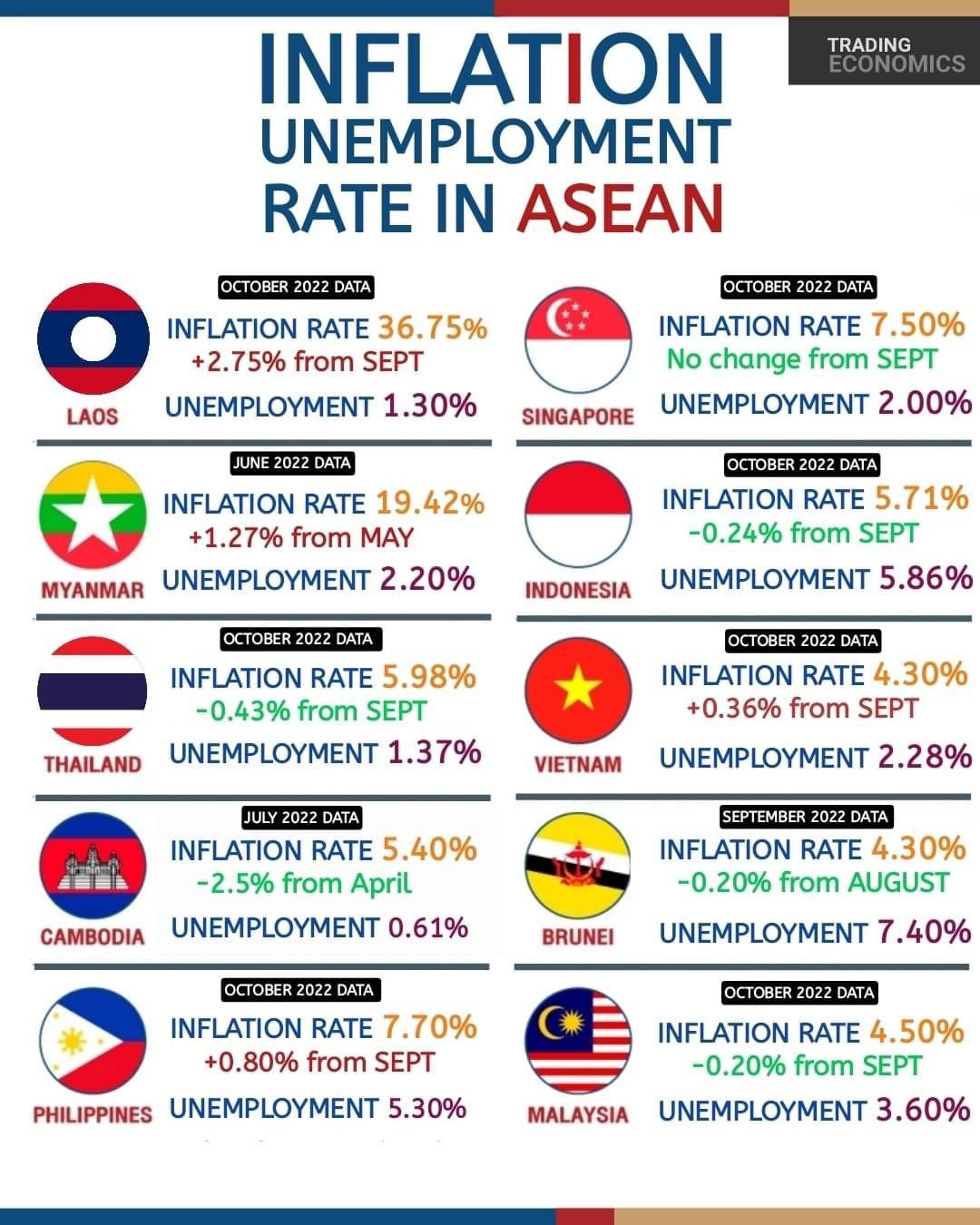

Increased Inflation And Unemployment: A Growing Source Of Economic Uncertainty

Table of Contents

H2: Understanding the Current Inflationary Environment

The current inflationary environment is a significant concern for policymakers and citizens alike. Understanding its causes is crucial to addressing its impact.

H3: Causes of Increased Inflation

Several factors contribute to the current surge in inflation. These include:

- Supply chain disruptions and shortages: The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to shortages of goods and increased production costs. This cost-push inflation significantly impacts the consumer price index (CPI).

