Indian Insurers Seek Regulatory Relief On Bond Forwards

Table of Contents

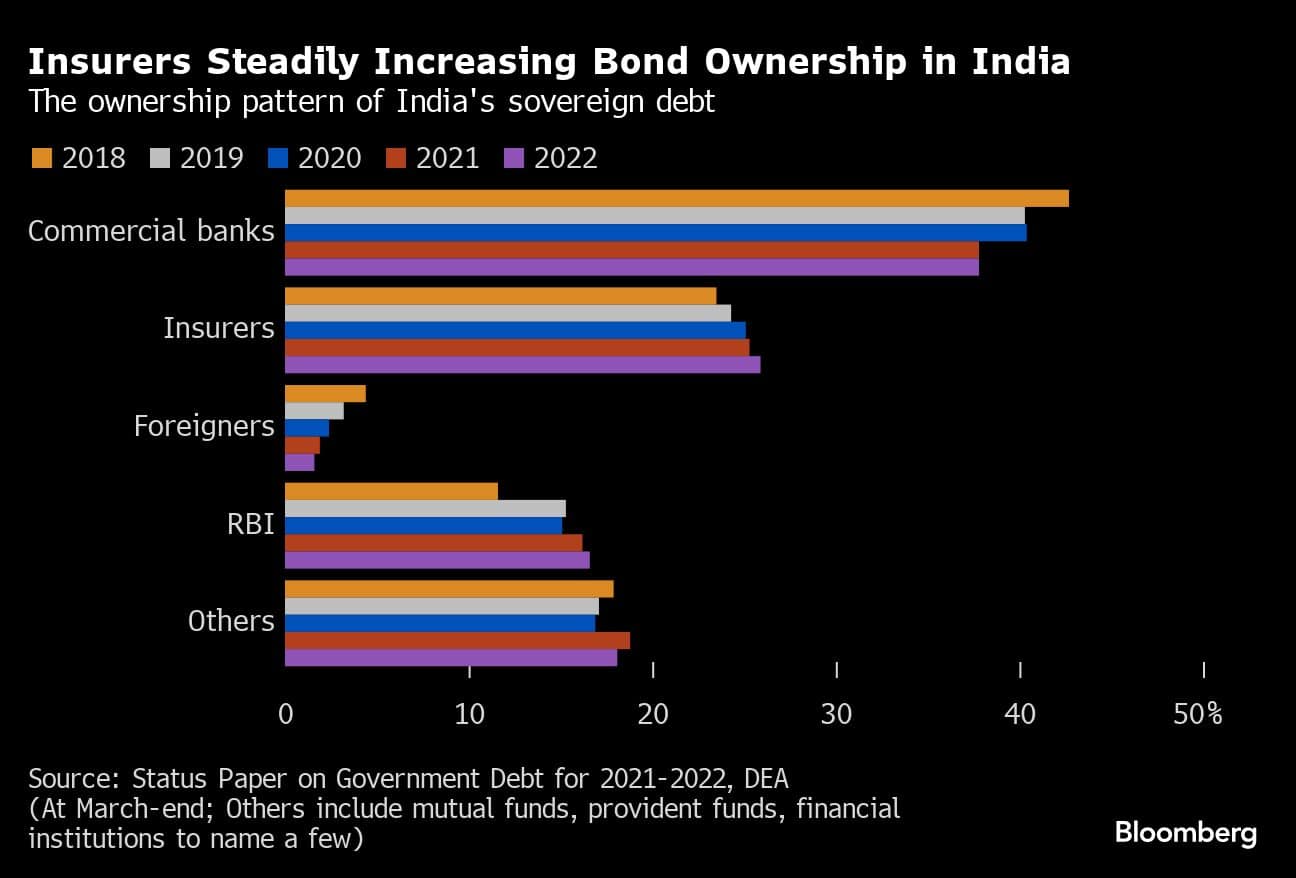

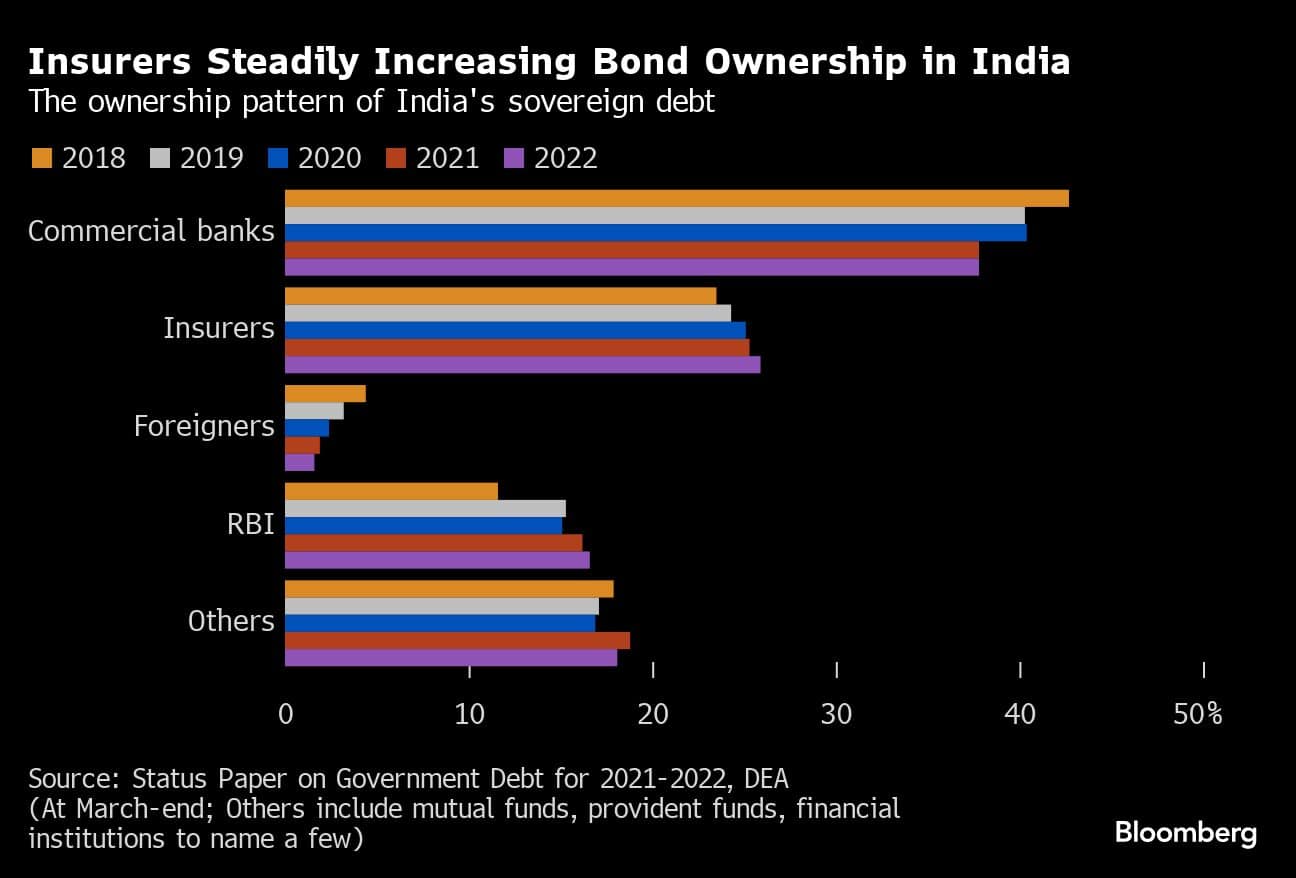

The Current Regulatory Landscape for Bond Forwards in India

The existing regulatory framework governing bond forwards for insurance companies in India presents several limitations. These restrictions hinder efficient interest rate risk management and increase operational complexities. The current Indian insurance regulations, specifically those pertaining to bond forward regulations, create a less competitive environment compared to global markets.

Specific challenges faced by insurers due to current regulations include:

- Limited flexibility in hedging interest rate risk: Current rules restrict the strategies insurers can employ to manage their exposure to interest rate fluctuations, leaving them vulnerable to market volatility.

