Increased Market Share Sought By Hanwha And OCI Following US Solar Tariffs

Table of Contents

Hanwha's Strategic Response to US Solar Tariffs

Hanwha, a global leader in solar energy solutions, is employing a multi-pronged approach to navigate the US solar tariffs and boost its market share. Their strategy focuses on bolstering domestic manufacturing, leveraging existing infrastructure, and emphasizing high-efficiency technologies.

Expanding Domestic Manufacturing Capabilities

To mitigate the impact of tariffs, Hanwha is significantly investing in expanding its US-based manufacturing capacity. This strategic move reduces reliance on imports and strengthens supply chain resilience.

- Investment in new facilities: Hanwha is actively exploring and investing in new manufacturing plants within the US.

- Partnerships with American companies: Collaborations with local businesses are being forged to facilitate the procurement of materials and services.

- Emphasis on polysilicon and cell production: Hanwha is concentrating its manufacturing efforts on key components like polysilicon and solar cells, securing its position in the value chain.

This vertical integration strategy offers several benefits. Reduced reliance on foreign suppliers minimizes vulnerability to trade disruptions and fluctuating import costs. Furthermore, it allows Hanwha to better control quality and production timelines.

Leveraging Existing US Infrastructure and Partnerships

Hanwha already benefits from a strong foundation in the US market. It’s leveraging its existing infrastructure and partnerships to accelerate market penetration.

- Key partnerships: Existing collaborations with distributors, installers, and project developers provide immediate access to the market.

- Established distribution networks: Hanwha's pre-existing distribution channels ensure efficient product delivery across the US.

- Strong customer relationships: Long-standing relationships with key customers facilitate smooth transitions and ongoing business.

These existing assets provide a substantial competitive advantage, reducing the time and resources needed to establish a strong market presence.

Focus on High-Efficiency Solar Technologies

Offering advanced solar technologies allows Hanwha to justify any price premiums associated with tariffs. The focus on superior performance differentiates their products and attracts customers willing to pay more for enhanced efficiency.

- Specific technologies: Hanwha is actively developing and deploying high-efficiency monocrystalline solar cells and modules.

- Technological advancements: R&D efforts focus on increasing power output, improving durability, and enhancing overall system performance.

By offering superior technology, Hanwha positions itself as a premium provider, mitigating the negative impact of tariffs on pricing competitiveness.

OCI's Strategy for Increased Market Share

OCI, a major polysilicon producer, is taking a different but equally effective approach to expanding its market share within the US solar market, leveraging its position in the supply chain and targeting specific market segments.

Polysilicon Production and Supply Chain Optimization

OCI's significant polysilicon production capabilities give it a crucial competitive advantage. Control over a key raw material allows it to manage costs effectively and ensures a stable supply chain.

- Global polysilicon production capabilities: OCI’s vast production network offers flexibility and resilience in responding to market demands.

- Impact on pricing: Control over polysilicon supply allows OCI to navigate pricing fluctuations more effectively than competitors reliant on external sources.

A stable and cost-effective polysilicon supply chain ensures OCI remains competitive even with the added costs of tariffs.

Targeting Specific Market Segments

Rather than trying to capture the entire market, OCI is strategically focusing on specific, high-value segments to maximize profitability and growth.

- Potential target segments: OCI is focusing on both utility-scale solar projects and the fast-growing residential solar market.

- Rationale: These segments present significant growth opportunities with potentially higher profit margins.

This targeted approach enables OCI to optimize its resources and focus on areas where it can achieve the greatest impact.

Strategic Partnerships and Collaborations

OCI is actively seeking strategic partnerships to expand its reach and access new technologies or markets.

- Potential collaborations: OCI is exploring partnerships with solar developers, installers, and technology companies to broaden its market presence.

- Synergistic benefits: These collaborations will create mutually beneficial relationships, fostering growth for all involved.

Strategic alliances allow OCI to leverage external expertise and resources, accelerating its market expansion efforts.

