Impact Of Tariffs On Canadian Businesses: Uncertainty And Economic Outlook (StatCan)

Table of Contents

Canadian businesses face increasing uncertainty due to the fluctuating impact of tariffs. This article examines the effects of tariffs on various sectors, drawing on data from Statistics Canada (StatCan) to assess the current economic outlook and potential future scenarios. We will delve into the challenges, adaptation strategies, and the overall implications for the Canadian economy. Understanding the complexities of tariff impact is crucial for navigating the current economic landscape and ensuring the long-term health of Canadian businesses.

Increased Costs and Reduced Competitiveness

Tariffs, essentially taxes on imported goods, significantly impact Canadian businesses by increasing costs and reducing competitiveness in both domestic and international markets. This section will explore these effects using data and insights from Statistics Canada.

Impact on Input Costs

Tariffs directly increase the price of imported goods used in production. This affects numerous sectors, including manufacturing, agriculture, and the automotive industry.

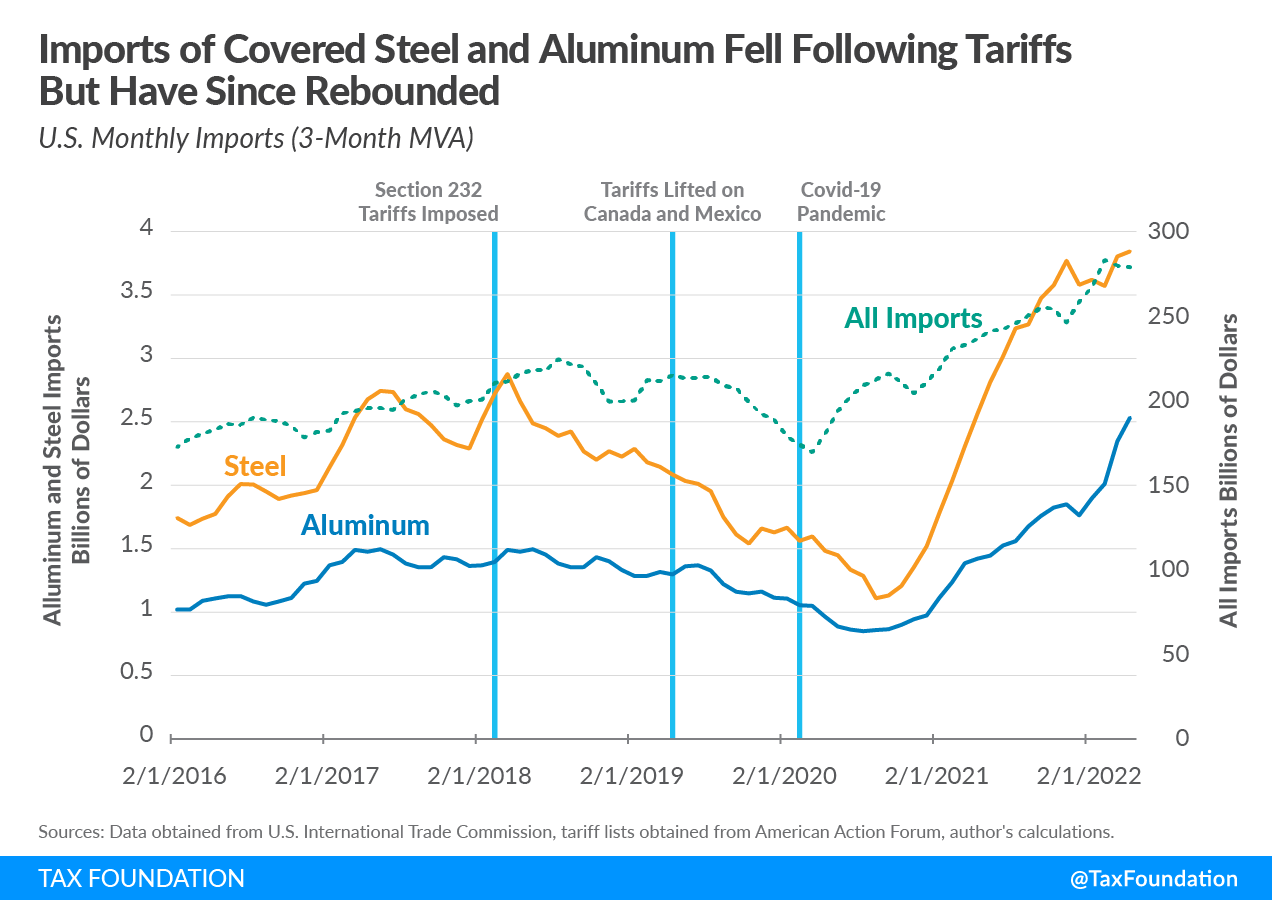

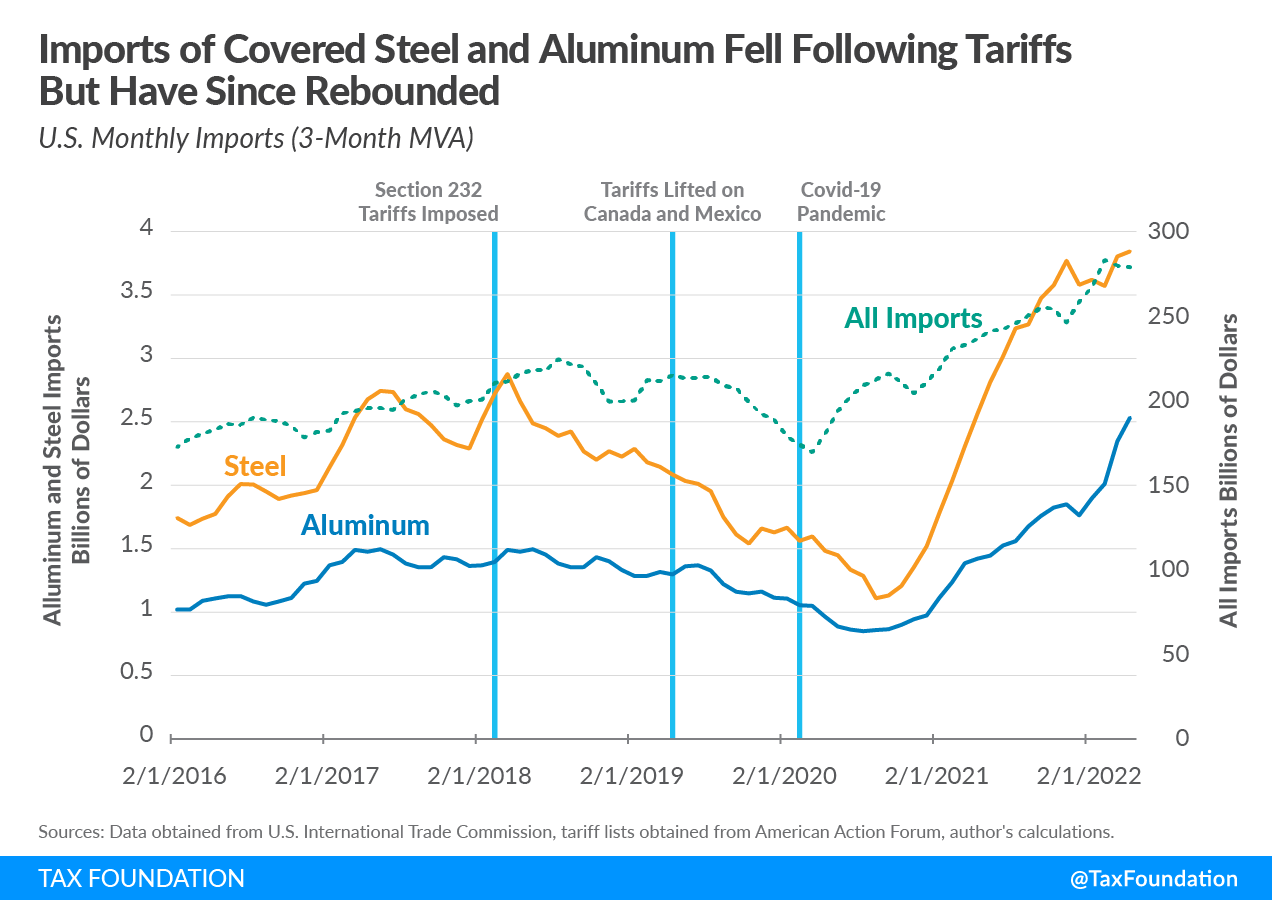

- Auto Manufacturing: Increased tariffs on imported steel and aluminum have raised production costs for Canadian auto manufacturers, impacting their profit margins and potentially leading to job losses. StatCan data on automotive production and employment can illustrate this impact.

