How Norway's Top Investor, Nicolai Tangen, Responded To Trump's Tariffs

Table of Contents

Analyzing the Impact of Trump's Tariffs on NBIM's Portfolio

Trump's tariffs significantly impacted global trade, creating uncertainty for investors worldwide. Understanding how these tariffs affected NBIM's portfolio requires examining its exposure to affected sectors and the geopolitical ramifications.

Exposure to Affected Sectors

NBIM, managing the world's largest sovereign wealth fund, holds a globally diversified portfolio. However, some sectors were inevitably more exposed to the negative effects of Trump's tariffs than others.

- Manufacturing: Companies in the manufacturing sector, particularly those involved in exporting goods to the US, faced significant challenges. While NBIM's exact holdings are not publicly listed in granular detail for competitive reasons, it's reasonable to assume exposure to multinational manufacturers impacted by increased import duties.

- Technology: The technology sector, encompassing companies reliant on global supply chains and US markets, also experienced disruption. Tariffs on components and finished goods could have affected the performance of technology investments held by NBIM.

- Potential Financial Impact: Precise quantification of the financial impact is difficult due to the complexity of NBIM's portfolio and the lack of publicly available, specific data on their holdings. However, reports suggest that reduced profitability for companies affected by tariffs could have translated into lower returns for NBIM.

- Divestment Strategies: While NBIM doesn't publicly announce specific divestment decisions based on individual tariff impacts, their overall strategy emphasizes long-term value creation and diversification to mitigate risk. This likely entailed a reassessment of risk profiles for companies significantly affected by tariffs.

Geopolitical Considerations

Tangen's response was not solely focused on immediate financial impacts. Geopolitical risks associated with the trade war were also factored into NBIM's decision-making.

- Diversification Strategy: NBIM's long-standing diversification strategy played a crucial role in mitigating the impact of the tariffs. By investing across various sectors and geographies, NBIM aimed to reduce its dependence on any single region or industry excessively affected by the trade war.

- Investment Shifts: While specific details remain undisclosed, it's plausible that NBIM adjusted its investment allocations, potentially shifting towards regions and sectors less affected by the tariffs. This could have involved increased investment in emerging markets or sectors less exposed to US-China trade tensions.

- Differentiation from other Investors: Tangen's approach likely differed from some investors who reacted more aggressively to the uncertainty, perhaps by engaging in short-term trading strategies. NBIM's long-term investment horizon provided a cushion against short-term market volatility.

Tangen's Strategic Responses and Risk Management

Navigating the uncertainty created by Trump's tariffs required strategic adjustments to NBIM's investment approach and a commitment to transparent communication.

Investment Strategy Adjustments

Tangen's response emphasized proactive risk management and a focus on long-term value.

- Long-Term Value Focus: Rather than making knee-jerk reactions, NBIM likely prioritized investments aligned with its long-term strategic goals, focusing on companies with strong fundamentals and resilient business models.

- Asset Allocation Shifts: Adjustments to asset allocation might have included a reassessment of exposure to equities versus fixed income, potentially shifting to sectors less susceptible to tariff-related disruptions.

- Hedging Strategies: NBIM might have employed hedging strategies to mitigate risks associated with currency fluctuations and trade uncertainties resulting from the tariffs. Specific examples remain confidential, however.

Communication and Transparency

NBIM's communication regarding its response to the tariffs is another key aspect.

- Proactive Communication: While the specifics of individual investment decisions are not publicly available, NBIM likely communicated its overall approach and strategy to stakeholders, emphasizing transparency and accountability.

- Public Statements and Reports: NBIM regularly publishes annual reports and other statements that provide broad overviews of its investment strategy and performance. These documents likely reflected the impact of the tariffs on the fund's performance, though not necessarily revealing individual stock-level adjustments.

Long-Term Implications for NBIM and Norway's Economy

The long-term implications of Trump's tariffs extended beyond the immediate impact on NBIM's portfolio, affecting both Norway's economy and shaping NBIM's future strategies.

