Invesco And Barings: Making Private Credit Investment Accessible To All

Table of Contents

Invesco's Approach to Private Credit Accessibility

Invesco, a global investment management firm, has taken a multi-pronged approach to make private credit investment more accessible. This involves developing innovative investment vehicles, leveraging technology, and emphasizing robust risk management.

Innovative Investment Vehicles

Invesco offers a range of products designed to lower the barrier to entry for private credit. These vehicles allow investors with varying risk tolerances and capital commitments to participate.

- Invesco Private Credit Funds: These pooled investment vehicles allow investors to participate in a diversified portfolio of private credit assets with lower minimum investment requirements than direct investments.

- Separately Managed Accounts (SMAs): SMAs offer customized private credit portfolios tailored to specific investor needs and risk profiles.

- Structured Note Offerings: Invesco offers structured notes that provide exposure to private credit strategies with a defined maturity date and return profile.

These products are designed with varying minimum investment requirements to cater to a wider investor base. Many Invesco private credit offerings have significantly lower minimums than traditional private credit investments, making them more approachable for smaller investors.

Technology and Platform

Invesco utilizes cutting-edge technology to enhance the investor experience and make the process more transparent.

- Online Investor Portal: Investors can access detailed portfolio information, performance reports, and other crucial data through a secure online portal.

- Real-time Reporting Tools: Regular, transparent reporting keeps investors informed about their investments and market conditions.

- Educational Resources: Invesco provides various educational materials, including webinars and white papers, to help investors understand private credit investment strategies.

Risk Management and Due Diligence

Invesco prioritizes risk management and thorough due diligence to protect investor capital and maintain transparency.

- Rigorous Due Diligence Process: Invesco employs a comprehensive due diligence process for every private credit investment to assess potential risks and identify opportunities.

- Independent Valuation: Regular independent valuations ensure accurate assessment of portfolio assets.

- Diversified Portfolio Construction: Portfolios are designed to be diversified across various sectors and credit ratings, reducing the impact of any single investment's underperformance.

Barings' Strategies for Expanding Private Credit Investment

Barings, another prominent global investment firm, employs diverse strategies to expand access to private credit investment. Their focus on diversification, niche markets, and client relationships sets them apart.

Diversified Portfolio Approach

Barings builds diversified private credit portfolios to minimize risk for investors.

- Direct Lending: Direct lending provides capital to businesses without going through traditional banks.

- Mezzanine Financing: Mezzanine financing offers a blend of debt and equity, balancing risk and return.

- Distressed Debt: Investing in distressed debt offers potentially high returns but carries higher risk.

Focus on Specific Market Niches

Barings targets specific market niches to offer specialized private credit opportunities.

- Sustainable Finance: Barings invests in businesses committed to environmental, social, and governance (ESG) principles.

- Specific Industry Sectors: They focus on sectors with strong growth potential and favorable credit profiles.

Client Relationship Management

Barings invests heavily in building strong client relationships to ensure accessibility and understanding.

- Personalized Client Consultations: Barings offers personalized consultations to discuss investment strategies and answer any questions.

- Educational Webinars and Materials: They provide regular educational resources to keep clients informed about market trends and investment opportunities.

Benefits of Increased Accessibility to Private Credit Investment

The increased accessibility of private credit investment offers numerous advantages for a wider range of investors.

Diversification of Investment Portfolios

Private credit offers a compelling diversification opportunity. Historically, it has exhibited a low correlation with traditional asset classes like equities and bonds, helping to reduce overall portfolio volatility.

- Studies show private credit can enhance risk-adjusted returns within a diversified portfolio.

Potential for Higher Returns

Private credit investments have the potential to deliver higher returns compared to publicly traded markets.

- Historically, private credit has generated attractive returns, though it's essential to note that past performance is not indicative of future results, and these investments carry inherent risk.

Enhanced Investment Opportunities

The increased accessibility of private credit expands the range of investment opportunities available.

- Investors can now access a broader spectrum of private credit strategies and niche markets, tailoring their investments to their specific goals and risk appetites.

Conclusion

Invesco and Barings are leading the charge in making private credit investment accessible to a wider audience. Through innovative product offerings, advanced technology, and a commitment to transparency and client education, they are breaking down traditional barriers and opening up this previously exclusive asset class to a more diverse investor base. The benefits are significant, including enhanced portfolio diversification, the potential for higher returns, and access to a broader range of investment opportunities. To explore the world of private credit investment and discover the opportunities available through Invesco and Barings, visit their respective websites and contact their investment representatives today. Start accessing private credit investment opportunities that align with your financial goals. Learn more about investing in private credit and discover the potential for enhanced returns.