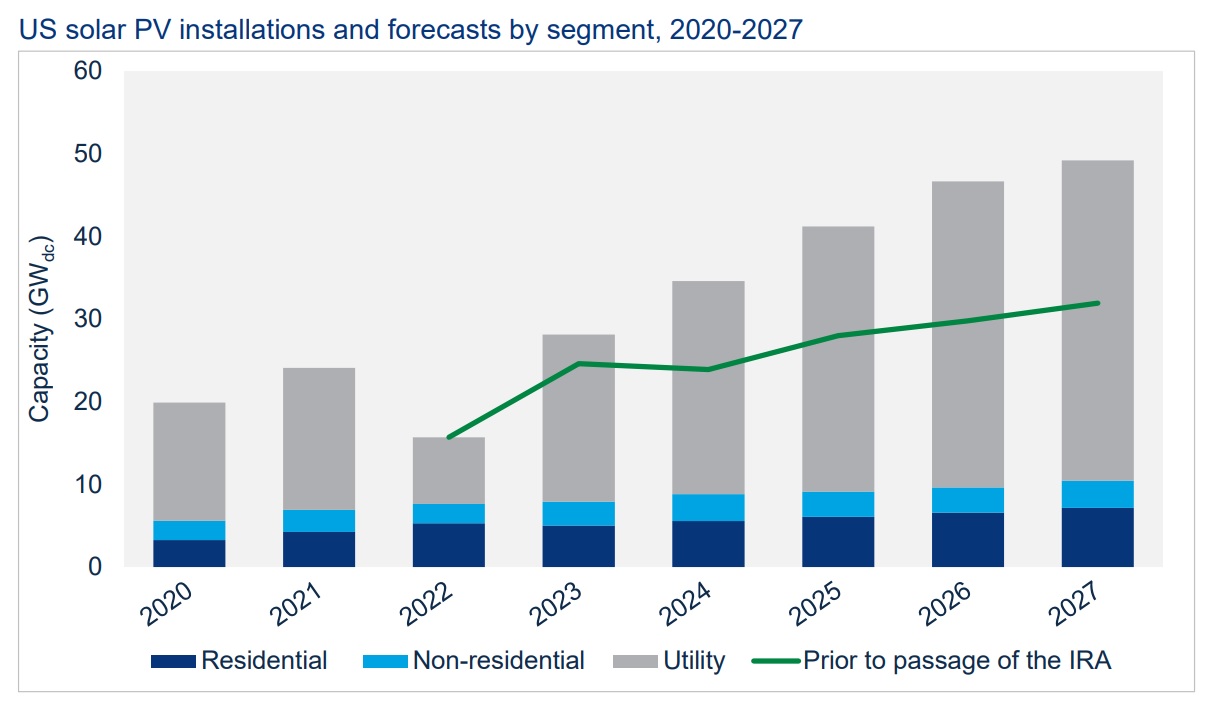

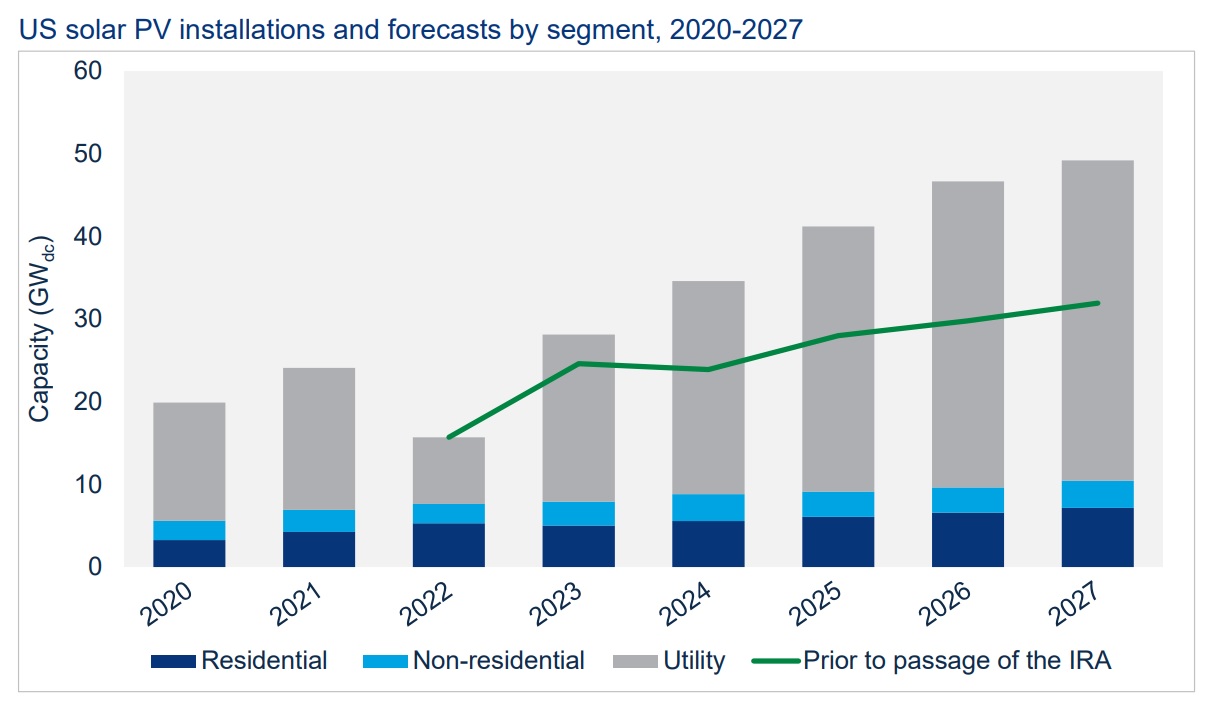

Impact on the Broader US Solar Industry

The strategies of Hanwha and OCI, while focused on individual market share gains, will have a significant impact on the broader US solar industry.

Increased Domestic Production and Job Creation

The increased domestic manufacturing efforts of these companies contribute to the growth of the US solar manufacturing sector.

- Job creation: New manufacturing facilities generate employment opportunities in various fields.

- Economic stimulus: Increased domestic production reduces reliance on imports, boosting the US economy.

This represents a positive shift toward greater energy independence and economic growth within the US.

Potential for Price Increases and Market Volatility

While increased domestic production offers benefits, it may also lead to short-term price fluctuations.

- Potential risks: Supply chain adjustments and increased demand could lead to temporary price increases.

- Market volatility: The transition to a more domestically focused market could cause some short-term instability.

Effective strategies for managing supply and demand will be critical to mitigating these risks.

Shifting Dynamics in the Solar Supply Chain

The US solar tariffs are fundamentally altering the solar supply chain, creating both challenges and opportunities.

- Key shifts: Companies are adapting to new trade policies, seeking domestic sources and building more resilient supply chains.

- Long-term consequences: The long-term outcome will be a more diversified and resilient US solar industry.

