India Market Update: Tailwinds Driving Nifty Gains

Table of Contents

Robust Economic Fundamentals Fueling Nifty Growth

The impressive performance of the Nifty 50 is strongly underpinned by the robust health of the Indian economy. Several key indicators point towards a sustained period of growth, further solidifying investor confidence in the Indian equity market.

Strong GDP Growth

India's GDP growth has consistently outperformed expectations, signaling a vibrant and expanding economy. Recent figures show [insert latest GDP growth percentage and source], a significant increase compared to [insert previous year's percentage and source]. This positive momentum is reflected in the buoyancy of the Nifty 50 index.

- Key sectors driving growth:

- Manufacturing sector experiencing a resurgence fueled by increased domestic demand and government initiatives.

- The services sector, a major contributor to India's GDP, continues to exhibit strong expansion.

- The IT sector, a cornerstone of India's economy, remains a significant driver of growth, benefiting from global demand for technology services.

- Government initiatives fostering growth:

- Significant infrastructure spending aimed at improving connectivity and boosting economic activity across the country.

- Ongoing reforms focused on easing the process of doing business in India, attracting further investments, both domestic and foreign.

Positive Inflation Trends

While inflation remains a concern globally, India has demonstrated relatively controlled inflation rates in recent periods. [Insert latest inflation data and source]. The Reserve Bank of India's (RBI) proactive monetary policy has played a crucial role in maintaining stability.

- Benefits of controlled inflation for the market:

- Controlled inflation fosters a stable investment environment, encouraging both domestic and foreign investment.

- Predictable inflation allows businesses to plan more effectively, leading to increased investment and job creation.

- Inflation rate comparison: Current inflation rates are [compare current rates to historical data and projections – cite sources]. This relatively controlled inflation boosts investor confidence and contributes to the positive Nifty 50 performance.

Foreign Institutional Investor (FII) Inflows

A significant contributor to the Nifty's growth is the surge in Foreign Institutional Investor (FII) inflows into the Indian stock market. This influx of foreign capital reflects a growing global confidence in India's economic potential.

Increased FII Investments

FIIs have poured significant capital into the Indian market, attracted by [Insert data on FII inflows and source]. This substantial investment is driven by several key factors.

- Sectors attracting significant FII investment:

- Technology companies benefiting from the global demand for digital services.

- Pharmaceutical companies, driven by strong growth in the sector and increasing global healthcare expenditure.

- Global economic factors influencing FII investment:

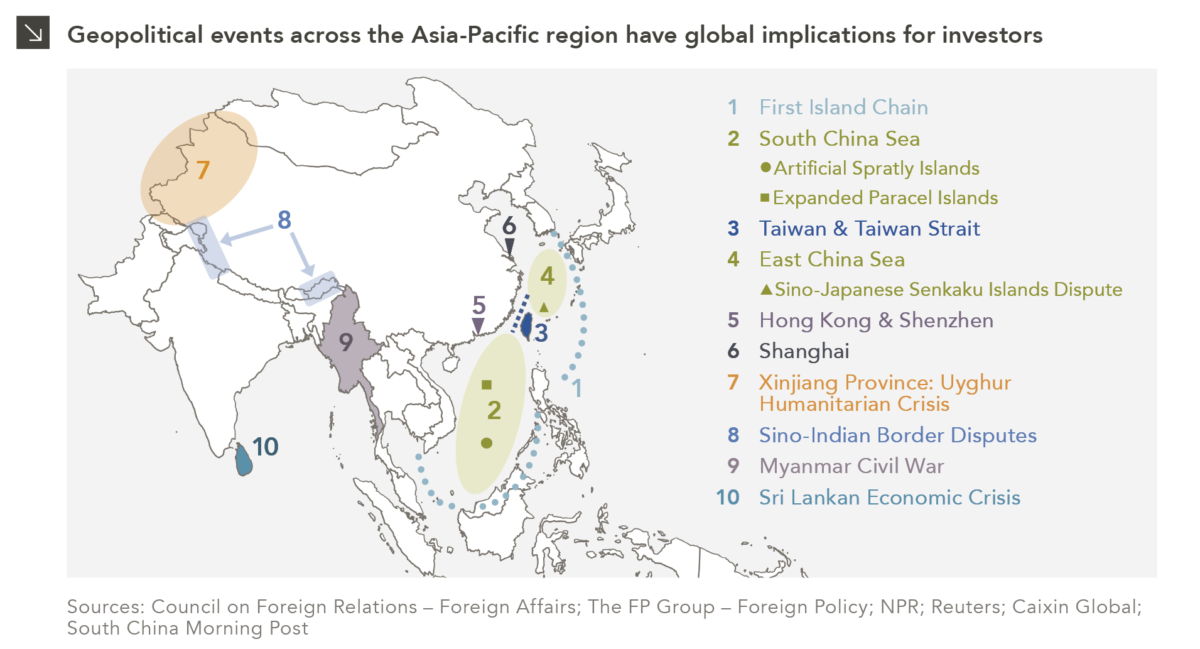

- Geopolitical instability in other regions is driving investors towards the relative stability and growth potential of India.

