Investigating The Reasons For CoreWeave, Inc.'s (CRWV) Impressive Stock Gains Last Week

Table of Contents

The Role of Positive Financial News and Earnings Reports

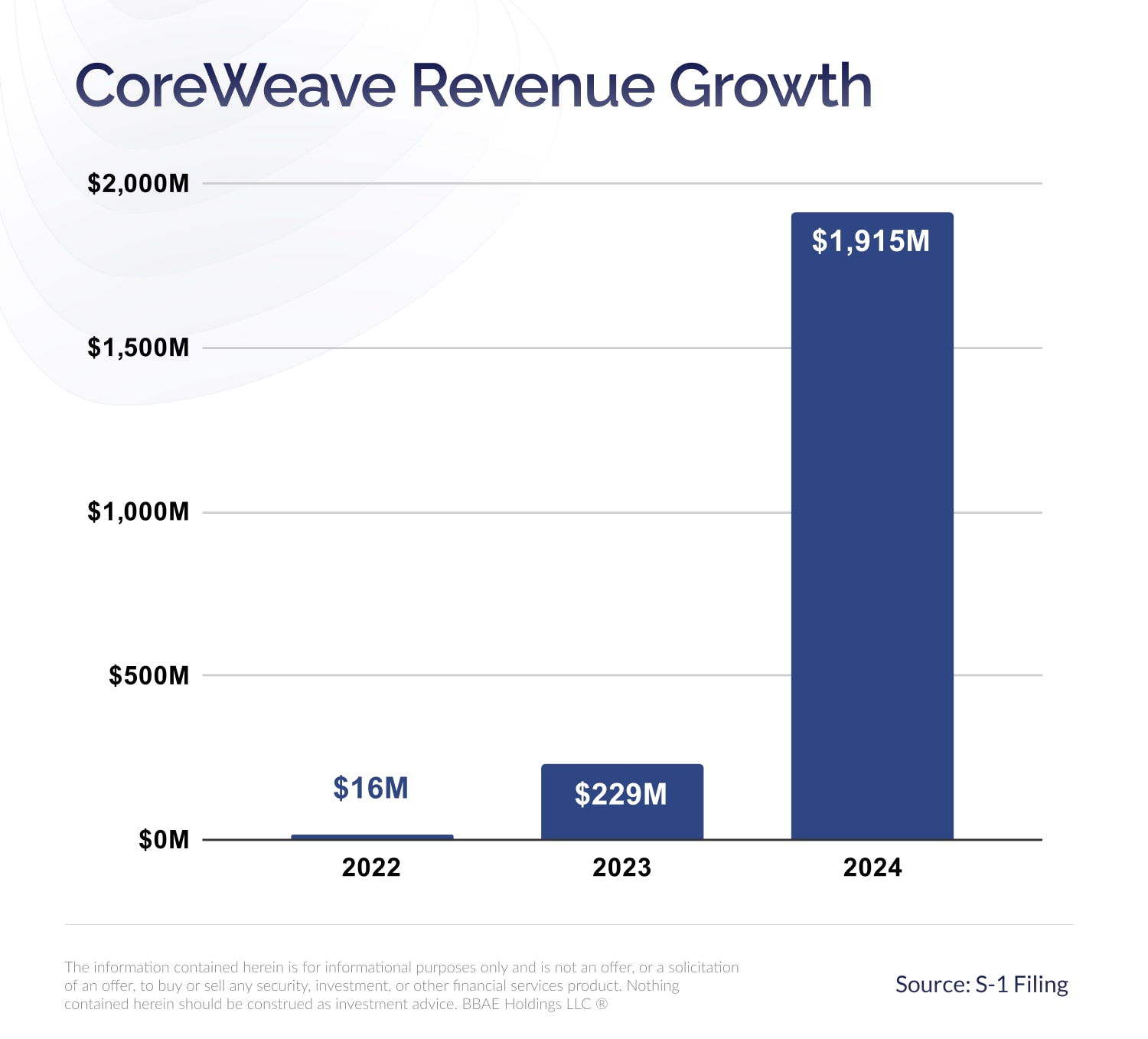

CoreWeave's recent stock price appreciation is undeniably linked to its strong financial performance. The company's robust earnings report played a pivotal role in boosting investor confidence.

Strong Q[Quarter] Earnings Beat Expectations

- Revenue exceeded projections: CoreWeave reported revenue significantly higher than analyst estimates for the [Specify Quarter] quarter, indicating strong demand for its cloud computing and AI infrastructure services. (Source: [Link to Financial News Source])

- Increased subscriptions: A substantial increase in subscription numbers demonstrates growing customer adoption and loyalty. This reflects the value proposition of CoreWeave's offerings within the competitive cloud computing market.

