Impact Of Rent Freeze: Housing Corporations Warn Of €3 Billion Loss

Table of Contents

Financial Impact on Housing Corporations

The €3 billion loss projected by housing corporations highlights the severe financial strain imposed by the rent freeze. This significant loss directly impacts their ability to maintain and improve the housing stock, invest in new developments, and meet their financial obligations. This financial strain has numerous consequences:

-

Maintenance backlog: Funds for essential repairs, renovations, and upgrades will be severely limited, potentially leading to a deterioration in housing quality. This includes vital maintenance such as roof repairs, plumbing fixes, and the replacement of outdated appliances. Neglecting these crucial repairs can create unsafe living conditions for tenants and lead to increased costs in the long run.

-

Investment slowdown in new developments: Reduced income means less capital for building new affordable housing units, exacerbating the existing housing shortage. This impacts the construction of both social housing and privately-owned rental properties, further hindering efforts to address the housing crisis. The lack of investment will directly contribute to longer waiting lists and increased competition for available rentals.

-

Difficulty meeting debt obligations: The freeze may hinder their capacity to repay loans and meet other financial commitments, potentially leading to financial instability for housing corporations. This could lead to defaults, bankruptcies, and a decrease in the overall supply of rental properties.

-

Reduced investment in energy efficiency improvements: Planned investments in making properties more energy-efficient may be delayed or cancelled, increasing tenant energy bills and hindering environmental sustainability goals. This is particularly concerning given the ongoing energy crisis and the importance of reducing carbon emissions in the housing sector.

Consequences for Tenants

While the rent freeze offers immediate relief, the long-term consequences for tenants could be detrimental, potentially undermining the very goal of the policy. The consequences include:

-

Deteriorating housing conditions: Lack of funds for maintenance could lead to neglected repairs and a decline in overall housing quality. This will negatively impact tenant well-being and could lead to health and safety issues.

-

Reduced availability of rental properties: The potential slowdown in new construction will further tighten the already competitive rental market, making it even harder for people to find suitable housing. This could lead to increased competition for limited available rentals, pushing up prices in the long run even if a freeze is in place.

-

Increased waiting lists for social housing: Fewer new rental units will lengthen waiting lists for social housing and affordable options, leaving vulnerable individuals and families in precarious housing situations.

-

Potential for larger rental increases in the future: The initial freeze might create a backlog of necessary rental adjustments, leading to potentially larger increases in the future once the freeze is lifted. This could cause further hardship for tenants after a period of apparent relief.

The Broader Impact on the Housing Market

The rent freeze creates ripple effects throughout the broader housing market, impacting investment, stability, and property values:

-

Slowdown in property investment: The reduced profitability will likely discourage private investment in the rental sector. This impacts both the construction of new rental units and the refurbishment of existing ones.

-

Market instability: Uncertainty surrounding the future of rental regulations might lead to market instability and volatility. Investors may become hesitant to commit to projects under uncertain regulatory environments.

-

Potential for government intervention: The government might need to provide financial support to housing corporations to mitigate the €3 billion loss, potentially leading to increased public debt and strained government resources.

-

Negative impact on property values: Reduced investment and uncertainty may impact property values in the long run, affecting both homeowners and investors.

Conclusion

The rent freeze, while intending to provide short-term relief to tenants, presents significant long-term challenges to housing corporations and the broader housing market. The projected €3 billion loss, combined with potential reductions in maintenance and new construction, threatens the long-term health of the rental sector and could ultimately harm the very tenants the freeze aims to protect. Understanding the far-reaching impact of a rent freeze, considering both short-term relief and long-term consequences, is crucial for creating sustainable solutions to the housing crisis. We need a nuanced approach that addresses affordability challenges without jeopardizing the long-term viability of the rental sector and access to decent, affordable housing. Let’s discuss effective alternatives to a blanket rent freeze and create a sustainable future for the rental sector and its tenants. Finding a balance between tenant protection and the financial sustainability of the housing sector is critical for navigating the complexities of the current housing crisis. Let's work towards solutions that ensure affordable housing without crippling the sector responsible for providing it.

Featured Posts

-

Manchester United Target Rayan Cherki Transfer Battle Looms

May 28, 2025

Manchester United Target Rayan Cherki Transfer Battle Looms

May 28, 2025 -

Analyzing Chicagos Recent Crime Reduction Whats Behind The Numbers

May 28, 2025

Analyzing Chicagos Recent Crime Reduction Whats Behind The Numbers

May 28, 2025 -

Bianca Censori Italy Rollerblading Trip Sparks Conversation

May 28, 2025

Bianca Censori Italy Rollerblading Trip Sparks Conversation

May 28, 2025 -

April Rainfall Is This Month Wetter Than Usual

May 28, 2025

April Rainfall Is This Month Wetter Than Usual

May 28, 2025 -

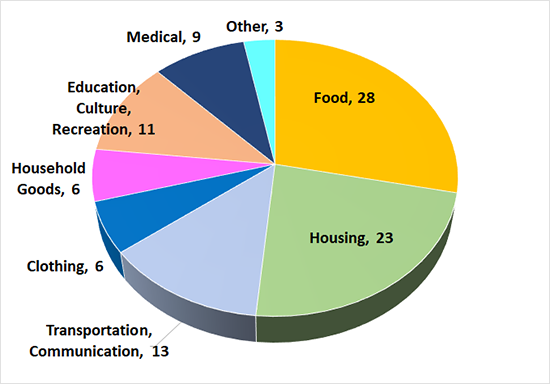

Household Spending In China Key Factor In Future Economic Growth

May 28, 2025

Household Spending In China Key Factor In Future Economic Growth

May 28, 2025

Latest Posts

-

May 15 2025 Deutsche Bank Investor Conference Featuring International Companies Live Webcasts

May 30, 2025

May 15 2025 Deutsche Bank Investor Conference Featuring International Companies Live Webcasts

May 30, 2025 -

Live Webcast Event Deutsche Bank Depositary Receipts Investor Conference May 15 2025

May 30, 2025

Live Webcast Event Deutsche Bank Depositary Receipts Investor Conference May 15 2025

May 30, 2025 -

International Companies To Present At Deutsche Banks Virtual Investor Conference May 15 2025

May 30, 2025

International Companies To Present At Deutsche Banks Virtual Investor Conference May 15 2025

May 30, 2025 -

Epirocs American Depositary Receipts Deutsche Banks Role

May 30, 2025

Epirocs American Depositary Receipts Deutsche Banks Role

May 30, 2025 -

Deutsche Bank Appointed As Depositary For Epirocs Level 1 Adrs

May 30, 2025

Deutsche Bank Appointed As Depositary For Epirocs Level 1 Adrs

May 30, 2025