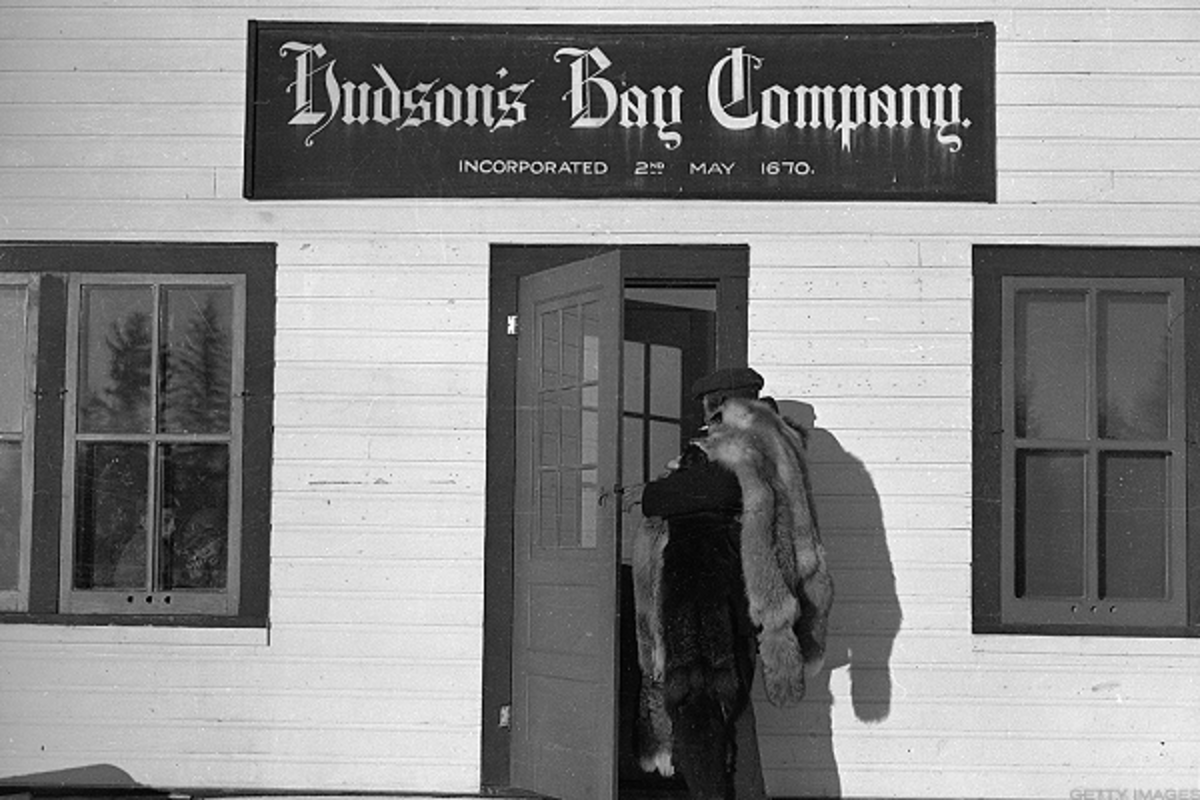

Hudson Bay Receives Court Approval To Extend Financial Restructuring

Table of Contents

Details of the Court Approval

On [Insert Date], a [Insert Court Name] court granted Hudson Bay Company approval to extend its financial restructuring plan. The judge, [Insert Judge's Name], cited [Insert Judge's Reasoning – e.g., the company's demonstrated commitment to restructuring and the potential for a successful reorganization] as key factors in the decision. This extension provides HBC with [Insert Duration of Extension] to implement its revised restructuring plan. The court order includes specific conditions, which are crucial for the continuation of the process.

- Timeline: The extended timeline allows HBC to [Explain the use of the extended time].

- Creditor Participation: The agreement necessitates [Explain creditor involvement and agreements].

- Operational Changes: HBC is required to [Outline mandatory operational changes as per court order].

- Transparency Requirements: The court mandates increased transparency regarding [Specify areas of required transparency].

Keywords: court order, legal proceedings, judicial approval, insolvency proceedings.

Implications for Hudson Bay's Future

The extension of the financial restructuring provides a crucial opportunity for HBC to regain its financial stability and chart a path towards long-term viability. However, the road ahead is fraught with challenges. The success of the restructuring hinges on several factors, including the ability to improve operational efficiency, attract new investments, and adapt to the evolving retail landscape.

- Positive Impacts: Successful restructuring could lead to a leaner, more efficient organization, better positioned for future growth. New investments and innovative strategies could revitalize the brand.

