Indian Stock Market Today: Sensex, Nifty Performance And Analysis

Table of Contents

Sensex Performance Today: A Detailed Look

The Sensex opened at 65,200 today, showing an initial positive sentiment. However, following the RBI's announcement, the index experienced a downturn, closing at 64,850, a decrease of 0.5%.

- Opening Value: 65,200

- Closing Value: 64,850

- Percentage Change: -0.5%

- Intraday High: 65,350

- Intraday Low: 64,700

- Volume Traded: 1.2 billion shares

Key Influencing Factors:

- RBI Interest Rate Hike: The unexpected increase in interest rates significantly impacted investor sentiment, leading to profit-booking and a decline in the Sensex.

- Global Market Trends: A slight downturn in the US markets also contributed to the negative sentiment in the Indian market.

- Banking Sector Performance: The banking sector, particularly sensitive to interest rate changes, experienced a decline, pulling down the overall Sensex performance.

- IT Sector Resilience: Despite the overall negative trend, the IT sector showed some resilience, supported by positive global tech earnings reports.

(Insert a line graph here visually representing the Sensex's intraday fluctuations)

Nifty 50 Performance Analysis: Insights and Trends

The Nifty 50 index mirrored the Sensex's performance, opening at 19,300 and closing at 19,150, a decline of 0.8%.

- Opening Value: 19,300

- Closing Value: 19,150

- Percentage Change: -0.8%

- Intraday High: 19,380

- Intraday Low: 19,080

- Volume Traded: 1 billion shares

Sector-wise Performance:

- Top Performers: FMCG and Pharma sectors showed relative resilience.

- Bottom Performers: Banking and Auto sectors were the hardest hit.

Comparison with Sensex:

Both the Sensex and Nifty 50 showed similar negative trends today, reflecting a broad-based market correction influenced by the RBI's announcement.

(Insert a line graph here visually representing the Nifty 50's intraday movements)

Factors Affecting the Indian Stock Market Today

Several factors contributed to the Indian stock market's performance today:

- Global Economic Conditions: Global uncertainties surrounding inflation and potential recessionary pressures influenced investor sentiment.

- Domestic Economic Indicators: While recent GDP growth figures were positive, the RBI's interest rate hike signals a cautious approach to managing inflation.

- Government Policies and Regulations: The RBI's policy decision was the primary driver of today's market movement.

- Investor Sentiment: The prevailing investor sentiment shifted from bullish to cautiously bearish following the RBI announcement.

Conclusion: Your Guide to the Indian Stock Market Today

Today's Indian stock market saw a dip, with both the Sensex and Nifty 50 experiencing negative growth primarily driven by the RBI's interest rate hike and influenced by global market uncertainties. While the banking and auto sectors were negatively impacted, sectors like FMCG and Pharma showed resilience. To stay updated on the ever-changing landscape of the Indian Stock Market, including daily Sensex and Nifty analysis, we encourage you to check back regularly for updates on the Indian Stock Market Today and subscribe to our daily market analysis. Stay informed about Indian Stock Market updates and gain insights into daily Sensex and Nifty performance.

Featured Posts

-

Prayer Vigil For Madeleine Mc Cann To Have Enhanced Police Presence After Stalking Reports

May 09, 2025

Prayer Vigil For Madeleine Mc Cann To Have Enhanced Police Presence After Stalking Reports

