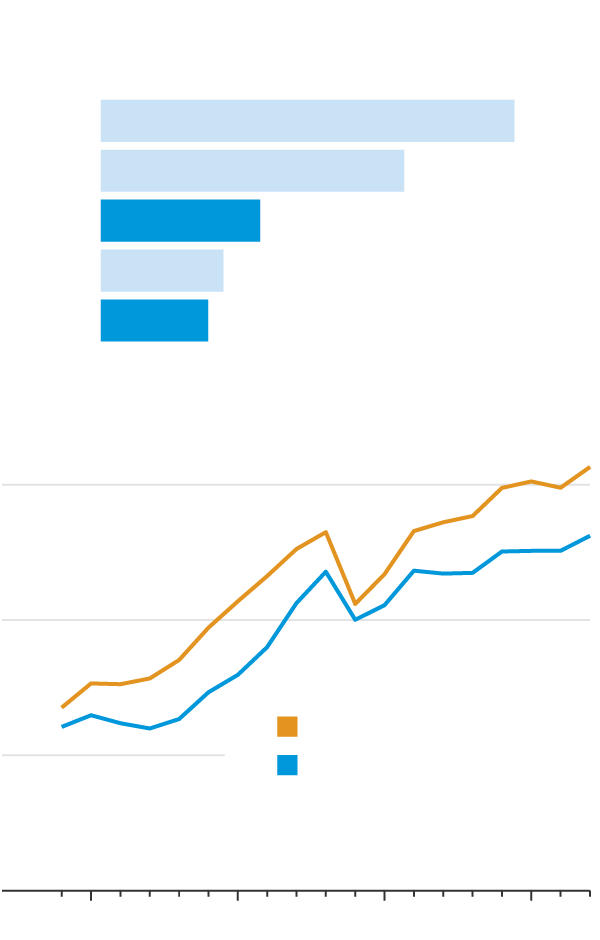

Ignoring The Recession? Why Stock Investors Expect A Bull Market

Table of Contents

The Fed's Influence on Market Sentiment

The Federal Reserve's (Fed) actions significantly impact market sentiment. While interest rate hikes aim to curb inflation, they can also inadvertently create opportunities for stock market growth.

Interest Rate Hikes and Their Impact

The Fed's aggressive interest rate hikes, though intended to combat inflation, might lead to a "soft landing"—a scenario where inflation is controlled without triggering a significant economic downturn.

- Potential for a Soft Landing: A soft landing would mean slower economic growth but avoids a deep recession, potentially leaving the stock market relatively unscathed. This scenario is predicated on the Fed successfully navigating a delicate balance between controlling inflation and avoiding excessive economic contraction.

- Historical Precedent: History shows that while interest rate hikes initially cause market volatility, they've often been followed by periods of market recovery and growth. Examining past cycles helps understand the potential for future rebounds. Analyzing past Fed responses to economic downturns provides valuable insights for predicting future market behavior.

- Inflation's Influence: Current inflation rates are crucial. If inflation cools significantly, the Fed might slow or pause its rate hikes sooner than expected, potentially boosting investor confidence and leading to a bull market. The interplay between inflation, interest rates, and stock market performance is complex but critical to understand.

Easing Monetary Policy and its Effect

Future shifts in monetary policy could significantly bolster investor confidence. A change towards easing monetary policy could fuel a bull market.

- Future Rate Cuts: If inflation falls substantially, the Fed might begin cutting interest rates. Lower rates reduce borrowing costs for businesses and consumers, stimulating economic activity.

- Stimulating Economic Activity: Decreased borrowing costs encourage businesses to invest and expand, leading to job creation and increased consumer spending. This positive feedback loop can fuel economic growth and drive stock prices higher.

- Stocks vs. Bonds: Easing monetary policy typically makes stocks more attractive than bonds. As interest rates fall, the returns on bonds decrease, making stocks, with their potential for higher growth, a more appealing investment. This shift in investor preference can significantly influence market performance.

Resilient Corporate Earnings and Strong Balance Sheets

Many companies have shown surprising resilience in the face of economic headwinds, bolstering confidence in a potential bull market despite recessionary fears.

Companies Adapting to Economic Challenges

Despite economic uncertainty, many companies have demonstrated impressive adaptability and exceeded earnings expectations.

- Exceeding Expectations: Several companies across various sectors have reported strong earnings, proving their ability to navigate challenging economic conditions. This demonstrates resilience and adaptability in the face of market volatility.

- Efficient Cost Management: Effective cost management and strategic planning have played a crucial role in maintaining profitability. Companies that streamlined operations and adapted to changing market demands are better positioned for future growth.

- Supply Chain Improvements: Improvements in supply chain efficiency have also positively impacted corporate profitability. This reduced disruption and enhanced efficiency have contributed to stronger financial results, even during times of economic stress.

