Invest Smartly: Discover The Country's Top Emerging Business Markets

Table of Contents

Identifying High-Growth Sectors in Emerging Markets

Several sectors within the country's emerging markets are experiencing exponential growth, presenting exciting investment opportunities. Smart investors are looking beyond traditional markets to capitalize on these high-growth sectors and build diverse, resilient portfolios.

The Rise of Renewable Energy

The demand for renewable energy sources like solar and wind power is surging. Government incentives, technological advancements making solar panels and wind turbines more efficient and affordable, and increasing consumer demand for sustainable energy are all driving this growth. The International Renewable Energy Agency (IRENA) projects a significant increase in renewable energy capacity in the coming years.

- Government incentives: Many governments offer tax breaks and subsidies to encourage renewable energy adoption.

- Technological advancements: Continuous improvements in efficiency and cost reduction are making renewable energy more competitive.

- Increasing consumer demand: Growing awareness of climate change and a desire for sustainable practices are boosting consumer interest.

- International collaborations: Global partnerships are fostering technological advancements and financing opportunities in this sector. This makes it a particularly attractive area for foreign investment in emerging markets.

Technological Advancements Fueling Growth

The tech sector is booming, with Artificial Intelligence (AI), Fintech (financial technology), and cybersecurity leading the charge. Venture capital funding is pouring into promising startups, attracted by a growing talent pool and government support for innovation. The development of robust technological infrastructure is further fueling this expansion, creating a fertile ground for smart investing.

- Venture capital funding: Significant capital is being invested in innovative tech startups.

- Talent pool: A growing number of skilled professionals are entering the tech workforce.

- Government support for innovation: Many governments are actively promoting technological advancements through various initiatives.

- Technological infrastructure: Investments in broadband and digital infrastructure are supporting the growth of the tech sector.

Healthcare's Expanding Horizons

The healthcare sector is experiencing significant growth, driven by an aging population, rising healthcare expenditure, and advancements in medical technology. Opportunities abound in medical technology, pharmaceuticals, and telehealth, offering attractive returns for investors willing to navigate this complex but rewarding field.

- Aging population: The increasing proportion of elderly people is driving demand for healthcare services.

- Rising healthcare expenditure: Governments and individuals are investing more in healthcare.

- Advancements in medical technology: Innovations in medical devices and treatments are creating new market opportunities.

- Increasing demand for healthcare services: A growing middle class and improved access to healthcare are fueling demand.

E-commerce and the Digital Economy

The e-commerce industry is experiencing explosive growth, fueled by rising internet penetration, increasing smartphone usage, and changing consumer behavior. Investment opportunities exist in logistics, digital marketing, and online payment systems, all crucial components of this rapidly expanding digital economy.

- Rising internet penetration: More people than ever are accessing the internet, driving e-commerce adoption.

- Increasing smartphone usage: Smartphones are becoming the primary means of accessing the internet and making purchases.

- Changing consumer behavior: Consumers are increasingly comfortable shopping online.

- Expanding delivery networks: Improved logistics and delivery networks are supporting the growth of e-commerce.

Analyzing Key Geographic Locations for Investment

Geographic diversification is crucial for smart investing in emerging markets. Several regions within the country stand out as particularly promising investment hotspots.

Region A: The Coastal Tech Hub

The Coastal Tech Hub boasts a vibrant tech scene, fueled by a highly skilled workforce, government support for innovation, and a strategic location facilitating international trade. Its rapidly expanding digital infrastructure and robust legal framework make it an attractive destination for both domestic and foreign investment.

- Key industries: Technology, tourism, renewable energy.

- Infrastructure projects: Significant investments in port infrastructure and digital connectivity are underway.

- Potential risks: Competition for talent and rising property prices.

- Regulatory environment: A relatively stable and transparent regulatory environment encourages foreign investment.

Region B: The Agricultural Heartland

The Agricultural Heartland benefits from fertile land and a growing demand for agricultural products both domestically and internationally. Government initiatives focused on agricultural modernization and infrastructure development are further enhancing its investment potential, offering opportunities in agritech and sustainable farming practices.

- Key industries: Agriculture, food processing, logistics.

- Infrastructure projects: Investments in irrigation systems, transportation networks, and cold storage facilities are planned.

- Potential risks: Dependence on weather patterns and global commodity prices.

- Regulatory environment: Government policies supporting agricultural development are creating a favorable environment for investment.

Region C: The Manufacturing Powerhouse

The Manufacturing Powerhouse benefits from a large and cost-effective workforce, abundant natural resources, and a strategic location for export-oriented businesses. Ongoing investments in industrial infrastructure and government support for manufacturing are creating numerous investment opportunities in this dynamic region.

- Key industries: Manufacturing, textiles, automotive parts.