- Lumber: Tariffs imposed on Canadian lumber exports have reduced demand and prices, negatively affecting the profitability of Canadian lumber companies. Analysis of StatCan data on lumber exports reveals the extent of this impact.

- Increased Production Costs: Higher input costs translate to higher prices for finished goods, potentially reducing consumer demand and impacting overall economic growth. StatCan's Consumer Price Index (CPI) data can be used to track the impact of tariffs on inflation.

- Reduced Profit Margins: The squeeze on profit margins forces businesses to either absorb the increased costs, potentially leading to lower profits, or pass them on to consumers, impacting affordability and competitiveness.

Loss of Market Share

Tariffs can make Canadian exports less competitive in global markets. This leads to decreased sales, potential job losses, and a slowdown in economic growth.

- Reduced Export Volumes: StatCan data on export volumes can show the decline in exports of goods affected by tariffs, illustrating the direct impact on Canadian businesses.

- Retaliatory Tariffs: The imposition of tariffs by Canada can lead to retaliatory tariffs from other countries, further restricting access to foreign markets and harming export-oriented businesses.

- Competitor Advantage: Tariffs can give foreign competitors an advantage, as their products may become relatively cheaper in the Canadian market, further eroding market share for Canadian businesses. Analysis of StatCan data comparing Canadian export performance to competitors highlights this issue.

Supply Chain Disruptions and Uncertainty

The imposition of tariffs creates significant uncertainty and necessitates adjustments to global supply chains, leading to further challenges for Canadian businesses.

Shifting Global Supply Chains

Tariffs often force businesses to re-evaluate and restructure their supply chains, resulting in increased complexity and cost.

- Relocation of Production: Some companies may choose to relocate their production facilities to countries with more favorable tariff conditions, potentially leading to job losses in Canada. StatCan data on foreign direct investment (FDI) can reveal trends in this area.

- Difficulties Sourcing Materials: Tariffs make it more challenging and expensive to source essential materials and components from traditional suppliers, impacting production timelines and efficiency.

- Nearshoring and Reshoring: Canadian businesses are increasingly considering nearshoring (moving production to nearby countries) or reshoring (returning production to Canada) to mitigate the risks associated with tariff volatility. StatCan data on business investment can reflect this trend.

Investment Uncertainty

The unpredictability of tariff policies creates considerable uncertainty, discouraging business investment and hindering economic growth.

- Delayed Investments: Companies may delay or postpone expansion plans, modernization projects, and research and development due to the fear of further tariff increases. StatCan data on business investment and capital expenditure reveal the impact of this uncertainty.

- Impact on Job Creation: Reduced investment directly impacts job creation, as businesses are less likely to hire new employees in an environment of economic uncertainty.

- Long-Term Economic Growth: This lack of investment in capacity expansion and innovation ultimately slows down long-term economic growth and competitiveness.

Government Support and Mitigation Strategies

The Canadian government has implemented various programs and initiatives to support businesses affected by tariffs, and businesses themselves are employing adaptation strategies to navigate this challenging environment.

Government Programs and Initiatives

Several government programs aim to mitigate the negative effects of tariffs on Canadian businesses.

- Financial Assistance: Government programs provide financial assistance to businesses impacted by tariffs, including grants, loans, and tax credits.

- Trade Diversification Initiatives: The government supports initiatives to diversify export markets, reducing reliance on countries with high tariffs.

- Tax Incentives: Tax incentives can encourage businesses to invest in new technologies and processes, improving their competitiveness in a tariff-affected environment.

The effectiveness and limitations of these programs should be assessed using data available from government websites and StatCan reports on government spending related to trade.

Business Adaptation Strategies

Canadian businesses are implementing various strategies to adapt to the challenges posed by tariffs:

- Cost Reduction Measures: Businesses are implementing cost reduction strategies to offset increased input costs, such as streamlining operations and improving efficiency.

- Product Diversification: Businesses are diversifying their product lines to reduce reliance on tariff-sensitive products.

- Market Diversification: Businesses are expanding into new markets to mitigate the risks associated with tariffs in existing markets.

- Lobbying Efforts: Businesses are actively engaging in lobbying efforts to influence government trade policies and advocate for the removal or reduction of harmful tariffs.