Strong Cash Reserves and Investment Opportunities

Strong corporate balance sheets, fueled by years of strong performance, are poised to fuel future growth and contribute to a bull market.

- Dividends and Buybacks: Companies with robust cash reserves can increase dividends or engage in share buybacks, boosting shareholder returns and investor confidence. These actions signal confidence in future growth and can attract further investment.

- Mergers and Acquisitions: Strong cash positions enable companies to pursue strategic mergers and acquisitions, further consolidating market share and driving growth. This acquisitive activity can create significant value for investors.

- Weathering Downturns: Companies with substantial cash reserves are significantly better positioned to withstand economic downturns. This financial strength provides a buffer against potential market volatility and enables continued investment and innovation.

Valuation Opportunities in a Bearish Market

A recessionary environment can create attractive valuation opportunities for savvy stock investors.

Attractive Stock Prices

Recessions often lead to undervalued stocks, presenting a chance for significant capital appreciation as the market recovers.

- Value Investing: Value investors actively seek out undervalued companies with strong fundamentals, believing these stocks offer significant upside potential. This approach is particularly relevant during economic downturns.

- Attractive Sectors: Certain sectors, such as healthcare and consumer staples, tend to be less sensitive to economic cycles and could offer attractive valuations during a recession. Identifying these resilient sectors is key for investors looking to capitalize on potential market opportunities.

- Capital Appreciation: Investing in undervalued stocks during a recession offers the potential for significant capital appreciation as the market recovers and these stocks regain their intrinsic value. This strategy requires patience and careful analysis.

Strategic Stock Selection for Growth

Successful navigation of a potentially volatile market necessitates careful stock selection and diversification.

- Fundamental Analysis: Thorough fundamental analysis is crucial before any investment. Understanding a company's financial health, business model, and competitive landscape is paramount to making informed investment decisions.

- Recession-Proof Industries: Identifying recession-proof industries and companies is essential for mitigating risk and securing returns even during economic downturns. These sectors tend to demonstrate resilience and continued growth even in challenging market conditions.

- Portfolio Diversification: Diversifying your portfolio across different asset classes and sectors minimizes risk and helps to stabilize returns during periods of market uncertainty. This strategic approach is fundamental to managing risk in a volatile investment landscape.

Conclusion

While the possibility of a recession remains, many stock investors see significant opportunities. The Federal Reserve's potential actions, resilient corporate performance, and attractive valuations are contributing to this optimistic outlook. However, stock markets are inherently volatile. Careful research, diversification, and a robust investment strategy are essential for navigating these complexities. Don't ignore the recessionary whispers, but understand the potential for a bull market and develop a sound approach to stock investment that aligns with your risk tolerance. Learn more about navigating the current economic climate and potentially profiting from a bull market by researching various recession-proof investments and investment strategies.

Featured Posts

-

Bmw And Porsche In China Market Share Challenges And Future Outlook

May 06, 2025

Bmw And Porsche In China Market Share Challenges And Future Outlook

May 06, 2025 -

The Economic Fallout Of Trumps Trade Deal Strategy

May 06, 2025

The Economic Fallout Of Trumps Trade Deal Strategy

May 06, 2025 -

How To Watch Celtics Vs Heat Live Stream And Tv Guide

May 06, 2025

How To Watch Celtics Vs Heat Live Stream And Tv Guide

May 06, 2025 -

Mindy Kaling Revelacao Sobre Relacionamento Conturbado Com Ex Colega De The Office

May 06, 2025

Mindy Kaling Revelacao Sobre Relacionamento Conturbado Com Ex Colega De The Office

May 06, 2025 -

Closure Of Anchor Brewing Company After 127 Years

May 06, 2025

Closure Of Anchor Brewing Company After 127 Years

May 06, 2025

Latest Posts

-

Mindy Kalings Peplum Power Hollywood Walk Of Fame Style

May 06, 2025

Mindy Kalings Peplum Power Hollywood Walk Of Fame Style

May 06, 2025 -

Mindy Kalings Dating History A Look At Her Past Relationships

May 06, 2025

Mindy Kalings Dating History A Look At Her Past Relationships

May 06, 2025 -

Bj Novak And Delaney Rowe A Normal Couple Public Perception Analyzed

May 06, 2025

Bj Novak And Delaney Rowe A Normal Couple Public Perception Analyzed

May 06, 2025 -

The Publics Reaction To Bj Novak And Delaney Rowes Relationship

May 06, 2025

The Publics Reaction To Bj Novak And Delaney Rowes Relationship

May 06, 2025 -

Fans React To Mindy Kalings Transformed Appearance

May 06, 2025

Fans React To Mindy Kalings Transformed Appearance

May 06, 2025