How Norway's Top Investor, Nicolai Tangen, Navigated Trump's Tariffs

Table of Contents

Understanding the Impact of Trump's Tariffs on Global Markets

Trump's tariffs, implemented as part of his "America First" trade policy, significantly impacted global markets. These protectionist measures aimed to shield American businesses from foreign competition but had far-reaching consequences. The ripple effects extended beyond the targeted industries, creating a period of significant uncertainty for global investors.

- Disruption of supply chains: Tariffs disrupted established global supply chains, forcing businesses to re-evaluate sourcing strategies and leading to increased costs and delays.

- Increased import costs for businesses: Tariffs directly increased the cost of imported goods, impacting businesses reliant on international trade and potentially squeezing profit margins.

- Uncertainty in global markets leading to volatility: The unpredictability surrounding tariff announcements and their potential escalation created significant market volatility, making investment decisions more challenging.

- Impact on specific sectors like manufacturing and technology: Sectors heavily reliant on international trade, such as manufacturing and technology, were particularly vulnerable to the effects of tariffs.

- Geopolitical tensions exacerbated by protectionist trade policies: Trump's trade policies fueled geopolitical tensions, increasing uncertainty and adding another layer of complexity for global investors like Nicolai Tangen. The resulting trade wars threatened to destabilize the global economy.

Tangen's Risk Management Strategy During the Tariff Wars

Nicolai Tangen's approach to managing the risks associated with Trump's tariffs was characterized by a long-term perspective and a focus on diversification. His strategy prioritized mitigating the potential negative impact on NBIM's massive portfolio while maintaining a commitment to long-term value creation.

- Diversification of NBIM's portfolio across various asset classes and geographies: A core element of Tangen's strategy was the diversification of NBIM's investments across a range of asset classes, including equities, fixed income, and real estate, and geographically, reducing reliance on any single sector or region. This minimized the impact of potential shocks stemming from the tariffs.

- Emphasis on long-term investment strategy, minimizing short-term reactions to market fluctuations: NBIM, under Tangen's leadership, avoided knee-jerk reactions to short-term market volatility. The fund maintained its long-term investment horizon, weathering the storm and avoiding potentially costly, impulsive decisions.

- Active monitoring of geopolitical events and their potential impact on investments: NBIM actively monitored geopolitical events, including developments in trade relations, to anticipate and mitigate potential risks to its investments. This proactive approach allowed for timely adjustments to the portfolio.

- Potential use of hedging strategies to protect against currency fluctuations: While specific details aren't publicly available, it's highly probable that NBIM employed hedging strategies to manage currency risks associated with the shifting global economic landscape brought about by the tariffs. This helped protect against losses due to currency fluctuations.

- Collaboration with external advisors and experts in international trade and economics: NBIM likely leveraged the expertise of external advisors specializing in international trade and economics to gain insights and inform their investment strategies during this turbulent period.

Specific Examples of Tangen's Actions and Their Outcomes

While specific details of NBIM's internal investment decisions during this period are often confidential, analysts suggest that Tangen's strategy likely involved:

- Shifting investments away from sectors particularly vulnerable to tariffs: NBIM might have reduced exposure to sectors directly impacted by tariffs, such as certain manufacturing sub-sectors reliant on imported materials.

- Increased investment in regions less affected by trade disputes: The fund might have increased investments in regions less impacted by the trade war, geographically diversifying its portfolio and reducing exposure to the affected markets.

- Public statements by Tangen regarding his approach to the tariffs: Any public statements or interviews by Tangen during that period would offer further insights into his specific strategies and approach. Unfortunately, specific examples are difficult to confirm publicly without access to NBIM's internal reports.

The Role of the Norges Bank Investment Management (NBIM) in Navigating Uncertainty

NBIM's institutional framework played a crucial role in successfully navigating the uncertainties created by Trump's tariffs. The fund's structure, mandate, and resources allowed for a measured and effective response.

- NBIM's mandate and its influence on investment decisions: NBIM's long-term investment mandate, focused on maximizing returns while maintaining a high level of risk management, provided a foundation for its actions during the tariff period.

- The expertise and resources available within NBIM to analyze global economic trends: The fund possesses significant expertise and resources, allowing it to thoroughly analyze global economic trends and anticipate the impact of potential disruptions.

- The communication and transparency of NBIM in reporting its investment strategies: While specific details are often kept confidential, NBIM generally maintains a level of transparency in reporting its overall investment strategies, fostering trust with stakeholders.

- NBIM's long-term outlook and its ability to withstand short-term market volatility: NBIM's long-term investment approach allowed it to withstand short-term market volatility caused by the trade war, focusing on the fund's long-term growth potential.