Featured Posts

-

Yankees Set New Homerun Record Judges 3 Lead 9 Homer Explosion

Apr 23, 2025

Yankees Set New Homerun Record Judges 3 Lead 9 Homer Explosion

Apr 23, 2025 -

Brewers Defeat Rockies Behind Chourios 5 Rbis And Homer

Apr 23, 2025

Brewers Defeat Rockies Behind Chourios 5 Rbis And Homer

Apr 23, 2025 -

Blue Origins New Glenn Launch Abruptly Halted

Apr 23, 2025

Blue Origins New Glenn Launch Abruptly Halted

Apr 23, 2025 -

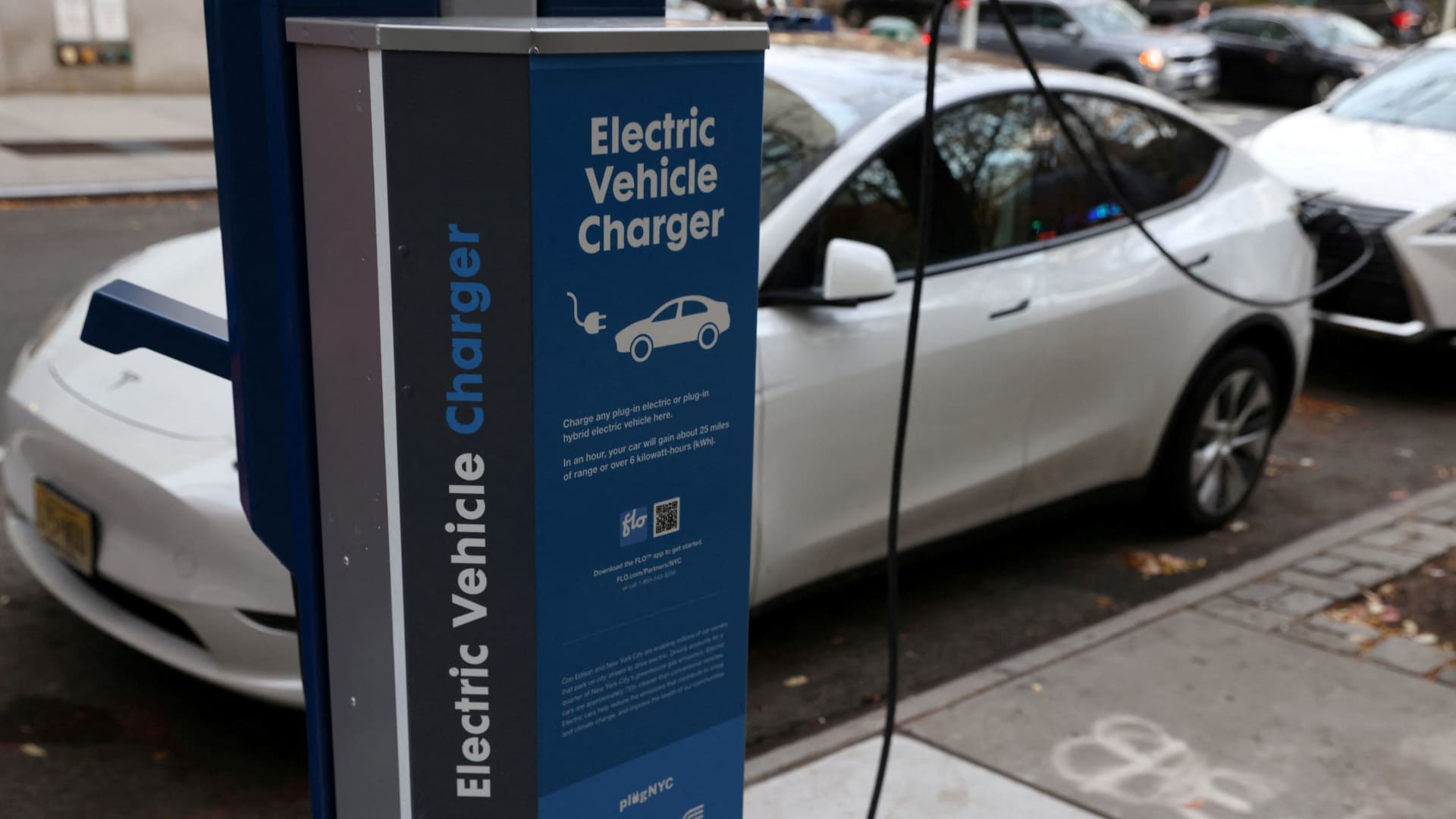

Auto Dealerships Push Back Against Mandatory Ev Quotas

Apr 23, 2025

Auto Dealerships Push Back Against Mandatory Ev Quotas

Apr 23, 2025 -

Je T Aime Moi Non Plus L Approche D Amandine Gerard Sur La Relation Europe Marches

Apr 23, 2025

Je T Aime Moi Non Plus L Approche D Amandine Gerard Sur La Relation Europe Marches

Apr 23, 2025