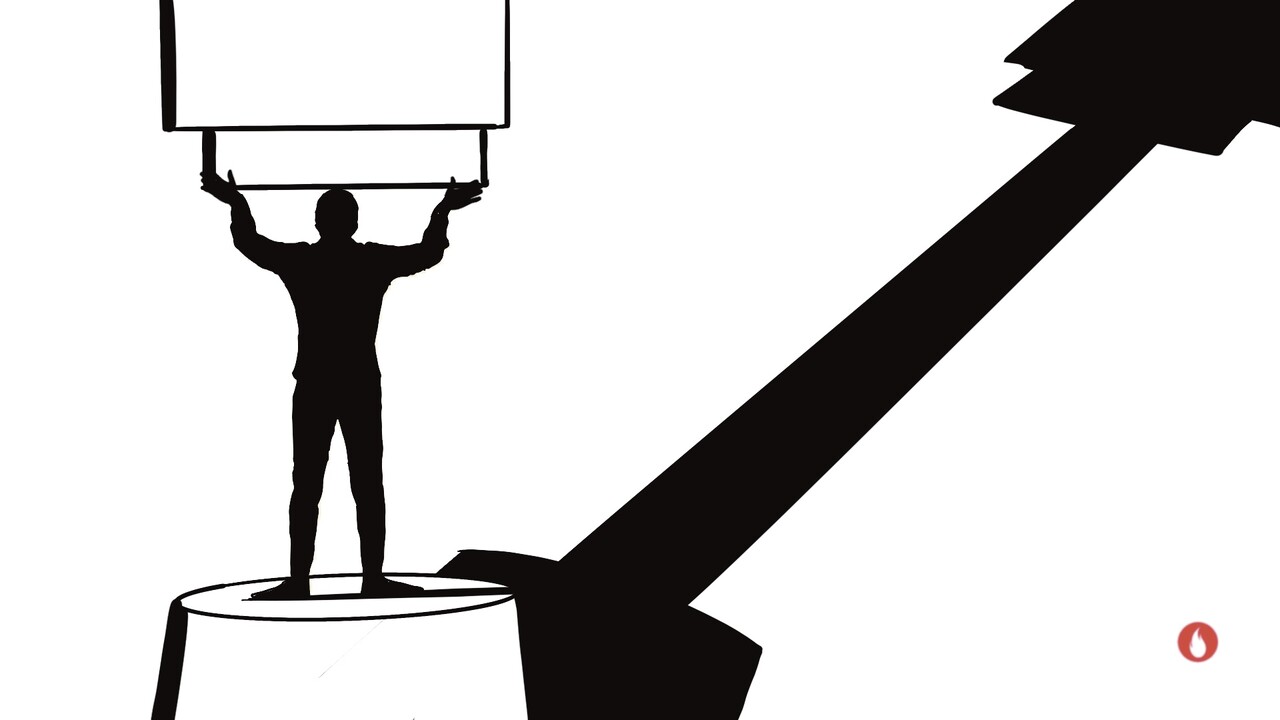

India's Bullish Market: Nifty's Growth And Future Prospects

Table of Contents

Nifty 50's Recent Performance and Key Drivers

The Nifty 50 index has demonstrated impressive growth in recent times. For example, [Insert specific data: e.g., "Over the past year, the Nifty 50 has witnessed a X% increase, surpassing the Y mark in [Month, Year]."]. This positive performance is fueled by several key drivers:

-

Robust GDP Growth: India's consistently strong Gross Domestic Product (GDP) growth provides a solid foundation for market expansion. [Insert specific data: e.g., "India's GDP growth consistently exceeded X% in the last [period], indicating a healthy economic environment"].

-

Significant FII and DII Inflows: Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII) have shown significant confidence in the Indian market, injecting substantial capital. [Insert specific data illustrating FII/DII inflows]. This influx demonstrates belief in India's long-term growth potential.

-

Government Initiatives and Policy Reforms: Pro-growth government policies and structural reforms have created a favorable investment climate. Examples include [mention specific government initiatives and their positive impact on the market]. These reforms enhance investor confidence and attract both domestic and international investment.

-

Improving Macroeconomic Indicators: Positive trends in key macroeconomic indicators like inflation and interest rates further boost investor sentiment. [Insert data showing improvements in inflation and interest rates]. Stable macroeconomic conditions contribute to a more predictable and attractive investment environment.

-

Sectoral Success Stories: Specific sectors like IT, Pharmaceuticals (Pharma), and Fast-Moving Consumer Goods (FMCG) have been particularly strong contributors to the Nifty's rise. The robust performance of these sectors reflects the underlying strength of the Indian economy.

Analyzing Sector-Specific Growth within the Nifty

While the Nifty 50 shows overall growth, analyzing sector-specific performance provides a more nuanced understanding of the market's dynamics.