- Negative Impacts: Failure to meet the conditions set by the court could result in further complications, potentially leading to more store closures, job losses, and ultimately, liquidation. The extended period of uncertainty could also damage customer confidence.

Keywords: financial stability, business recovery, future prospects, operational efficiency, strategic restructuring.

Impact on Creditors and Stakeholders

The court's decision significantly impacts various stakeholders within the HBC ecosystem. Creditors, including banks and bondholders, will experience a change in their repayment schedules and potentially adjusted interest rates. Employees face uncertainty regarding job security, while suppliers may experience delays in payments. Customers might see alterations in store operations and product offerings.

- Creditors: The extension may involve adjustments to repayment terms, potentially resulting in [Explain potential outcomes for creditors, e.g., reduced returns or extended payment periods].

- Employees: Job security remains a significant concern, with the possibility of further layoffs or restructuring within different departments.

- Suppliers: Delayed payments are a likely outcome, potentially impacting their own financial stability and their willingness to continue supplying HBC.

- Customers: Potential changes in store operations and product offerings could affect customer experience and loyalty.

Keywords: creditors' rights, stakeholder interests, debt repayment, financial obligations, impact on employees.

Comparison to Previous Restructuring Attempts

HBC has undertaken previous attempts to restructure its debt and improve its financial position. [Insert details about previous attempts]. This current extension differs significantly from prior efforts in [Explain key differences, such as scale, approach, or involvement of stakeholders]. The current strategy appears to be more comprehensive and collaborative, aiming for a longer-term solution rather than short-term fixes.

- Previous Restructuring (Year): [Briefly describe the approach, results, and key differences compared to the current restructuring].

- Current Restructuring: [Highlight the key differences in strategies and objectives].

Keywords: previous restructuring, debt management, financial recovery, turnaround strategy.

Conclusion: Hudson Bay's Path Forward After Restructuring Extension

The court's approval to extend Hudson Bay's financial restructuring marks a critical juncture for the company. While the extension provides a crucial opportunity for recovery, the path forward remains challenging and requires careful execution of the restructuring plan. The success of the plan hinges on collaboration among stakeholders, operational efficiencies, and adaptation to the changing retail landscape. The next steps will be closely watched by industry analysts, creditors, employees, and customers alike. Stay updated on further developments in Hudson Bay's financial restructuring process and learn more about the company's restructuring plan. Share your opinions or insights in the comments section below. We encourage you to stay informed about the ongoing Hudson Bay financial restructuring and the company’s efforts towards debt management and business recovery.

Featured Posts

-

Maple Leafs Vs Red Wings Prediction Picks And Odds For Tonights Nhl Game

May 16, 2025

Maple Leafs Vs Red Wings Prediction Picks And Odds For Tonights Nhl Game

May 16, 2025 -

Nba And Nhl Round 2 Betting Analysis And Predictions

May 16, 2025

Nba And Nhl Round 2 Betting Analysis And Predictions

May 16, 2025 -

Menko Ahy Dan Pembangunan Giant Sea Wall Detail Proyek Strategis Nasional

May 16, 2025

Menko Ahy Dan Pembangunan Giant Sea Wall Detail Proyek Strategis Nasional

May 16, 2025 -

Eastpointe Foot Locker Shooting 4 Shot 2 Killed In Parking Lot

May 16, 2025

Eastpointe Foot Locker Shooting 4 Shot 2 Killed In Parking Lot

May 16, 2025 -

Tam Krwz Ks Ke Sath Telqat Myn Hyn

May 16, 2025

Tam Krwz Ks Ke Sath Telqat Myn Hyn

May 16, 2025

Latest Posts

-

Crystal Palace Vs Nottingham Forest En Directo

May 16, 2025

Crystal Palace Vs Nottingham Forest En Directo

May 16, 2025 -

La Liga Announces Uk And Ireland Rights Tender Process

May 16, 2025

La Liga Announces Uk And Ireland Rights Tender Process

May 16, 2025 -

La Liga Seeks Uk And Ireland Broadcast Rights Tender Launched

May 16, 2025

La Liga Seeks Uk And Ireland Broadcast Rights Tender Launched

May 16, 2025 -

Where To Watch Barcelona Vs Girona Free Live Stream Tv Broadcast Details And Match Schedule

May 16, 2025

Where To Watch Barcelona Vs Girona Free Live Stream Tv Broadcast Details And Match Schedule

May 16, 2025 -

Barcelona Vs Girona Live Stream Free Online Tv Listings And Match Time

May 16, 2025

Barcelona Vs Girona Live Stream Free Online Tv Listings And Match Time

May 16, 2025