Income Inequality In Relationships: A Star's Perspective

Table of Contents

The Financial Power Dynamic: Navigating Control and Dependence

Differing incomes often create a financial power imbalance within a relationship. This imbalance can manifest in various ways, subtly or overtly shaping the dynamics of the partnership. The partner with the higher income might inadvertently (or intentionally) exert greater control over financial decisions, leading to resentment and feelings of inadequacy in the other partner.

- One partner controlling finances leading to resentment: This can range from making all major financial decisions unilaterally to withholding financial information, creating a sense of powerlessness and distrust.

- Dependence creating vulnerability and potential for exploitation: A significant income disparity can leave one partner financially dependent on the other, making them vulnerable to manipulation or control.

- Impact on decision-making regarding major life choices: Decisions about housing, having children, investments, and even vacations can become heavily weighted towards the higher earner's preferences, neglecting the other partner's needs and desires.

- The importance of open communication about finances: Transparency and honest conversations about money are paramount to navigating this potential pitfall. Open dialogue can help prevent resentment and foster a sense of shared responsibility.

For example, consider a couple where one partner earns significantly more than the other. If the higher earner consistently makes financial decisions without consulting their partner, it can create a sense of exclusion and disempowerment. This is not just about money management; it's about shared decision-making and mutual respect.

Communication and Transparency: The Foundation of a Healthy Financial Partnership

Honest and open communication is the cornerstone of any successful relationship, but it's especially crucial when dealing with income inequality. Money is often a sensitive topic, but avoiding conversations about finances only exacerbates the problem.

- Importance of regular budget discussions: Establishing a routine for discussing finances, perhaps monthly, allows for transparent tracking of income, expenses, and savings.

- Strategies for joint financial planning and goal setting: Creating shared financial goals, whether it's saving for a house, retirement, or a dream vacation, fosters a sense of partnership and collaboration.

- Addressing financial anxieties and insecurities openly: Creating a safe space to discuss financial anxieties and insecurities, without judgment, can build empathy and understanding.

- Seeking professional financial advice as a couple: A financial advisor can provide objective guidance and help develop a financial plan that works for both partners.

Couples should strive for a collaborative approach to budgeting and financial planning. This might involve creating a joint account for shared expenses, while maintaining separate accounts for personal spending.

Resolving Conflict and Building Equity: Practical Strategies for Success

Income inequality often leads to conflict, but effective conflict resolution strategies can help couples navigate these challenges.

- Fair distribution of household responsibilities based on income and time availability: Acknowledging the time commitment required for both paid work and household chores is essential. A fair distribution of responsibilities can alleviate stress and foster a sense of equality.

- Creating a shared financial vision and goals: Working together to define shared financial goals fosters a sense of unity and purpose. This requires open communication and compromise.

- Compromise and negotiation skills: Learning to compromise and negotiate effectively is crucial in addressing financial disagreements. Both partners need to feel heard and valued.

- Seeking couples therapy if needed: If couples struggle to resolve conflicts independently, seeking professional help from a therapist specializing in relationship finances can be beneficial.

Addressing income inequality isn't about equalizing earnings; it's about equalizing power and ensuring a sense of fairness and partnership in financial matters. This might involve creative solutions like the higher earner contributing a larger percentage to shared expenses or investing in the lower earner's education or career development.

Redefining Success: Beyond Monetary Measures

Our society often equates success with monetary achievement. However, a successful relationship transcends financial metrics.

- Focusing on shared values and life goals: A strong relationship is built on shared values, life goals, and mutual support, regardless of individual income levels.

- Prioritizing emotional well-being and mutual support: Emotional support and understanding are invaluable, regardless of financial status.

- Appreciating non-monetary contributions: Contributions like childcare, household management, and emotional support are equally valuable, even if they don't generate a monetary income.

- Defining success as a couple based on individual and collective values: Success in a relationship should be defined by the couple based on their shared values and goals, not solely on financial wealth.

The Role of Gender and Societal Expectations

Traditional gender roles and societal expectations significantly influence income inequality in relationships.

- Impact of societal biases on career choices and earning potential: Societal biases often steer women towards lower-paying professions, contributing to income disparities.

