Internal GOP Conflict Could Sink Trump's Tax Legislation

Table of Contents

The Republican Party faces a critical juncture. Internal divisions threaten to derail President Trump's ambitious tax legislation, potentially causing significant political fallout and economic uncertainty. Will infighting sink the bill, or can party unity prevail? This article analyzes the key conflicts and their potential impact on Trump's Tax Legislation.

<h2>Deepening Divisions Within the Republican Party</h2>

The Republican Party is far from monolithic. Significant fissures exist between different factions, creating a major obstacle for the passage of Trump's Tax Legislation. These divisions complicate the already complex legislative process and threaten to unravel the carefully constructed plan.

-

Conservative vs. Moderate factions: Conservatives prioritize substantial tax cuts for corporations and high-income earners, believing this will stimulate economic growth through trickle-down economics. Moderates, however, express concerns about the potential impact on the national debt and advocate for more targeted tax relief for the middle class. This fundamental disagreement forms the bedrock of the current GOP infighting.

-

Differing views on tax cuts for corporations vs. individuals: A central point of contention revolves around the extent of corporate tax cuts. While some Republicans champion deep cuts, arguing they will boost investment and job creation, others worry about the distributional effects and the potential for increased corporate profits without corresponding benefits for workers. This disagreement fuels the Republican Party divisions regarding the legislation's core tenets.

-

Disagreements on the proposed tax reform's long-term economic impact: Economic modeling and forecasting vary widely, with differing interpretations of the tax reform’s potential long-term consequences. Some argue it will lead to significant economic growth, while others predict increased national debt and widening income inequality. These differing analyses contribute to the intra-party struggle over the bill’s merits.

-

The role of influential GOP senators and their public statements: Key figures like Senators [Insert names of relevant senators and their stances] have publicly voiced their concerns, further escalating the conflict. Their statements have fueled media coverage and intensified the intra-party struggle, making the passage of Trump’s Tax Legislation even more uncertain.

-

Specific examples of public disagreements and internal lobbying efforts: [Insert specific examples of public disagreements and lobbying efforts, citing sources]. These examples highlight the intensity of the conflict and the significant efforts being made by various factions to influence the final bill.

<h2>Key Provisions Facing Opposition and the Reasons Behind It</h2>

Several provisions within Trump's Tax Legislation are generating considerable internal conflict within the GOP. These disagreements highlight the deep divisions regarding the bill’s core principles and its potential impact.

-

Corporate tax rate reductions and their perceived benefits/drawbacks: The proposed reduction in the corporate tax rate from 35% to 20% is a central component of the plan, but it faces significant opposition from those concerned about its impact on the national debt and its potential to disproportionately benefit large corporations.

-

Individual tax bracket changes and their impact on different income groups: Changes to individual tax brackets are another major source of disagreement. Some argue the proposed changes favor high-income earners, while others contend they will provide relief for the middle class. This discrepancy fuels the ongoing debate.

-

Elimination or reduction of specific tax deductions and loopholes: The elimination or reduction of certain tax deductions, such as the state and local tax (SALT) deduction, has provoked strong opposition from high-tax states, threatening to derail the entire bill.

-

Concerns about the national debt and the long-term fiscal implications: The bill's potential impact on the national debt is a major concern for many Republicans, fueling the debate about fiscal responsibility and the long-term sustainability of the tax cuts.

-

State and local tax (SALT) deduction limitations and the opposition from high-tax states: The proposed limitations on the SALT deduction have sparked significant opposition from representatives of high-tax states, who argue it will disproportionately harm their residents and undermine local government budgets. This opposition is a critical factor in the current tax reform conflict.

<h2>The Political Ramifications of Failure</h2>

The failure of Trump's Tax Legislation would carry substantial political ramifications for the Republican Party and President Trump himself.

-

Damage to President Trump's legislative agenda: Failure would be a significant setback for Trump’s legislative agenda, undermining his credibility and potentially hindering future legislative initiatives.

