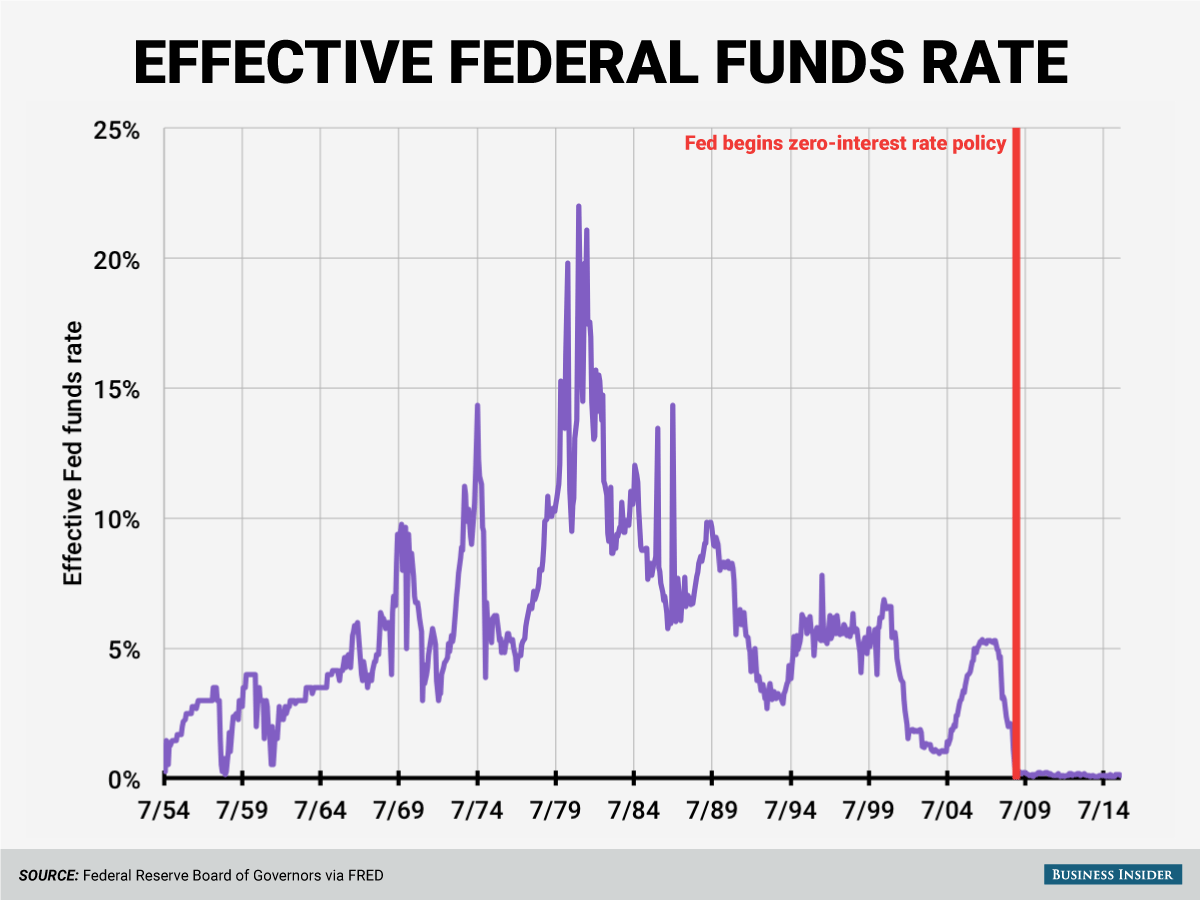

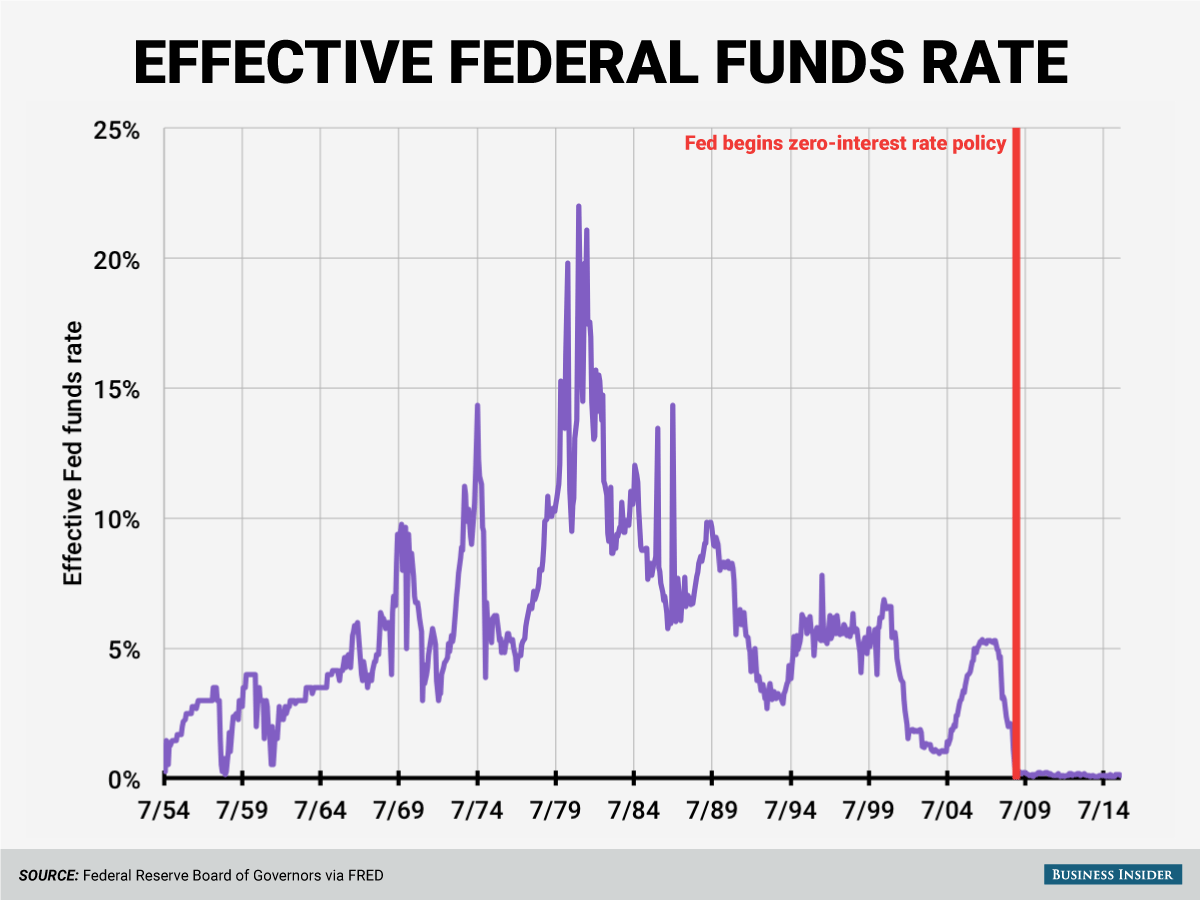

Interest Rate Cuts: Why The Federal Reserve Is Lagging Behind

Table of Contents

Persistent Inflation as a Primary Barrier to Interest Rate Cuts

The current high inflation rate is the primary obstacle to immediate interest rate cuts. The Consumer Price Index (CPI) and Producer Price Index (PPI) consistently show inflation remaining stubbornly above the Fed's target of 2%. This persistent inflation significantly impacts the Fed's decision-making process. The Fed's mandate is to maintain price stability and maximum employment. While interest rate cuts could boost economic growth and potentially lower unemployment in the short term, the risk of fueling further inflation is a major concern.

- High inflation erodes purchasing power: Rising prices reduce the real value of wages and savings, impacting consumers' ability to afford essential goods and services.

- The Fed fears triggering a wage-price spiral: Interest rate cuts could lead to increased demand, prompting businesses to raise wages to attract workers. This, in turn, could lead to further price increases, creating a vicious cycle.

- The impact of supply chain disruptions on inflation: Global supply chain bottlenecks continue to contribute to higher prices. Easing monetary policy before resolving these issues could exacerbate inflationary pressures.

