Interest Rate Cuts Expected In Thailand Following Negative Inflation

Table of Contents

Negative Inflation in Thailand: Understanding the Causes

The alarming news of negative inflation in Thailand, confirmed by recent Consumer Price Index (CPI) figures, demands a thorough examination. This deflation, a sustained decrease in the general price level, signifies a worrying slowdown in economic activity. Several factors contribute to this concerning trend:

- Decreased Consumer Spending: A palpable reduction in consumer spending power is a key driver. Economic uncertainty, coupled with rising household debt, has led to cautious spending habits, hindering demand-pull inflation.

- Global Economic Slowdown: Thailand's export-oriented economy is heavily impacted by global economic headwinds. The ongoing slowdown in major economies worldwide has reduced demand for Thai exports, impacting production and further dampening price increases.

- Supply Chain Disruptions: Lingering supply chain disruptions, although easing, still contribute to elevated import costs. This combination of reduced consumer demand and expensive imports has created a deflationary pressure on prices.

- Deflation vs. Disinflation: It's crucial to differentiate between deflation and disinflation. Disinflation refers to a slowing rate of inflation, while deflation is an actual decline in the general price level. Thailand's current situation represents a concerning instance of deflation, raising the specter of a deflationary spiral.

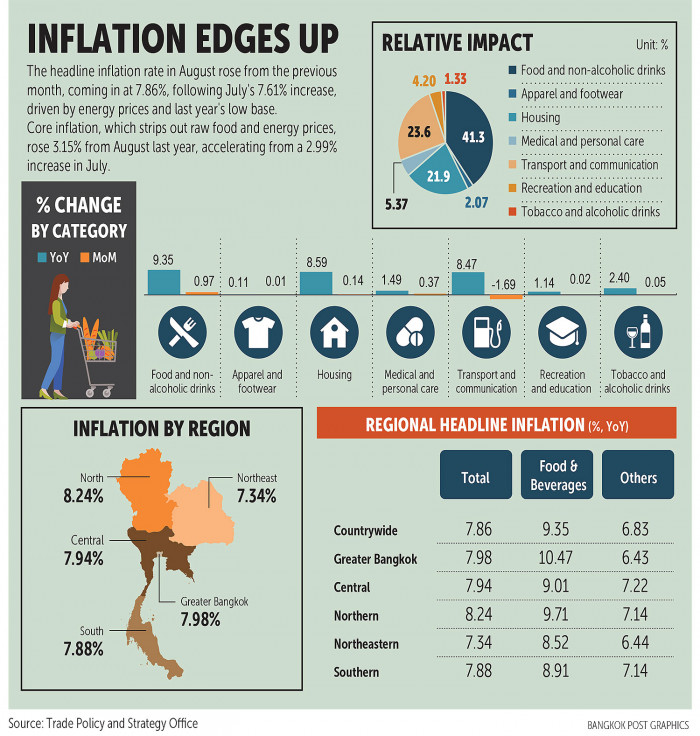

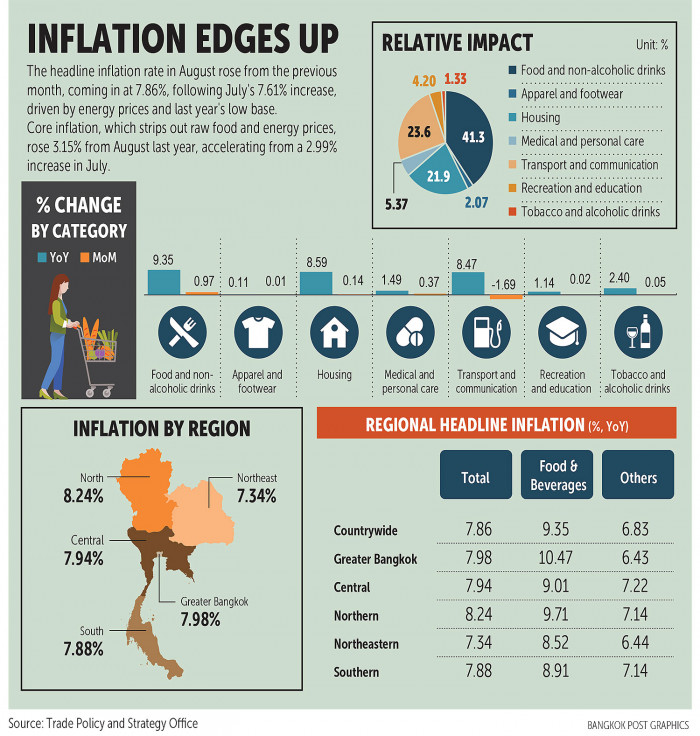

The risk of a deflationary spiral is significant. Falling prices incentivize consumers to delay purchases, anticipating further price drops. This reduced demand leads to lower production and further price decreases, creating a vicious cycle that can be incredibly difficult to break. The severity of the situation is illustrated by [insert relevant statistical data, chart, or graph showcasing the CPI decline]. [Insert quote from a prominent economist on the situation].