-

Impact on Republican voter confidence and midterm elections: The failure could significantly dampen Republican voter enthusiasm, potentially impacting the outcome of the upcoming midterm elections. This political fallout could reshape the political landscape for years to come.

-

Economic uncertainty and its effect on markets and investor sentiment: Uncertainty surrounding the tax legislation could negatively impact investor sentiment, causing market volatility and potentially slowing economic growth.

-

Potential for a government shutdown if budget negotiations are impacted: The failure could further complicate budget negotiations, potentially leading to a government shutdown, which would have severe consequences for the country.

-

Loss of political capital for the Republican party: The failure would represent a significant loss of political capital for the Republican Party, diminishing their ability to pass other key legislation.

<h3>Potential Compromise and Negotiation Strategies</h3>

Resolving the internal conflicts surrounding Trump's Tax Legislation requires compromise and effective negotiation.

-

Compromise on specific tax provisions to appease dissenting factions: Finding common ground on specific provisions, perhaps through targeted amendments, is crucial to garnering wider support.

-

Negotiations between the White House and key senators: Direct negotiations between the White House and key senators are necessary to bridge the gap between differing viewpoints.

-

The role of lobbyists and special interest groups in shaping the final bill: Lobbyists and special interest groups will continue to play a significant role in shaping the final bill through behind-the-scenes negotiations and lobbying efforts.

-

Potential for amendments and revisions to the original legislation: The original legislation will likely undergo several amendments and revisions to accommodate the concerns of dissenting factions.

-

The timeline for legislative action and the pressure to pass the bill: The pressure to pass the bill before the end of the year will intensify the negotiations and increase the likelihood of compromise.

<h2>Conclusion</h2>

The internal conflict within the GOP regarding President Trump's tax legislation presents a significant obstacle to its passage. The deep divisions, coupled with the potential political and economic ramifications of failure, underscore the high stakes involved. The coming weeks will be crucial in determining whether the Republican party can overcome its internal strife and pass this landmark legislation, or if Trump's Tax Legislation will ultimately be sunk by its own party. Stay informed on the latest developments to fully grasp the evolving political landscape and the future of this crucial tax reform.