- Data points supporting persistent inflation: The CPI and PPI consistently exceeding the Fed's target, coupled with strong wage growth, paint a picture of persistent inflationary pressures, making interest rate cuts a risky proposition.

Concerns About Potential Negative Economic Impacts of Premature Interest Rate Cuts

Cutting interest rates prematurely carries substantial risks. The Fed is acutely aware of the potential for unintended consequences.

- Risk of exacerbating existing inflation: Lowering interest rates too soon could inject more money into the economy, further fueling demand and driving up prices. This would defeat the purpose of price stability.

- Possibility of asset bubbles: Lower interest rates can inflate asset prices, creating bubbles in the stock market, real estate, and other sectors. The bursting of these bubbles can have devastating consequences for the economy.

- Unintended consequences on employment: While interest rate cuts might stimulate short-term employment, if inflation remains high, it could lead to long-term economic instability, ultimately affecting job markets negatively.

The Fed's Data-Driven Approach and Cautious Stance

The Federal Reserve employs a data-driven approach to monetary policy. Before making decisions about interest rate cuts or hikes, the Fed meticulously analyzes a wide array of economic indicators.

- Importance of analyzing employment data (unemployment rate): The unemployment rate is a crucial indicator of the health of the labor market. The Fed needs to assess whether the current employment situation justifies the risk of inflation acceleration.

- Consideration of consumer confidence indices: Consumer confidence is a leading indicator of future spending and economic activity. A decline in consumer confidence might signal a need for stimulus, but only if it's not overshadowed by inflation concerns.

- Role of leading economic indicators: The Fed tracks various leading indicators, such as manufacturing activity and business investment, to anticipate future economic trends.

- The Fed’s communication strategy and transparency: The Fed's transparency in communicating its policy decisions and rationale builds trust and manages market expectations. Clear communication helps mitigate market volatility caused by uncertainty about interest rate cuts.

Alternative Monetary Policy Tools Beyond Interest Rate Cuts

While interest rate cuts are a primary tool, the Fed possesses other instruments to stimulate the economy.

- Quantitative easing (QE) and its mechanisms: QE involves the Fed purchasing government bonds and other securities to increase the money supply and lower long-term interest rates.

- Forward guidance as a communication tool: The Fed uses forward guidance to signal its intentions and manage market expectations, influencing borrowing and investment decisions without immediate interest rate cuts.

- Other unconventional monetary policies: In extreme circumstances, the Fed may employ other unconventional policies, such as negative interest rates (though this is not currently being considered).

Conclusion: Understanding the Delay in Interest Rate Cuts – What's Next?

The Fed's hesitancy to implement interest rate cuts stems from the persistent threat of inflation and the potential for negative economic consequences of premature action. The data-driven approach emphasizes the careful consideration of various economic indicators before initiating any significant changes in monetary policy. The Fed's cautious stance is a calculated strategy aiming to balance economic growth with price stability.

What's next? Stay informed about future announcements regarding interest rate cuts and the Federal Reserve’s monetary policy. Follow the developments in interest rate cuts closely by regularly checking the Federal Reserve's website and reputable financial news sources to make informed financial decisions. Understanding the nuances of interest rate cuts and the Fed's decision-making process is crucial for navigating the current economic climate.

Featured Posts

-

Elon Musk Jeff Bezos And Mark Zuckerberg Billions Lost After Trumps Presidency Began

May 10, 2025

Elon Musk Jeff Bezos And Mark Zuckerberg Billions Lost After Trumps Presidency Began

May 10, 2025 -

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025 -

5 Crucial Dos And Don Ts Securing A Private Credit Role

May 10, 2025

5 Crucial Dos And Don Ts Securing A Private Credit Role

May 10, 2025 -

Zelenskiy Tramp Vatikan Makron Otsenil Itogi Vstrechi

May 10, 2025

Zelenskiy Tramp Vatikan Makron Otsenil Itogi Vstrechi

May 10, 2025 -

Inside The Reimagined Queen Elizabeth 2 A 2 000 Guest Cruise Ship Transformed

May 10, 2025

Inside The Reimagined Queen Elizabeth 2 A 2 000 Guest Cruise Ship Transformed

May 10, 2025