How Deutsche Bank's FIC Traders Are Becoming World Leaders

Table of Contents

Strategic Investments and Technological Advancements

Deutsche Bank's dominance in FIC trading is significantly fueled by its commitment to technological innovation and strategic growth. This two-pronged approach has created a powerful engine for success.

Cutting-Edge Technology

The bank has made substantial investments in advanced technologies, providing its Deutsche Bank FIC Traders with a significant competitive advantage.

- Implementation of AI-driven trading strategies: Artificial intelligence and machine learning algorithms are used to analyze vast datasets, predict market movements, and optimize trading strategies for improved efficiency and risk management. This allows for faster execution and more informed decisions, crucial in the fast-paced world of FIC trading.

- Development of proprietary trading technology: Deutsche Bank has developed proprietary high-frequency trading (HFT) platforms and algorithms, giving its traders a crucial speed and accuracy advantage over competitors. This proprietary technology is constantly refined and updated, ensuring Deutsche Bank remains at the forefront of technological innovation in FIC trading.

- Investment in robust cybersecurity infrastructure: Protecting sensitive financial data is paramount. Deutsche Bank's investment in robust cybersecurity ensures the security and integrity of its trading operations, fostering trust and confidence among clients and partners.

Strategic Acquisitions and Partnerships

Deutsche Bank's strategic approach extends beyond internal development. Strategic acquisitions and partnerships have significantly expanded its capabilities and market reach.

- Acquisitions of smaller firms specializing in niche areas: Acquiring smaller, specialized firms allows Deutsche Bank to expand its expertise into niche segments of the FIC market, broadening its service offerings and attracting a wider range of clients.

- Strategic partnerships with technology companies: Collaborations with leading technology companies enhance Deutsche Bank's data processing and analytical capabilities, providing its FIC traders with even more sophisticated tools and insights.

- Collaborations with other financial institutions: Facilitating seamless cross-border transactions through collaborations with global financial institutions strengthens Deutsche Bank's international presence and enhances its ability to serve a global clientele.

Exceptional Talent Acquisition and Development

The success of Deutsche Bank's FIC trading division is inextricably linked to the exceptional talent within its ranks. The bank invests heavily in attracting, developing, and retaining top-tier professionals.

Recruiting Top Talent

Deutsche Bank's ability to attract and retain top FIC traders is a testament to its commitment to talent acquisition.

- Attracting experienced traders with proven track records: The bank actively recruits experienced traders with established reputations and proven success in the FIC market. These experienced professionals bring valuable knowledge and expertise to the team.

- Investing in training and development programs: Deutsche Bank offers comprehensive training and development programs to both enhance the skills of existing employees and cultivate future leaders within the organization. This ongoing investment in human capital ensures the ongoing success of the division.

- Cultivating a diverse and inclusive workplace: A diverse and inclusive work environment is essential for attracting and retaining the best talent. Deutsche Bank actively promotes diversity and inclusion initiatives, creating a welcoming and supportive environment for all employees.

Focus on Employee Growth and Retention

Beyond recruitment, Deutsche Bank prioritizes employee growth and retention to foster a culture of excellence.

- Mentorship programs to guide and support junior traders: Mentorship programs provide valuable guidance and support for junior traders, accelerating their professional development and fostering a strong sense of community.

- Opportunities for professional development and continuing education: Continued learning and professional development are encouraged through various opportunities, including conferences, workshops, and advanced certifications.

- Competitive benefits packages and work-life balance initiatives: Attractive compensation packages and initiatives supporting work-life balance help retain talented employees and create a positive work environment.

Innovative Trading Strategies and Market Expertise

Deutsche Bank's FIC traders stand out due to their innovative trading strategies and deep understanding of global markets.

Adapting to Market Volatility

The ability to adapt and thrive in volatile market conditions is a hallmark of Deutsche Bank's FIC trading team.

- Developing robust risk management strategies: Sophisticated risk management strategies are implemented to mitigate potential losses during periods of market uncertainty.

- Employing diverse trading strategies: A diverse range of trading strategies is employed to capitalize on market opportunities and hedge against potential risks.

- Proactive monitoring of market trends and geopolitical events: Close monitoring of market trends and geopolitical events allows traders to anticipate shifts and adjust strategies proactively.

Deep Market Understanding

A deep understanding of global financial markets and regulatory environments is critical for success.

- Access to high-quality market data and research: Deutsche Bank provides its traders with access to high-quality data and research, enabling informed decision-making.

- Strong relationships with key players in the financial industry: Strong relationships with key players in the industry provide valuable insights and opportunities.

- Compliance with stringent regulatory requirements: Adherence to stringent regulatory requirements ensures ethical and responsible trading practices.

Conclusion

Deutsche Bank's FIC traders are leading the way due to a powerful combination of strategic investments in technology, the cultivation of top-tier talent, and the implementation of innovative trading strategies. Their success is a testament to the bank's commitment to excellence in the face of a dynamic and challenging market. To learn more about the future of finance and the crucial role of Deutsche Bank FIC Traders, continue exploring our resources and stay informed about the latest developments in global finance. Understanding the strategies of leading Deutsche Bank FIC Traders is crucial for anyone interested in the future of global finance.