The Broader Economic Effects

The tariffs had broader consequences for Norway's economy.

- Global Trade Impact: The global trade war created uncertainty and potentially reduced export opportunities for Norwegian businesses relying on international markets.

- Economic Resilience: NBIM's actions, though not directly influencing macroeconomic policy, likely contributed to Norway's overall economic resilience by mitigating the negative effects of the tariffs on its sovereign wealth fund.

Tangen's Legacy

Tangen's leadership during this period is important in assessing NBIM's future.

- Leadership in Uncertainty: His approach demonstrated the importance of strategic long-term thinking, diversification, and transparency in navigating global economic uncertainties.

- Lessons Learned: The experience likely solidified NBIM's commitment to robust risk management practices and informed future investment decisions, particularly regarding geopolitical risks and the impact of protectionist policies.

Conclusion:

This article has examined Nicolai Tangen's response to Trump's tariffs, highlighting his strategic adjustments and risk management techniques employed by Norges Bank Investment Management (NBIM). By analyzing NBIM's portfolio exposure, its diversification strategies, and the transparency of its communication, we've gained insights into how a major sovereign wealth fund navigated this period of significant economic uncertainty. Understanding how prominent investors like Nicolai Tangen responded to such global events is crucial for comprehending the complexities of international finance and the management of significant investment portfolios. Further research into the specific details of NBIM's investment decisions during this period, particularly around Nicolai Tangen Trump tariffs, would offer a more comprehensive understanding of his approach to managing global economic risks.

