Indonesia's Falling Reserves: A Deep Dive Into The Rupiah Crisis

Table of Contents

Historical Context: Lessons from Past Rupiah Crises

The 1997-98 Asian Financial Crisis serves as a stark reminder of the devastating consequences of a Rupiah crisis. Triggered by a combination of factors, including unsustainable levels of debt, capital flight, and currency speculation, the crisis led to a sharp devaluation of the Indonesian Rupiah, triggering a deep recession. The crisis exposed significant vulnerabilities in Indonesia's financial system, leading to widespread bank failures and economic hardship.

- Impact on the Indonesian Economy: The 1997-98 crisis resulted in a sharp contraction in GDP, soaring inflation, and massive unemployment. Many businesses collapsed, and poverty levels increased dramatically.

- Social and Political Consequences: The crisis fueled social unrest, political instability, and a loss of public confidence in the government. The economic turmoil contributed to widespread social upheaval and a period of political uncertainty.

- Government Response and Effectiveness: The Indonesian government's initial response to the crisis was widely criticized as being too slow and ineffective. The International Monetary Fund (IMF) provided a bailout package, but its conditions were controversial and contributed to further economic hardship. The experience highlighted the need for stronger regulatory frameworks and proactive crisis management strategies.

Current Economic Indicators: A Warning Sign?

Current economic indicators paint a mixed picture, but some trends raise concerns about the potential for another Rupiah crisis. While Indonesia's economy has shown resilience in recent years, a declining trend in foreign exchange reserves is a significant cause for concern. The current account deficit, while not as severe as in the pre-1998 crisis, remains a vulnerability. Global economic uncertainty and fluctuating commodity prices—crucial to Indonesia's export-oriented economy—further exacerbate the situation.

- Key Economic Data: Analyzing data on inflation, GDP growth, the trade balance, and foreign direct investment (FDI) is critical. A comparison of these indicators with those preceding the 1997-98 crisis reveals potential parallels and highlights areas of vulnerability. (Charts and graphs visualizing this data would be included here in a full article).

- Comparison with Past Crises: While the current situation is not an exact replica of the 1997-98 crisis, key similarities in certain economic indicators warrant caution and proactive measures. A detailed comparative analysis would help assess the likelihood and potential severity of a future crisis.

Contributing Factors to Falling Reserves

Several factors contribute to the decline in Indonesia's foreign exchange reserves. The impact of global capital flows, influenced by global economic uncertainty and investor sentiment, plays a significant role. Government spending policies and debt management strategies also influence reserve levels. Domestic and international factors, including speculation and the global demand for the Rupiah, influence its value and impact reserves.

- Key Vulnerabilities: Indonesia's reliance on commodity exports, its relatively high level of external debt, and its susceptibility to global capital flows all contribute to its vulnerability. Analyzing these vulnerabilities is crucial in developing effective mitigation strategies.

- Impact of Specific Policies: Government policies related to fiscal management, monetary policy, and trade have a direct impact on the country's foreign exchange reserves. Evaluating the effectiveness of these policies is crucial in preventing future crises.

- Speculation and Investor Sentiment: Speculative attacks and shifts in investor sentiment can significantly impact the Rupiah's value and lead to rapid depletion of foreign exchange reserves. Understanding these dynamics is crucial for managing risk.

Potential Consequences and Mitigation Strategies

Further depletion of foreign exchange reserves could have severe consequences for Indonesia's economy and stability. A sharp devaluation of the Rupiah could lead to increased inflation, higher import costs, and reduced economic growth. It could also trigger social unrest and political instability. Addressing the falling reserves requires a multi-pronged approach involving government policy adjustments, international cooperation, and structural reforms.

- Potential Scenarios: Different scenarios, ranging from a manageable slowdown to a full-blown crisis, must be considered to prepare for various contingencies. Probability assessments of each scenario are vital for effective policymaking.

- Policy Recommendations: This could include fiscal consolidation measures, reforms to improve the business environment, diversification of exports, and strengthening regulatory frameworks for the financial sector.

- Structural Reforms: Implementing structural reforms to enhance the resilience of the Indonesian economy is essential for long-term stability. This includes improving governance, reducing corruption, and investing in human capital.

Conclusion

This article has examined the concerning decline in Indonesia's foreign exchange reserves and the potential for a renewed Rupiah crisis. We explored the historical context, analyzed current economic indicators, identified contributing factors, and discussed potential consequences and mitigation strategies. Understanding the complexities of Indonesia's economic situation is crucial to navigating the challenges ahead. To stay informed about the evolving situation and its implications for Indonesia's future, continue to monitor key economic indicators and follow reputable financial news sources for updates on the Rupiah crisis and its potential impact on the Indonesian economy. Regularly researching and understanding the intricacies of the Rupiah crisis is vital for investors and policymakers alike.

Featured Posts

-

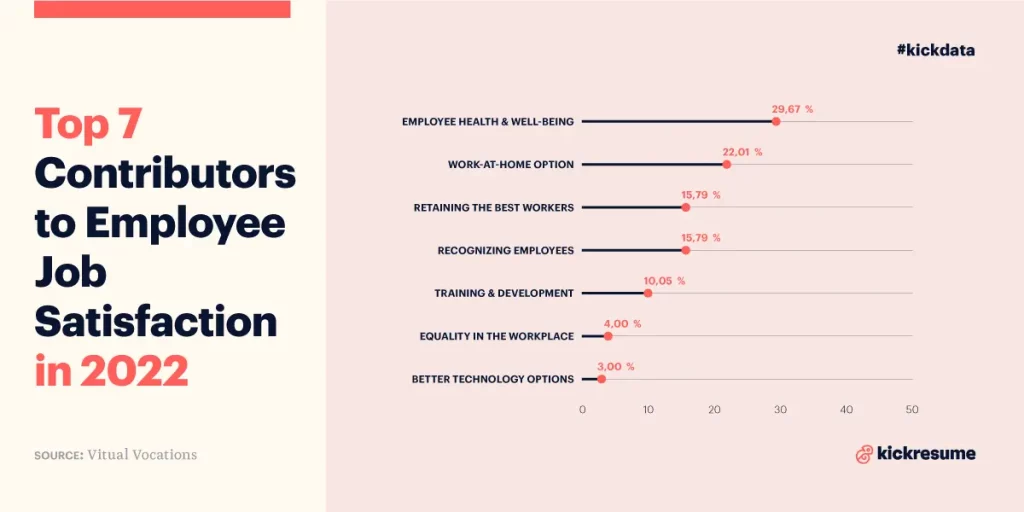

Middle Managers Key Contributors To Company Performance And Employee Satisfaction

May 09, 2025

Middle Managers Key Contributors To Company Performance And Employee Satisfaction

May 09, 2025 -

Offres D Emploi A Dijon Rooftop Et Restaurants

May 09, 2025

Offres D Emploi A Dijon Rooftop Et Restaurants

May 09, 2025 -

Polish Woman And Accomplice Deny Charges In Mc Cann Home Incident

May 09, 2025

Polish Woman And Accomplice Deny Charges In Mc Cann Home Incident

May 09, 2025 -

Edmonton Oilers Lose Leading Goal Scorer Leon Draisaitl To Injury

May 09, 2025

Edmonton Oilers Lose Leading Goal Scorer Leon Draisaitl To Injury

May 09, 2025 -

A Nonbinary Life Lost Examining The Death Of Americas First

May 09, 2025

A Nonbinary Life Lost Examining The Death Of Americas First

May 09, 2025