May 09, 2025 -

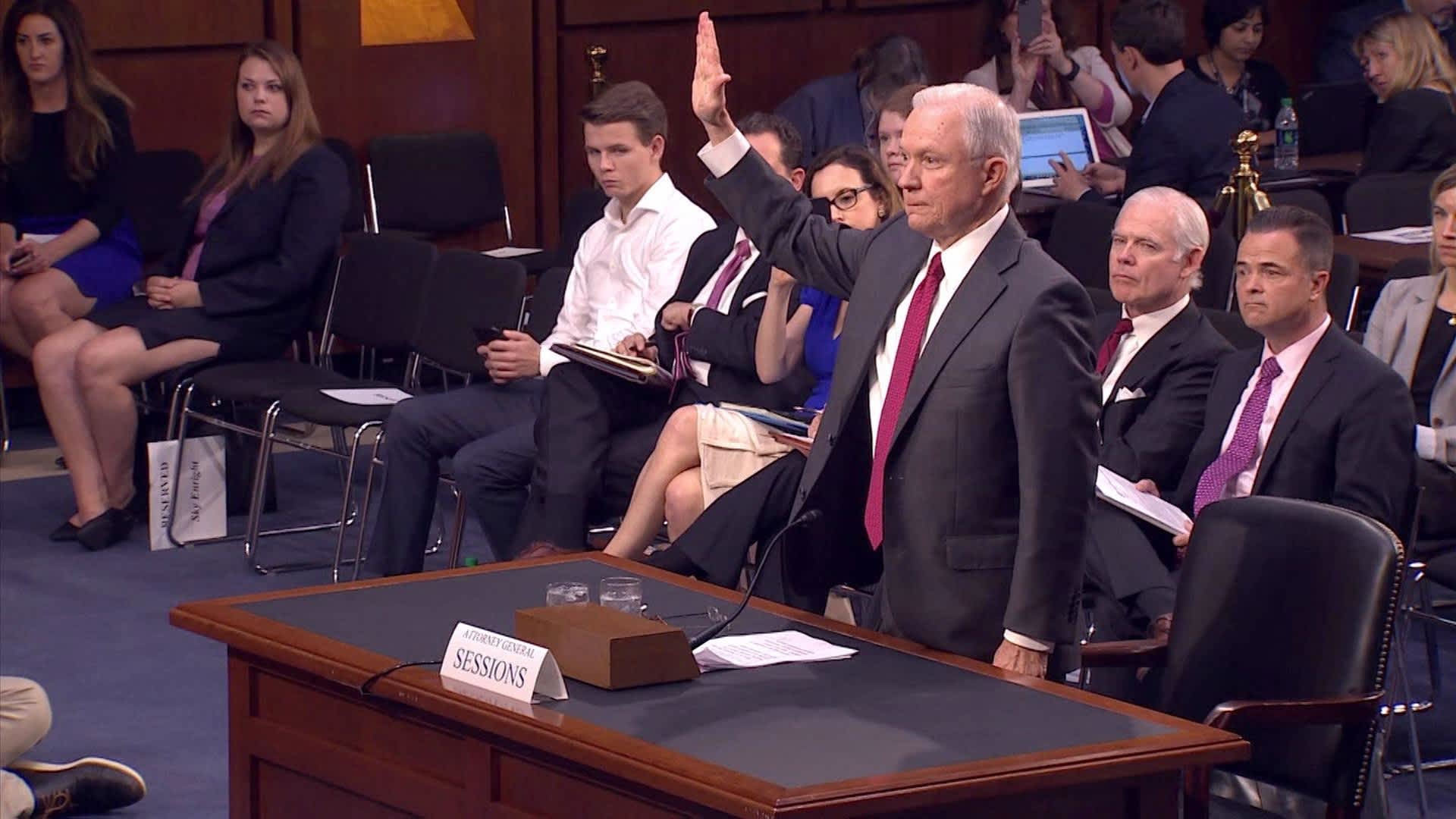

Attorney Generals Dire Warning To Those Opposing Donald Trump

May 09, 2025

Attorney Generals Dire Warning To Those Opposing Donald Trump

May 09, 2025 -

Edmonton Unlimited A New Strategy For Global Tech Innovation

May 09, 2025

Edmonton Unlimited A New Strategy For Global Tech Innovation

May 09, 2025 -

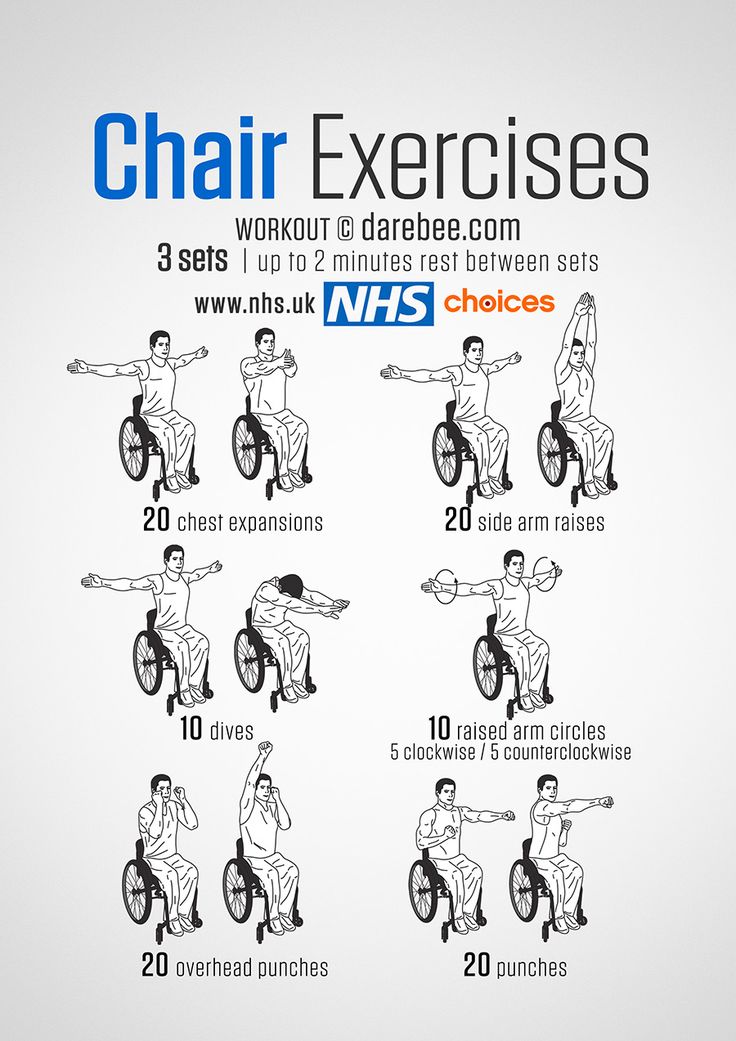

Navigating The Elizabeth Line A Guide For Wheelchair Users

May 09, 2025

Navigating The Elizabeth Line A Guide For Wheelchair Users

May 09, 2025 -

Is Benson Boone Copying Harry Styles A Detailed Look

May 09, 2025

Is Benson Boone Copying Harry Styles A Detailed Look

May 09, 2025