Hudson Bay Company's Creditor Protection Extended To July 31: Court Ruling

Table of Contents

Details of the Court Ruling

The court's decision to extend HBC's creditor protection until July 31st represents a significant development in the company's ongoing battle for survival. Judge [Insert Judge's Name], of the [Insert Court Name], cited [Insert reason for extension, e.g., "the company's demonstrable progress in developing a viable restructuring plan" or "the need for additional time to explore strategic alternatives"] as the primary justification for granting the extension. This crucial extension buys HBC valuable time to explore various options, allowing for a more deliberate and potentially more successful outcome.

- Date of the court ruling: [Insert Date]

- Length of the extension: Until July 31st, 2024.

- Conditions attached to the extension: [Insert any conditions imposed by the court, e.g., regular reporting requirements, limitations on spending, etc.]

- Quote from the judge or legal representative: "[Insert quote if available, appropriately attributed]"

Impact on HBC's Restructuring Plan

This extension significantly impacts HBC's restructuring efforts. The added time allows the company to pursue various strategies aimed at improving its financial position and long-term viability. These strategies may include:

- Potential sale of assets: HBC might consider selling off non-core assets to raise capital and reduce its debt burden. This could involve selling individual stores, real estate holdings, or entire brands.

- Debt renegotiation: Negotiating more favorable terms with creditors is another crucial aspect of the restructuring plan. This might involve extending repayment deadlines, reducing interest rates, or converting debt into equity.

- Operational cost reductions: HBC will likely continue to focus on streamlining operations and reducing costs. This could involve workforce reductions, store closures, or renegotiating supplier contracts.

- Focus on key profitable areas of the business: The company might shift its focus toward its most profitable business units to maximize revenue generation and profitability.

Implications for Creditors and Stakeholders

The extension of creditor protection has significant implications for HBC's creditors and various stakeholders. The outcomes will vary depending on the success of the restructuring efforts.

- Impact on creditor payments: Creditors may experience delays or reductions in payments during the restructuring process. The ultimate outcome will depend on the success of HBC's restructuring plan.

- Potential for equity dilution: Existing shareholders might experience equity dilution if the company resorts to issuing new shares to raise capital.

- Effect on employee jobs and benefits: While job losses are possible, the extension could also buy time to explore alternatives that minimize negative impacts on employees.

- Impact on the company’s long-term viability: The success of the restructuring will determine whether HBC can emerge as a financially healthy and sustainable enterprise.

Future Outlook and Next Steps for HBC

The period leading up to the July 31st deadline will be critical for HBC. Several scenarios are possible:

-

Successful Restructuring: HBC successfully renegotiates its debt, streamlines operations, and improves profitability, emerging from creditor protection as a viable business.

-

Sale of the Company: A buyer might emerge, acquiring all or part of HBC's assets. Potential buyers could include private equity firms, other retailers, or real estate investment trusts.

-

Liquidation: In the worst-case scenario, HBC might be forced into liquidation, with its assets sold off to pay creditors.

-

Potential buyers or investors: [Mention any potential interested parties if known]

-

Timeline for key decisions: The coming months will see critical decisions made regarding asset sales, debt renegotiation, and potential buyers.

-

Likely scenarios and their implications: The most likely outcomes depend heavily on the success of the restructuring plan and the ability to secure additional funding.

-

Risks and uncertainties going forward: The retail industry remains challenging, and HBC faces significant risks, including competition, economic uncertainty, and the ongoing impact of the pandemic.

The Future of HBC After Creditor Protection Extension

The extension of creditor protection offers HBC a crucial opportunity to restructure and secure its future. The July 31st deadline looms large, and the success of the restructuring efforts will determine the ultimate fate of this iconic retailer. While uncertainty remains, the extension provides a window of opportunity for a positive outcome. However, the challenges remain substantial, and ongoing monitoring of the situation is crucial. Stay informed about further developments regarding HBC's creditor protection and restructuring plans by regularly checking reputable news sources for updates on the Hudson's Bay Company.