- Improved margins: Enhanced operational efficiency and increased economies of scale likely contributed to improved profit margins, signaling a healthy and sustainable business model. (Source: [Link to Financial News Source])

- Key Metric Outperformance: [Specify a key metric, e.g., Customer Acquisition Cost (CAC) decreased by X%, exceeding analyst expectations by Y%.] This shows CoreWeave's effectiveness in acquiring and retaining customers.

Upbeat Future Guidance

CoreWeave's management provided optimistic guidance for future growth, further fueling the stock price surge.

- Expansion plans: The company outlined ambitious plans for infrastructure expansion, indicating confidence in future demand. This includes plans to [mention specific expansion plans, e.g., open new data centers in key regions].

- New partnerships: Potential collaborations with key technology players were hinted at, promising further market penetration and revenue growth. These partnerships could unlock access to new customer segments.

- Revenue growth projections: CoreWeave projected significant revenue growth for the coming quarters, exceeding market expectations. This positive outlook reflects the company's strong position in the rapidly expanding AI cloud computing market.

Increased Investor Interest in the AI Sector and CRWV's Position

The surge in CRWV's stock price is also inextricably linked to the current boom in the artificial intelligence (AI) sector.

Growing Demand for AI Infrastructure

The AI revolution is driving an unprecedented surge in demand for high-performance computing resources. CoreWeave is exceptionally well-positioned to capitalize on this demand.

- Market Growth: The AI market is projected to reach [insert statistic on market size and growth rate] in the coming years. (Source: [Link to reputable market research report])

- Specialized Infrastructure: CoreWeave offers specialized infrastructure optimized for AI workloads, giving it a competitive advantage. This includes features like [mention specific features, e.g., GPU-optimized instances, high-speed networking].

- First-Mover Advantage: CoreWeave's early adoption of cutting-edge technologies has established it as a key player in the AI infrastructure space.

Strategic Partnerships and Collaborations

Strategic partnerships further solidify CoreWeave's position and enhance its ability to deliver AI solutions.

- Collaboration with [Partner Name]: This partnership [explain the benefits of the partnership, e.g., expands CoreWeave’s reach into a new market segment or integrates crucial technology].

- Technology Integration: The integration of [mention specific technologies] strengthens CoreWeave’s platform and enables it to provide more comprehensive AI solutions.

Market Sentiment and Speculative Trading

Beyond fundamental factors, market sentiment and speculative trading also played a role in CRWV's stock price movement.

Positive Analyst Upgrades and Price Target Increases

Several financial analysts upgraded their ratings and increased price targets for CRWV stock, contributing to the positive investor sentiment.

- Analyst Upgrade 1: [Analyst name] upgraded CRWV from [previous rating] to [new rating], citing [reason for upgrade].

- Price Target Increase: [Analyst name] increased their price target for CRWV to [new price target], indicating a significant upside potential. (Source: [Link to Analyst Report])

Short Squeeze Potential

While not definitively confirmed, the possibility of a short squeeze cannot be ruled out.

- High Short Interest: A high level of short interest in CRWV before the price surge could have contributed to the rapid price increase as short sellers covered their positions.

- Short Squeeze Mechanics: A short squeeze occurs when short sellers rush to buy shares to cover their positions, driving up the price even further.

Understanding CoreWeave, Inc.'s (CRWV) Stock Performance and Future Outlook

CoreWeave's recent stock gains are a result of a confluence of factors: strong Q[Quarter] earnings that beat expectations, positive future guidance, the burgeoning AI market's demand for its specialized cloud computing and AI infrastructure, and positive analyst sentiment. However, investors should acknowledge potential risks and uncertainties inherent in the technology sector and the volatility of the stock market. The future outlook for CRWV remains positive, given its strong position in the rapidly growing AI infrastructure market. However, competition remains fierce, and economic headwinds could affect future performance.

While this analysis provides insights into CoreWeave's recent success, thorough due diligence is crucial before making any investment decisions. Continue your research on CoreWeave (CRWV) to form your own informed opinion about its future potential and understand the intricacies of its cloud computing and AI infrastructure offerings before investing in CRWV stock. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Descubre 5 Podcasts Imprescindibles De Misterio Suspenso Y Terror