Featured Posts

-

Bookstores Valuable Find A 45 000 Rare Novel

May 05, 2025

Bookstores Valuable Find A 45 000 Rare Novel

May 05, 2025 -

V Mware Costs To Skyrocket At And T Reports 1050 Price Hike From Broadcom

May 05, 2025

V Mware Costs To Skyrocket At And T Reports 1050 Price Hike From Broadcom

May 05, 2025 -

Colonial Downs To Host Virginia Derby Stones Official Announcement

May 05, 2025

Colonial Downs To Host Virginia Derby Stones Official Announcement

May 05, 2025 -

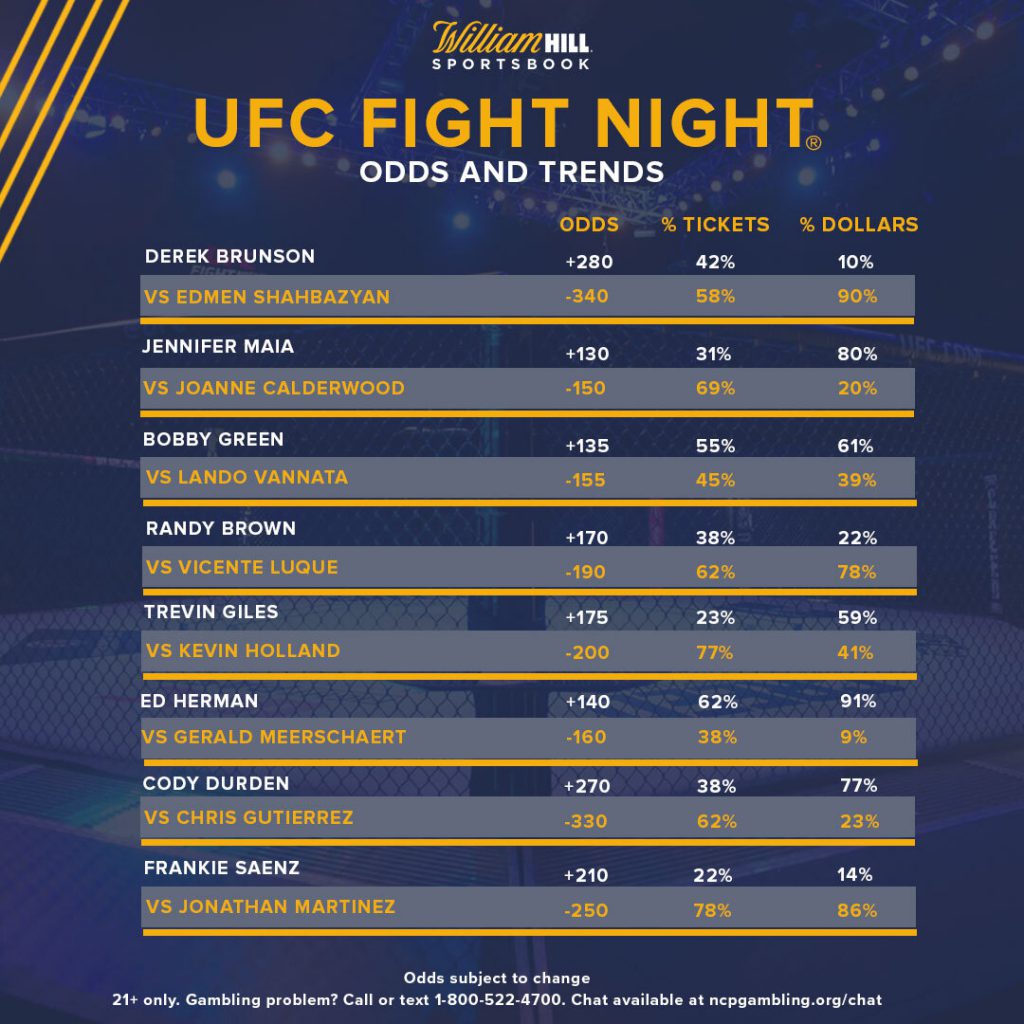

Ufc 314 Early Betting Odds For Every Fight

May 05, 2025

Ufc 314 Early Betting Odds For Every Fight

May 05, 2025 -

Navigating The Complexities Automakers Facing Headwinds In The Chinese Market

May 05, 2025

Navigating The Complexities Automakers Facing Headwinds In The Chinese Market

May 05, 2025

Latest Posts

-

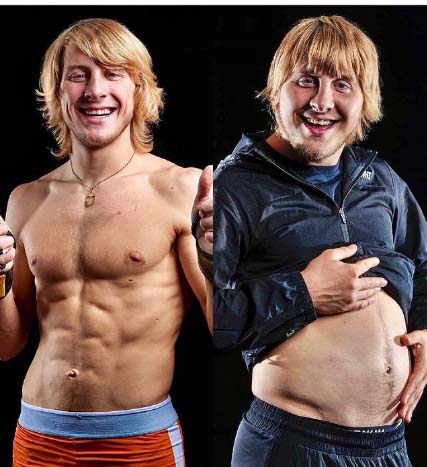

Was Dustin Poirier Wrong To Retire Paddy Pimblett Weighs In

May 05, 2025

Was Dustin Poirier Wrong To Retire Paddy Pimblett Weighs In

May 05, 2025 -

Chandler Vs Pimblett Ufc 314 Co Main Event Odds Analysis And Predictions

May 05, 2025

Chandler Vs Pimblett Ufc 314 Co Main Event Odds Analysis And Predictions

May 05, 2025 -

Paddy Pimblett Calls Dustin Poiriers Retirement Decision Idiot Analysis

May 05, 2025

Paddy Pimblett Calls Dustin Poiriers Retirement Decision Idiot Analysis

May 05, 2025 -

Paddy Pimblett On Dustin Poiriers Retirement A Controversial Opinion

May 05, 2025

Paddy Pimblett On Dustin Poiriers Retirement A Controversial Opinion

May 05, 2025 -

Ufc 314 Revised Fight Card After Prates Neal Bout Cancellation

May 05, 2025

Ufc 314 Revised Fight Card After Prates Neal Bout Cancellation

May 05, 2025