Investing In 2025: MicroStrategy Stock Compared To Bitcoin

Table of Contents

Understanding MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's Core Business

MicroStrategy is a publicly traded company specializing in enterprise analytics, software, and cloud-based services. Its core business revolves around providing business intelligence, mobile software, and cloud-based applications to large corporations. This sector, while relatively stable, isn't immune to economic downturns. The success of MicroStrategy's core business hinges on the continued demand for its enterprise software solutions and its ability to adapt to evolving technological trends.

- Market Position: MicroStrategy holds a notable position in the business intelligence market, competing with other established players. However, the market is competitive, requiring continuous innovation and adaptation.

- Revenue Streams and Growth Projections: MicroStrategy's revenue streams primarily come from software licenses, subscriptions, and services. Future growth projections depend on securing new enterprise clients and expanding existing partnerships.

- Dependence on Enterprise Clients: A key aspect of MicroStrategy's risk profile is its significant dependence on enterprise clients. Economic slowdowns or shifts in corporate IT spending can directly impact its revenue.

- Financial Performance and Stability: While historically profitable, MicroStrategy's financial performance fluctuates, influenced by factors such as macroeconomic conditions and the success of its product offerings.

MicroStrategy's Bitcoin Investment Strategy

MicroStrategy has made headlines for its substantial investment in Bitcoin, making it a significant holder of the cryptocurrency. This strategy, while bold, has exposed the company to considerable price volatility. The rationale behind this strategy is multifaceted, including a belief in Bitcoin's long-term potential as a store of value and a hedge against inflation. However, this strategy directly impacts the company's stock price, creating both significant risk and potential rewards for shareholders.

- Total Bitcoin Holdings and Value Fluctuations: The value of MicroStrategy's Bitcoin holdings fluctuates dramatically with the price of Bitcoin, impacting its overall financial performance and stock price.

- Impact of Bitcoin Price Volatility on MicroStrategy's Stock Price: The correlation between Bitcoin's price and MicroStrategy's stock price is high, meaning significant Bitcoin price swings will be reflected in the stock price.

- MicroStrategy's Long-Term Vision for Bitcoin Adoption: MicroStrategy's continued investment in Bitcoin demonstrates a long-term belief in the cryptocurrency's adoption and potential.

- Risks and Benefits Associated with this Strategy: The strategy carries substantial risk due to Bitcoin's inherent volatility. However, if Bitcoin’s price appreciates significantly, this could yield substantial returns for MicroStrategy shareholders.

Bitcoin's Potential as an Investment in 2025

Bitcoin's Market Position and Volatility

Bitcoin remains the largest cryptocurrency by market capitalization, representing a significant portion of the overall cryptocurrency market. Its adoption continues to grow, though at a fluctuating pace, influenced by regulatory developments, technological advancements, and investor sentiment. Bitcoin's price is notoriously volatile, exhibiting large swings in short periods.

- Projected Growth of the Cryptocurrency Market: The cryptocurrency market is projected to continue expanding, although predictions vary significantly depending on factors such as regulatory changes and broader economic trends.

- Factors Influencing Bitcoin's Price Fluctuations: Bitcoin's price is influenced by various factors, including adoption rates, regulatory announcements, overall market sentiment, and macroeconomic conditions.

- Risks Associated with Bitcoin's Volatility: The high volatility of Bitcoin presents considerable risk for investors, potentially resulting in significant losses if the market turns bearish.

- Potential for Long-Term Growth: Many believe Bitcoin has the potential for long-term growth, driven by its decentralized nature, limited supply, and increasing adoption as a store of value.

Comparing Bitcoin's Risk to MicroStrategy Stock

Investing in Bitcoin is inherently riskier than investing in MicroStrategy stock, primarily due to Bitcoin's extreme price volatility. MicroStrategy, while influenced by Bitcoin's price, is also subject to the risks associated with its core business operations. Regulatory uncertainty surrounding cryptocurrencies also adds another layer of risk to Bitcoin investments.

- Volatility Comparison: Bitcoin's volatility significantly surpasses that of MicroStrategy stock, making Bitcoin a much riskier asset.