Featured Posts

-

Yukon Legislators Threaten Contempt Action Against Uncooperative Mine Manager

Apr 29, 2025

Yukon Legislators Threaten Contempt Action Against Uncooperative Mine Manager

Apr 29, 2025 -

Speedboat Stunt Goes Wrong Dramatic Flip At Arizona Boating Event

Apr 29, 2025

Speedboat Stunt Goes Wrong Dramatic Flip At Arizona Boating Event

Apr 29, 2025 -

Move Over Quinoa Introducing The Next Big Health Food

Apr 29, 2025

Move Over Quinoa Introducing The Next Big Health Food

Apr 29, 2025 -

Chicago Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025

Chicago Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025 -

March 15 2025 Nyt Spelling Bee Pangram And Solution

Apr 29, 2025

March 15 2025 Nyt Spelling Bee Pangram And Solution

Apr 29, 2025

Latest Posts

-

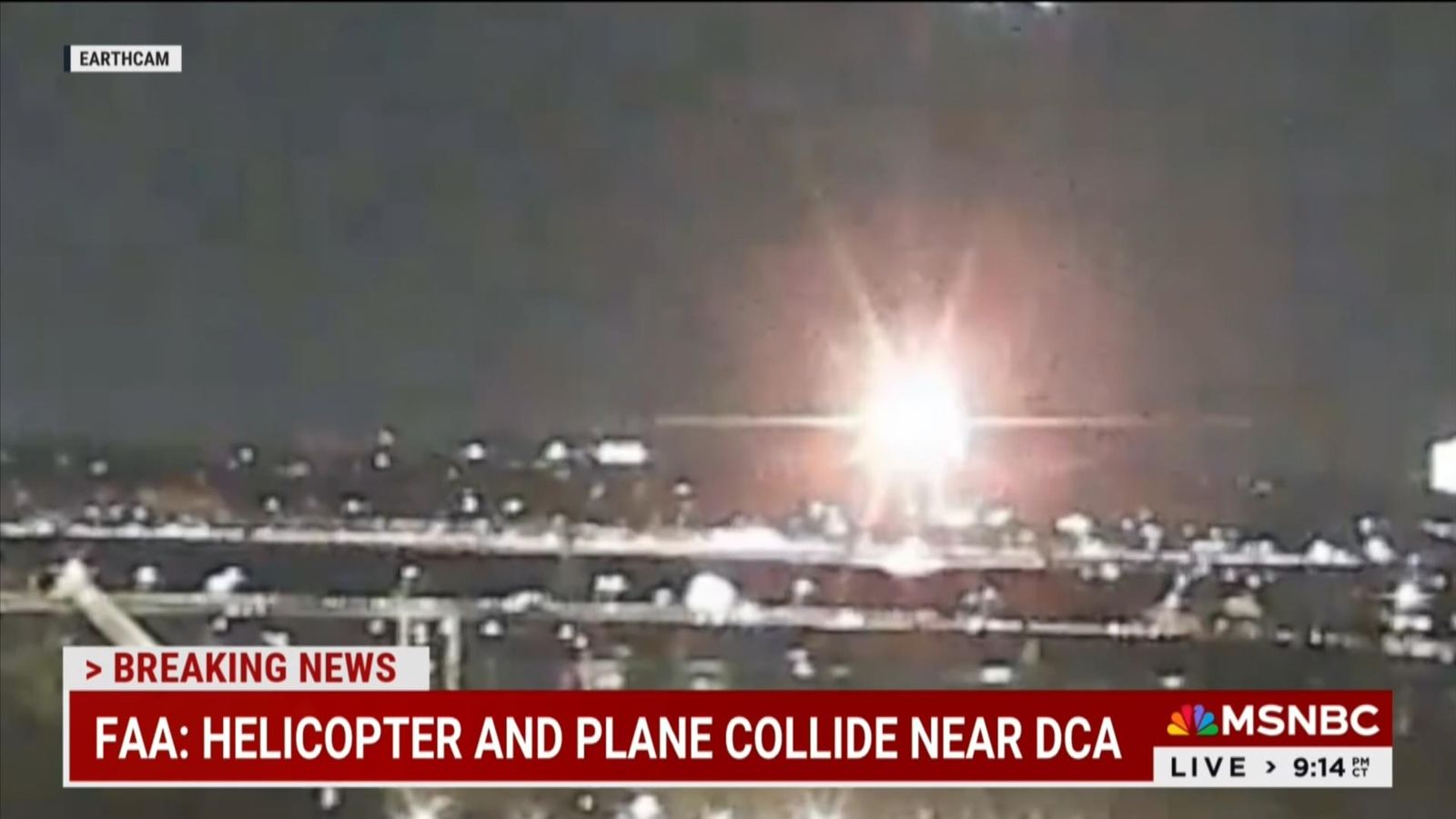

Remembering The Fallen Fort Belvoir Honors Soldiers Killed In Dc Helicopter Crash

Apr 29, 2025

Remembering The Fallen Fort Belvoir Honors Soldiers Killed In Dc Helicopter Crash

Apr 29, 2025 -

Investigation Reveals Pilots Actions Before Deadly Black Hawk Crash In Washington D C

Apr 29, 2025

Investigation Reveals Pilots Actions Before Deadly Black Hawk Crash In Washington D C

Apr 29, 2025 -

Dc Black Hawk Crash New Report Reveals Pilot Error Before Collision

Apr 29, 2025

Dc Black Hawk Crash New Report Reveals Pilot Error Before Collision

Apr 29, 2025 -

Black Hawk Collision Near Dc Report Details Pilots Failure To Follow Instructions

Apr 29, 2025

Black Hawk Collision Near Dc Report Details Pilots Failure To Follow Instructions

Apr 29, 2025 -

The Ny Times And The January 29th Dc Air Disaster What Was Omitted

Apr 29, 2025

The Ny Times And The January 29th Dc Air Disaster What Was Omitted

Apr 29, 2025