Invesco And Barings Expand Private Credit Access For Everyday Investors

Table of Contents

Private credit, which involves lending directly to businesses outside of public markets, offers several compelling advantages. It often provides higher potential returns than traditional fixed-income investments, while also offering diversification benefits due to its typically low correlation with publicly traded stocks and bonds.

This article aims to delve into the specific strategies employed by Invesco and Barings to expand access to private credit for individual investors, highlighting the significant implications for the future of personal finance.

Invesco's Initiatives to Democratize Private Credit Investment

Invesco is leading the charge in making private credit more accessible to retail investors through a multi-pronged approach.

Lowering Minimum Investment Requirements

Invesco is actively lowering the barrier to entry for individual investors by reducing minimum investment amounts in their private credit funds. This is achieved through several strategies:

- Fractional share offerings: Invesco allows investors to purchase fractional shares of certain private credit funds, enabling participation with smaller capital commitments. This dramatically lowers the financial hurdle for many potential investors.

- Lower minimums for select funds: Invesco has launched several private credit funds with significantly reduced minimum investment requirements compared to traditional private credit vehicles, typically reserved for institutional investors. These funds often target specific niches within the private credit market.

- Partnerships with financial advisors: Invesco collaborates with financial advisors to offer private credit access to their clients through managed accounts and other tailored solutions.

Diversified Private Credit Portfolios

Invesco constructs diversified portfolios designed to mitigate risk and enhance returns for retail investors. Their private credit strategies span a range of investment types:

- Direct lending: Providing loans directly to businesses.

- Mezzanine debt: A hybrid of debt and equity financing.

- Distressed debt: Investing in the debt of financially troubled companies.

- Senior secured loans: Offering investors a high level of protection.

This diversification across sectors and risk profiles aims to reduce the impact of any single investment performing poorly.

Enhanced Transparency and Reporting

Invesco prioritizes transparency and clear communication with retail investors. They achieve this through:

- Regular quarterly reports: Providing detailed updates on fund performance, including key metrics and explanations of investment decisions.

- Online investor dashboards: Offering convenient online access to portfolio information and performance data.

- Investor education resources: Providing educational materials, webinars, and other resources to help investors understand private credit strategies and manage their investments effectively.

Barings' Strategies for Expanding Private Credit Access

Barings also employs innovative strategies to make private credit more accessible to individual investors.

Innovative Fund Structures

Barings utilizes various fund structures tailored for retail participation:

- Interval funds: These funds allow investors to buy and sell shares at specific intervals, offering a degree of liquidity that's rare in traditional private credit vehicles.

- Closed-end funds: These funds have a fixed number of shares and a defined life cycle, providing a more structured investment option.

These innovative structures provide a balance between liquidity and access to the potentially higher returns of private credit.

Focus on Specific Niches within Private Credit

Barings may focus on specific, high-growth sectors to provide targeted investment opportunities:

- Sustainable finance: Focusing on environmentally and socially responsible businesses.

- Specific geographic regions: Concentrating investments in certain regions with strong economic growth potential.

This targeted approach allows investors to align their investments with their personal values and potentially benefit from specific market trends.

Utilizing Technology for Enhanced Access

Barings leverages technology to improve accessibility:

- User-friendly online investment platforms: Simplifying the investment process and providing easy access to account information.

- Automated reporting and communication tools: Streamlining communication and ensuring timely updates to investors.

These technological advancements create a more efficient and user-friendly experience for retail investors.

The Benefits of Increased Private Credit Accessibility for Everyday Investors

The expanding availability of private credit offers substantial benefits to everyday investors:

Diversification and Risk Management

Private credit investments typically exhibit low correlation with traditional asset classes like stocks and bonds. This means that they can help diversify portfolios and reduce overall risk.

- Uncorrelated returns: In times of market volatility, private credit investments can potentially provide a buffer against losses in other parts of the portfolio.

Potential for Higher Returns

Private credit investments have historically shown the potential for higher returns compared to traditional fixed-income options.

- Long-term investment horizon: It's important to remember that private credit investments typically require a longer-term perspective due to lower liquidity.

Disclaimer: Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal.

