Infineon's (IFX) Lower-Than-Expected Sales Guidance: Impact Of Trump Tariffs

Table of Contents

Infineon's Revised Sales Projections and Market Reaction

Infineon's downward revision of its sales guidance sent shockwaves through the financial markets. The company announced a [insert percentage]% decrease in projected sales for [insert timeframe], primarily impacting its [insert specific product lines, e.g., automotive, industrial power control] segments. This resulted in a revised financial forecast showing [insert specific figures, e.g., reduced earnings per share, lower revenue projections].

The market reacted swiftly to this news. Infineon's stock price experienced a [insert percentage]% drop immediately following the announcement, reflecting investor concerns about the company's future performance. Analyst sentiment also shifted, with several firms downgrading their ratings and lowering price targets for IFX stock.

- Specific figures: Sales decreased by [insert percentage]% compared to previous projections, resulting in a [insert dollar amount] shortfall in revenue.

- Analyst comments: [Insert quotes from reputable analysts, mentioning specific concerns and ratings changes].

- Stock price movement: [Include a chart or graph illustrating the stock price fluctuation around the announcement date].

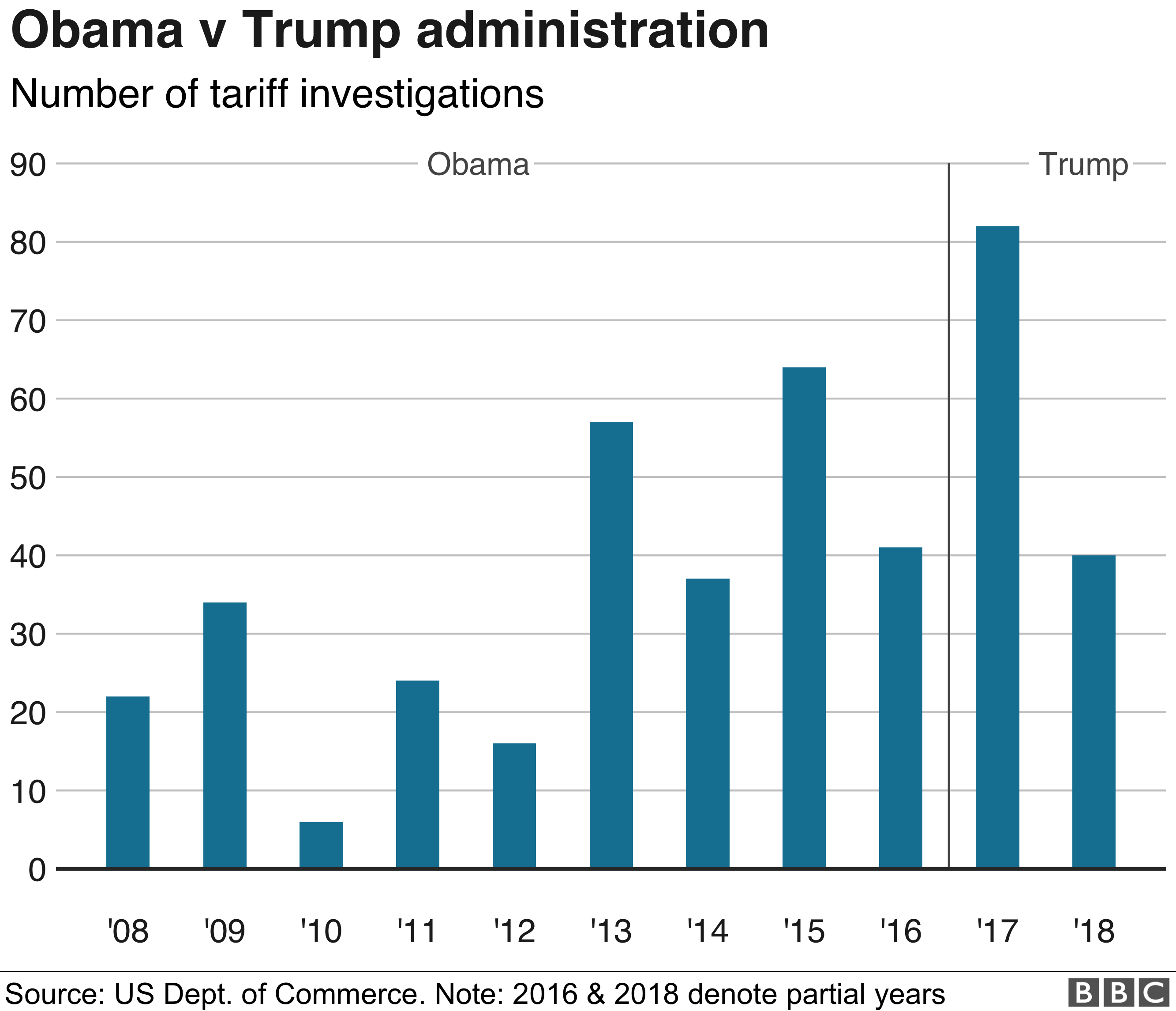

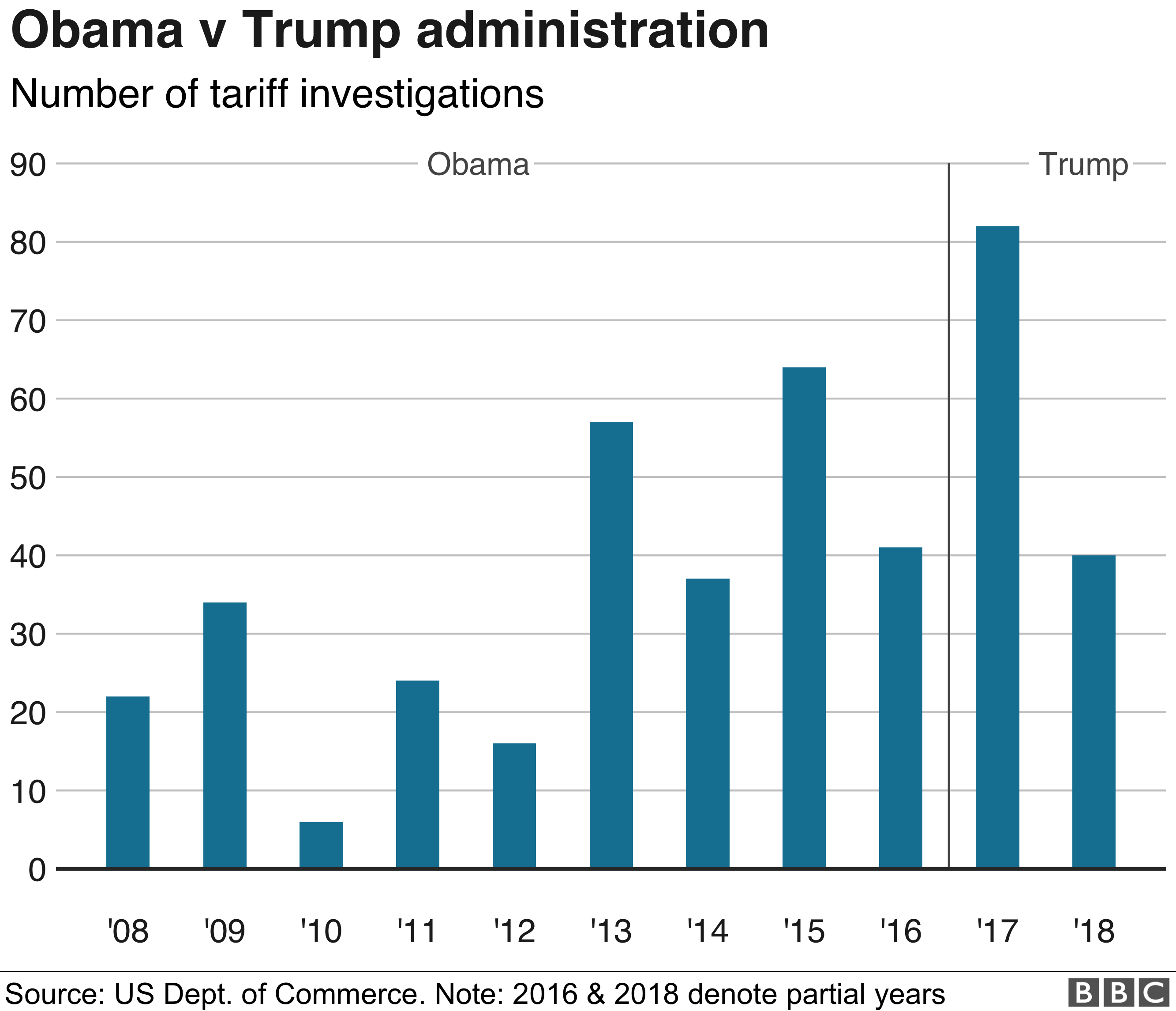

The Role of Trump-Era Tariffs on Infineon's Operations

The Trump administration's tariffs significantly impacted Infineon's operations. The company faced both import tariffs on raw materials crucial for semiconductor production (e.g., [insert specific materials]) and export tariffs on finished goods shipped to key markets like the US and China. These tariffs created supply chain disruptions, increased production costs, and reduced competitiveness.