- The pressure to conform to traditional gender roles and financial structures: The pressure to conform to traditional gender roles can limit individual earning potential and lead to unequal financial burdens within the relationship.

- How to challenge these norms and create a more equitable relationship: Actively challenging these norms and striving for an equitable distribution of responsibilities and financial contributions is crucial.

Overcoming these societal pressures requires conscious effort from both partners and a commitment to creating a more equitable dynamic within the relationship.

Conclusion

Income inequality in relationships presents significant challenges, but open communication, transparency, and a willingness to adapt are key to overcoming them. Addressing income disparities requires a collaborative approach, focusing on fair distribution of responsibilities, shared financial goals, and a redefinition of success beyond monetary measures. Tackling income inequality in your relationship means proactively discussing finances, building a strong foundation of trust and mutual respect, and appreciating the value of non-monetary contributions. If you’re struggling to navigate these challenges, consider seeking professional help from a couples counselor or a financial planner. Remember, addressing income disparities is an investment in the long-term health and happiness of your relationship.

Featured Posts

-

You Tuber Arrested For Spying Isi Connection And Punjab Espionage Crackdown

May 19, 2025

You Tuber Arrested For Spying Isi Connection And Punjab Espionage Crackdown

May 19, 2025 -

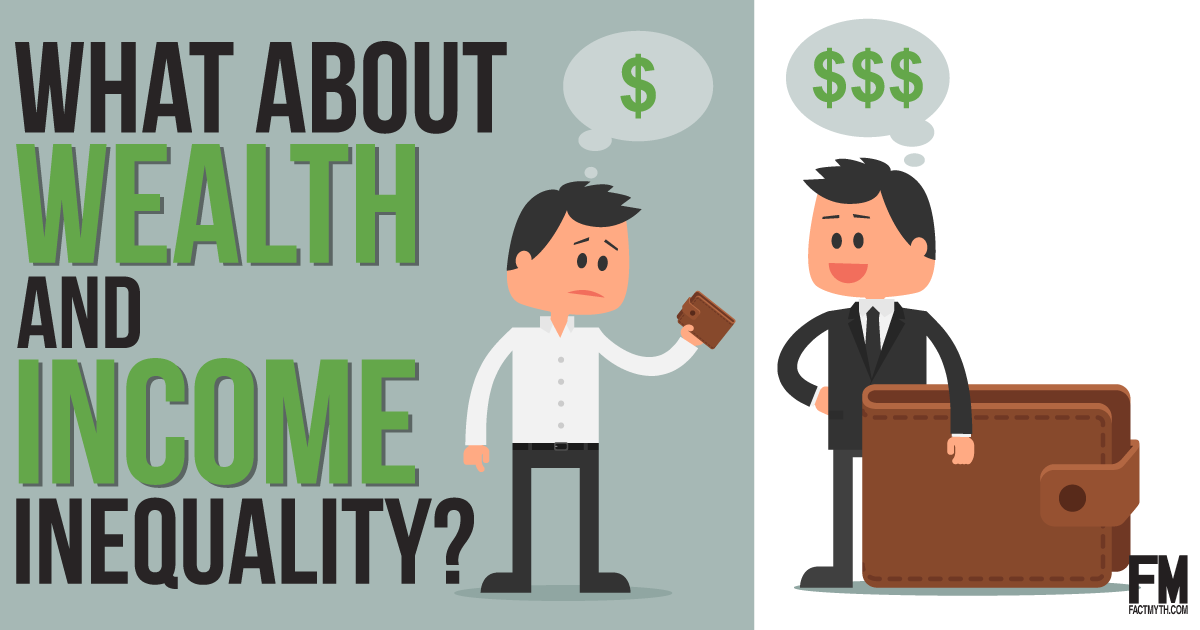

First Class Stamp Price Hike 1 70 Increase Confirmed

May 19, 2025

First Class Stamp Price Hike 1 70 Increase Confirmed

May 19, 2025 -

Oernskoeldsviks Intresse Foer Eurovision 2026

May 19, 2025

Oernskoeldsviks Intresse Foer Eurovision 2026

May 19, 2025 -

Jennifer Lawrence And Cooke Maroney Spotted Together Amidst Baby No 2 Reports

May 19, 2025

Jennifer Lawrence And Cooke Maroney Spotted Together Amidst Baby No 2 Reports

May 19, 2025 -

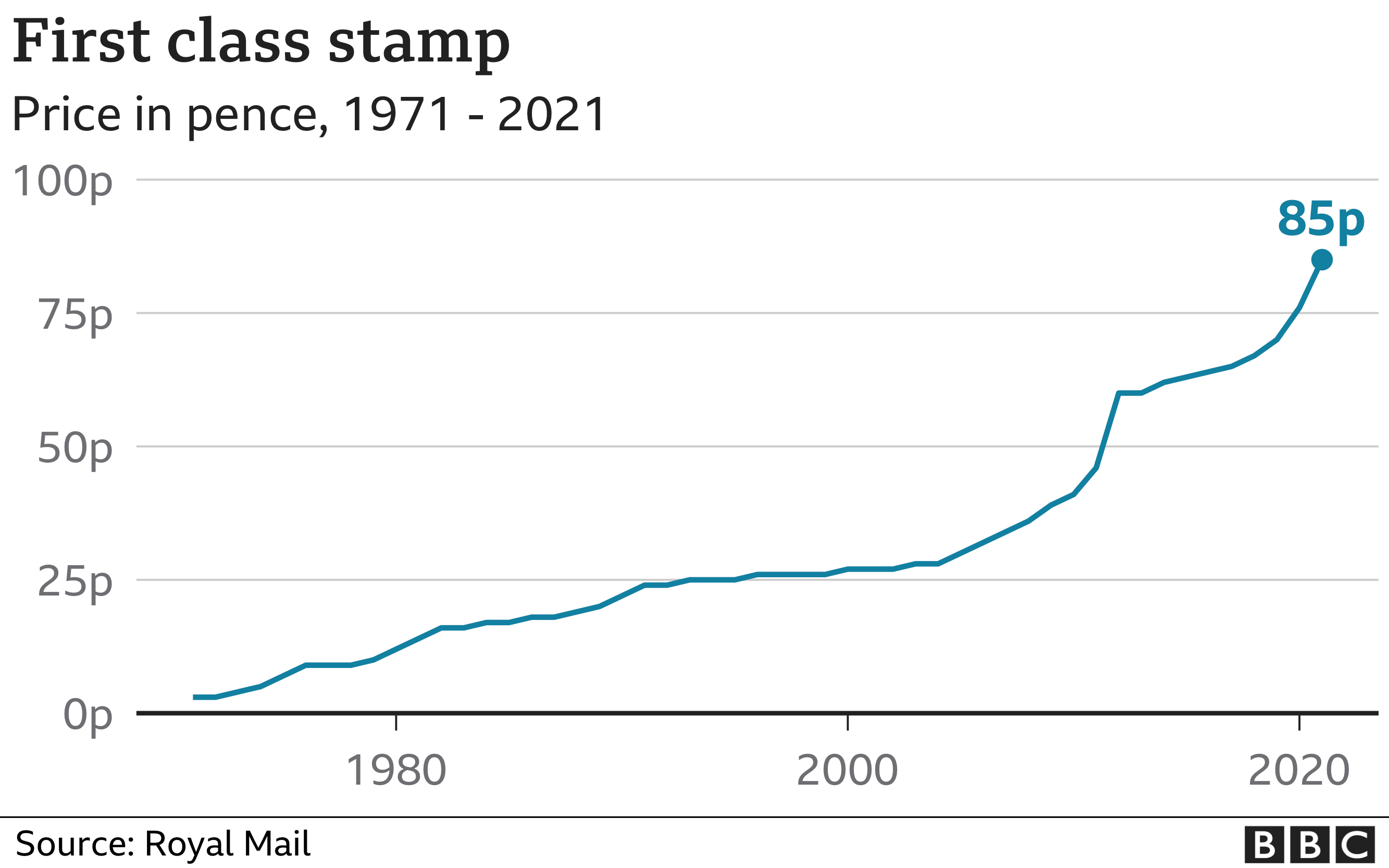

Canada Stands Firm Us Tariff Dispute Continues Despite Oxford Study

May 19, 2025

Canada Stands Firm Us Tariff Dispute Continues Despite Oxford Study

May 19, 2025