- Regulatory Risks for Bitcoin vs. the Regulatory Framework for MicroStrategy: The regulatory landscape for cryptocurrencies is still evolving, creating uncertainty. MicroStrategy, as a publicly traded company, is subject to existing securities regulations.

- Diversification Benefits of Including Either or Both in a Portfolio: Both Bitcoin and MicroStrategy stock can contribute to portfolio diversification, but their high correlation necessitates careful consideration of overall portfolio risk tolerance.

Investment Strategies: MicroStrategy Stock vs. Bitcoin in a Diversified Portfolio

Diversification and Risk Management

Diversification is crucial for managing investment risk. A well-diversified portfolio includes assets that are not highly correlated, reducing the impact of any single asset's underperformance. Both MicroStrategy stock and Bitcoin can play a role in a diversified portfolio, but their high correlation demands careful consideration.

- Ideal Portfolio Allocation for Different Risk Tolerances: The optimal allocation of MicroStrategy stock and Bitcoin will vary significantly depending on individual risk tolerance and investment goals.

- Correlation Between MicroStrategy Stock and Bitcoin Price Movements: Because MicroStrategy's holdings are heavily weighted towards Bitcoin, a strong positive correlation exists between the two assets.

- How to Mitigate Risk Through Diversification: To mitigate risk, investors should diversify across various asset classes, including stocks, bonds, and alternative investments, while carefully considering the correlation between different assets.

Long-Term vs. Short-Term Investment Horizons

The choice between MicroStrategy stock and Bitcoin also depends on your investment time horizon. Bitcoin's volatility makes it a more suitable investment for those with a higher risk tolerance and a longer-term perspective. MicroStrategy stock, while still carrying significant risk, presents a potentially less volatile option for a medium to long-term strategy.

- Suitable Investment Timeframe for Each Asset: Bitcoin is generally better suited for long-term investors comfortable with high volatility, while MicroStrategy stock might be more appropriate for those with a slightly lower risk tolerance and a medium to long-term outlook.

- Long-Term Growth Potential vs. Short-Term Gains: Both assets have the potential for long-term growth, but Bitcoin's potential for short-term gains (and losses) is significantly higher.

- The Impact of Market Trends on Investment Decisions: Market trends heavily influence both MicroStrategy and Bitcoin, requiring investors to stay informed and potentially adjust their strategy.

Conclusion

Investing in MicroStrategy stock or Bitcoin in 2025 requires careful consideration of individual risk tolerance, investment goals, and a comprehensive understanding of each asset's potential rewards and risks. While both offer potential for significant growth, Bitcoin's volatility significantly surpasses that of MicroStrategy stock. MicroStrategy's dependence on its core business and the direct correlation between its stock and Bitcoin's price need to be assessed thoroughly. Diversification is key to mitigating risk in any investment strategy involving these two assets.

Make informed decisions about your investment in MicroStrategy stock and Bitcoin for 2025 and beyond. Remember to conduct thorough research and seek professional financial advice before making any investment decisions. A well-defined investment strategy, tailored to your unique circumstances, is essential for success.

Featured Posts

-

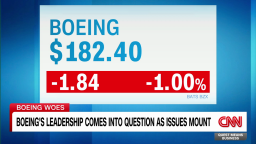

Antisemitism Investigation Boeing Seattle Campus Under Scrutiny

May 08, 2025

Antisemitism Investigation Boeing Seattle Campus Under Scrutiny

May 08, 2025 -

Grayscale Xrp Etf Filing And Sec Action Impact On Xrp And Bitcoin Prices

May 08, 2025

Grayscale Xrp Etf Filing And Sec Action Impact On Xrp And Bitcoin Prices

May 08, 2025 -

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025 -

Gewinnzahlen Lotto 6aus49 Vom 19 April 2025 Ueberpruefen Sie Ihren Tipp

May 08, 2025

Gewinnzahlen Lotto 6aus49 Vom 19 April 2025 Ueberpruefen Sie Ihren Tipp

May 08, 2025 -

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn Jary

May 08, 2025

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn Jary

May 08, 2025