Conclusion

Nicolai Tangen's successful navigation of Trump's tariffs demonstrates the importance of a well-defined, diversified investment strategy. His emphasis on long-term vision, proactive risk management, and utilizing NBIM's robust resources enabled the fund to weather the economic storm and mitigate potential losses. Diversification, a long-term perspective, and a thorough understanding of geopolitical factors were key to his success. These lessons are invaluable for investors facing similar economic uncertainties.

Learn from Nicolai Tangen's experience and develop a robust strategy for managing risks associated with global trade disputes. Understanding how experienced investors like Tangen adapt to unpredictable events like Trump's tariffs is crucial for navigating your own investment journey and mitigating potential losses during times of economic and geopolitical uncertainty. Further research into Nicolai Tangen's investment philosophy and the workings of Norway's sovereign wealth fund will provide valuable insights into successful global investment strategies.

Featured Posts

-

The Blake Lively Anna Kendrick Feud A Year By Year Look

May 04, 2025

The Blake Lively Anna Kendrick Feud A Year By Year Look

May 04, 2025 -

Ruth Buzzi 88 Remembering A Comedy Icon From Laugh In And Sesame Street

May 04, 2025

Ruth Buzzi 88 Remembering A Comedy Icon From Laugh In And Sesame Street

May 04, 2025 -

Blake Lively And Anna Kendricks Relationship On The Set Of Another Simple Favor The Director Speaks Out

May 04, 2025

Blake Lively And Anna Kendricks Relationship On The Set Of Another Simple Favor The Director Speaks Out