- Increased energy prices: The war in Ukraine and geopolitical instability have driven up energy prices globally, impacting transportation, manufacturing, and household expenses. This adds to the overall inflation rate and contributes to stagflationary pressures.

- Demand-pull inflation: Increased consumer spending, fueled by pent-up demand after lockdowns and government stimulus packages, has driven up prices in certain sectors. This demand-pull inflation exacerbates the existing cost-push pressures.

- Government spending and monetary policy: While necessary in some instances, expansive government spending and loose monetary policies can contribute to inflationary pressures if not carefully managed.

These interconnected factors create a complex inflationary environment, impacting real wages and reducing purchasing power for consumers.

H3: Impact of Inflation on Consumers

The impact of increased inflation on consumers is substantial and far-reaching:

- Reduced purchasing power: As prices rise faster than wages, consumers' ability to purchase goods and services decreases, leading to a decline in their real income.

- Increased cost of living: Essential expenses like housing, food, and transportation become more expensive, squeezing household budgets and impacting quality of life. This necessitates finding effective inflation hedges.

- Impact on savings and investments: Inflation erodes the value of savings and investments, reducing their real return and impacting long-term financial planning.

- Disproportionate impact on lower-income brackets: Lower-income households are disproportionately affected by inflation, as a larger percentage of their income is spent on essentials.

H2: The Rise in Unemployment and its Contributing Factors

Simultaneously, unemployment rates are rising in many countries, adding another layer of complexity to the economic outlook.

H3: Causes of Increased Unemployment

The rise in unemployment is driven by several interconnected factors:

- Automation and technological advancements: Automation and technological progress continue to displace workers in various sectors, leading to structural unemployment.

- Global economic slowdown: Global economic uncertainty and slower growth negatively impact businesses' ability to hire and retain employees, leading to job losses.

- Impact of inflation on businesses and hiring: Increased production costs due to inflation can force businesses to cut back on hiring or even lay off employees to maintain profitability.

- Sectoral shifts in the economy: The transition away from certain industries and towards others can lead to job losses in declining sectors and a skills mismatch in the labor market.

H3: The Social and Economic Consequences of Unemployment

Increased unemployment has severe social and economic consequences:

- Increased poverty and income inequality: Job losses exacerbate poverty and widen the gap between the rich and poor, increasing social tensions.

- Strain on social safety nets: Increased demand for unemployment benefits and other social welfare programs puts a strain on government resources.

- Reduced consumer spending and economic growth: High unemployment leads to decreased consumer spending, which negatively impacts overall economic growth.

- Mental health impacts: Unemployment is associated with increased stress, anxiety, and depression, negatively impacting mental well-being.

H2: The Interplay Between Inflation and Unemployment

The simultaneous increase in inflation and unemployment presents a complex challenge.

H3: The Phillips Curve and its Limitations

The traditional Phillips Curve suggests an inverse relationship between inflation and unemployment. However, this relationship has proven less reliable in recent times, especially considering the possibility of stagflation.

H3: Stagflation and its Implications

Stagflation, characterized by high inflation and high unemployment, is a particularly challenging economic scenario. It requires carefully calibrated policy responses and can significantly hinder economic growth and stability.

H3: Policy Responses to Combat Inflation and Unemployment

Addressing the dual challenge of increased inflation and unemployment requires a multifaceted approach:

- Monetary policy: Central banks can use monetary policy tools, such as interest rate adjustments, to control inflation and influence economic activity. Increasing interest rates can curb inflation but may also increase unemployment.

- Fiscal policy: Governments can use fiscal policy measures, such as government spending and taxation, to stimulate demand and reduce unemployment. However, excessive government spending can fuel inflation.

- Supply-side policies: Addressing supply chain bottlenecks and improving productivity through investment in infrastructure and technology can help reduce inflationary pressures without significantly impacting employment.

3. Conclusion

The simultaneous rise of increased inflation and unemployment presents a significant challenge to economic stability. The interconnectedness of these factors, coupled with the limitations of traditional economic models like the Phillips Curve, necessitates a nuanced and adaptable approach to policymaking. Understanding the complexities of this economic situation is paramount. The impact on consumers, businesses, and the overall economy is profound, requiring a careful balancing act between controlling inflation and mitigating unemployment.

