Institutional XRP Investment: The Trump Factor

Table of Contents

The Trump Administration's Stance on Cryptocurrencies

The Trump administration's approach to cryptocurrencies, including XRP, was characterized by a notable lack of a clear, unified policy. This ambiguity significantly impacted the landscape for institutional XRP investment. Keywords related to this section include: Trump Cryptocurrency Policy, SEC XRP, Ripple Lawsuit, Regulatory Scrutiny, Crypto Regulation.

- Unclear Regulatory Framework: The administration lacked a cohesive strategy for regulating cryptocurrencies, leaving many aspects undefined. This uncertainty created a challenging environment for institutional investors, who typically prefer clear regulatory frameworks before making substantial investments.

- Key Figures and Opinions: While some within the administration expressed interest in blockchain technology, there was no consistent, high-level support for cryptocurrencies. This absence of strong, vocal advocacy left the regulatory path unclear.

- The Ripple Lawsuit's Shadow: The ongoing SEC lawsuit against Ripple, the company behind XRP, cast a long shadow during the Trump era. The uncertainty surrounding the outcome created considerable risk for institutional investors considering XRP. While the lawsuit wasn't directly initiated by the Trump administration, its progression and lack of resolution during that period contributed to the uncertainty surrounding XRP's regulatory status.

- Impact on Institutional Investment: The combination of regulatory uncertainty and the Ripple lawsuit likely deterred many institutional investors from significant XRP investments during this period. The perceived risk outweighed the potential rewards for many risk-averse firms.

Impact on Institutional Investor Sentiment

The Trump administration's ambiguous stance significantly affected institutional investor sentiment towards XRP. Keywords for this section are: Institutional Investors XRP, Hedge Funds XRP, Pension Funds XRP, Risk Tolerance, Market Volatility, XRP Adoption.

- Risk-Averse Nature of Institutions: Institutional investors, such as hedge funds and pension funds, are inherently risk-averse. Regulatory uncertainty is a major deterrent, as it makes it difficult to accurately assess and manage risk.

- Influence on Investment Strategies: The lack of clear regulatory frameworks during the Trump era led many institutional investors to adopt a "wait-and-see" approach, delaying or avoiding XRP investments altogether.

- Case Studies (Illustrative): While specific case studies of institutional XRP investment during this time are often kept private, the overall market trend reflects a cautious approach. Many institutions likely prioritized assets with clearer regulatory landscapes.

- Correlation with XRP Price Fluctuations: The uncertainty surrounding XRP's regulatory status and the overall cryptocurrency market volatility during the Trump era undoubtedly contributed to fluctuations in XRP's price. This price volatility further discouraged institutional investors.

Post-Trump Era: Navigating the Evolving Regulatory Landscape

The Biden administration's approach to cryptocurrency regulation represents a shift from the Trump era's ambiguity. Keywords for this section include: Biden Cryptocurrency Policy, Regulatory Clarity, Future of XRP, XRP Price, Long-Term Investment, Crypto Market Outlook.

- Shifting Regulatory Landscape: The Biden administration has shown a more proactive approach to cryptocurrency regulation, focusing on establishing clearer frameworks. While still evolving, this shift towards greater clarity offers some optimism for institutional investors.

- Current Regulatory Environment: The current regulatory environment is still developing, but the increased focus on providing clarity is a positive sign. This could lead to increased institutional investment in the future.

- Potential for Increased Clarity: As regulatory frameworks become more defined, the risks associated with XRP investment may decrease, attracting a wider range of institutional investors.

- Long-Term Prospects: The long-term prospects for institutional XRP investment depend heavily on the clarity and stability of the regulatory landscape. Increased clarity will likely lead to greater institutional adoption.

The Future of Institutional XRP Investment

Understanding how to approach institutional XRP investment requires careful consideration. Keywords here are: XRP Investment Strategy, Diversification, Risk Management, Long Term Growth, Crypto Portfolio.

- Thorough Due Diligence: Before any institutional XRP investment, thorough due diligence is paramount. This includes a comprehensive analysis of the regulatory landscape, technical aspects of the XRP ledger, and the overall market outlook.

- Benefits and Risks: XRP offers potential benefits such as speed and lower transaction fees. However, risks remain, including regulatory uncertainty and market volatility.

- Diversification Strategies: Diversification is crucial for mitigating risk. Institutional investors should consider XRP as only one component of a broader, diversified cryptocurrency portfolio.

- Long-Term Growth Potential: While predicting the future price of XRP is impossible, its long-term growth potential is tied to broader adoption of blockchain technology and its potential use cases.

Conclusion

The Trump administration's ambiguous approach to cryptocurrency regulation significantly impacted institutional investor sentiment towards XRP. The lack of clear guidelines created a risk-averse environment, hindering substantial investment. However, the shift towards more defined regulatory frameworks under the Biden administration offers a more optimistic outlook for the future of institutional XRP investment. Understanding the political and regulatory factors affecting XRP is crucial for informed decision-making. Conduct thorough research and consult with financial advisors before making any institutional XRP investment. Stay updated on the latest developments in the cryptocurrency market to navigate the complexities of this evolving asset class and make sound judgments regarding institutional XRP investment.

