Impact Of U.S.-China Tariff Reductions On The American Economy

Table of Contents

Impact on Consumer Prices

The most immediate impact of U.S.-China tariff reductions is felt by American consumers through changes in prices.

Reduced Costs for Consumers

Tariff reductions on imported goods directly translate to lower prices for consumers. This is particularly noticeable in sectors heavily reliant on Chinese imports.

- Examples: Electronics (smartphones, laptops), clothing and apparel, furniture, and certain household goods have seen price decreases following tariff reductions.

- Statistical Data: While precise figures vary depending on the specific product and time period, studies have shown a measurable decrease in the Consumer Price Index (CPI) for certain categories following tariff adjustments. For example, a study by [cite a relevant source here] showed a [insert percentage]% decrease in the price of [specific product] following the [specific tariff reduction].

- Price Comparisons: Comparing pre-reduction and post-reduction prices for specific goods reveals the tangible benefits for consumers. This price relief can be substantial, particularly for lower-income households where these goods represent a larger portion of their spending.

Increased Consumer Spending and Economic Growth

Lower prices on imported goods increase consumers' purchasing power, leading to increased spending. This boost in consumer demand can stimulate economic growth.

- Consumer Confidence: Reduced prices contribute to higher consumer confidence, encouraging further spending.

- Impact on GDP: Increased consumer spending directly contributes to Gross Domestic Product (GDP) growth. Economic models suggest that even modest price reductions can have a significant multiplicative effect on overall economic activity.

- Related Economic Indicators: Monitoring retail sales, consumer confidence indices, and GDP growth provides valuable insights into the effectiveness of tariff reductions in stimulating economic activity.

Potential for Inflationary Pressures

While tariff reductions generally lower prices, there's a potential for inflationary pressures in certain sectors.

- Supply Chain Factors: Reduced tariffs can increase demand, potentially outstripping the ability of supply chains to meet that demand.

- Bottlenecks: This imbalance can lead to bottlenecks and shortages, driving up prices for specific goods.

- Inflation Mitigation Strategies: Government policies aimed at improving supply chain efficiency and addressing potential bottlenecks are essential to mitigate inflationary risks associated with tariff reductions.

Effects on American Businesses

U.S.-China tariff reductions have a complex and varied impact on American businesses.

Increased Profit Margins for Importers

Businesses importing goods from China directly benefit from lower tariffs, leading to increased profit margins.

- Benefiting Industries: Industries such as retail, electronics, and manufacturing see significant improvements in profitability.

- Case Studies: Successful businesses have leveraged tariff reductions to expand their market share and invest in growth opportunities.

- Increased Competitiveness: Lower input costs enhance the competitiveness of these businesses in both domestic and international markets.

Challenges for Domestic Industries

Domestic businesses producing goods similar to those imported from China can face challenges competing with cheaper imports.

- Negatively Affected Industries: Industries like textiles and certain manufacturing sectors may experience reduced market share and profitability.

- Adaptation Strategies: Domestic businesses need to adopt innovative strategies, such as focusing on niche markets, improving efficiency, and investing in higher value-added products to remain competitive.

- Government Support Programs: Government support programs, such as grants, tax breaks, and investment in research and development, are crucial in helping domestic businesses adapt and thrive in this changing environment.

Restructuring of Supply Chains

Businesses are actively restructuring their supply chains in response to tariff changes.

- Diversification of Sourcing: Many companies are diversifying their sourcing, exploring alternative suppliers outside of China to mitigate risks associated with future tariff adjustments.

- Relocation Challenges: Relocating production can be costly and complex, requiring substantial investment and logistical adjustments.

- Impact on Jobs and Employment: Supply chain restructuring has significant implications for employment, with potential job losses in some sectors and job creation in others.

Geopolitical Implications of U.S.-China Tariff Reductions

U.S.-China tariff reductions have significant geopolitical implications.