Featured Posts

-

New Russia Sanctions Trump Expresses Skepticism

May 30, 2025

New Russia Sanctions Trump Expresses Skepticism

May 30, 2025 -

Us Slaps 3 521 Tariffs On Some Southeast Asian Solar Panels Impact Analysis

May 30, 2025

Us Slaps 3 521 Tariffs On Some Southeast Asian Solar Panels Impact Analysis

May 30, 2025 -

Guillermo Del Toros Frankenstein Movie A Puzzling New Teaser And Its Unexpected Theme

May 30, 2025

Guillermo Del Toros Frankenstein Movie A Puzzling New Teaser And Its Unexpected Theme

May 30, 2025 -

Proces Hanouna Le Pen Vers Un Appel En 2026 L Analyse De Laurent Jacobelli

May 30, 2025

Proces Hanouna Le Pen Vers Un Appel En 2026 L Analyse De Laurent Jacobelli

May 30, 2025 -

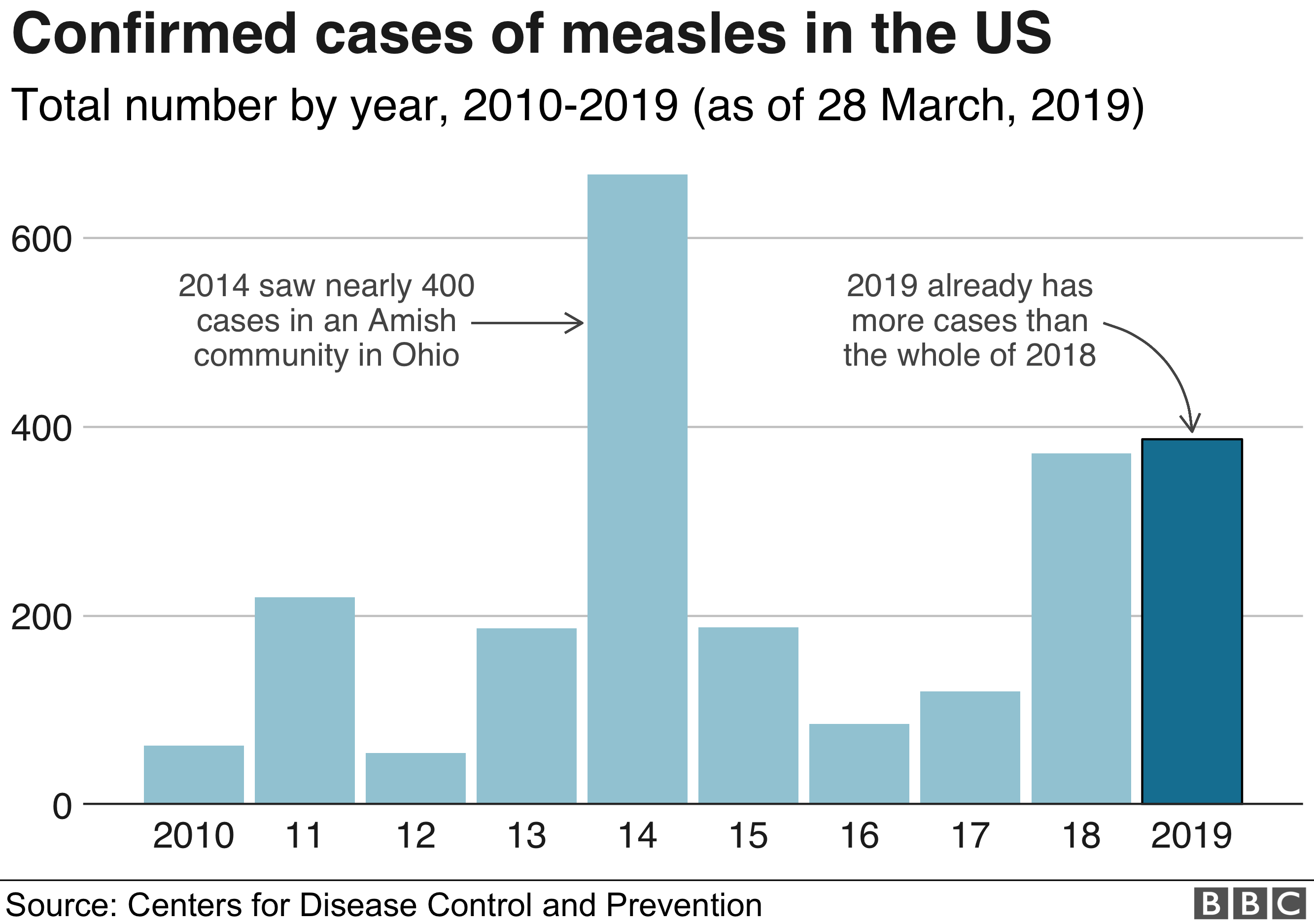

Us Measles Cases Rise To 1 046 Indiana Outbreak Concludes

May 30, 2025

Us Measles Cases Rise To 1 046 Indiana Outbreak Concludes

May 30, 2025