- Specific tariff rates: Import tariffs on [specific materials] were at [percentage]%, while export tariffs on [specific products] reached [percentage]%.

- Affected regions: The tariffs impacted trade with the US, China, and [other relevant regions].

- Impact on costs: Increased costs resulted in [explain impact, e.g., higher prices for customers, reduced profit margins].

Infineon's Strategies to Mitigate Tariff Impacts

To counteract the negative effects of the tariffs, Infineon implemented several strategies. These included diversifying its supply chains by sourcing raw materials from alternative regions, relocating some production facilities to mitigate export tariffs, and undertaking cost-cutting measures to maintain profitability.

- Supply chain diversification: Infineon shifted sourcing of [specific materials] from [original region] to [new region(s)].

- Cost-cutting measures: The company implemented [examples, e.g., streamlining operations, reducing workforce].

- Assessment of success: While these strategies helped partially mitigate the impact, the overall effectiveness is still being evaluated. The long-term impact on Infineon’s business model remains to be seen.

Broader Implications for the Semiconductor Industry

The Trump-era tariffs had a far-reaching impact on the global semiconductor industry. Many companies faced similar challenges, leading to increased production costs, reduced competitiveness, and uncertainty in the market. The geopolitical tensions underlying the trade war also created instability and risk for semiconductor manufacturers globally.

- Other affected companies: [List examples of other semiconductor companies significantly impacted by tariffs].