Understanding the dynamics of increased inflation and unemployment is crucial for navigating these uncertain economic times. Stay informed and engage in thoughtful discussion to advocate for policies that promote economic stability and growth. Further research into the impact of specific government policies and the effectiveness of different strategies to combat increased inflation and unemployment is highly encouraged.

Featured Posts

-

Nvidias Upbeat Forecast Despite China Slowdown

May 30, 2025

Nvidias Upbeat Forecast Despite China Slowdown

May 30, 2025 -

Reforme Des Retraites Convergence Inattendue Entre Le Rn Et La Gauche

May 30, 2025

Reforme Des Retraites Convergence Inattendue Entre Le Rn Et La Gauche

May 30, 2025 -

Chronique D Une Banque L Histoire Moderne De La Deutsche Bank

May 30, 2025

Chronique D Une Banque L Histoire Moderne De La Deutsche Bank

May 30, 2025 -

The Baim Collection Chronicling A Lifetime

May 30, 2025

The Baim Collection Chronicling A Lifetime

May 30, 2025 -

35 Mal For Kasper Dolberg Muligt Eller Umuligt

May 30, 2025

35 Mal For Kasper Dolberg Muligt Eller Umuligt

May 30, 2025

Latest Posts

-

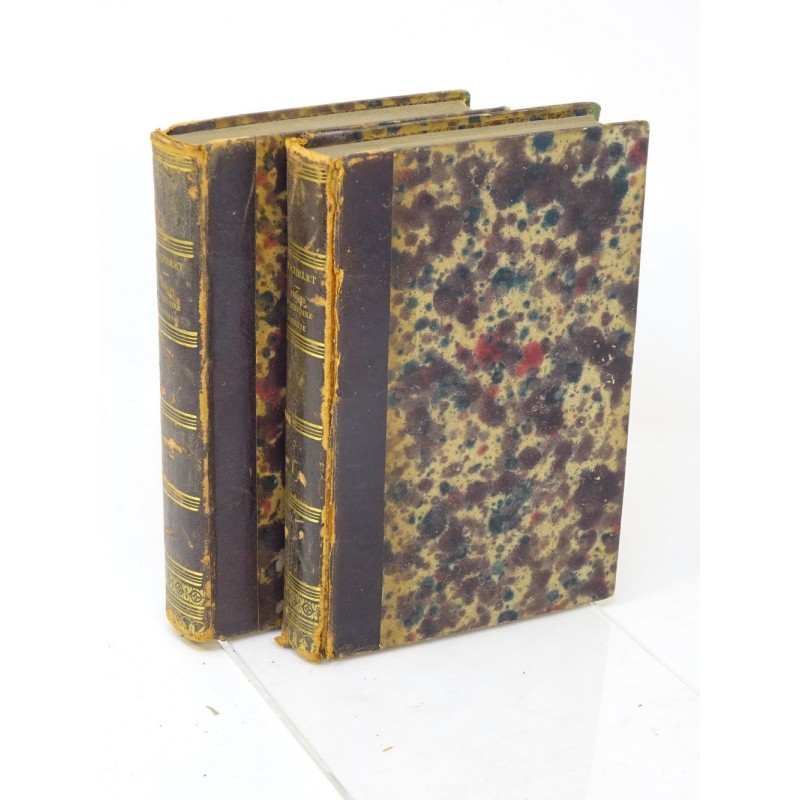

Canadian Wildfire Smoke Blankets Us States Amidst Unprecedented Evacuations

May 31, 2025

Canadian Wildfire Smoke Blankets Us States Amidst Unprecedented Evacuations

May 31, 2025 -

Massive Wildfires Force Largest Evacuation In Canadian History Impacting Us Air Quality

May 31, 2025

Massive Wildfires Force Largest Evacuation In Canadian History Impacting Us Air Quality

May 31, 2025 -

Hudbay Minerals Staff Evacuated Due To Flin Flon Wildfires

May 31, 2025

Hudbay Minerals Staff Evacuated Due To Flin Flon Wildfires

May 31, 2025 -

Hotter Summer Means Higher Wildfire Risk In Saskatchewan Officials

May 31, 2025

Hotter Summer Means Higher Wildfire Risk In Saskatchewan Officials

May 31, 2025 -

Saskatchewan Faces Heightened Wildfire Threat Due To Hot Summer Outlook

May 31, 2025

Saskatchewan Faces Heightened Wildfire Threat Due To Hot Summer Outlook

May 31, 2025