May 22, 2025

Descubre 5 Podcasts Imprescindibles De Misterio Suspenso Y Terror

May 22, 2025 -

Could The Trans Australia Run Record Fall

May 22, 2025

Could The Trans Australia Run Record Fall

May 22, 2025 -

Taylor Swift And Blake Lively Friendship Fracture Amidst Legal Dispute

May 22, 2025

Taylor Swift And Blake Lively Friendship Fracture Amidst Legal Dispute

May 22, 2025 -

Pilot And Sons Recovery After Lancaster County Crash

May 22, 2025

Pilot And Sons Recovery After Lancaster County Crash

May 22, 2025 -

Ceo Romance Gone Wrong A Business Scandal

May 22, 2025

Ceo Romance Gone Wrong A Business Scandal

May 22, 2025

Latest Posts

-

Understanding Different Types Of Briefs A Practical Guide

May 22, 2025

Understanding Different Types Of Briefs A Practical Guide

May 22, 2025 -

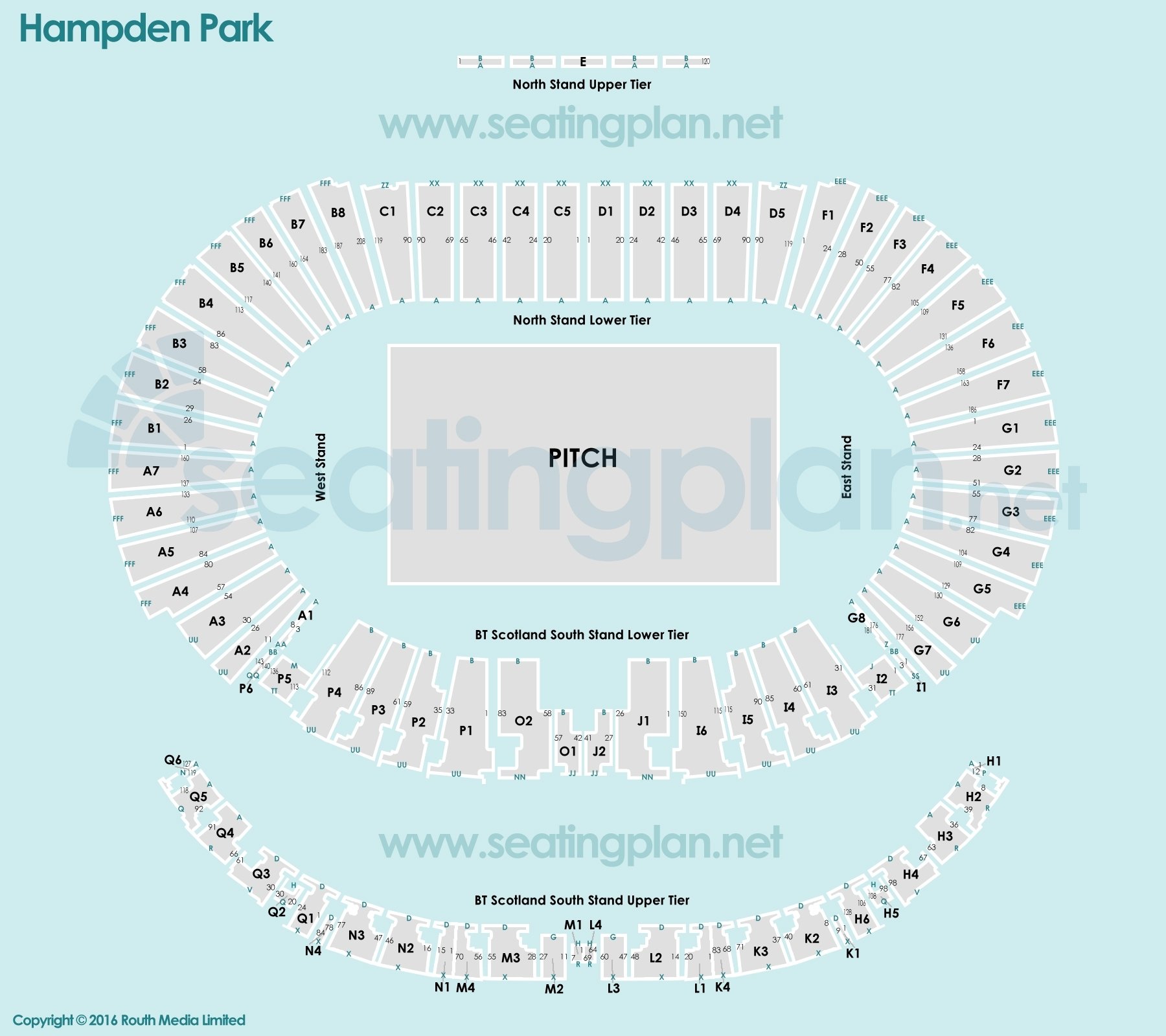

How To Buy Tickets For Metallica At Hampden Park Glasgow

May 22, 2025

How To Buy Tickets For Metallica At Hampden Park Glasgow

May 22, 2025 -

Get Metallica Glasgow Hampden Tickets A Complete Guide

May 22, 2025

Get Metallica Glasgow Hampden Tickets A Complete Guide

May 22, 2025 -

The Ultimate Guide To Briefs A Comprehensive Overview

May 22, 2025

The Ultimate Guide To Briefs A Comprehensive Overview

May 22, 2025 -

Metallicas Hampden Park Gig Your Guide To Securing Tickets

May 22, 2025

Metallicas Hampden Park Gig Your Guide To Securing Tickets

May 22, 2025