Case studies illustrating successful adaptation strategies by Canadian businesses can provide valuable insights.

Long-Term Economic Outlook and Projections

The long-term economic consequences of tariffs on Canada are complex and depend on various factors. Analyzing StatCan forecasts allows for a more informed understanding.

Economic Growth Forecasts

StatCan provides economic growth forecasts under different scenarios, considering the impact of tariffs.

- Optimistic Scenario: This scenario assumes a resolution to trade disputes and a gradual easing of tariff tensions.

- Pessimistic Scenario: This scenario considers continued tariff uncertainty and its impact on investment and economic growth.

StatCan's projections on GDP growth rates, employment rates, and other key economic indicators can be used to illustrate the potential outcomes under these scenarios.

Sector-Specific Impacts

The long-term impact of tariffs will vary significantly across different sectors.

- Vulnerable Sectors: Sectors heavily reliant on imported inputs or exports to tariff-affected markets are likely to be the most vulnerable.

- Resilient Sectors: Sectors with strong domestic demand or diversified export markets are expected to exhibit greater resilience.

StatCan sector-specific data on productivity, profitability, and employment can be used to predict and analyze long-term trends.

Conclusion

The impact of tariffs on Canadian businesses is multifaceted, resulting in increased costs, reduced competitiveness, supply chain disruptions, and significant economic uncertainty. Reliance on data from Statistics Canada is vital for analyzing the extent of these impacts and their effect on Canadian economic growth. Government support programs and business adaptation strategies play a critical role in mitigating these challenges. However, the long-term economic outlook depends heavily on the resolution of trade disputes and the overall stability of the international trade environment.

Call to Action: Understanding the impact of tariffs on your Canadian business is crucial for strategic planning and navigating the current economic climate. Utilize the resources provided by Statistics Canada (StatCan) and proactively develop mitigation strategies to manage the challenges of tariff uncertainty. Stay informed on the evolving landscape of international trade and tariff policies to effectively protect your business's long-term success.

Featured Posts

-

Turning Toilet Talk Into Talk Radio An Ai Powered Podcast Revolution

May 29, 2025

Turning Toilet Talk Into Talk Radio An Ai Powered Podcast Revolution

May 29, 2025 -

Fnv Ontmaskert Uitbuiting Transportsector Op Venlose Parkeerplaats

May 29, 2025

Fnv Ontmaskert Uitbuiting Transportsector Op Venlose Parkeerplaats

May 29, 2025 -

Game Cheats Distribute New Arcane Infostealer Malware To You Tube And Discord Users

May 29, 2025

Game Cheats Distribute New Arcane Infostealer Malware To You Tube And Discord Users

May 29, 2025 -

100 Forintos Ermek Hogyan Ismerd Fel A Dragakoeveket

May 29, 2025

100 Forintos Ermek Hogyan Ismerd Fel A Dragakoeveket

May 29, 2025 -

2 Hour Thriller Mind Blowing Climax 1 On Ott

May 29, 2025

2 Hour Thriller Mind Blowing Climax 1 On Ott

May 29, 2025

Latest Posts

-

Sanofi Et Ses Concurrents Europeens Une Etude De La Sous Performance Boursiere

May 31, 2025

Sanofi Et Ses Concurrents Europeens Une Etude De La Sous Performance Boursiere

May 31, 2025 -

Sanofi Fda Erteilt Orphan Drug Status Fuer Rilzabrutinib Chancen Fuer Die Aktie

May 31, 2025

Sanofi Fda Erteilt Orphan Drug Status Fuer Rilzabrutinib Chancen Fuer Die Aktie

May 31, 2025 -

Rilzabrutinib Sanofi Orphan Drug Designation Auswirkungen Auf Die Sanofi Aktie

May 31, 2025

Rilzabrutinib Sanofi Orphan Drug Designation Auswirkungen Auf Die Sanofi Aktie

May 31, 2025 -

Sous Valorisation De Sanofi Comparaison Avec Les Laboratoires Pharmaceutiques Europeens

May 31, 2025

Sous Valorisation De Sanofi Comparaison Avec Les Laboratoires Pharmaceutiques Europeens

May 31, 2025 -

Sanofi Depakine Et L Enquete Sur Les Rejets Toxiques A Mourenx

May 31, 2025

Sanofi Depakine Et L Enquete Sur Les Rejets Toxiques A Mourenx

May 31, 2025