Impact Of A Minority Federal Government On The Canadian Dollar Exchange Rate

Table of Contents

Increased Political Uncertainty and its Effect on the CAD

Minority governments, by their very nature, create an environment of heightened political uncertainty. This uncertainty directly impacts the Canadian dollar exchange rate through several key mechanisms.

Impact on Investor Confidence

The inherent instability of a minority government can significantly erode investor confidence in the Canadian economy. This lack of confidence stems from several factors:

- Policy Instability: The need for constant negotiation with opposition parties to pass legislation can lead to policy delays, reversals, and a general lack of predictability.

- Potential for Snap Elections: The constant threat of a snap election creates further uncertainty, as investors worry about the potential for significant policy shifts following a change in government.

- Difficulty Passing Key Legislation: Crucial economic legislation, such as budget bills or trade agreements, may face significant hurdles in a minority parliament, leading to delays and uncertainty.

This decreased confidence translates directly into reduced foreign investment and potential capital flight, weakening the CAD. Investors may seek safer havens in more politically stable economies, further depressing the Canadian dollar's value.

Risk Premium on Canadian Assets

The increased political risk associated with a minority government leads to a higher risk premium on Canadian assets, including the CAD.

- Risk Premium Explained: A risk premium is the extra return investors demand for taking on additional risk. In the context of a politically unstable environment, investors will demand a higher return on Canadian investments to compensate for the perceived increased risk.

- International Examples: Similar scenarios have played out in other countries, where minority governments or periods of political instability have been correlated with a weaker domestic currency. For example, [insert example of another country experiencing similar effects].

This higher risk premium manifests as a lower CAD value. Investors are less willing to hold CAD-denominated assets, leading to increased selling pressure and a depreciation of the currency.

Fiscal Policy Challenges and their Currency Implications

A minority government faces significant challenges in implementing effective fiscal policies, directly impacting the Canadian dollar.

Budgetary Impasse and Spending Constraints

Negotiating budgets and implementing fiscal policies becomes significantly more complex in a minority government setting.

- Negotiation Hurdles: Reaching consensus on spending priorities with opposition parties can be time-consuming and lead to budgetary impasses.

- Budget Delays and Scaled-Back Spending: This can result in delays in crucial government spending programs and potentially scaled-back spending initiatives.

This fiscal uncertainty negatively impacts economic growth and investor sentiment, resulting in a weaker CAD. Investors may perceive a lack of decisive economic management, leading them to reduce their exposure to the Canadian economy.

Impact on Government Debt and Credit Rating

The challenges faced by a minority government in managing public finances can have significant ramifications for government debt levels and Canada's credit rating.

- Political Gridlock and Debt Management: Political gridlock can hinder effective debt management strategies, potentially leading to increased government debt.

- Credit Rating Downgrade: A perceived weakening of fiscal management can result in a credit rating downgrade by international rating agencies, increasing borrowing costs and further impacting the CAD.

A downgraded credit rating increases the risk premium on Canadian government bonds and other assets, contributing to a weaker CAD exchange rate.

Monetary Policy Response and its Influence on the CAD

The Bank of Canada plays a crucial role in attempting to mitigate the impact of political uncertainty on the CAD through monetary policy.

Bank of Canada's Role in Managing Exchange Rate Volatility

The Bank of Canada employs various monetary policy tools to manage exchange rate volatility during periods of political uncertainty:

- Interest Rate Adjustments: Adjusting interest rates can influence the CAD's value by affecting capital flows and investor sentiment.

- Quantitative Easing: In times of extreme economic uncertainty, the Bank of Canada may resort to quantitative easing to inject liquidity into the markets and stimulate economic activity.

These tools are used to balance the need for economic stability with the challenges posed by a minority government. However, the effectiveness of these tools can be limited in the face of significant political uncertainty.

Coordination Between Fiscal and Monetary Policy

Effective coordination between fiscal (government) and monetary (Bank of Canada) policies is vital for macroeconomic stability during a minority government.

- Coordination Challenges: Achieving effective coordination can be difficult, particularly when a minority government faces challenges in passing fiscal legislation.

- Consequences of Misalignment: Misalignment between fiscal and monetary policies can exacerbate economic volatility and negatively impact the CAD.

Historical examples demonstrate that successful coordination between fiscal and monetary policy can help mitigate the negative impacts of a minority government on the CAD exchange rate.

Conclusion

A minority federal government in Canada introduces considerable political uncertainty, impacting investor confidence and leading to a higher risk premium on Canadian assets, including the CAD. The challenges in implementing effective fiscal policies and the potential for budgetary impasses further contribute to exchange rate volatility. While the Bank of Canada employs monetary policy tools to manage this volatility, effective coordination between fiscal and monetary policies is crucial for mitigating the negative effects. To understand and predict future fluctuations in the Canadian dollar exchange rate, analyze the impact of future minority governments by staying informed about Canadian political and economic developments. Monitor key economic indicators and the responses of both the government and the Bank of Canada to better navigate the complexities of the Canadian economy under a minority government.

Featured Posts

-

Russias Faltering Spring Offensive Can Warmer Weather Turn The Tide

Apr 30, 2025

Russias Faltering Spring Offensive Can Warmer Weather Turn The Tide

Apr 30, 2025 -

Car Dealers Renew Fight Against Ev Mandates

Apr 30, 2025

Car Dealers Renew Fight Against Ev Mandates

Apr 30, 2025 -

Download Google Slides Free Android I Os Web App And Apk

Apr 30, 2025

Download Google Slides Free Android I Os Web App And Apk

Apr 30, 2025 -

Eurovision 2024 Irishman Makes History With Armenian Song Performance

Apr 30, 2025

Eurovision 2024 Irishman Makes History With Armenian Song Performance

Apr 30, 2025 -

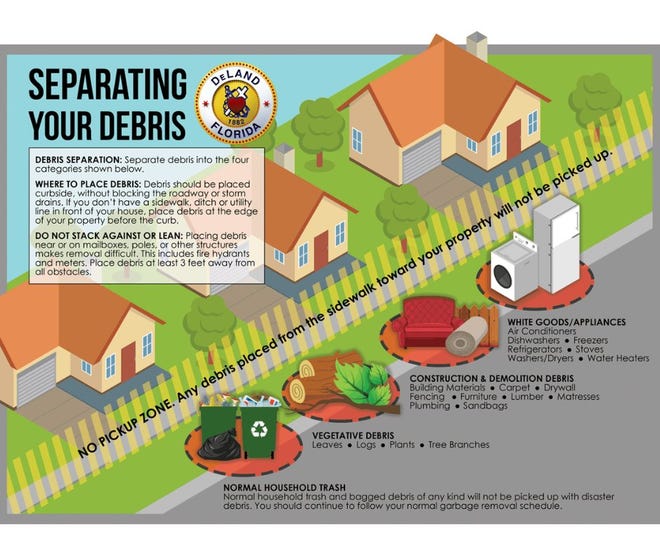

Louisville Storm Debris Pickup How To Request Removal After Recent Severe Weather

Apr 30, 2025

Louisville Storm Debris Pickup How To Request Removal After Recent Severe Weather

Apr 30, 2025