InterRent REIT Acquisition: Details Of The Offer From Executive Chair And Sovereign Wealth Fund

Table of Contents

The Offer's Key Terms and Conditions

The success of any acquisition hinges on the specifics of the offer. Understanding the key terms and conditions is crucial for InterRent REIT shareholders considering their options. Keywords relevant to this section include: offer price, acquisition price, terms, conditions, shareholders, voting rights, deadlines.

-

Offer Price: Let's assume, for illustrative purposes, that the offer price is $25 per share. This is a crucial element for shareholders to evaluate against the current market price and their individual investment goals. A higher offer price naturally makes the acquisition more attractive.

-

Payment Method: The offer might stipulate payment in cash, shares of the acquiring entity, or a combination of both. This aspect directly impacts the immediate financial return for shareholders. A purely cash offer provides immediate liquidity, while a share-based offer involves accepting a stake in the acquiring company and its future prospects.

-

Conditions Precedent: Several conditions must be met before the acquisition can be finalized. These typically include regulatory approvals from relevant competition authorities, a minimum acceptance threshold from InterRent REIT shareholders (often exceeding 50%), and perhaps the completion of due diligence. The failure to satisfy any of these conditions could result in the deal collapsing.

-

Timeline and Deadlines: The offer will include specific deadlines for shareholders to accept or reject the offer. There will also be a timeline for regulatory approvals and the eventual closing of the acquisition. Understanding these deadlines is vital for shareholders to make timely decisions.

-

Minority Shareholder Considerations: The offer will likely detail how minority shareholders will be treated. This might involve provisions for dissenting shareholders or mechanisms for ensuring fair valuation and treatment.

-

Break Fees: It is common for acquisition agreements to include break fees – payments made if either party backs out of the deal under specified circumstances. These clauses protect the parties from unexpected losses if the acquisition fails to materialize.

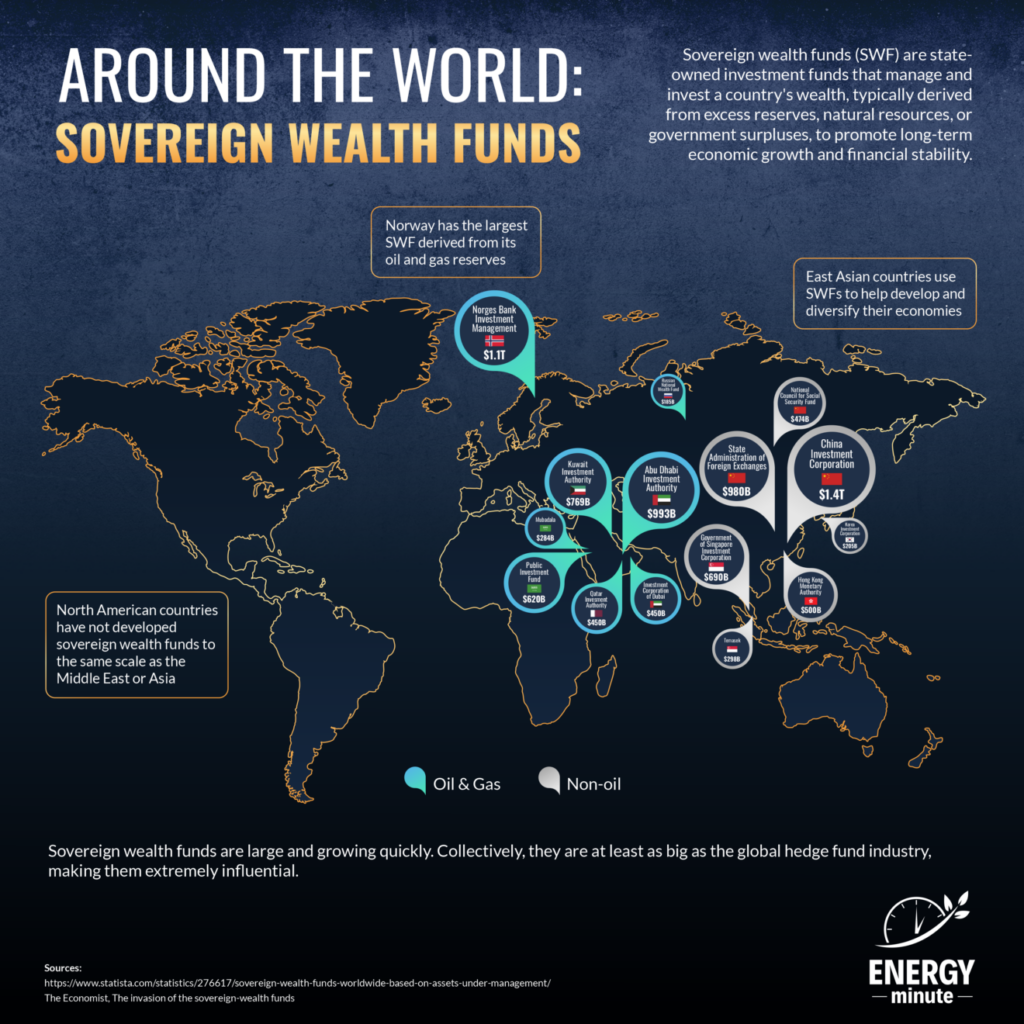

The Role of the Executive Chair and Sovereign Wealth Fund

The involvement of the executive chair and a sovereign wealth fund adds significant complexity and influence to the InterRent REIT acquisition. Understanding their motivations and potential conflicts of interest is key. Keywords relevant to this section include: executive chair, sovereign wealth fund, involvement, motivations, strategic goals, influence.