The changes in the supply chain will ultimately strengthen the US solar market's independence and long-term sustainability.

Conclusion

The US solar tariffs have created both challenges and opportunities for companies operating in the American solar market. Hanwha and OCI, through strategic initiatives focused on domestic manufacturing, supply chain optimization, and technological innovation, are actively pursuing increased market share. Their success will not only impact their own growth but also significantly shape the future landscape of the US solar industry. To stay informed about the latest developments and the ongoing impact of US solar tariffs on major players like Hanwha and OCI, continue to follow industry news and analysis. Understanding these strategies is crucial for anyone involved in or interested in the future of the solar industry and the impact of market share competition within the context of evolving trade policies.

Featured Posts

-

Jon Joness 29 Million Demand A Ufc Vets Take On Dana Whites Next Move

May 30, 2025

Jon Joness 29 Million Demand A Ufc Vets Take On Dana Whites Next Move

May 30, 2025 -

Jon Jones And Daniel Cormier An Unresolved Rivalry

May 30, 2025

Jon Jones And Daniel Cormier An Unresolved Rivalry

May 30, 2025 -

O Caso Bruno Fernandes Demandas Por Justica E O Caminho A Seguir

May 30, 2025

O Caso Bruno Fernandes Demandas Por Justica E O Caminho A Seguir

May 30, 2025 -

Otay Mountain Rescue Border Patrol Saves Two Women

May 30, 2025

Otay Mountain Rescue Border Patrol Saves Two Women

May 30, 2025 -

Recours De L Etat Le Projet A69 Pourrait Reprendre Malgre Son Annulation

May 30, 2025

Recours De L Etat Le Projet A69 Pourrait Reprendre Malgre Son Annulation

May 30, 2025