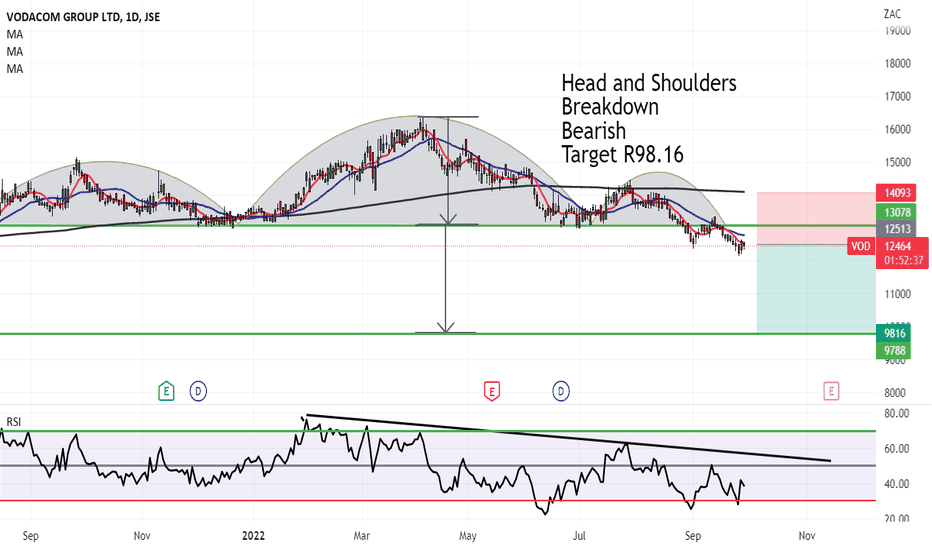

Improved Earnings Drive Higher Payout At Vodacom (VOD)

Table of Contents

Strong Financial Performance Fuels Higher Vodacom Dividend

The connection between increased earnings and higher dividend payouts is straightforward: stronger profits allow companies to distribute more to their shareholders. Vodacom's recent announcement underscores this principle. The company's improved financial health directly fueled the increased Vodacom dividend.

- Revenue Growth: Vodacom reported a substantial increase in revenue, exceeding expectations for the [specify period, e.g., fiscal year 2023]. Specific figures from their financial reports show a [percentage]% growth compared to the previous year.

- Growth in Key Sectors: Significant growth was observed across key sectors. The data segment experienced particularly strong growth, driven by increasing smartphone penetration and data consumption. Similarly, mobile financial services (MFS) showed robust expansion, reflecting the increasing adoption of mobile money solutions across their markets.

- Improved Operational Efficiency: Vodacom implemented several cost-saving measures, leading to improved operational efficiency and higher profit margins. These measures, along with strategic investments, contributed to enhanced profitability and ultimately, a larger Vodacom payout.

- Profitability Analysis: Analysis of the company's profitability metrics, including EBITDA and net income, reveals a significant upward trend, demonstrating a healthy financial position and supporting the increased Vodacom dividend.

- Financial Reports: These findings are supported by Vodacom's official financial reports and statements, available on their investor relations website.

Vodacom (VOD) Dividend Payout Details and Implications

The increased Vodacom dividend translates to a payout of [specify amount] per share, representing a [percentage]% increase compared to the previous payout. This represents a significant boost for investors holding VOD shares.

- Dividend Yield: This translates to a dividend yield of [percentage]%, which is [compare to competitors, e.g., competitive/higher/lower] compared to similar companies in the telecommunications sector. This comparison is crucial for investors seeking a strong income stream.

- Ex-Dividend Date and Record Date: The ex-dividend date is [date], and the record date is [date]. Investors need to own VOD shares before the ex-dividend date to be eligible for the increased Vodacom payout.

- Impact on Investor Returns: The higher Vodacom dividend significantly boosts investor returns, particularly for income-focused investors. This increased payout adds another layer of return beyond potential capital appreciation from the VOD share price.

- Attractiveness to Different Investor Profiles: The improved Vodacom dividend makes the stock more attractive to both income investors seeking regular dividend payments and long-term investors looking for sustainable returns.

- Potential Implications for the VOD Share Price: The increased Vodacom dividend announcement may have a positive impact on the VOD share price in the short-term, although market conditions and other factors will play a role.

