How One Crypto Trader Shorted $TRUMP And Won A White House Dinner

Table of Contents

The cryptocurrency market is a rollercoaster of exhilarating highs and terrifying lows. One minute you're riding a wave of astronomical profits, the next you're plummeting into a pit of devastating losses. This unpredictable nature makes it a breeding ground for daring traders willing to take on high-risk, high-reward opportunities. Our story centers on one such trader who executed a bold strategy: shorting the fictional $TRUMP token – and landed an invitation to a White House dinner as a bizarre, yet rewarding, consequence. This article explores the trader's strategy, the inherent risks of shorting $TRUMP, and the unusual reward that followed, shedding light on the complexities of crypto trading and high-stakes investing in the volatile world of political cryptocurrency.

Main Points:

2.1 Understanding the $TRUMP Token and its Market Volatility

The fictional $TRUMP token, a hypothetical cryptocurrency, was designed to represent a speculative investment linked to the political fortunes of a certain prominent figure. Its target audience comprised politically engaged individuals and crypto enthusiasts willing to gamble on political outcomes. The token's price was incredibly volatile, making it a prime target for experienced traders adept at navigating unpredictable market conditions.

- Factors Influencing Volatility: The $TRUMP token's price was significantly influenced by various factors, including:

- Political News: Positive news cycles surrounding the figure the token represented would often lead to price surges, while negative news would trigger sharp sell-offs.

- Social Media Trends: Viral social media campaigns, both positive and negative, exerted a considerable impact on the token's trading volume and price.

- Speculative Trading: The token's inherent volatility attracted speculative traders, exacerbating price fluctuations and creating opportunities for both gains and significant losses. This made market manipulation a genuine risk.

2.2 The Trader's Strategy: Executing a Successful Short Sell

Our trader, let's call him Alex, recognized the extreme volatility of $TRUMP. He decided to employ a short-selling strategy. In simple terms, short selling involves borrowing an asset (in this case, $TRUMP tokens), selling them at the current market price, and hoping to buy them back later at a lower price. The difference represents the profit. This is a high-risk maneuver, as the price could rise instead of fall, leading to potentially significant losses.

- Alex's Approach: Alex carefully analyzed market indicators, anticipating a negative news cycle that would likely depress the $TRUMP token's price.

- Risk Management: To mitigate potential losses, Alex implemented crucial risk management techniques:

- Stop-Loss Orders: He set stop-loss orders to automatically sell his borrowed tokens if the price rose above a predetermined threshold, limiting his potential losses.

- Diversification: Alex didn't put all his eggs in one basket. He diversified his portfolio, investing in other cryptocurrencies to reduce overall risk.

2.3 The White House Dinner: An Unlikely Reward

The connection between Alex's successful shorting of $TRUMP and his White House dinner invitation is intriguing. The $TRUMP token was, unbeknownst to many, linked to a charitable foundation focused on supporting emerging technological initiatives. Alex's substantial profit from his short sale resulted in a significant donation to this foundation, bringing him to the attention of the administration. This philanthropic aspect, coupled with his demonstrable trading acumen, earned him an invitation to a White House dinner celebrating advancements in the tech sector.

- Ethical Considerations: While the story highlights a unique reward, it raises ethical questions surrounding the use of politically charged cryptocurrencies and the potential for market manipulation.

2.4 Lessons Learned: Analyzing the Success and Risks of Shorting $TRUMP

Alex's success with shorting $TRUMP underscores the importance of thorough market analysis and effective risk management in cryptocurrency trading. While he profited handsomely, this strategy comes with enormous risk.

- Key Takeaways:

- Thorough Market Research: Successful crypto trading requires meticulous analysis of market trends, news cycles, and social media sentiment.

- Effective Risk Management: Employing stop-loss orders and diversifying investments are crucial for mitigating potential losses.

- Understanding Volatility: Cryptocurrency markets are inherently volatile; high-risk strategies like short selling require a deep understanding of these dynamics.

- Ethical Considerations: Investors should always consider the ethical implications of their trades, particularly those involving politically sensitive assets.

Conclusion: Mastering the Art of Shorting $TRUMP and Similar Crypto Assets

Alex's story illustrates the potential for high rewards and equally high risks associated with shorting cryptocurrencies like the fictional $TRUMP token. His success was built on a foundation of market analysis, calculated risk management, and a touch of fortunate timing. While replicating his unusual reward might be unlikely, mastering the art of shorting requires understanding market dynamics and managing risk effectively. To learn more about responsible crypto trading strategies and various approaches to short selling, explore reliable resources and educational platforms. Begin your journey towards mastering crypto short selling by starting with less volatile assets and gradually increasing your understanding of market complexities. Don't jump into high-risk strategies like shorting $TRUMP (or any other volatile asset) until you have a solid foundation in crypto trading principles.