Improved Access to Alternative Investment Strategies

The increasing accessibility of private credit represents a significant step towards democratizing finance, giving a wider range of investors access to alternative investment strategies that were previously unattainable.

Investing in Private Credit: Making it Accessible for Everyone

Invesco and Barings are significantly expanding access to private credit for individual investors through lower minimum investment requirements, diversified portfolios, enhanced transparency, innovative fund structures, niche market specialization, and the strategic use of technology. This increased accessibility offers retail investors the opportunity to diversify their portfolios, potentially achieve higher returns, and participate in a previously exclusive asset class. Learn more about the exciting private credit investment options available from Invesco and Barings by visiting their respective websites (links to be inserted here). Explore the world of accessible private credit funds and consider how democratizing private credit can benefit your investment strategy.

Featured Posts

-

Apprendre A Utiliser Les Seuils Techniques Pour Votre Alerte Trader

Apr 23, 2025

Apprendre A Utiliser Les Seuils Techniques Pour Votre Alerte Trader

Apr 23, 2025 -

Car Dealers Unite Against Enforced Electric Vehicle Sales

Apr 23, 2025

Car Dealers Unite Against Enforced Electric Vehicle Sales

Apr 23, 2025 -

Cole Ragans Stellar Performance Highlights Royals Bullpen Victory Against Brewers

Apr 23, 2025

Cole Ragans Stellar Performance Highlights Royals Bullpen Victory Against Brewers

Apr 23, 2025 -

Supreme Court To Hear Case On Parental Notification For Lgbtq Books In Elementary Schools

Apr 23, 2025

Supreme Court To Hear Case On Parental Notification For Lgbtq Books In Elementary Schools

Apr 23, 2025 -

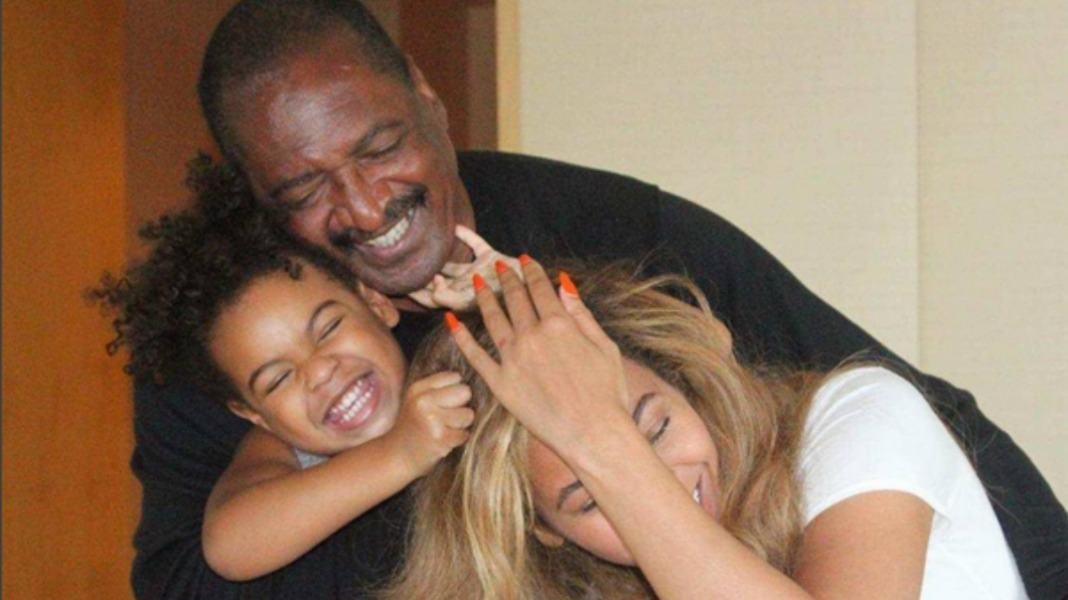

Preventing Breast Cancer Learning From Tina Knowles Experience With A Missed Mammogram

Apr 23, 2025

Preventing Breast Cancer Learning From Tina Knowles Experience With A Missed Mammogram

Apr 23, 2025