- Infrastructure projects: Large-scale investments in industrial parks and transportation infrastructure are underway.

- Potential risks: Competition from other low-cost manufacturing hubs and dependence on global demand.

- Regulatory environment: Government policies promoting industrial development are creating a favorable investment climate.

Strategies for Smart Investing in Emerging Markets

Successful investing in emerging markets requires a strategic approach. Risk management, portfolio diversification, and thorough due diligence are essential components of a successful investment strategy.

Thorough Due Diligence

Before making any investment, conduct comprehensive research. This includes analyzing market trends, reviewing financial statements, assessing the competitive landscape, and ensuring regulatory compliance. Never underestimate the importance of thorough due diligence in mitigating investment risks.

- Market analysis: Understand market dynamics, growth potential, and competitive pressures.

- Financial statements: Analyze the financial health and performance of potential investments.

- Competitor analysis: Evaluate the competitive landscape and identify potential threats.

- Regulatory compliance: Ensure the investment complies with all relevant laws and regulations.

Diversifying your Portfolio

Spread investments across multiple sectors and geographic locations to mitigate risk. Diversification is a cornerstone of smart investing, helping to reduce the impact of potential losses in any single sector or region. A well-diversified portfolio is more resilient to market fluctuations.

- Asset allocation: Distribute investments across different asset classes to optimize risk and return.

- Risk tolerance: Understand your own risk tolerance before making any investment decisions.

- Investment goals: Align your investments with your long-term financial goals.

Seeking Professional Advice

Consider seeking guidance from experienced financial advisors. They can provide valuable insights into market trends, investment strategies, and risk management. Their expertise can help you navigate the complexities of emerging markets and make informed investment decisions.

- Investment planning: Develop a comprehensive investment plan tailored to your specific needs and goals.

- Portfolio management: Receive ongoing management and adjustments to your portfolio.

- Risk assessment: Gain a deeper understanding of the risks and potential rewards associated with different investment opportunities.

Conclusion

Investing in the country's top emerging business markets presents significant opportunities for substantial returns. By carefully analyzing high-growth sectors, identifying promising geographic locations, and employing smart investment strategies, you can effectively navigate this dynamic landscape. Remember to conduct thorough due diligence and, if necessary, seek professional guidance to maximize your chances of success. Start exploring the exciting world of emerging markets and discover the potential for profitable ventures today! Invest smartly and build a brighter financial future.

Featured Posts

-

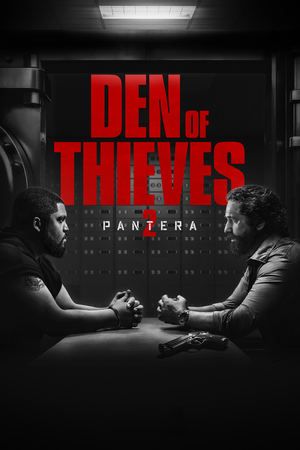

Den Of Thieves 2 Is It Streaming On Netflix This Week

May 13, 2025

Den Of Thieves 2 Is It Streaming On Netflix This Week

May 13, 2025 -

Hands On Life Cycle Education The Role Of Campus Farm Animals

May 13, 2025

Hands On Life Cycle Education The Role Of Campus Farm Animals

May 13, 2025 -

Leonardo Di Caprio Faces Intense Backlash Where Is He Now

May 13, 2025

Leonardo Di Caprio Faces Intense Backlash Where Is He Now

May 13, 2025 -

Exploring Kanika House The Delhi Bungalows Significance In Indian History

May 13, 2025

Exploring Kanika House The Delhi Bungalows Significance In Indian History

May 13, 2025 -

79 Year Old Woman Missing Portola Valley Preserve Search Intensifies

May 13, 2025

79 Year Old Woman Missing Portola Valley Preserve Search Intensifies

May 13, 2025

Latest Posts

-

Dean Huijsen Transfer Saga Which Premier League Clubs Are Involved

May 14, 2025

Dean Huijsen Transfer Saga Which Premier League Clubs Are Involved

May 14, 2025 -

Is Dean Huijsen The Next Premier League Star Transfer Rumours Explained

May 14, 2025

Is Dean Huijsen The Next Premier League Star Transfer Rumours Explained

May 14, 2025 -

Premier League Interest In Dean Huijsen A Closer Look At The Transfer Speculation

May 14, 2025

Premier League Interest In Dean Huijsen A Closer Look At The Transfer Speculation

May 14, 2025 -

Dean Huijsen Premier League Clubs Fuel Transfer Rumours

May 14, 2025

Dean Huijsen Premier League Clubs Fuel Transfer Rumours

May 14, 2025 -

Huijsen Transfer To Chelsea Will The Deal Be Done By June 14th

May 14, 2025

Huijsen Transfer To Chelsea Will The Deal Be Done By June 14th

May 14, 2025