-

IT Sector: The Indian IT sector continues to thrive, driven by global demand for technology services and software solutions. However, potential risks include global economic slowdown and competition from other markets.

-

Pharma Sector: The pharmaceutical sector demonstrates strong growth potential, fuelled by increasing healthcare spending and the emergence of generic drug manufacturers. Challenges include regulatory hurdles and pricing pressures.

-

FMCG Sector: The FMCG sector benefits from rising disposable incomes and increasing consumption patterns within India's large population. However, competition and inflation remain key factors to watch.

-

Banking Sector: The banking sector's performance reflects the overall health of the economy. Growth opportunities exist in lending and financial services, but challenges such as Non-Performing Assets (NPAs) must be considered. Understanding the financial performance of each bank within the Nifty is crucial for strategic investment.

Analyzing these sectors independently allows investors to create diversified portfolios and reduce overall risk.

Challenges and Risks Facing the Indian Stock Market

Despite the bullish sentiment, several challenges and risks could impact the Nifty's future performance:

-

Global Economic Uncertainty: Global economic slowdowns or geopolitical instability can negatively affect the Indian market, impacting investor confidence and capital flows.

-

Inflationary Pressures and Interest Rate Hikes: Rising inflation can erode purchasing power and potentially lead to interest rate hikes, impacting economic growth and market valuation.

-

Geopolitical Risks: Global geopolitical events can create uncertainty and volatility in the market.

-

Regulatory Changes: Changes in government regulations can influence the performance of specific sectors, creating both opportunities and challenges.

-

Market Corrections and Volatility: Even in a bullish market, corrections and periods of volatility are expected. Investors must be prepared for market fluctuations.

Future Prospects and Investment Opportunities in Nifty

Despite the inherent risks, the long-term outlook for the Nifty 50 remains positive, driven by India's strong fundamentals and growth potential.

-

Promising Sectors for Investment: Sectors like IT, renewable energy, and infrastructure offer promising long-term investment opportunities.

-

Diversification and Risk Management: Diversifying your investment portfolio across different sectors and asset classes is crucial to mitigate risk.

-

Investment Strategies: Investment strategies should be tailored to individual risk tolerance and financial goals. Conservative investors might prefer blue-chip stocks, while more aggressive investors may explore growth stocks.

-

Responsible Investment: Thorough research and understanding of individual company performance and market trends are crucial.

Conclusion:

India's bullish market, reflected in the Nifty 50's growth, presents significant investment opportunities. While the potential for continued growth is high, investors must carefully consider the challenges and risks discussed above. By understanding the key drivers, analyzing sector-specific performances, and adopting appropriate risk management strategies, investors can navigate this dynamic market effectively. Further research into specific companies within the Nifty 50 and careful consideration of your risk tolerance are recommended before making any investment decisions. Remember to consult a qualified financial advisor before making any investment choices. Capitalize on India's bullish market and explore the investment opportunities presented by the Nifty 50 – but always invest wisely.

Featured Posts

-

The Bold And The Beautiful Spoilers February 20 Liams Loneliness Finns Warning

Apr 24, 2025

The Bold And The Beautiful Spoilers February 20 Liams Loneliness Finns Warning

Apr 24, 2025 -

Middle Managers The Unsung Heroes Of Employee Development And Business Success

Apr 24, 2025

Middle Managers The Unsung Heroes Of Employee Development And Business Success

Apr 24, 2025 -

South Carolina Voters Confrontation With Rep Nancy Mace Details And Reactions

Apr 24, 2025

South Carolina Voters Confrontation With Rep Nancy Mace Details And Reactions

Apr 24, 2025 -

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 24, 2025

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 24, 2025 -

A Geographic Analysis Of The Countrys Newest Business Hot Spots

Apr 24, 2025

A Geographic Analysis Of The Countrys Newest Business Hot Spots

Apr 24, 2025

Latest Posts

-

Stallones Missed Opportunity The 1978 Oscar Winner Coming Home

May 12, 2025

Stallones Missed Opportunity The 1978 Oscar Winner Coming Home

May 12, 2025 -

Sylvester Stallone Action Thriller Armor Now Streaming Free

May 12, 2025

Sylvester Stallone Action Thriller Armor Now Streaming Free

May 12, 2025 -

Sylvester Stallones Regret Turning Down The 1978 Best Picture Coming Home

May 12, 2025

Sylvester Stallones Regret Turning Down The 1978 Best Picture Coming Home

May 12, 2025 -

Find Kojak On Itv 4 Episode Guide And Listings

May 12, 2025

Find Kojak On Itv 4 Episode Guide And Listings

May 12, 2025 -

Find Kojak On Itv 4 A Comprehensive Guide To Episodes And Showtimes

May 12, 2025

Find Kojak On Itv 4 A Comprehensive Guide To Episodes And Showtimes

May 12, 2025