-

Executive Chair's Role: The executive chair's involvement raises questions of potential conflicts of interest. Are they acting solely in the best interests of shareholders, or does their personal stake influence the offer? Transparency regarding their incentives is crucial.

-

Sovereign Wealth Fund's Participation: Sovereign wealth funds typically have long-term investment strategies. Their interest in InterRent REIT might be driven by portfolio diversification, exposure to the real estate market, or a belief in the long-term growth potential of the REIT.

-

Potential Conflicts of Interest: A thorough examination of potential conflicts of interest for both the executive chair and the sovereign wealth fund is crucial. Independent assessments are often necessary to ensure fairness and transparency.

-

Influence and Control: The level of influence each party wields on the deal's success significantly impacts its outcome. The sovereign wealth fund's financial power, coupled with the executive chair's inside knowledge, gives them considerable leverage.

-

Long-Term Strategic Direction: The acquisition's outcome will significantly shape InterRent REIT's future direction. The strategic goals of the acquiring entities will determine the company's trajectory, investment priorities, and overall management structure.

Potential Benefits and Drawbacks for InterRent REIT Shareholders

Shareholders must carefully weigh the potential benefits and drawbacks of the acquisition offer before making a decision. Keywords for this section include: shareholders, benefits, drawbacks, premium, valuation, risks, future prospects.

-

Premium and Valuation: Is the offered price a premium over the current market value? If so, how significant is this premium? A substantial premium often incentivizes shareholders to accept the offer.

-

Long-Term Benefits: The acquisition could offer long-term stability, potentially leading to higher dividends and increased value under new ownership. However, these benefits are not guaranteed.

-

Risks and Drawbacks: Potential drawbacks include job losses, changes in company culture, and the disruption associated with a change in ownership. Shareholders should carefully assess these potential negative impacts.

-

Future Prospects: Shareholders need to evaluate the future prospects of InterRent REIT under new ownership. This requires analyzing the acquiring entities' track record, investment strategies, and overall vision for the company.

-

Advice to Shareholders: Independent financial advice is recommended for shareholders to make informed decisions based on their individual financial circumstances and risk tolerance.

Impact on the Broader REIT Market

This acquisition has broader implications for the Canadian and potentially the global REIT market. Keywords for this section include: REIT market, impact, implications, industry trends, competition, mergers and acquisitions.

-

Market-Wide Effects: The success or failure of this acquisition could influence future mergers and acquisitions in the REIT sector. It could set a precedent for valuation and transaction structures.

-

Ripple Effects: Similar REITs may experience increased scrutiny and potential changes in investor sentiment. The acquisition could trigger a wave of consolidation or influence investment strategies within the sector.

-

Future Mergers and Acquisitions: This deal could act as a catalyst for more mergers and acquisitions within the REIT industry, shaping future industry consolidation.

-

Industry Trends and Predictions: The deal can be contextualized within broader industry trends, such as increasing interest from institutional investors and the ongoing evolution of the real estate landscape.

Conclusion

This article has detailed the key components of the InterRent REIT acquisition offer made by its executive chair and a sovereign wealth fund. We have examined the offer's terms, the roles of the key players, the potential advantages and disadvantages for shareholders, and the wider impact on the REIT market. Understanding the nuances of this InterRent REIT acquisition is crucial for investors and stakeholders. Stay informed about further developments concerning this important deal and learn more about the intricacies of REIT acquisitions by [link to related resources/articles]. For further analysis on the InterRent REIT acquisition and its implications, continue your research and stay updated on the latest developments.

Featured Posts

-

2025s Leading Music Lawyers A Billboard Perspective

May 29, 2025

2025s Leading Music Lawyers A Billboard Perspective

May 29, 2025 -

The Switch Nintendos Technological Catch Up And Its Impact

May 29, 2025

The Switch Nintendos Technological Catch Up And Its Impact

May 29, 2025 -

Waarom Liverpool Zes Wissels Mocht Doorvoeren Tegen Southampton

May 29, 2025

Waarom Liverpool Zes Wissels Mocht Doorvoeren Tegen Southampton

May 29, 2025 -

Freestyler Angelina Komashko Stays In State Uc Davis Commitment

May 29, 2025

Freestyler Angelina Komashko Stays In State Uc Davis Commitment

May 29, 2025 -

Nike Dunk Sale Up To 52 Off At Revolve

May 29, 2025

Nike Dunk Sale Up To 52 Off At Revolve

May 29, 2025

Latest Posts

-

Solve The Nyt Mini Crossword Saturday May 3rd Clues And Answers

May 31, 2025

Solve The Nyt Mini Crossword Saturday May 3rd Clues And Answers

May 31, 2025 -

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025 -

Complete Guide Nyt Mini Crossword Answers For Saturday April 19th

May 31, 2025

Complete Guide Nyt Mini Crossword Answers For Saturday April 19th

May 31, 2025 -

Nyt Mini Crossword Saturday April 19th Full Solutions And Hints

May 31, 2025

Nyt Mini Crossword Saturday April 19th Full Solutions And Hints

May 31, 2025 -

Find The Answers Nyt Mini Crossword Saturday April 19th

May 31, 2025

Find The Answers Nyt Mini Crossword Saturday April 19th

May 31, 2025