Factors Contributing to Vodacom's Improved Earnings

Vodacom's enhanced profitability is the result of several contributing factors.

- Subscriber Base Growth: A steady increase in the subscriber base across their markets contributed significantly to revenue growth, driving increased Vodacom earnings. Expanding the user base is key to increased revenues for telecommunication companies.

- Expansion into New Markets/Services: Vodacom's strategic expansion into new markets and the launch of innovative services broadened their revenue streams and significantly boosted Vodacom earnings.

- Effective Cost Management: Implementing cost-effective strategies, improving operational efficiency and streamlined processes resulted in enhanced profitability.

- Positive Industry Trends: Favorable industry trends, such as the continued growth in mobile data consumption and the increasing adoption of digital services, provided a conducive environment for Vodacom's expansion.

- Strategic Acquisitions/Partnerships: Strategic acquisitions and partnerships have further strengthened Vodacom's market position and enhanced their ability to deliver higher earnings.

Market Outlook and Future Expectations for Vodacom (VOD)

The outlook for Vodacom's future performance and dividend potential appears positive, although challenges remain.

- Future Earnings Growth: Analysts predict continued earnings growth for Vodacom in the coming years, driven by sustained subscriber growth and increased data consumption. However, this growth depends on various factors, such as competition and regulatory changes.

- Impact of Regulatory Changes: Regulatory changes within the telecommunications sector could impact Vodacom's future earnings and dividend policy. Therefore, the influence of new regulations warrants close monitoring.

- Competitive Landscape Analysis: The competitive landscape in the telecommunications industry is dynamic and requires Vodacom to continuously innovate and adapt to stay ahead of its competitors. This factor will play a significant role in influencing Vodacom's future performance and dividend payout capabilities.

- Expert Opinions: Industry experts generally express optimism regarding Vodacom's future prospects, anticipating continued growth and a sustained increase in the Vodacom dividend.

Conclusion

Vodacom's improved earnings, driven by strong revenue growth across key sectors, effective cost management, and strategic expansion, have resulted in a higher dividend payout for shareholders. This increased Vodacom (VOD) dividend reflects positively on the company's financial health and future prospects, strengthening investor confidence.

Are you interested in learning more about the investment opportunities presented by the increased Vodacom (VOD) dividend and its strong financial performance? Conduct further research on Vodacom's financial reports and consider its potential as part of your investment portfolio. Stay informed about future Vodacom (VOD) dividend announcements and financial news to make informed investment decisions related to Vodacom payout and the VOD share price.

Featured Posts

-

Hl Syueyd Aldhkae Alastnaey Ktabt Rwayat Ajatha Krysty

May 20, 2025

Hl Syueyd Aldhkae Alastnaey Ktabt Rwayat Ajatha Krysty

May 20, 2025 -

Job Exchange Scheme Leads To Bribery Charges Against Navys Burke

May 20, 2025

Job Exchange Scheme Leads To Bribery Charges Against Navys Burke

May 20, 2025 -

Nyt Mini Crossword Answers For March 13 2025

May 20, 2025

Nyt Mini Crossword Answers For March 13 2025

May 20, 2025 -

Major Infrastructure Boost 6 B Awarded For Coastal Protection Projects

May 20, 2025

Major Infrastructure Boost 6 B Awarded For Coastal Protection Projects

May 20, 2025 -

Nou Membru In Familia Schumacher Pilotul Legendar Devine Bunic

May 20, 2025

Nou Membru In Familia Schumacher Pilotul Legendar Devine Bunic

May 20, 2025

Latest Posts

-

Checking For Rain The Latest Hourly And Daily Updates

May 20, 2025

Checking For Rain The Latest Hourly And Daily Updates

May 20, 2025 -

Rain Predictions The Most Up To Date Forecast

May 20, 2025

Rain Predictions The Most Up To Date Forecast

May 20, 2025 -

Updated Rain Forecast Knowing When To Expect Precipitation

May 20, 2025

Updated Rain Forecast Knowing When To Expect Precipitation

May 20, 2025 -

Latest Rain Chances When To Expect Showers

May 20, 2025

Latest Rain Chances When To Expect Showers

May 20, 2025 -

Stay Safe Strong Wind And Severe Storm Warning Issued

May 20, 2025

Stay Safe Strong Wind And Severe Storm Warning Issued

May 20, 2025