- Higher transaction costs compared to global markets: The regulatory environment contributes to increased transaction costs, reducing profitability and competitiveness.

- Complexity in complying with existing regulations: Navigating the intricate web of regulations adds administrative burden and increases operational expenses.

- Restrictions on the types of bond forwards permissible: The limited range of permissible bond forwards restricts insurers' ability to tailor their hedging strategies to specific needs.

Reasons for Seeking Regulatory Relief

Indian insurers advocate for regulatory changes based on several compelling arguments. Easing restrictions on bond forwards offers significant potential benefits for the sector's overall health and competitiveness. The core arguments presented center on improving risk management capabilities, boosting investment returns, and enhancing global competitiveness.

Regulatory relief would provide numerous benefits, including:

- Improved risk management capabilities: Greater flexibility in utilizing bond forwards will allow insurers to more effectively hedge against interest rate risk, improving portfolio stability.

- Enhanced investment returns: Optimized risk management and increased investment options can lead to better investment returns for insurers.

- Increased competitiveness in the global insurance market: A more streamlined and efficient regulatory environment will attract foreign investment and improve the competitiveness of Indian insurers globally.

- Better allocation of capital: Flexibility in using bond forwards allows for more efficient capital allocation, improving overall profitability.

- Lower overall costs: Reduced transaction costs and administrative burdens will result in significant cost savings for insurers.

Potential Solutions and Proposed Changes

To address the current challenges, insurers and industry bodies propose several regulatory changes:

Potential regulatory amendments include:

- Relaxation of limits on bond forward positions: Easing restrictions on the amount of bond forwards insurers can hold will enhance their risk management capabilities.

- Clarification of regulatory guidelines for specific types of bond forwards: Providing clearer guidelines will reduce ambiguity and simplify compliance procedures.

- Simplified reporting requirements: Reducing the complexity of reporting requirements will lower administrative burdens and free up resources.

- Adoption of international best practices: Aligning Indian regulations with global best practices will enhance efficiency and competitiveness.

The Role of IRDAI (Insurance Regulatory and Development Authority of India)

The IRDAI plays a pivotal role in evaluating and implementing these proposed changes. The IRDAI's regulatory framework directly influences the operational efficiency and risk management capabilities of Indian insurance companies. The authority's decisions regarding policy changes will significantly impact the future of the Indian insurance industry. IRDAI's responsiveness to the needs of the industry will determine whether the sector can achieve its full potential in the global market. Positive policy implementation will foster a more robust and competitive Indian insurance landscape.

Conclusion

The call for regulatory relief on bond forwards for Indian insurers stems from a need to enhance risk management, improve investment performance, and boost international competitiveness. Easing restrictions would allow insurers to better manage interest rate risks, optimize their investment strategies, and participate more effectively in the global market. The potential benefits are substantial. The IRDAI's role in enacting these changes will be crucial in shaping the future of the Indian insurance sector. The push for regulatory relief on bond forwards is vital for the ongoing growth and stability of India's insurance sector. Understanding these proposed changes and their potential impact is essential for all stakeholders. Stay informed about the latest developments concerning bond forwards and their implications for Indian insurers. Further research into regulatory relief and its effects on Indian insurance investments is strongly recommended.

Featured Posts

-

Uy Scuti Young Thugs New Album Expected Release Date

May 09, 2025

Uy Scuti Young Thugs New Album Expected Release Date

May 09, 2025 -

Psg Formacioni Me I Forte Ne Gjysmefinalet E Liges Se Kampioneve

May 09, 2025

Psg Formacioni Me I Forte Ne Gjysmefinalet E Liges Se Kampioneve

May 09, 2025 -

Woman 23 Claims To Be Madeleine Mc Cann Dna Test Results Released

May 09, 2025

Woman 23 Claims To Be Madeleine Mc Cann Dna Test Results Released

May 09, 2025 -

R3 2

May 09, 2025

R3 2

May 09, 2025 -

3e Ligne De Tram A Dijon Adoption Du Projet De Concertation

May 09, 2025

3e Ligne De Tram A Dijon Adoption Du Projet De Concertation

May 09, 2025