Featured Posts

-

Sergey Bobrovskiy 5 Y Sukhar V Pley Off N Kh L

May 15, 2025

Sergey Bobrovskiy 5 Y Sukhar V Pley Off N Kh L

May 15, 2025 -

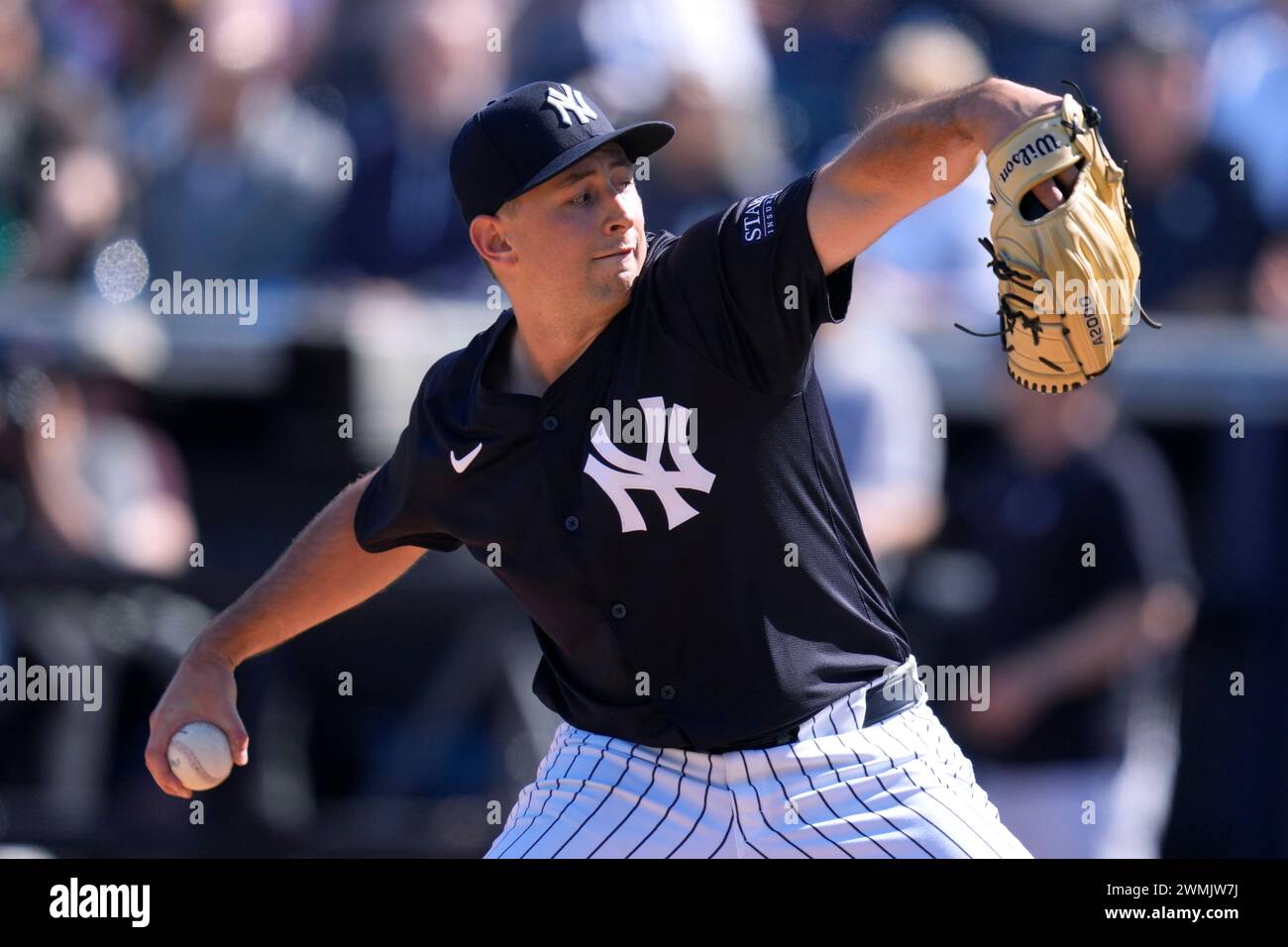

Cody Poteets Spring Training Abs Challenge Victory

May 15, 2025

Cody Poteets Spring Training Abs Challenge Victory

May 15, 2025 -

Analyzing The 2025 Nhl Draft Lottery Impact On The Utah Hockey Club

May 15, 2025

Analyzing The 2025 Nhl Draft Lottery Impact On The Utah Hockey Club

May 15, 2025 -

The China Factor Why Luxury Carmakers Face Headwinds In The Worlds Largest Market

May 15, 2025

The China Factor Why Luxury Carmakers Face Headwinds In The Worlds Largest Market

May 15, 2025 -

Npo Baas In Opspraak Beschuldigingen Van Angstcultuur Door Meerdere Medewerkers

May 15, 2025

Npo Baas In Opspraak Beschuldigingen Van Angstcultuur Door Meerdere Medewerkers

May 15, 2025

Latest Posts

-

Gsw Campus Incident Resolved All Clear Issued

May 15, 2025

Gsw Campus Incident Resolved All Clear Issued

May 15, 2025 -

Nba Playoffs Charles Barkleys Take On The Warriors Timberwolves Matchup

May 15, 2025

Nba Playoffs Charles Barkleys Take On The Warriors Timberwolves Matchup

May 15, 2025 -

Ohio City Apartment Complex Shooting Leaves One Man Injured

May 15, 2025

Ohio City Apartment Complex Shooting Leaves One Man Injured

May 15, 2025 -

Georgia Southwestern State University Lifts Lockdown Following Campus Incident

May 15, 2025

Georgia Southwestern State University Lifts Lockdown Following Campus Incident

May 15, 2025 -

Barkleys Bold Prediction Who Wins The Warriors Timberwolves Series

May 15, 2025

Barkleys Bold Prediction Who Wins The Warriors Timberwolves Series

May 15, 2025