Improved Bilateral Relations

Tariff reductions can contribute to improved diplomatic ties between the U.S. and China.

- Increased Cooperation: Reduced trade tensions can pave the way for increased cooperation on other issues of mutual concern.

- Future Trade Agreements: Tariff reductions can build trust and facilitate negotiations for future comprehensive trade agreements.

- Impact on Global Stability: Improved U.S.-China relations can positively impact global stability and reduce uncertainty in international markets.

Shifting Global Trade Dynamics

Adjustments to U.S.-China tariffs impact global trade patterns and relationships with other countries.

- Trade Diversion: Tariff reductions might lead to trade diversion, as businesses shift sourcing from other countries to China.

- Effects on Other Major Economies: Changes in U.S.-China trade dynamics affect other major economies, requiring adjustments to their trade strategies.

- Potential for New Trade Alliances: The shift in trade patterns could lead to the formation of new trade alliances and partnerships.

Conclusion

The impact of U.S.-China tariff reductions on the American economy is multifaceted and complex. While reductions can lead to lower consumer prices, increased consumer spending, and higher profit margins for some businesses, they also pose challenges for domestic industries and necessitate adjustments to supply chains. The geopolitical implications are equally significant, influencing bilateral relations and global trade dynamics. Further research and ongoing monitoring are crucial to fully understand the long-term effects of these reductions. We need a nuanced approach to U.S.-China tariff policy, ensuring that adjustments optimize economic benefits for the American people while mitigating potential risks. Continued research and open discussion on the long-term implications of U.S.-China tariff reductions are essential for informed policymaking. Explore further resources on the impact of U.S.-China tariff reductions and their economic consequences to deepen your understanding.