The Bank of Thailand's Response: Anticipated Interest Rate Cuts

Facing this economic downturn, the Bank of Thailand (BOT) is widely expected to respond with interest rate cuts. The BOT's primary mandate is to maintain price stability and foster sustainable economic growth. Historically, the BOT has used interest rate adjustments as a key monetary policy tool to navigate economic challenges.

- Mechanism of Interest Rate Cuts: Lowering interest rates reduces borrowing costs for businesses and consumers. This stimulus aims to encourage investment, spending, and overall economic activity.

- Likelihood of a Rate Cut: Given the negative inflation figures and the BOT's historical responses to similar economic downturns, a rate cut is highly probable. [Insert analysis based on news articles, statements from BOT officials, and forecasts from financial institutions regarding the likelihood and timing of the rate cut].

- Alternative Measures: Beyond interest rate cuts, the BOT might consider other measures, such as quantitative easing (QE), to inject liquidity into the financial system. QE involves purchasing government bonds or other assets to increase the money supply.

The anticipation of a rate cut reflects the BOT's proactive approach to counter the negative inflation and stimulate economic growth. The effectiveness of this measure will depend on various factors, including consumer confidence and global economic conditions.

Potential Impacts of Interest Rate Cuts on the Thai Economy

Interest rate cuts, while intended to stimulate the economy, carry both potential benefits and risks:

-

Positive Impacts:

- Stimulating Borrowing and Investment: Lower borrowing costs incentivize businesses to invest in expansion and modernization, creating jobs and boosting economic activity.

- Boosting Consumer Spending: Reduced interest rates on loans can encourage consumers to increase spending, thereby stimulating demand.

- Preventing a Deflationary Spiral: Timely intervention can help break the cycle of falling prices and declining demand.

-

Potential Risks:

- Increased Inflation in the Long Run: While aimed at combating deflation, excessively low interest rates could lead to higher inflation in the future.

- Weakening of the Thai Baht: Lower interest rates might make the Thai baht less attractive to foreign investors, potentially leading to a depreciation of the currency.

- Impact on Foreign Investment: The attractiveness of Thailand as an investment destination could be affected by lower interest rates, especially compared to other countries.

The impact of interest rate cuts will vary across different sectors. For instance, the real estate sector might experience a surge in activity, while the manufacturing sector could benefit from increased investment. The tourism sector, however, might be less directly affected.

Alternative Economic Strategies and Their Effectiveness

Beyond monetary policy adjustments, the Thai government can employ alternative economic strategies to address negative inflation:

- Fiscal Policy: Fiscal stimulus measures, such as increased government spending on infrastructure projects, can directly boost aggregate demand. [Include data on government spending and its impact on the economy].

- Export Promotion: Strengthening export promotion strategies can increase demand for Thai goods and services internationally, offsetting the impact of a global slowdown. [Include data on trade balances and export performance].

The effectiveness of these alternative strategies depends on their careful implementation and coordination with monetary policy. A balanced approach, combining interest rate adjustments with fiscal stimulus and export promotion, might yield the best results.

Conclusion

Thailand's current struggle with negative inflation necessitates a comprehensive response. The anticipated interest rate cuts by the Bank of Thailand represent a crucial step towards stimulating economic activity. While these cuts offer the potential for increased borrowing, investment, and consumer spending, they also carry the risk of future inflation and currency depreciation. The effectiveness of interest rate cuts will be further enhanced by the implementation of complementary fiscal policies and export promotion strategies. Staying informed about the Bank of Thailand's upcoming interest rate decision and its implications for the Thai economy is vital. Follow reputable financial news sources for updates on interest rate cuts in Thailand and their impact on your investments and financial planning. Understanding these changes is crucial for navigating the evolving economic landscape.

Featured Posts

-

Ps 5 Pro Sales Fall Short Of Ps 4 Pro Expectations An Analysis

May 07, 2025

Ps 5 Pro Sales Fall Short Of Ps 4 Pro Expectations An Analysis

May 07, 2025 -

Ldc Future Forum Concludes Ambitious Plans For Resilience

May 07, 2025

Ldc Future Forum Concludes Ambitious Plans For Resilience

May 07, 2025 -

Best April Fools Day Pranks Of All Time

May 07, 2025

Best April Fools Day Pranks Of All Time

May 07, 2025 -

Learning From Losses Historical Context For The Warriors Blowout Defeat

May 07, 2025

Learning From Losses Historical Context For The Warriors Blowout Defeat

May 07, 2025 -

A Conversation With Aces President Nikki Fargas Community 2025 Season And Beyond

May 07, 2025

A Conversation With Aces President Nikki Fargas Community 2025 Season And Beyond

May 07, 2025

Latest Posts

-

76

May 08, 2025

76

May 08, 2025 -

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025 -

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025