May 04, 2025 -

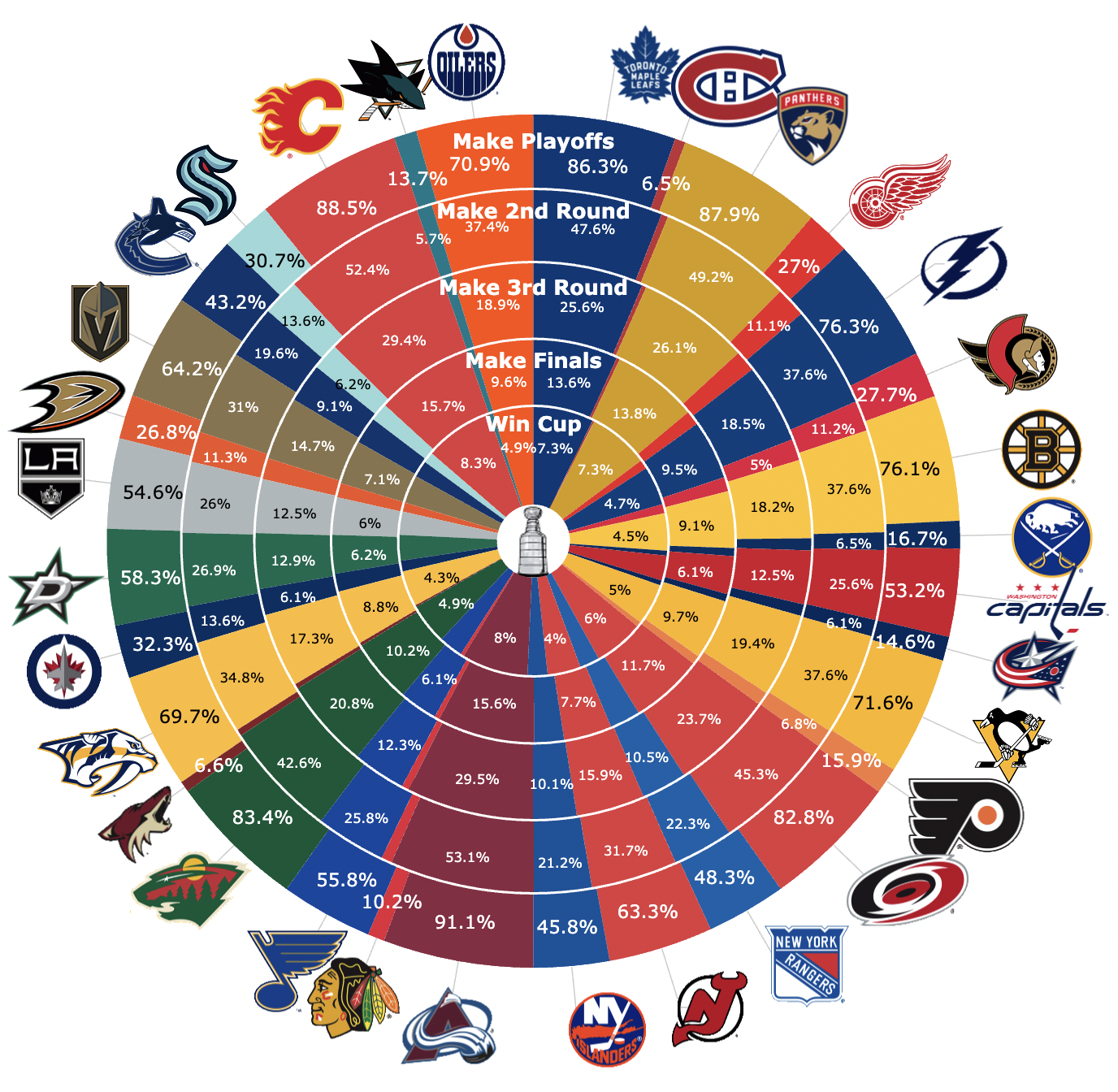

Nhl Playoffs 2024 Who Will Win The Stanley Cup

May 04, 2025

Nhl Playoffs 2024 Who Will Win The Stanley Cup

May 04, 2025 -

Carney Promises Biggest Economic Overhaul In A Generation

May 04, 2025

Carney Promises Biggest Economic Overhaul In A Generation

May 04, 2025

Latest Posts

-

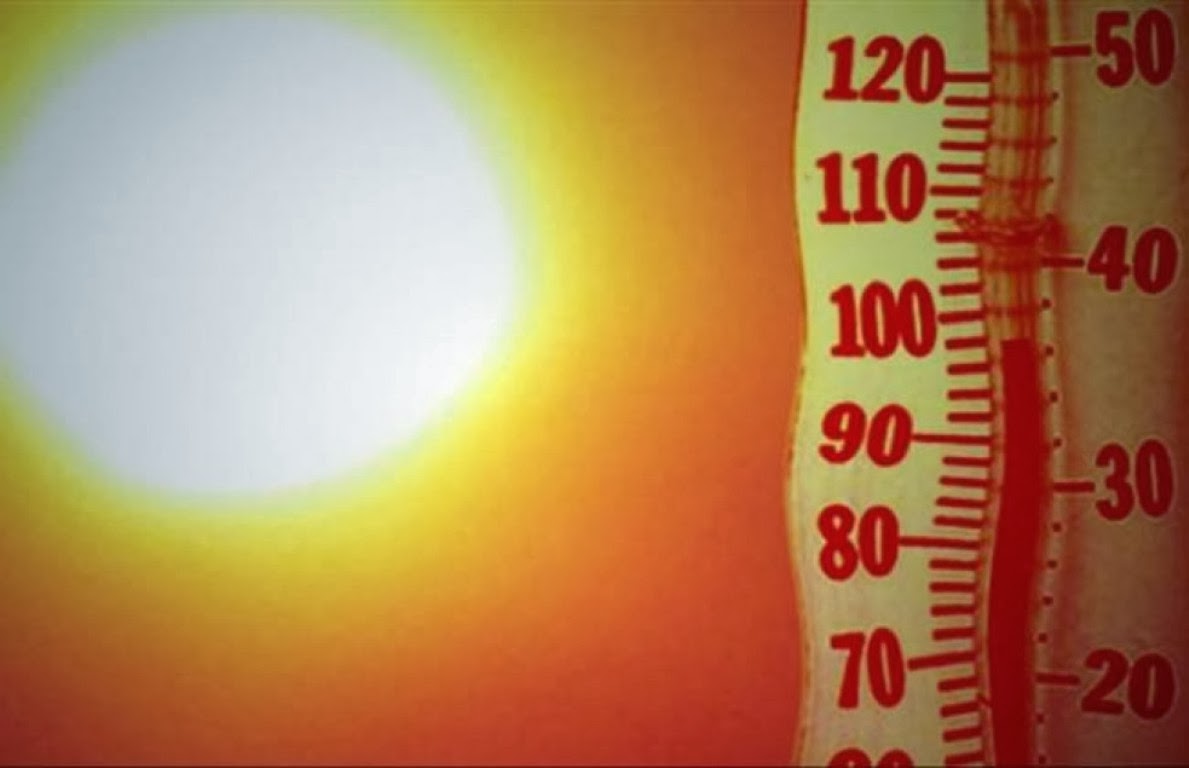

Holi Heatwave South Bengal Temperatures Reach Near 38 Degrees

May 04, 2025

Holi Heatwave South Bengal Temperatures Reach Near 38 Degrees

May 04, 2025 -

Anna Kendricks Blake Lively Comment Fans Obsessed

May 04, 2025

Anna Kendricks Blake Lively Comment Fans Obsessed

May 04, 2025 -

South Bengal Sizzles Temperatures Soar To 38 C On Holi

May 04, 2025

South Bengal Sizzles Temperatures Soar To 38 C On Holi

May 04, 2025 -

Get The Look Anna Kendricks Sparkling Shell Crop Top

May 04, 2025

Get The Look Anna Kendricks Sparkling Shell Crop Top

May 04, 2025 -

Shell Crop Tops The Summer Trend Inspired By Anna Kendrick

May 04, 2025

Shell Crop Tops The Summer Trend Inspired By Anna Kendrick

May 04, 2025