- Long-term consequences: The tariffs contributed to a restructuring of global supply chains and could potentially hinder the long-term competitiveness of the semiconductor industry.

- Impact on global trade: The tariffs exacerbated trade tensions and raised questions about the future of free trade agreements.

Conclusion: Infineon's (IFX) Lower-Than-Expected Sales Guidance: Analyzing the Impact of Trump Tariffs

In conclusion, Infineon's lower-than-expected sales guidance is directly linked to the lingering impact of Trump-era tariffs. The tariffs created supply chain disruptions, increased costs, and reduced the company's competitiveness. While Infineon implemented mitigation strategies, the full impact on its financial performance and the broader semiconductor industry remains to be seen. Understanding the effect of trade policies on global businesses like Infineon is crucial for investors and industry analysts alike. To stay informed about Infineon's financial performance and the ongoing effects of trade policies on the semiconductor sector, regularly follow Infineon's sales guidance updates, financial reports, and news related to trade agreements and the impact of tariffs on Infineon.

Featured Posts

-

From Entrepreneur To Billionaire Tracing Elon Musks Financial Success

May 09, 2025

From Entrepreneur To Billionaire Tracing Elon Musks Financial Success

May 09, 2025 -

Pochemu Starmer Makron Merts I Tusk Ne Poedut V Kiev 9 Maya

May 09, 2025

Pochemu Starmer Makron Merts I Tusk Ne Poedut V Kiev 9 Maya

May 09, 2025 -

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025 -

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

May 09, 2025

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

May 09, 2025 -

Wave Of Car Break Ins Hits Elizabeth City Apartment Complexes

May 09, 2025

Wave Of Car Break Ins Hits Elizabeth City Apartment Complexes

May 09, 2025