- The search for higher returns in a low-interest-rate global environment makes India an attractive investment destination.

Positive Sentiment Towards India

The world is increasingly viewing India as a promising investment destination for long-term growth. This positive sentiment is fueled by several factors.

- India's demographic dividend: India's large and youthful population represents a massive consumer market and a vast pool of skilled labor.

- India's emergence as a global manufacturing hub: Government initiatives like "Make in India" are attracting significant foreign investment and boosting domestic manufacturing.

Strong Corporate Earnings and Profitability

The impressive performance of the Nifty 50 is also fueled by strong corporate earnings and improved profitability amongst major listed companies.

Improved Corporate Performance

Recent earnings reports from several Nifty 50 companies have exceeded expectations, signaling a robust corporate sector. [Insert examples of companies and their earnings performance – cite sources]. This improved profitability is a result of various factors.

- Sectors exhibiting strong earnings growth: [List sectors and reasons for growth - cite sources].

- Factors contributing to improved profitability:

- Cost-cutting measures implemented by companies to improve efficiency and competitiveness.

- Expansion into new markets, both domestically and internationally.

Positive Future Outlook

Analysts remain largely optimistic about the future outlook for corporate earnings in India. [Insert analyst predictions and projections – cite sources]. This positive sentiment further supports the continued upward trajectory of the Nifty 50.

- Consensus forecasts for key sectors: [Summarize forecasts for major sectors - cite sources].

- Potential risks and challenges: While the outlook is positive, potential risks include global economic slowdown, geopolitical uncertainties, and domestic inflationary pressures.

Conclusion: India Market Update: Sustained Nifty Gains?

The recent gains in the Nifty 50 index are a result of a confluence of positive factors: robust economic fundamentals, significant FII inflows, and strong corporate earnings. The outlook for the Indian stock market remains largely positive, driven by India's strong growth potential and its increasing attractiveness as a global investment destination. However, investors should remain aware of potential risks and challenges. To stay informed about the India Market Update and the factors influencing Nifty gains, continuous monitoring of market trends and economic indicators is crucial. Consider conducting further research and consulting with a financial advisor to develop informed investment strategies in the dynamic Indian equity market. Understanding the nuances of the Nifty index and the broader Indian market is key to navigating its opportunities and challenges.

Featured Posts

-

Trumps Softened Stance On The Fed Boosts Us Dollar

Apr 24, 2025

Trumps Softened Stance On The Fed Boosts Us Dollar

Apr 24, 2025 -

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025 -

Positive Market Sentiment Fueling The Niftys Bullish Charge In India

Apr 24, 2025

Positive Market Sentiment Fueling The Niftys Bullish Charge In India

Apr 24, 2025 -

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

Apr 24, 2025

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

Apr 24, 2025 -

Minnesota Attorney General Files Lawsuit Against Trumps Transgender Athlete Ban

Apr 24, 2025

Minnesota Attorney General Files Lawsuit Against Trumps Transgender Athlete Ban

Apr 24, 2025

Latest Posts

-

Trumps Energy Policy Cheap Oil And Its Geopolitical Implications

May 12, 2025

Trumps Energy Policy Cheap Oil And Its Geopolitical Implications

May 12, 2025 -

The Impact Of Trumps Presidency On Cheap Oil And The Energy Industry

May 12, 2025

The Impact Of Trumps Presidency On Cheap Oil And The Energy Industry

May 12, 2025 -

Understanding The Dynamics Between Trumps Policies And Cheap Oil

May 12, 2025

Understanding The Dynamics Between Trumps Policies And Cheap Oil

May 12, 2025 -

Trumps Cheap Oil Policies An Assessment Of Their Success And Failures

May 12, 2025

Trumps Cheap Oil Policies An Assessment Of Their Success And Failures

May 12, 2025 -

Examining Trumps Actions And Their Effect On Cheap Oil Production

May 12, 2025

Examining Trumps Actions And Their Effect On Cheap Oil Production

May 12, 2025