Featured Posts

-

Jannes Horn Von Eintracht Braunschweig Zum Rivalen Hannover 96

May 13, 2025

Jannes Horn Von Eintracht Braunschweig Zum Rivalen Hannover 96

May 13, 2025 -

Yamamotos Strong Outing Leads Dodgers To 3 0 Victory Over Cubs

May 13, 2025

Yamamotos Strong Outing Leads Dodgers To 3 0 Victory Over Cubs

May 13, 2025 -

Walk Your Dog Boost Your Mood Didcot Mental Health Event

May 13, 2025

Walk Your Dog Boost Your Mood Didcot Mental Health Event

May 13, 2025 -

Nba Draft Lottery Espns Coverage Shake Up

May 13, 2025

Nba Draft Lottery Espns Coverage Shake Up

May 13, 2025 -

Jelena Ostapenkos Repeat Victory Over Iga Swiatek Sends Her To Stuttgart Semis

May 13, 2025

Jelena Ostapenkos Repeat Victory Over Iga Swiatek Sends Her To Stuttgart Semis

May 13, 2025

Latest Posts

-

Urgent Recall Dangerous Coffee Creamer Found In Michigan Stores

May 14, 2025

Urgent Recall Dangerous Coffee Creamer Found In Michigan Stores

May 14, 2025 -

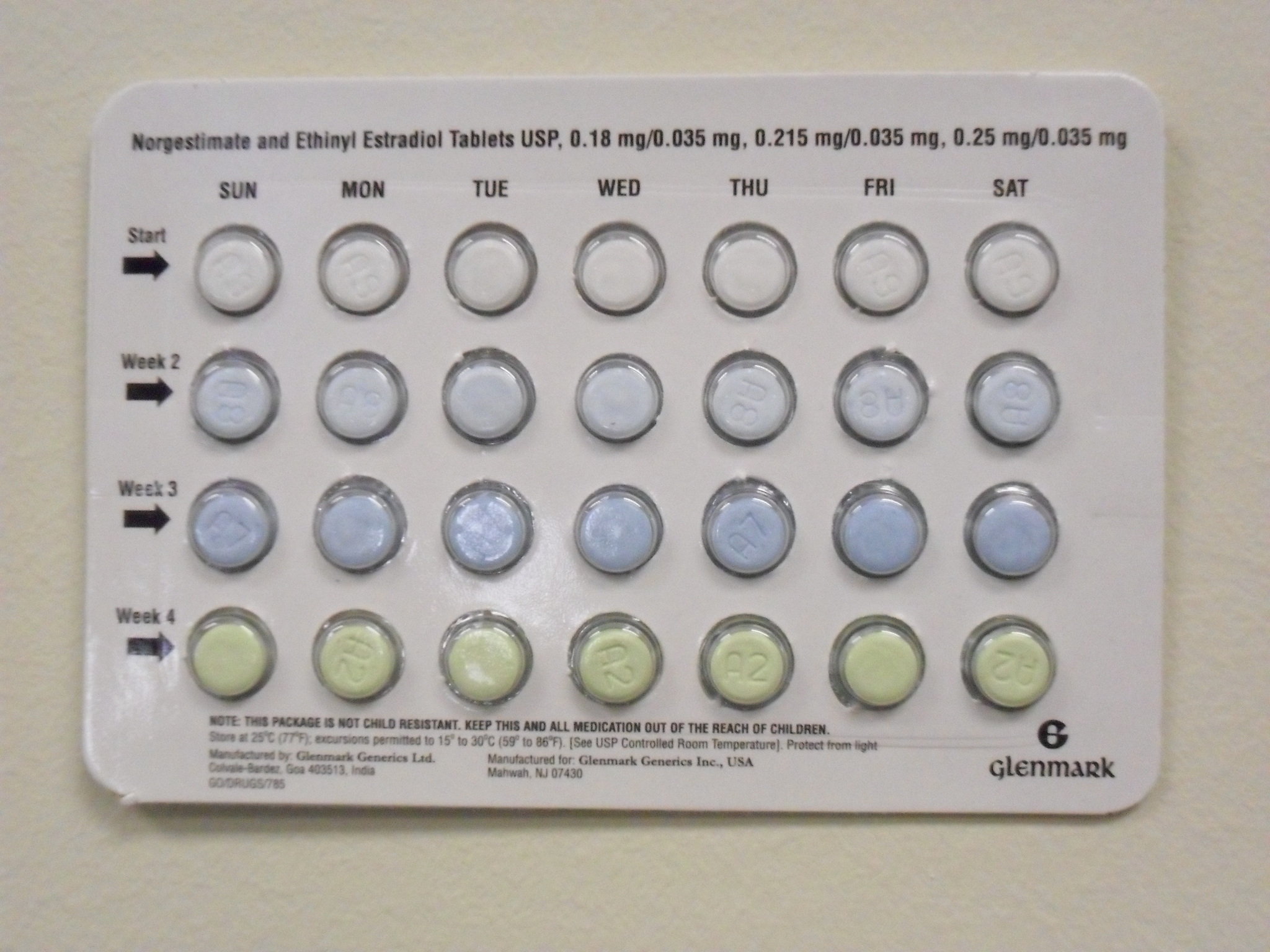

Product Recall Ontario And Canada Issue Alert For Specific Dressings And Birth Control Pills

May 14, 2025

Product Recall Ontario And Canada Issue Alert For Specific Dressings And Birth Control Pills

May 14, 2025 -

Where To Find And Avoid Banned Candles In Canada Etsy Walmart Amazon

May 14, 2025

Where To Find And Avoid Banned Candles In Canada Etsy Walmart Amazon

May 14, 2025 -

Coffee Creamer Recall In Michigan Is Your Brand Affected

May 14, 2025

Coffee Creamer Recall In Michigan Is Your Brand Affected

May 14, 2025 -

Recall Alert Dressings And Birth Control Pills Recalled In Ontario And Canada

May 14, 2025

Recall Alert Dressings And Birth Control Pills Recalled In Ontario And Canada

May 14, 2025