Featured Posts

-

Pocket Shining Revelry A Collectors Guide To A Difficult Set

May 29, 2025

Pocket Shining Revelry A Collectors Guide To A Difficult Set

May 29, 2025 -

Netflixs Sarandos Hints At Emotional Impact Of Stranger Things Season 5

May 29, 2025

Netflixs Sarandos Hints At Emotional Impact Of Stranger Things Season 5

May 29, 2025 -

Coco 2 Confirmed A Critical Analysis Of Pixars Decision

May 29, 2025

Coco 2 Confirmed A Critical Analysis Of Pixars Decision

May 29, 2025 -

New Crown Zenith Cards Pocket Edition Details Revealed

May 29, 2025

New Crown Zenith Cards Pocket Edition Details Revealed

May 29, 2025 -

Mena Lw Ansf Alqwmu Fy Dhkra Astqlalna

May 29, 2025

Mena Lw Ansf Alqwmu Fy Dhkra Astqlalna

May 29, 2025

Latest Posts

-

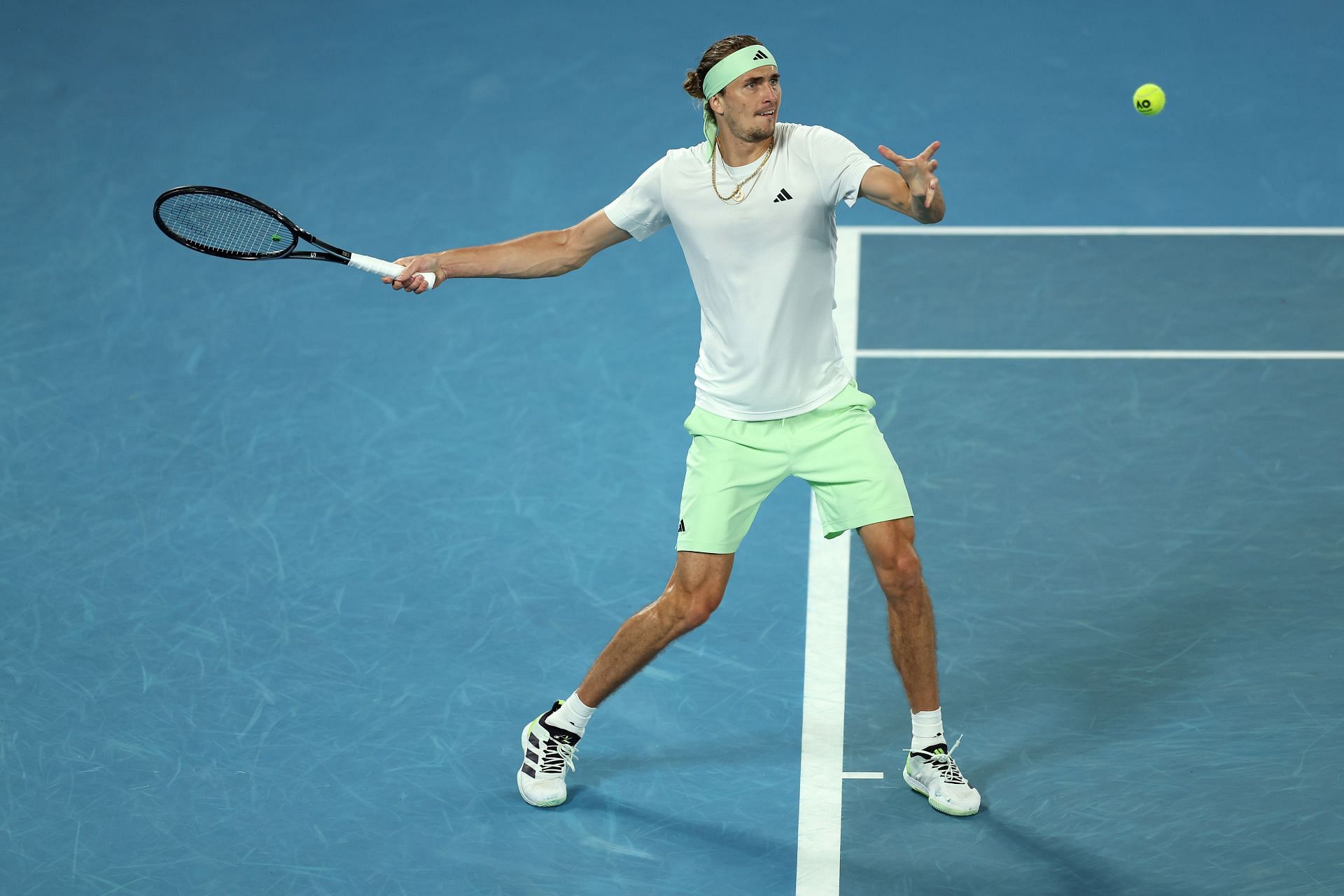

Zverevs Indian Wells Campaign Ends Early Griekspoor Upsets Top Seed

May 31, 2025

Zverevs Indian Wells Campaign Ends Early Griekspoor Upsets Top Seed

May 31, 2025 -

Zverevs Indian Wells Loss A Griekspoor Masterclass

May 31, 2025

Zverevs Indian Wells Loss A Griekspoor Masterclass

May 31, 2025 -

Upset In The Desert Griekspoor Defeats Top Seeded Zverev At Indian Wells

May 31, 2025

Upset In The Desert Griekspoor Defeats Top Seeded Zverev At Indian Wells

May 31, 2025 -

Alexander Zverev Loses To Tallon Griekspoor At Indian Wells

May 31, 2025

Alexander Zverev Loses To Tallon Griekspoor At Indian Wells

May 31, 2025 -

Zverevs Comeback Victory Sends Him To Munich Semifinals

May 31, 2025

Zverevs Comeback Victory Sends Him To Munich Semifinals

May 31, 2025