conquered the WTT, visit [link to AIMSCAP website or relevant resource]. Don't miss the opportunity to explore the world of algorithmic trading and achieve your own AIMSCAP-level success in the World Trading Tournament!

Featured Posts

-

Call For Dialogue Switzerland And China On Tariffs

May 21, 2025

Call For Dialogue Switzerland And China On Tariffs

May 21, 2025 -

5 Podcasts De Terror Misterio Y Suspenso Para No Dormir En La Noche

May 21, 2025

5 Podcasts De Terror Misterio Y Suspenso Para No Dormir En La Noche

May 21, 2025 -

From Anfield To Hout Bay Klopps Legacy In South African Football

May 21, 2025

From Anfield To Hout Bay Klopps Legacy In South African Football

May 21, 2025 -

Huizenprijzen 2024 Abn Amros Verwachtingen En De Rol Van De Rente

May 21, 2025

Huizenprijzen 2024 Abn Amros Verwachtingen En De Rol Van De Rente

May 21, 2025 -

Confronting The Love Monster Practical Strategies For Healthy Relationships

May 21, 2025

Confronting The Love Monster Practical Strategies For Healthy Relationships

May 21, 2025

Latest Posts

-

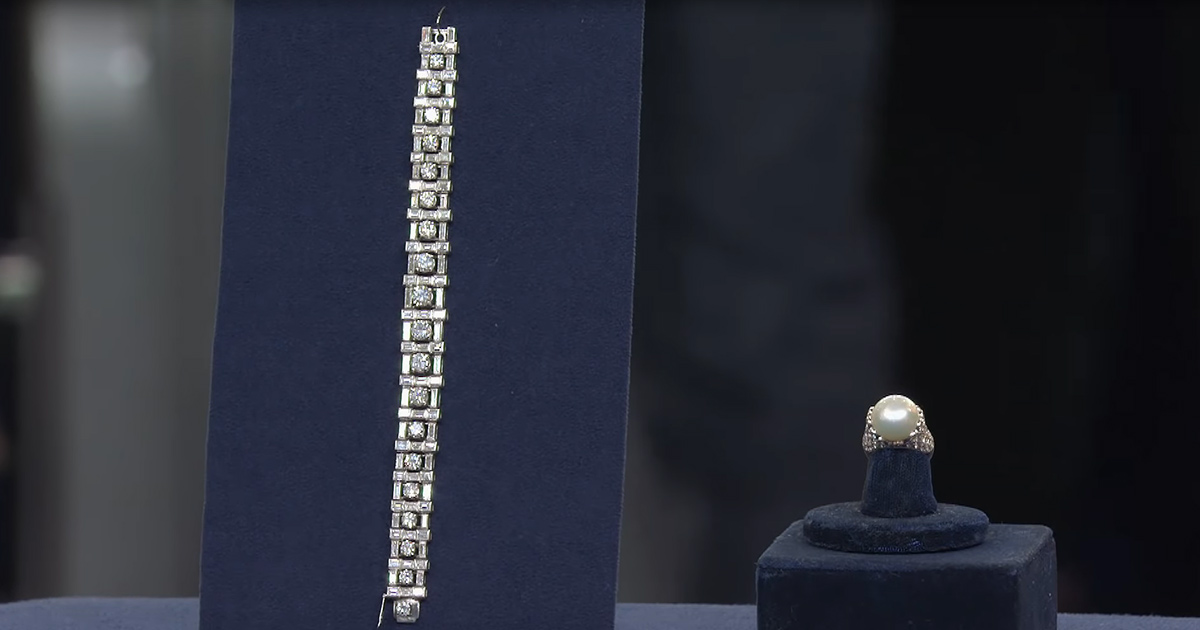

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025 -

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025 -

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025 -

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025 -

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025