Featured Posts

-

April 16 2025 Daily Lotto Winning Numbers

May 07, 2025

April 16 2025 Daily Lotto Winning Numbers

May 07, 2025 -

Building A Resilient Future The Third Ldc Future Forums Action Plan

May 07, 2025

Building A Resilient Future The Third Ldc Future Forums Action Plan

May 07, 2025 -

Remembering Skype A Pioneer In Communication Technology

May 07, 2025

Remembering Skype A Pioneer In Communication Technology

May 07, 2025 -

Onetu I Newsweek Podcast Stan Wyjatkowy Regularne Aktualizacje

May 07, 2025

Onetu I Newsweek Podcast Stan Wyjatkowy Regularne Aktualizacje

May 07, 2025 -

Konklawe Wedlug Ks Sliwinskiego Czynniki Decydujace O Wyborze Papieza

May 07, 2025

Konklawe Wedlug Ks Sliwinskiego Czynniki Decydujace O Wyborze Papieza

May 07, 2025

Latest Posts

-

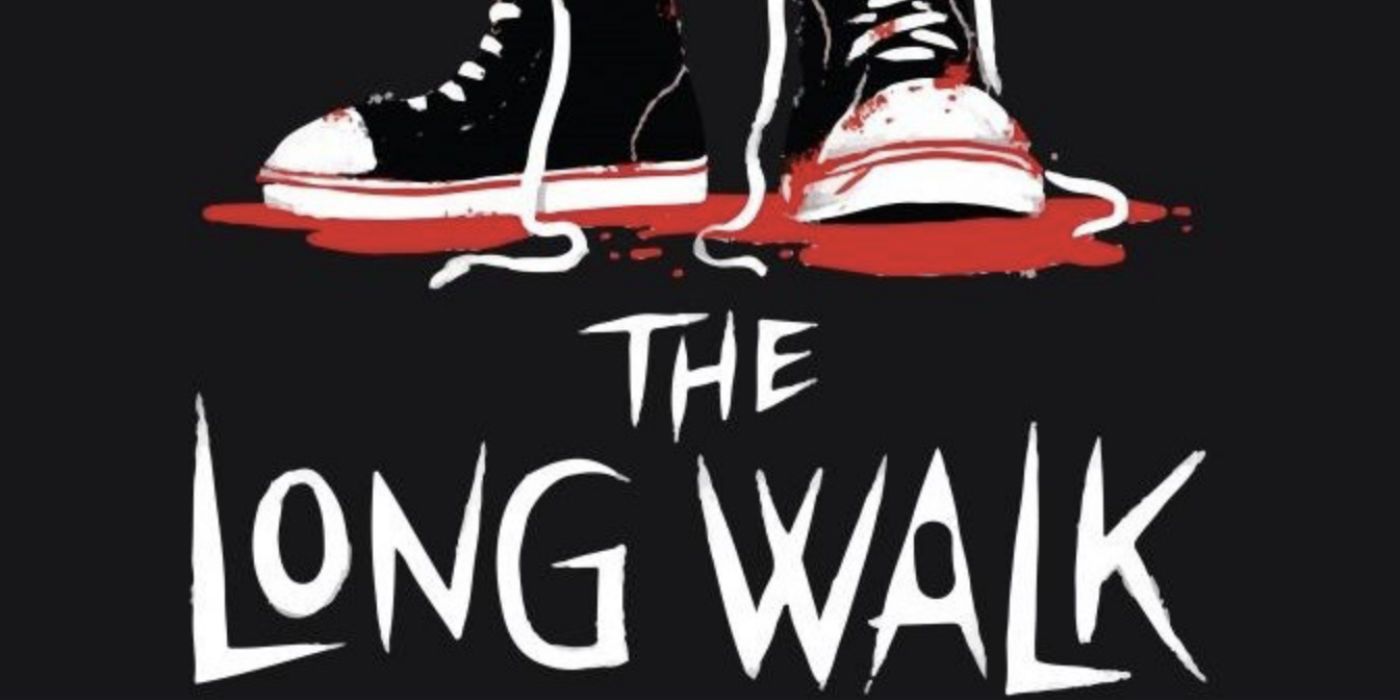

Mark Hamills New Role First Trailer For Stephen Kings The Long Walk

May 08, 2025

Mark Hamills New Role First Trailer For Stephen Kings The Long Walk

May 08, 2025 -

The Long Walk Trailer Reveals Stephen Kings Brutal Survival Story

May 08, 2025

The Long Walk Trailer Reveals Stephen Kings Brutal Survival Story

May 08, 2025 -

Glen Powells Physical And Mental Preparation For The Running Man

May 08, 2025

Glen Powells Physical And Mental Preparation For The Running Man

May 08, 2025 -

The Running Man Glen Powells Fitness Regime And Character Method

May 08, 2025

The Running Man Glen Powells Fitness Regime And Character Method

May 08, 2025 -

Glen Powells Bulletproof Transformation For The Running Man

May 08, 2025

Glen Powells Bulletproof Transformation For The Running Man

May 08, 2025